For Designer Style, It's All Outlet - Value Retail News

For Designer Style, It's All Outlet - Value Retail News

For Designer Style, It's All Outlet - Value Retail News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

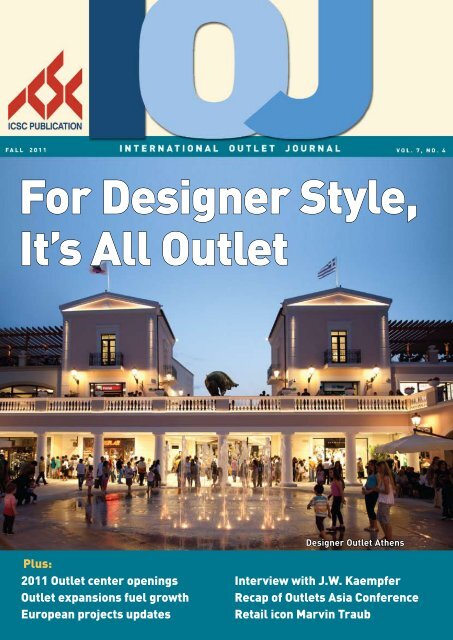

<strong>For</strong> <strong>Designer</strong> <strong>Style</strong>,<br />

It’s <strong>All</strong> <strong>Outlet</strong><br />

Plus:<br />

2011 <strong>Outlet</strong> center openings<br />

<strong>Outlet</strong> expansions fuel growth<br />

European projects updates<br />

<strong>Designer</strong> <strong>Outlet</strong> Athens<br />

Interview with J.W. Kaempfer<br />

Recap of <strong>Outlet</strong>s Asia Conference<br />

<strong>Retail</strong> icon Marvin Traub

ALBERTA FERRETTI<br />

ARMANI<br />

BALLANTYNE<br />

BLUMARINE<br />

BOTTEGA VENETA<br />

BRIONI<br />

BROOKS BROTHERS<br />

BULGARI<br />

BURBERRY<br />

COSTUME NATIONAL<br />

DAMIANI<br />

DOLCE & GABBANA<br />

ERMENEGILDO ZEGNA<br />

ESCADA<br />

ETRO<br />

FENDI<br />

GUCCI<br />

HUGO BOSS<br />

JIL SANDER<br />

JOHN RICHMOND<br />

KENZO<br />

LA PERLA<br />

MARNI<br />

MISSONI<br />

MONCLER<br />

MULBERRY<br />

PAUL SMITH<br />

POLO RALPH LAUREN<br />

PRADA<br />

ROBERTO CAVALLI<br />

SERGIO ROSSI<br />

TAG HEUER<br />

TRUSSARDI<br />

VALENTINO<br />

VERSACE<br />

WE ARE<br />

LISTENING<br />

We are a company of retailers with 17 years of experience<br />

building and managing designer outlet villages. Every week our<br />

20 centres bring millions of the best customers face-to-face with<br />

the finest collection of international brands and luxury labels.<br />

In June we opened our newest village in Athens, and we are<br />

currently under construction near Hamburg with our 21st centre<br />

(now 33% pre-leased) which will open in September 2012. We<br />

are also expanding our most popular centres near Düsseldorf<br />

(Roermond), Vienna (Parndorf), Milan/Genoa (Serravalle),<br />

Venice (Veneto), Florence (Barberino), Rome (Castel Romano) and<br />

Naples (La Reggia).<br />

<strong>All</strong>ow us to help you expand your business in the fastest-growing<br />

retail sector in Europe.<br />

Built by retailers who listen,<br />

for retailers who care about their business.<br />

Please contact Adrian Nelson on +44 (0)20 7535 2300 or<br />

a.nelson@mcarthurglen.com www.mcarthurglengroup.com

PAGE 6 PAGE 16<br />

PAGE 30<br />

STAFF<br />

International <strong>Outlet</strong> Journal is a publication for the<br />

non-U.S. factory outlet industry. Copyright © 2011<br />

CONTENTS<br />

Vol. 7 No. 4 INTERNATIONAl OuTlET JOuRNAl<br />

Fall 2011<br />

DAVID B. HENRy<br />

ICSC ChaIrman<br />

MICHAEl P. KERCHEVAl<br />

ICSC PreSIdent & CeO<br />

RuDOlPH E. MIlIAN, SCSM, SCMD<br />

ICSC SenIOr VP<br />

ICSC EuROPE<br />

London, +44 20 7976 3100<br />

icsc.europe@icsc.org<br />

ICSC/IOJ<br />

2519 n. mcmullen Booth rd.<br />

Suite 510-356<br />

Clearwater, FL 33761<br />

+1 727 781 7557<br />

lINDA HuMPHERS<br />

editor in Chief/director ext. 3<br />

lhumphers@icsc.org<br />

RANDy GDOVIN<br />

art director ext. 4<br />

rgdovin@icsc.org<br />

KAREN KNOBElOCH<br />

advertising Prod. mgr. ext. 2<br />

kknobeloch@icsc.org<br />

S<strong>All</strong>y STEPHENSON<br />

Senior advertising executive<br />

+1 847 835 1617<br />

Fax: +1 847 835 5196<br />

sstephenson@icsc.org<br />

iICSC PUBLICATION<br />

In s I d e<br />

4 Europe is flush with FOC openings<br />

6 MCG’s <strong>Designer</strong> <strong>Outlet</strong> Athens opens<br />

9 Neinver’s Coruna The <strong>Style</strong> <strong>Outlet</strong>s opens<br />

10 Melilli and Nailloux set 2011 openings<br />

12 <strong>Retail</strong> icon Marvin Traub speaks on outlets<br />

16 Roermond expansion ices a designer cake<br />

17 MCG’s J.W. Kaempfer talks of outlet future<br />

18 European expansions fuel outlet growth<br />

20 European project updates<br />

22 <strong>Designer</strong> <strong>Outlet</strong> Luxembourg opens<br />

24 European development briefs<br />

26 Full recap of ICSC’s <strong>Outlet</strong> Asia Conference<br />

29 EWB and APOC form JV for China<br />

30 RDM’s Florentia Village opens in JingJin<br />

32 Snapshot on China: 3 researchers report<br />

Advertiser Index<br />

destiny USa .......................................... 19<br />

Fashion house ..................................... BC<br />

Fashion <strong>Outlet</strong>s of Chicago ................... 15<br />

Freeport retail ..................................... 21<br />

henderson Global Investors ............... IBC<br />

mcarthurGlen designer <strong>Outlet</strong>s ..........IFC<br />

neinver ................................................. 11<br />

Stable <strong>Outlet</strong> management ................... 23<br />

<strong>Value</strong> retail ............................................ 5<br />

<strong>Value</strong> retail news Spring ..................... 33<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 3

EurOpEaN OpENiNgS<br />

europe flush with new FOCs<br />

Six grand openings and<br />

at least 3 expansions<br />

add 162,000 m2 of<br />

outlet GLA to Europe<br />

By lINDA HuMPHERS<br />

Editor in Chief<br />

The economy might be wretched<br />

and funding as scarce as hens’ teeth,<br />

but outlet developers have hosted<br />

at least six delirious parties this year in<br />

celebration of their newly opened GLA.<br />

Depending on how you count them,<br />

by the end of this year four, five or<br />

maybe even six phase 1 outlet centers<br />

will have opened in Europe.<br />

Four of those phase 1 openings are<br />

projects in France, Greece, Sicily and<br />

Spain that have added more than 88,000<br />

m2 to Europe’s total outlet GLA. (See<br />

stories on Coruna, ˜<br />

Athens, Melilli and Nail-<br />

loux in this issue).<br />

McArthurGlen, which has been rolling<br />

out new space with a vengeance,<br />

also relaunched the former Factory<br />

Shopping Messancy in April. The<br />

center was completely renovated and<br />

remerchandised to <strong>Designer</strong> <strong>Outlet</strong><br />

Luxembourg, but it continued operating<br />

during the extreme makeover. Even<br />

though MCG calls the opening a phase<br />

1 project, it didn’t add new GLA to<br />

the industry total, so we’ll opt not to<br />

include it in the new-projects list.<br />

4 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

<strong>Designer</strong> <strong>Outlet</strong> Athens<br />

<strong>Designer</strong> <strong>Outlet</strong> Parndorf<br />

Another project that might or might<br />

not be included on the phase 1 opening<br />

list is the 56,000-m2 Adana Optimum<br />

<strong>Outlet</strong> Center. The reason for<br />

our hesitation is that this center is in<br />

Turkey, and we’re never sure where to<br />

put Turkey – in Europe or the Middle<br />

East. But any outlet center that can<br />

draw 280,000 shoppers during its grand<br />

opening week deserves to be on the list.<br />

There were also three significant<br />

expansions to McArthurGlen projects in<br />

Austria, Italy and The Netherlands, which<br />

added another 17,000 m2 to the total. Expansions<br />

are proving a good way to make<br />

a strong center stronger. In the U.S., Simon<br />

Property Group recently announced<br />

it would expand four outlet centers by<br />

a total of nearly 42,000 m2. In some<br />

markets, expansions are a way of telling<br />

would-be competitors to look elsewhere<br />

for new development opportunities.<br />

Looking forward, VRN/IOJ counts 18<br />

planned projects in 10 European countries<br />

that have scheduled openings for 2012. If<br />

all 18 planned projects were to open, even<br />

though history shows they all won’t, they<br />

would total more than 370,000 m 2 .<br />

Who’s planning all these outlet centers?<br />

Neinver is busy with four; Fashion<br />

House with three; Promos and Rioja<br />

with two each; and rounding out that<br />

group, with one center each are Evo<br />

Land Development, Hines, IPEC, ITG/<br />

One <strong>Outlet</strong> Services, McArthurGlen<br />

Group, Mutschler Group and Stable<br />

<strong>Outlet</strong> Management.<br />

Germany is the biggest hotspot for<br />

2012 outlet-center openings – four<br />

projects are scheduled to open there next<br />

year. France, Italy, Russia and Slovakia<br />

each could see two centers opening in<br />

2012, and the remaining centers planned<br />

for 2012 are in Finland, Poland, Portugal,<br />

Serbia, Slovenia and Ukraine. c<br />

European Phase 1 <strong>Outlet</strong> Openings in 2011<br />

CENTER lOCATION DEVElOPER 2011 OPENING GlA SF GlA M 2<br />

Adana Optimum <strong>Outlet</strong> Center adana, turkey renaissance/<br />

amstar Global partners<br />

april 602,800 56,060<br />

~ ~<br />

~<br />

Coruna The <strong>Style</strong> <strong>Outlet</strong>s<br />

Coruna The <strong>Style</strong> <strong>Outlet</strong>s La Coruna, Spain neinver may 137,800 12,815<br />

<strong>Designer</strong> <strong>Outlet</strong> Athens Yalou, Greece mcarthurGlen Group June 226,000 21,018<br />

Melilli <strong>Outlet</strong> Siracusa, Sicily Promos SrL September 258,342 24,026<br />

Nailloux Fashion Village nailloux, France SanOUX SCI november 333,100 30,978<br />

Total 2011 phase 1 GlA 1,558,042 144,897<br />

Expansions to Existing <strong>Outlet</strong> Projects Opening in 2011<br />

<strong>Designer</strong> <strong>Outlet</strong> Roermond, Phase 3 roermond, the netherlands mcarthurGlen Group august 77,760 7,200<br />

<strong>Designer</strong> <strong>Outlet</strong> Parndorf, phase 4 Parndorf, austria mcarthurGlen Group September 57,240 5,300<br />

la Reggia <strong>Designer</strong> <strong>Outlet</strong>, phase 2B naples, Italy mcarthurGlen Group September 48,000 4,500<br />

Total 2011 expansion GlA 183,000 17,000<br />

Source: VRN/IOJ

© <strong>Value</strong> <strong>Retail</strong> PLC 2010<br />

THE<br />

Chic <strong>Outlet</strong> Shopping®<br />

VILLAGES<br />

Discover Europe’s leading luxury outlet shopping experience,<br />

created and operated by <strong>Value</strong> <strong>Retail</strong> www.Chic<strong>Outlet</strong>Shopping.com<br />

Bicester Village, London • La Vallée Village, Paris • Fidenza Village, Milan<br />

Las Rozas Village, Madrid • La Roca Village, Barcelona • Ingolstadt Village, Munich<br />

Maasmechelen Village, Brussels / Düsseldorf • Wertheim Village, Frankfurt • Kildare Village, Dublin<br />

Alexander McQueen, Anya Hindmarch, Armani, Bally, Burberry, Calvin Klein,<br />

Carolina Herrera, Celine, DKNY, Diane von Furstenberg, Diesel, Dior, Dolce & Gabbana, Dunhill,<br />

Ermenegildo Zegna, Façonnable, Givenchy, Gucci, Hugo Boss, Jimmy Choo, La Perla, Loewe, Loro Piana,<br />

Marni, Matthew Williamson, Max Mara, Mulberry, Paul Smith, Polo Ralph Lauren, Salvatore Ferragamo,<br />

Smythson, TAG Heuer, Tod’s, Valentino, Versace and many more<br />

RUN BY RETAILERS AND SERVING RETAILERS<br />

19 BERKELEY STREET, LONDON W1J 8ED, ENGLAND +44 (0)1869 323 757 WWW.VALUERETAIL.COM

graNd OpENiNgS<br />

Greeks finding lots to like<br />

at sunny center in Athens<br />

McArthurGlen’s 21,000-m 2 <strong>Designer</strong> <strong>Outlet</strong>s Athens has been exceeding projected<br />

sales and footfall by more than 20 percent since its opening in June.<br />

6 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

McArthurGlen’s newest<br />

outlet center brightens up<br />

Greece’s dim economy with<br />

big discounts and a sparkling<br />

food offer.<br />

As the saying goes, when the going gets<br />

tough, the tough go shopping. And lately,<br />

the tough are going outlet shopping.<br />

That old adage has been proven true in toughtimes<br />

Greece ever since McArthurGlen <strong>Designer</strong><br />

<strong>Outlet</strong> Athens opened on June 2. Nearly three<br />

months after the grand opening, sales in the<br />

center were 22 percent above expectations with<br />

no relief in sight, despite the country’s famously<br />

beleaguered economy.<br />

And as testimony to the healing powers of outlet<br />

shopping, these sales are being driven primarily<br />

by Greek shoppers until the tourist season starts,<br />

according to Eric Decouvelaere, the developer’s<br />

director for Southern Europe.<br />

“One of the things we are most pleased about<br />

is the extremely happy feedback from the shoppers,”<br />

said Decouvelaere, who oversees<br />

10 centers throughout Italy, France,<br />

Belgium and now Greece. “We have 78<br />

stores open and we have been careful to<br />

merchandise this center with the shoppers<br />

in mind.”<br />

To that end, the 21,000-m2 center<br />

has four types of tenancy: international<br />

luxury, international fashion, leading<br />

Greek brands and food tenants.<br />

The center’s 10 restaurants provide<br />

everything from ice cream to cafes<br />

to sit-down restaurants, and they are<br />

an obvious draw for locals, even on<br />

Sundays when Greek law doesn’t<br />

allow retail shops to open. “We have<br />

4,000 to 5,000 people come on Sundays<br />

just to meet up with their friends<br />

over a meal or a snack,” Decouvelaere<br />

said. “And then they window shop<br />

together.”<br />

To optimize the consumer’s experience,<br />

the developer has created

the McArthurGlen <strong>Retail</strong> Academy,<br />

which helps brands hone all aspects<br />

of retailing, from staffing and training,<br />

to inventory management, pricing,<br />

merchandising, store design, and, in<br />

particular, customer service. In fact,<br />

Decouvelaere and other MCG executives<br />

have strong retail backgrounds.<br />

His experience includes positions with<br />

the Printemps department store chain<br />

and luxury textile company Dormeuil,<br />

where he launched a line of bespoke<br />

men’s suits.<br />

When completely tenanted, the €100<br />

million center – MCG’s sixth in three<br />

years – will have 110 tenants.<br />

Located in Spata, 30 minutes from<br />

central Athens, the center is designed<br />

in the neoclassical style in pale pinks<br />

and soft yellows, with stone flooring<br />

and fountains. The buildings, composed<br />

of scaled-down urban units<br />

rather than a monolithic shopping<br />

structure, are extensively varied and<br />

form a succession of open air spaces<br />

and sheltered walkways leading to<br />

shops, clearings, seating areas and<br />

cafés. Although the center has two<br />

levels – three, really since the 1,350<br />

parking spaces are underground – the<br />

project’s pleasing scale helps <strong>Designer</strong><br />

<strong>Outlet</strong>s Athens fit aesthetically into<br />

the area’s residential and agricultural<br />

surroundings. The center’s architectural<br />

elements include small roofs, pergolas,<br />

small doorways and differentiation of<br />

each shop unit.<br />

The main thing about this center, Decouvelaere<br />

said, is that “It’s just a very<br />

cool place. You just have to see it.” c<br />

McArthurGlen <strong>Designer</strong> <strong>Outlet</strong> Athens tenants include:<br />

Accessorize<br />

Adidas<br />

Alberta Ferretti<br />

A.L.E.<br />

American Vintage<br />

Anna Maria Mazaraki<br />

Attrattivo<br />

Billabong<br />

Bill Cost<br />

BoConcept<br />

Body Talk<br />

Brooks Brothers<br />

BSB<br />

Chipie<br />

Class Roberto Cavalli<br />

Colin’s<br />

Colori<br />

Columbia<br />

Diesel<br />

Docksteps<br />

DPAM<br />

Edward Jeans<br />

Element<br />

Eye Q<br />

Fila<br />

Gant<br />

Gianfranco Ferre<br />

Ginestra<br />

Guess<br />

Gutteridge<br />

Haralas<br />

House & Travel<br />

Hugo Boss<br />

Hunter<br />

Iceberg<br />

Interni<br />

Architecturally, <strong>Designer</strong> <strong>Outlet</strong>s Athens incorporates urban features such as<br />

small roofs and doorways, open-air walkways and differentiated shop fronts for a pleasing<br />

pedestrian scale.<br />

Kalogirou<br />

Kem<br />

Lacoste<br />

Lapin<br />

Lussile<br />

Luna<br />

Mandarino<br />

Marasil<br />

Matou France<br />

Mefisto<br />

Moschino<br />

My Home<br />

Nara Camicie<br />

Navy Green<br />

New Balance<br />

Nike<br />

Nine West<br />

Notos Galleries<br />

Oxette<br />

Oxford Company<br />

Papasotiriou<br />

Polo Ralph Lauren<br />

Reebok<br />

Replay<br />

Rococo<br />

Salvatore Ferragamo<br />

Sebago<br />

Skechers<br />

Staff<br />

Symbol<br />

Toi & moi<br />

Tommy Hilfiger<br />

Trussardi<br />

Tsakiris Mallas<br />

Vardas<br />

Venus Victoria<br />

Versace<br />

Waks,<br />

Yazz<br />

restaurants & Cafes:<br />

Ambiente Caffe<br />

Corso Como<br />

Cucina Italiana<br />

Haagen Dazs Café<br />

I Grill<br />

Il Barretto<br />

Meat Me<br />

Palmie Bistro<br />

Piazza di Nero<br />

Ya Su<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 7

graNd OpENiNgS<br />

neinver’s Spanish <strong>Style</strong> <strong>Outlet</strong><br />

Neinver’s signature outlet center design is seen at Coruña The <strong>Style</strong> <strong>Outlet</strong>s, where the<br />

enclosed mall is modern, with lots of glass for a well-lit interior, plenty of seating, play areas<br />

and a free Wi-fi lounge.<br />

8 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Coruña The <strong>Style</strong> <strong>Outlet</strong>s opens<br />

in Galicia to crowds of shoppers<br />

who have come to expect a<br />

comfy environment and top<br />

brands from Neinver.<br />

Spanish developer Neinver opened its fifth<br />

outlet center in Spain and 12th in Europe<br />

this summer. The 135,600-sf Coruña The<br />

<strong>Style</strong> <strong>Outlet</strong>s in Galicia is also the first to open in<br />

Spain under Neinver’s <strong>Style</strong> <strong>Outlet</strong> concept, which<br />

is aimed at markets that are more demanding in<br />

terms of trends and style, high quality and the overall<br />

shopping experience.<br />

Shoppers were obviously hungry for the concept:<br />

When it opened in May, more than 25,000 visitors<br />

flocked to the center in the first four days, ravenous<br />

for deals, bargains and selection at the enclosed<br />

center’s three dozen outlet stores.<br />

Their pent up shopping lust drove sales to triple<br />

their projected rate during the weekdays, and on the<br />

weekend, sales doubled projections. Management<br />

at Cortefiel Group’s Fifty Factory reported that the<br />

store’s sales had far outstripped expectations.<br />

Manuel Lagares, CEO of Neinver, said he expects<br />

Coruña The <strong>Style</strong> <strong>Outlet</strong>s to become “the benchmark<br />

outlet center for the north of<br />

Spain…We couldn’t have chosen a<br />

better location: Galicia, the birthplace<br />

of Spanish fashion.”<br />

Galicia has become important<br />

in Spain as the home of Inditex,<br />

which is Europe’s largest textile<br />

company and parent of global<br />

retail giant Zara. With that kind of<br />

inspiration, Neinver’s leasing team<br />

knew it had to bring in the chains<br />

with drawing power, including such<br />

international brands as Amichi,<br />

Callaghan, Calvin Klein, Geox,<br />

Guess, Hush Puppies, Jerem, Puma,<br />

Varlion and the first Element outlet<br />

in the world. Prestigious Spanish<br />

brands tenanting the center include<br />

Caramelo, the Cortefiel Group,<br />

Desigual, Mayoral, Mustang, Punto<br />

Blanco, Roberto Verino and Trucco.<br />

In addition to merchandising its<br />

centers with an appealing tenant<br />

mix, Neinver is known for creating<br />

a relaxed and easy environment

Coruna The Syle <strong>Outlet</strong>s has a tenant<br />

line-up that includes such international<br />

brands as Amichi and Geox.<br />

for shoppers, and this new center is no<br />

exception. It features large areas for<br />

relaxing, a Wi-Fi lounge, restaurants<br />

and other food services (including some<br />

with terraced seating), play areas for<br />

children up to age 3 and a staffed playroom<br />

for children 4 to 13, with activities<br />

designed especially for them. The<br />

sustainable, environmentally friendly,<br />

energy-saving architecture optimizes<br />

natural light and is Building Research<br />

Establishment Environmental Assessment<br />

Method (BREEAM) certified.<br />

In design, the enclosed mall follows<br />

Neinver’s established footprint of<br />

modern styling, lots of glass, comfortable<br />

temperatures, plenty of seating and<br />

nearly 900 parking spaces.<br />

Neinver’s other outlet centers in<br />

Spain are Factory Madrid Las Rozas,<br />

Factory Madrid Getafe, Factory Madrid<br />

San Sebastián de los Reyes, and Factory<br />

Sevilla Aeropuerto. Neinver also operates<br />

outlet centers in Germany, Italy,<br />

Poland and Portugal. A center being<br />

developed with MAB in Roppenheim,<br />

France is due to open in 2012. c<br />

~<br />

TENANTS AT CORuNA THE STylE OuTlETS INCluDE:<br />

amichi<br />

Callaghan<br />

Calvin Klein Jeans<br />

Calvin Klein Underwear<br />

Caramelo<br />

Cortefiel<br />

desigual<br />

egomundi Veracruz<br />

element<br />

en Panes<br />

Geox<br />

Grupo hergar<br />

Guess<br />

hush Puppies<br />

Inuvik<br />

Jerem<br />

Kiko<br />

Kina Fernández<br />

Krack<br />

La Perfumería<br />

Laga<br />

mango<br />

mayoral<br />

menbur<br />

mustang<br />

nike<br />

Panama Jack<br />

Pikolinos-martinelli<br />

Puma<br />

Punto Blanco<br />

roberto Verino<br />

trucco<br />

UnderBlue<br />

Varlion<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 9

graNd OpENiNgS<br />

4 th Quarter Grand Openings<br />

Early opening set for Melilli <strong>Outlet</strong><br />

The 9,600-m 2 phase 1 of Melilli <strong>Outlet</strong>, a Fashion District<br />

brand, was scheduled to open September 16, after<br />

IOJ’s press time, with 104 stores. The center is just 10<br />

km from Siracusa, one of the most economically dynamic areas<br />

of Sicily. The sweeping project will be part of the Belvedere<br />

business district, which already has Auchan Shopping Center,<br />

Paradise Acquapark, Decathlon, Media World, a hotel, a sports<br />

center, an aquatic park and an office complex.<br />

Strategically located near the splendid beaches of the Ionian<br />

Sea and the extraordinary archeological sites of Siracusa, Melilli<br />

<strong>Outlet</strong> will draw shoppers from the 3.5 million tourist arrivals<br />

a year and more than 1 million households within a 60-minute<br />

drive. The center can be easily reached from the Belvedere-Siracusa<br />

Nord exit of the Superstrada 114, which is the four-lane<br />

continuation of the Autostrada A18 from Catania.<br />

Melilli <strong>Outlet</strong>’s modern design has an elliptical shape and<br />

multiple levels with parking on each. Open terraces overlook<br />

a large central plaza protected by a moveable roof that<br />

ensures a comfortable shopping experience in all seasons. A<br />

4,300-m 2 (GLA) phase 2 with 25 stores is also planned.<br />

Among the tenants are Max Mara Group’s first Diffusione<br />

Nailloux Fashion Village, the 31,000-m 2 outlet<br />

center being developed by Advantail and Corio, has<br />

begun turning space over to tenants in anticipation of<br />

the grand opening set for November 23.<br />

Located in the heart of the French Midi-Pyrenees, near<br />

Toulouse, Nailloux Fashion Village is expecting 1.7 million<br />

shoppers to visit the center in its first year, with that number<br />

quickly growing to more than 3 million.<br />

The center, which has 1,800 parking spaces, will attract<br />

shoppers from the 2.4 million people who live within a<br />

90-minute drive and from the 18 million tourists who visit<br />

the Midi-Pyrenees every year.<br />

The center is 20 minutes from Toulouse, which has the<br />

second-largest economy in France after Paris. It is also just<br />

40 minutes from the fortified city of Carcossone, which dates<br />

back to 100 B.C. and is the third most popular tourist destination<br />

in France, drawing 4 million visitors annually.<br />

The center will open at least 75 percent occupied with<br />

more than 90 tenants. It is designed in the style of an authentic<br />

Lauragais village with a charming central square, arcades<br />

and restaurants with terraces.<br />

Corio is the financial partner with a 75 percent ownership<br />

stake in Nailloux Fashion Village, and Advantail is handling<br />

10 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Melilli <strong>Outlet</strong>, which was set to open in September, is part of<br />

the sweeping Belevedere business district in Siracusa, Sicily.<br />

Tessile store in Sicily, expected to be the largest in Italy.<br />

Tecnall is the owner of the center and the exclusive licensee<br />

of the Fashion District trademark in Sicily. Tecnall’s use of the<br />

Fashion District trademark marks the first time such a licensing<br />

agreement has been put into place in Italy. Promos S.r.l., is<br />

handling marketing and management of the project. c<br />

grand opening draws close<br />

for Nailloux Fashion Village<br />

Advantail starated construction of Nailloux Fashion Village in<br />

March and plans to open the center 75-percent leased in November.<br />

the development, marketing and management of the center.<br />

Advantail started construction in March of this year on<br />

another outlet center, The West Paris <strong>Outlet</strong>, a 20,000-m 2<br />

project scheduled to open in April 2013. That center is being<br />

developed with Catinvest at the entrance of Grand Plaisir, a<br />

large regional mall that’s west of Paris, near Versailles. c

We look after the brands as if they were our own.<br />

<strong>All</strong> the brands have their own interest but just one joins them all: selling.<br />

That’s why 700 of the world’s best brands put their trust in NEINVER. Because we are<br />

the second largest outlet operator in Europe, managing more than 243,000 sq.m. GLA and<br />

over 1,000 stores. Because we manage 11 outlet centers in Spain, Italy, Poland, Portugal<br />

and Germany and 5 more about to be opened.<br />

And above all, because we make a commitment to our retailers to support them with all<br />

our experience. We recognize that the success of a brand is also ours.<br />

This is what has made us leaders.<br />

OUTLETS WITH<br />

THEIR OWN STYLE

iOJ iNTErViEw<br />

retail icon Marvin traub<br />

speaks on outlet retailing<br />

Now working with<br />

<strong>Value</strong> <strong>Retail</strong>, the venerable<br />

retailer-turned-advisor<br />

gives his views on how<br />

the outlet sector can<br />

thrive and flourish.<br />

By linda Humphers<br />

Editor in Chief<br />

If there is one person around the<br />

globe who understands how to attract<br />

upscale shoppers, it’s Marvin<br />

Traub, the legendary former president<br />

of Bloomingdale’s. During his 41 years<br />

with the chain – including 22 years as<br />

its president – Traub made clear his<br />

conviction that retailing should be fun,<br />

energizing and compelling, in short,<br />

entertaining.<br />

He was one of the first Americans<br />

to begin importing European furniture<br />

and fashion to the U.S., beginning<br />

in the 1950s. <strong>For</strong> his involvement in<br />

the French economy he was awarded<br />

the Order of Merit and the Legion<br />

d’Honneur. The latter award also<br />

recognized his service in the U.S. Army<br />

in World War II; he was wounded at<br />

Metz when he was 19 and subsequently<br />

spent 15 months in the hospital. He<br />

has also received the Commendatore de<br />

la Republic for helping to build Italy’s<br />

economy.<br />

In 1992, shortly after he left Bloomingdale’s,<br />

he founded Marvin Traub<br />

Associates, a consulting firm with<br />

expertise in global retailing, marketing<br />

and consumer goods. MT’s lengthy list<br />

of luminary clients includes Banana Republic,<br />

Coach, Elie Tahari, Gap, Guess,<br />

Harvey Nichols, Missoni, Nautica,<br />

Ralph Lauren, Selfridges, Stuart Weitzman,<br />

Tommy Hilfiger and Tumi.<br />

Traub also served on the board of the<br />

12 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Marvin Traub<br />

former American outlet-center developer<br />

Prime <strong>Retail</strong> for 10 years, and he<br />

recently joined forces with <strong>Value</strong> <strong>Retail</strong>,<br />

which operates nine designer outlet villages<br />

throughout Europe.<br />

Now 86, he is the author of two books,<br />

“Like No Other Store” and “Like No<br />

Other Career,” a chronicle of his second<br />

career as a consultant and his account of<br />

the future trends in retailing. In August,<br />

he spoke with IOJ about outlet retailing.<br />

Here’s what he had to say.<br />

n n n<br />

IOJ: You have a reputation as a<br />

master merchandiser, the sage of<br />

bricks and mortar, the man who<br />

made Bloomingdales into a unique<br />

retail environment. But earlier this<br />

year your company invested in Ixtens,<br />

which is a technology company<br />

that provides services to online<br />

retailers. Clearly you see a place<br />

for all inventory channels. Can you<br />

talk about the meshing of inventory<br />

channels and where outlets fit?<br />

MT: In my book I talk about retailing<br />

requiring a multi-strategy approach.<br />

Most of the successful retailers – Saks,<br />

Neiman Marcus, Nordstrom – have<br />

a combination of bricks and mortar,<br />

outlet, internet and catalog distribution<br />

channels. It’s quite evident and research<br />

shows that people who shop across<br />

channels spend more money than those<br />

who don’t. So all of these channels help<br />

create a better customer.<br />

n n n<br />

IOJ: Do you think the outlet channel<br />

is essential to a brand’s growth?<br />

If so, at what point should the brand<br />

expand into this channel?<br />

MT: Well-run outlet chains serve<br />

a valuable function, not only as part<br />

of the brands’ growth, but also to<br />

dispose of excess inventory. Brands<br />

should expand into outlets as soon as<br />

they have a significant presence in a<br />

market, whether it’s the U.S., Europe<br />

or Asia.<br />

With so many brands moving to Asia,<br />

there is going to be a need for more<br />

outlets there, and we do know that<br />

Chinese consumers enjoy outlet shopping.<br />

I believe that outlets are essential<br />

as long as their outlets are authentic.<br />

Unauthentic goods not only weaken<br />

the store, they weaken the center and<br />

ultimately they weaken the brand. By<br />

that I mean that the brand can produce<br />

for the outlet stores – that can certainly<br />

be part of the strategy – but the quality<br />

and styling has to be in direct relation to<br />

the full-price products.<br />

<strong>Value</strong> <strong>Retail</strong> understands this point<br />

and requires that all the goods sold<br />

in their centers be authentic. When<br />

shoppers from Shanghai are routinely<br />

spending €5,000 to €10,000 per visit<br />

at Bicester Village, it’s because they<br />

know they’re getting authentic merchandise.<br />

n n n<br />

IOJ: Your list of the most compelling<br />

outlet tenants seems primarily<br />

high-end. Do you see upscale<br />

shoppers as the main driver of outlet<br />

retailing?<br />

MT: Most of the successful outlet<br />

centers have a balance between bridge

<strong>Value</strong> <strong>Retail</strong>’s Bicester Village in England is said to be the most productive outlet village in Europe, with sales of more than<br />

€2,080 per square foot.<br />

and midprice retailers, but the greatest<br />

way to create footfall is to have luxury<br />

brands at outlet prices. The excitement<br />

of those names is highly appealing.<br />

They’re the magnets that draw shoppers<br />

to the centers. Not everyone shops in<br />

those stores, but the presence of pure<br />

luxury adds spice to the experience.<br />

n n n<br />

IOJ: The outlet industry is doing<br />

very well, especially in today’s<br />

economic climate. With your strong<br />

department-store background,<br />

particularly from a parent company<br />

(Macy’s) that was famous for giving<br />

agita to outlet chains, did you think<br />

15 or 20 years ago that this industry<br />

had legs?<br />

MT: Fifteen years ago I was on the<br />

board of Prime <strong>Retail</strong>, so outlet retailing<br />

absolutely was on my mind then.<br />

On the other hand, 25 years ago<br />

when it started in the U.S., the department<br />

stores were very concerned about<br />

the impact it would have on full-price<br />

retailing. Now the department stores<br />

want to go into the outlet business!<br />

Now we all recognize it as an important<br />

distribution channel. That opposition in<br />

the early days, though, may have helped<br />

establish the outlet sector’s differentiation<br />

and authenticity.<br />

n n n<br />

IOJ: Why do you think the industry<br />

is now successful? Do you see outlet<br />

retailing as a distribution channel or<br />

a shopping center sector?<br />

MT: The answer is complex – outlet<br />

retailing is both a distribution channel<br />

and a shopping center sector. It’s the<br />

only retail sector that is both. What’s interesting<br />

to me is that there is a very limited<br />

number of strong players – you have<br />

only Simon, Tanger, McArthurGlen and<br />

<strong>Value</strong> <strong>Retail</strong>. It’s a very small industry.<br />

Traditional shopping centers have<br />

declining traffic, whereas outlet centers<br />

are seeing increasing traffic. The sector<br />

has great growth potential and it gives<br />

the customer a new offering. <strong>Outlet</strong><br />

developers see themselves as partners<br />

with the brands, which is unusual in retail<br />

real estate. <strong>Value</strong> <strong>Retail</strong>, for instance, has<br />

these strong retail teams in every center<br />

that work directly with the tenants to<br />

improve their performance. That model<br />

is more like a department store, but that<br />

has to be the way successful developers<br />

approach this business.<br />

n n n<br />

IOJ: What factors would you say<br />

separate the top performing outletcenter<br />

portfolios from the ones that<br />

struggle?<br />

MT: Two things immediately come<br />

to mind: marketing and attention to<br />

tourism. Both are hugely important to<br />

outlet-center performance, and those<br />

two aspects are quite different from<br />

full-price malls.<br />

<strong>Outlet</strong> centers must market beyond<br />

the local area and they must make use<br />

of all the social networking and technology<br />

tools they can find.<br />

Understanding the importance of<br />

tourism is what distinguishes a <strong>Value</strong><br />

<strong>Retail</strong> from developers with less vision.<br />

Bicester Village, for instance, is one<br />

of England’s top tourism attractions –<br />

approximately 60 percent of Bicester<br />

Village customers are tourists. This is<br />

no accident. <strong>Value</strong> <strong>Retail</strong> sends teams<br />

around the world to do nothing but at-<br />

(continued on page 14)<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 13

iOJ iNTErViEw<br />

(continued from page 13)<br />

tract tourists. They advertise in and are<br />

covered by top fashion magazines, and<br />

their social networking content is available<br />

in more than 15 languages.<br />

I see five keys to operating a successful<br />

outlet-center portfolio – and I<br />

base these on the way <strong>Value</strong> <strong>Retail</strong> does<br />

business because it has what we believe<br />

to be the most productive portfolio in<br />

the world with average sales of $1,200<br />

[€866] per square foot, and sales at Bicester<br />

Village approach $3,000 [€2,080]<br />

per square foot.<br />

Here are the five keys:<br />

l Merchandise the center with an appealing<br />

mix of international and local brands.<br />

l Set up standards to ensure shoppers<br />

that all product sold in the center is<br />

authentic.<br />

l Create an environment in which the<br />

level of customer service and brand presentation<br />

makes shopping a memorable<br />

experience. There should be great emphasis<br />

on the center’s design, which must<br />

include amenities that extend customer<br />

service and architecture that enhances<br />

luxury brands’ full-price position.<br />

l Develop a unique travel and tourism<br />

marketing platform.<br />

l Owners should operate their own<br />

centers.<br />

n n n<br />

IOJ: What do you see for the<br />

future of outlet retailing in terms of<br />

growth and how it could or should<br />

evolve?<br />

MT: We’re in a difficult and challenging<br />

period for retailing because of the<br />

uncertainty in the domestic and European<br />

markets. Full-price retailing is mature<br />

and few shopping centers are being built<br />

in the U.S. and Europe, though there are<br />

still opportunities, especially in Canada.<br />

On the other hand, the emerging markets<br />

of Asia, India, South America and the<br />

Middle East can be a bright future for the<br />

outlet sector if the operators have a clear,<br />

defined strategy that recognizes changes in<br />

the retail climate and can provide a different<br />

experience for the customer.<br />

A long time ago, I believed that<br />

retailing is entertainment. I still believe<br />

that, but not too many centers create a<br />

comfortable gathering place for tourists.<br />

Being entertaining applies to the brands,<br />

too, because they have to be disciplined<br />

about the look of their stores and how<br />

they run them. So there’s a bright future<br />

ahead for those who execute well. c<br />

14 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

With tenants that include Celine, Jimmy Choo and Versace, <strong>Value</strong> <strong>Retail</strong>’s LaVallee<br />

Village, which is in Disneyland Resort Paris, is one of the most productive outlet centers<br />

in Europe<br />

Marvin Traub’s top 50 brands<br />

MARVIN TRAuB HAS compiled a list of 50 fashion and luxury brands he<br />

considers essential for outlet centers hoping to attract global shoppers.<br />

Traub says if these brands can find the right outlet centers, “they will<br />

create tourism shopping destinations in their own right…These brands<br />

are crucial to today’s sophisticated outlet offer. They are the foundation<br />

brands that appeal to the growing number of international customers.”<br />

Here is the list, in alphabetical order:<br />

1. aquascutum<br />

2. Bottega Veneta<br />

3. Brioni<br />

4. Bulgari<br />

5. Burberry<br />

6. Calvin Klein<br />

7. Celine<br />

8. Chloe<br />

9. Church’s<br />

10. Coach<br />

11. diane von Furstenberg<br />

12. dolce & Gabbana<br />

13. donna Karan<br />

14. dunhill<br />

15. ermenegildo Zegna<br />

16. escada<br />

17. estee Lauder<br />

18. etro<br />

19. Fendi<br />

20. Ferragamo<br />

21. Furla<br />

22. Gieves & hawkes<br />

23. Giorgio armani<br />

24. Givenchy<br />

25. Gucci<br />

26. hugo Boss<br />

27. Jaeger<br />

28. Jimmy Choo<br />

29. La Perla<br />

30. Lacoste<br />

31. Longchamp<br />

32. Loro Piana<br />

33. marc Jacobs<br />

34. marni<br />

35. maxmara<br />

36. michael Kors<br />

37. missoni<br />

38. mulberry<br />

39. Paul Smith<br />

40. Prada<br />

41. ralph Lauren<br />

42. roberto Cavalli<br />

43. tag heuer<br />

44. thomas Pink<br />

45. tod’s<br />

46. tommy hilfiger<br />

47. tumi<br />

48. Valentino<br />

49. Versace<br />

50. Yves St. Laurent

OVER THE TOP<br />

UNDER THE RADAR<br />

FASHION OUTLETS OF CHICAGO<br />

ROSEMONT 305. 932. 6202<br />

WWW.FASHIONOUTLETSOFCHICAGO.COM

OErMONd<br />

roermond expansion is<br />

icing on a designer cake<br />

McArthurGlen says<br />

its thriving project in<br />

Holland is already the<br />

most popular designer<br />

outlet center in<br />

northwestern Europe.<br />

The 7,200-m 2 phase 3 of<br />

McArthurGlen’s <strong>Designer</strong> <strong>Outlet</strong><br />

Roermond in The Netherlands<br />

that opened on August 18 has brought<br />

the center’s total GLA to 35,000 m 2 ,<br />

which is certainly worth crowing about.<br />

But in addition to the extra footprint<br />

16 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

and 35 new tenants, the expansion is<br />

also expected to ratchet up the center’s<br />

annual visitor numbers to 4.2 million<br />

from the present 3.8 million.<br />

The center is enormously popular<br />

with German shoppers, thanks to its<br />

location just 30 minutes from Dusseldorf.<br />

As a McArthurGlen press<br />

release states, the center is “Northern<br />

and Western Europe’s most visited<br />

outlet center with 20 percent of the<br />

market’s share.”<br />

The center has certainly benefited<br />

from the emerging economies in<br />

Eastern Europe, Asia, the Middle<br />

East and South America, with spend<br />

from international shoppers more<br />

than doubling in the first six months<br />

The phase 3 expansion at McArthurGlen’s <strong>Designer</strong> <strong>Outlet</strong> Roermond, which opened in August,<br />

doubles the 10-year-old center’s original GLA, bringing it to 35,000 m 2 .<br />

of 2011. According to Global Blue,<br />

a financial services company that<br />

advises retailers on shopping trends,<br />

Chinese visitors were the top spenders<br />

at <strong>Designer</strong> <strong>Outlet</strong> Roermond<br />

during this period, with their spending<br />

almost doubling compared to the<br />

same period in 2010.<br />

Speaking of doubling, the center<br />

now has nearly twice the GLA<br />

it opened with in 2001 – 17,500<br />

m 2 . The center is still growing – an<br />

11,000-m 2 phase 4 is scheduled to<br />

open in 2014. Although the center’s<br />

first phase is part of Henderson<br />

Global Investors European <strong>Outlet</strong><br />

Mall Fund, the expansions are not.<br />

A new Burberry flagship store, triple<br />

the size of its former store<br />

in the center, is the phase 3<br />

anchor at Roermond. The<br />

35 new tenants – which<br />

brings the center’s total<br />

to 150 stores – include<br />

premier brands Moncler,<br />

Calvin Klein Collection,<br />

Navyboot, Baldinini and<br />

Abro; young fashion and<br />

jeanswear brands Desigual,<br />

Guess, Mexx, Ben Sherman,<br />

Bench, Trussardi Jeans,<br />

True Religion and River<br />

Woods; childrenswear brand<br />

Vingino; casual brands Fossil,<br />

O’Neill, Victorinox, and<br />

Converse and Gant shoes.<br />

Premium brand Furla will<br />

open in the fourth quarter.<br />

Expansions at two other<br />

McArthurGlen centers<br />

were due to open in September,<br />

after IOJ’s press<br />

time: a 5,300-m 2 phase 4 at<br />

<strong>Designer</strong> <strong>Outlet</strong> Parndorf<br />

in Austria, and a 4,500m<br />

2 phase 2B at La Reggia<br />

<strong>Designer</strong> <strong>Outlet</strong> in Naples.<br />

See page 18 for more expansion<br />

updates. c

McArthurGlen’s Kaempfer<br />

discusses outlets’ future<br />

The industry continues<br />

to evolve and improve,<br />

he said, pointing out<br />

that each country has<br />

its own outlet flavor.<br />

By linda Humphers<br />

Editor in Chief<br />

Anyone who knows J.W. Kaempfer<br />

knows a few things about<br />

him: He’s as close to a modern<br />

day Renaissance man as any of us are<br />

likely to meet; he goes by “Joey,” he<br />

loves to sail, he values loyalty, and he’s<br />

one tough businessman. When he came<br />

to Europe from Washington, D.C., in<br />

1993 to found McArthurGlen Group<br />

and bring U.S.-style outlet centers across<br />

the pond, he already had a successful<br />

company that specialized in developing<br />

first-class urban office buildings.<br />

He has never been one to do anything<br />

in a small way, so naturally he has<br />

led McArthurGlen to become Europe’s<br />

largest developer, owner and manager<br />

of designer outlet shopping villages,<br />

with a portfolio of 20 centers totaling<br />

more than 5 million sf (46,500 m2). It is<br />

the third largest outlet company in the<br />

world, behind Simon Property Group<br />

and Tanger Factory <strong>Outlet</strong> Centers.<br />

Like most successful entrepreneurs,<br />

Kaempfer brings many interests to the<br />

table, including a passion for architecture,<br />

occasionally even lecturing at<br />

Harvard Graduate School of Design.<br />

Over the past 30 years his companies<br />

have worked with many of the world’s<br />

outstanding architects, including I.M.<br />

Pei and Lord Richard Rogers, as well<br />

as exceptional architects specializing in<br />

historic preservation. Paul Goldberger,<br />

architecture critic for the venerable New<br />

Yorker magazine, wrote, “for people<br />

like Joey Kaempfer...architecture is not a<br />

choice between art and commerce, but a<br />

J.W. Kaempfer<br />

way of embracing both these realms.”<br />

When approached by IOJ, he quickly<br />

agreed to be interviewed, with the caveat<br />

that he might not answer any of the questions.<br />

J.W. Kaempfer always has a viewpoint<br />

– often humorous, always candid and<br />

perpetually insightful – quite unlike anyone<br />

else’s, so IOJ was happy to go along for the<br />

conversational ride. By the way, he ended<br />

up answering most of the questions.<br />

IOJ: You’ve been a part of the<br />

European outlet industry since Day<br />

One. Is this recent tight credit market<br />

any worse than the previous ones?<br />

JWK: We haven’t had a terrible time<br />

getting funding, but it’s taking longer<br />

than it used to. But I don’t know that<br />

we’re typical.<br />

IOJ: Generally speaking, how does<br />

outlet retailing in Europe compare<br />

with the U.S. sector?<br />

JWK: I don’t really know how the U.S.<br />

outlet industry works. When I’m in the<br />

U.S., I visit outlet centers, and we seem<br />

to be completely different. We have a<br />

different design sensibility, a different<br />

lease structure, a different tenant mix,<br />

although there are more crossovers now.<br />

The U.S. is vastly larger than Europe.<br />

When I first started developing outlet<br />

centers in Europe, I was told that we<br />

had to be at last 60 miles from the nearest<br />

department store. In Great Britain<br />

if I went 60 miles, I was already overlap-<br />

iOJ iNTErViEw<br />

ping another department store. Sometimes<br />

I was in another country.<br />

IOJ: How many more outlet centers<br />

and how much more GLA can<br />

Europe absorb? Do you have a feel<br />

for opportunities in Russia? Asia?<br />

Latin America? Where will McArthurGlen<br />

go next?<br />

JWK: I think Great Britain is probably<br />

built out, but there might be a place for<br />

one or two more. Throughout Europe<br />

there are some odd places here and<br />

there that can accommodate another<br />

center. There are a lot of opportunities<br />

in Russia, Asia, Latin America, wherever<br />

there are big populations and wealth. But<br />

would you want to open an outlet center<br />

in Mexico now? No way. Ten years ago<br />

we tried to get a foothold in Russia, but it<br />

was still too early there. We couldn’t make<br />

any kind of deal on a piece of land. So<br />

we walked away. The truth is, we’re not<br />

going anywhere. I personally don’t want<br />

to travel anymore, and when we offered<br />

the chance to younger people in the<br />

company, they chose quality of life. They<br />

didn’t want to go anywhere, either.<br />

IOJ: How long can the outlet gig<br />

keep going? Does it have legs? Is it<br />

really just the flavor of the month,<br />

the passing phase that was predicted<br />

when you first joined the industry?<br />

JWK: It’s not the flavor of the month.<br />

The fact is, stretching dollars is how<br />

people shop now. We see no evidence that<br />

they stop shopping at outlets when they<br />

have more money to spend. When they’ve<br />

bought their kid a great pair of sneakers at<br />

40 percent less, they don’t think to themselves,<br />

“Oh, let’s pay more next time.”<br />

We’re reinventing ourselves as we go.<br />

Our center in Athens gets 4,000 to 5,000<br />

people every Sunday just for the food. The<br />

shops aren’t allowed to open, but people<br />

love coming there with their families, window<br />

shopping, enjoying the great food.<br />

The industry is constantly improving and<br />

giving shoppers what they want. c<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 17

ExpaNSiONS<br />

expansions fuel outlet growth<br />

Nine expansions in<br />

the next two years<br />

could add nearly<br />

85,000 m 2 to Europe’s<br />

outlet GLA.<br />

If most of the expansions planned<br />

for existing outlet centers in<br />

Europe open, the industry will<br />

have to thank McArthurGlen for<br />

the increased square footage. The<br />

London based developer, Europe’s<br />

largest, opened three expansions<br />

this year and plans another six in the<br />

next two years. Opening this year for<br />

MCG:<br />

l 7,200-m2 phase 3 at <strong>Designer</strong><br />

<strong>Outlet</strong> Roermond (The Netherlands)<br />

l 5,300-m2 phase 4 at Deisgner<br />

<strong>Outlet</strong> Parndorf (Austria)<br />

l 4,500-m2 phase 2B at La Reggia<br />

<strong>Designer</strong> <strong>Outlet</strong>, Naples c<br />

Planned Expansions to Existing <strong>Outlet</strong> Centers, 2012-2014<br />

NAME CITy COuNTRy DEVElOPER GlA m 2 GlA sf OPENING<br />

Roses Fashion <strong>Outlet</strong> Zagreb Croatia dayland Group 8,521 92,030 2012<br />

<strong>Designer</strong> <strong>Outlet</strong>s Wolfsburg Wolfsburg Germany OCI 8,472 91,500 2012<br />

Veneto <strong>Designer</strong> <strong>Outlet</strong> Venice Italy mcarthurGlen Group 6,500 70,200 2012<br />

Castel Romano <strong>Designer</strong> <strong>Outlet</strong> rome Italy mcarthurGlen Group 8,000 86,400 2012<br />

Barberino <strong>Designer</strong> <strong>Outlet</strong> Florence Italy mcarthurGlen Group 6,000 64,800 2012<br />

Festival Park ebbw Vale Wales, UK Chester Properties 25,000 270,000 2012<br />

asset management<br />

la Reggia <strong>Designer</strong> <strong>Outlet</strong> naples Italy mcarthurGlen Group 6,000 64,800 2013<br />

Swindon <strong>Designer</strong> <strong>Outlet</strong> Swindon england mcarthurGlen Group 5,000 54,000 2014<br />

<strong>Designer</strong> <strong>Outlet</strong> Roermond düsseldorf Germany mcarthurGlen Group 11,000 118,800 2014<br />

9 expansions 5 countries 4 developers 84,493 m 2 912,530 sf<br />

18 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

OCI’s <strong>Designer</strong> <strong>Outlet</strong>s Wolfsburg, which opened in 2007, has gotten approvals for<br />

an 8,472-m 2 expansion, which will open in 2012.<br />

Source: <strong>Value</strong> <strong>Retail</strong> <strong>News</strong>/International <strong>Outlet</strong> Journal

A New Kind of Destination<br />

Destiny USA is a new 2.4 million square foot destination that includes an existing 1.5 million square foot super regional<br />

shopping center, luxury outlets, dining and entertainment all under one roof.<br />

A Strategic Location. Brands have the opportunity to capture the entire Upstate New York region, along with parts of<br />

Canada and Pennsylvania by placing one store at Destiny USA.<br />

Over 29 Million Visits. Oxford Economics projects over 29 million annual visits.<br />

Your Customers. This unique offering of restaurants, entertainment, full priced retail, and luxury outlets will draw high<br />

impact, high spend visitor segments such as university students, regional tourists, Canadian and overseas shoppers.<br />

A LEED® Certified Green Building. Be a part of the largest LEED® Certified commercial retail project in the country.<br />

Join Our List Of Signed Leading Brands.<br />

<strong>For</strong> more information contact Mark Congel<br />

315-422-7000 markcongel@pyramidmg.com<br />

Visit us at DestinyUSA.com<br />

Follow us on Twitter @DestinyUSA

EurOpEaN prOJECTS<br />

uK<br />

Wembley outlet<br />

signs popular<br />

restaurants<br />

lONDON DESIGNER OuTlET, a<br />

350,000-sf outlet destination being<br />

developed by Quintain Estates in<br />

northwest London as part of Wembley<br />

City mixed-use project, has signd<br />

three restaurant tenants:<br />

l Frankie and Benny’s, Italian-American<br />

fare, taking 4,138 sf for 25 years<br />

l Handmade Burger Co., 40 different<br />

burgers made from scratch, 2,700 sf<br />

for 15 years<br />

l Jimmy Spices, multicultural range<br />

of Indian, Thai, Italian and Chinese<br />

dishes, 13,121 sf for 25 years<br />

Wembley City is the transformation of<br />

87 acres of land surrounding Wembley<br />

Stadium and Arena. The development<br />

FRANCE<br />

Roppenheim<br />

<strong>Outlet</strong>s sets<br />

Grand opening<br />

for 2012<br />

NEINVER AND MAB Development<br />

are well into the construction of their<br />

new joint venture, Roppenheim The<br />

<strong>Style</strong> <strong>Outlet</strong>s, scheduled to open in early<br />

2012. The 27,280-m 2 center is on the<br />

RD4 near the French village of Roppenheim<br />

and the German border. It will<br />

be the sixth <strong>Style</strong> <strong>Outlet</strong> concept that<br />

Neinver has opened since creating the<br />

concept two years ago.<br />

The center will group 107 shops in<br />

27,280 m 2 with 50,000 m 2 of green area<br />

on a lakeshore.<br />

“<strong>All</strong> the buildings will be under<br />

construction by the end of summer and<br />

the towers will be finished in September<br />

2011,” promised Marc Vaquier, CEO of<br />

MAB.<br />

The center will look like a fortified<br />

Alsatian village with traditionally colored<br />

walls and roofs. Thalès Architectures<br />

designed the project to reflect<br />

three different styles: Baroque, Renaissance<br />

and Medieval.<br />

20 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Quintain Estates’ planned London <strong>Designer</strong> <strong>Outlet</strong> has intentionally begun its leasing<br />

program with restaurants and leisure operators to create a lifestyle destination.<br />

will eventually include the outlet center,<br />

homes, office/commercial space and a<br />

Hilton hotel. Site work is under way, and<br />

development of LDO is due to start later<br />

this year with the opening of 85 outlets,<br />

a nine-screen cinema and 15 restaurants<br />

in 2013. The site is 15 minutes from<br />

London Marylebone by train; 8.4 million<br />

Village d’Aquitaine<br />

sets 2013 opening<br />

THE OPENING OF the Village<br />

d’Aquitaine Fashion <strong>Outlet</strong>, being developed<br />

on the outskirts of Bordeaux,<br />

France, has been confirmed for 2013.<br />

The fourth generation outlet center,<br />

developed by Bergerac <strong>Outlet</strong>s SAS part<br />

of Rioja Developments, is planned to<br />

have a phase 1 of 15,000 m 2 .<br />

The 18-hectare (44 acres) outlet scheme<br />

will sit within St. Andre du Cubzac. The<br />

masterplan will oversee the development<br />

of 40 hectares (100 acres) of commercial,<br />

live within a 60-minute drive.<br />

“We have intentionally targeted leisure<br />

operators in the first phase of the lettings<br />

strategy as part of our overall aim<br />

to deliver a mixed-use retail, restaurant<br />

and entertainment lifestyle destination.”<br />

said Phil Cottingham, managing director<br />

of <strong>Retail</strong> at Quintain.<br />

Neinver and MAB are developing Roppenheim The <strong>Style</strong> <strong>Outlet</strong>s in a French village<br />

near the German border.<br />

tourist and leisure facilities in the heart of<br />

the Gironde.<br />

Giles Membrey, managing director at<br />

Rioja Developments said, “The scheme<br />

at Village d’Aquitaine has huge potential<br />

for brands, drawing a catchment from<br />

the whole of Bordeaux and the Aquitaine<br />

region. Annually 27.5 million tourists<br />

travel on the A10 motorway, close to the<br />

retail and leisure complex at St. Andre du<br />

Cubzac, allowing retailers the opportunity<br />

to draw on residents as well as a constant<br />

flow of tourists year on year. With its accessibility,<br />

design and glorious setting, it is<br />

easy to see why retailers are already keen<br />

to be involved in the scheme.”

uKRAINE<br />

Progress reported<br />

On Kiev E95 center<br />

EVO lAND DEVElOPMENT has<br />

completed the design phase of Kiev<br />

E95 <strong>Outlet</strong> Centre, which will be the<br />

first FOC to open in Ukraine next<br />

year.<br />

The design, based on the typical<br />

European outlet center’s village style,<br />

will include Ukrainian baroque details<br />

and a comfortable, appealing old-town<br />

setting. The 170,435-sf mall will be<br />

on a site 12 km south of Kiev, on the<br />

intersection of E95 highway and new<br />

the Kiev ring route. The E95 connects<br />

Kiev with Odessa, which is more than<br />

400 km south.<br />

EVO Land Development specializes<br />

in retail and residential real estate<br />

development in major Ukrainian cities.<br />

Chameleon <strong>Retail</strong> is handling leasing on<br />

the property.<br />

EurO updaTES<br />

With the center’s design completed, Evo Land Development is pushing hard to get<br />

Kiev E95 <strong>Outlet</strong> Centre open in Ukraine in 2012.<br />

Fall 2011 InternAtIOnAl <strong>Outlet</strong> JOurnAl 21

EurOpEaN prOJECTS<br />

RuSSIA<br />

Belaya Dacha plans<br />

March 2012 opening<br />

HINES INTERNATIONAl Real<br />

Estate says it will open <strong>Outlet</strong> Village<br />

Belaya Dacha in Moscow in March<br />

2012 in the Moscow area town of<br />

Kotelniki.<br />

A joint venture of Hines and Belaya<br />

Dacha Group, the €120 million, 38,000m<br />

2 project is more than 75 percent<br />

pre-leased.<br />

BElAyA DACHA TENANTS<br />

adidas<br />

aldo<br />

Baldinini<br />

Bebe<br />

BmL munchen<br />

Bosco<br />

Burberry<br />

Cacharel<br />

Champion<br />

Chevignon<br />

CK Jeans<br />

dimensione danza<br />

energie/Killah<br />

SlOVAKIA<br />

escada<br />

Fabi<br />

Ferragamo<br />

Fifa<br />

Furla<br />

Gant<br />

Giovane Gentile<br />

Gizia<br />

henderson & hayas<br />

Il Patio<br />

Imperiya Sumok<br />

Incanto<br />

Incity<br />

Fashion House plus<br />

a newcomer plan<br />

centers in Russia<br />

VNuKOVO OuTlET VIllAGE is the<br />

latest new outlet center to take aim on<br />

Russia. Colliers International is handling<br />

leasing, but other details, such as the<br />

One Fashion <strong>Outlet</strong><br />

names tenants<br />

ONE FASHION OuTlET, the 16,000m<br />

2 center set to open in spring 2012<br />

near Bratislava, Slovakia, has released<br />

the names of several tenants that have<br />

signed up for the project: Adidas,<br />

Benetton, Envy, Esprit & Schiesser<br />

Underwear, Gant, Levi’s, Lindt, Nike<br />

and Tom Tailor.<br />

Realiz, the developer of the €75 million<br />

project, is working with outlet spe-<br />

22 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Hines International plans to open the €120 million, 38,000-m2 <strong>Outlet</strong> Village Belaya<br />

Dacha in Moscow in March 2012.<br />

Italian Osteria<br />

James<br />

Jamilco<br />

Jeans Symphony<br />

Joymiss<br />

Kanz Kids<br />

Karen millen<br />

Kurt Geiger<br />

Lacoste<br />

Le Coq Sportif<br />

L’etoile<br />

Levi’s<br />

Louvre<br />

m&S<br />

mascotte<br />

mexx<br />

michelle design<br />

miss Sixty<br />

modabella<br />

murphy & nYe<br />

naf naf<br />

new Balance<br />

nike<br />

nine West<br />

no One<br />

Ochnik<br />

center’s size and exact location weren’t<br />

available at IOJ press time.<br />

Fashion House is continuing to develop<br />

two projects in Russia:<br />

Fashion House <strong>Outlet</strong> Centre Moscow,<br />

a 29,000-m 2 center set to open in the<br />

spring of 2012. The site is northwest of<br />

Sheremetyvo International Airport on<br />

the main highway to St. Petersburg. The<br />

cialists Rioja Developments, Rohleder<br />

Lumby, SJ International, Freeport and<br />

Graham Coxhead, who has been appointed<br />

business development manager.<br />

Prior to joining One Fashion <strong>Outlet</strong>,<br />

Coxhead was with D1 <strong>Outlet</strong> Bratislava,<br />

a competing outlet project.<br />

One Fashion center, designed by<br />

Holder Mathias, is in Voderady on the<br />

outskirts of Bratislava. The center’s<br />

catchment includes 4.8 million people<br />

within a 90-minute drive in Slovakia, the<br />

Czech Republic, Austria and Hungary.<br />

Oasis<br />

Pal Zileri<br />

Parfois<br />

Patrizia Pepe<br />

Pente<br />

Pinko<br />

Planeta Sushi<br />

ramsey<br />

red Caffee<br />

Sonia rykiel<br />

StepoS<br />

Strellson<br />

Svyaznoy<br />

timberland<br />

tommy hilfiger<br />

triumph<br />

trussardi<br />

tsum<br />

tvoe<br />

UGG<br />

UOmO Collezioni<br />

US Polo<br />

Van Laak<br />

Williams & Oliver<br />

Wolford<br />

scheme is within a 45-minute drive of the<br />

center of Moscow and has a catchment<br />

of 13.4 million within a 90-minute drive.<br />

Fashion House <strong>Outlet</strong> Centre St.<br />

Petersburg, a 37,000-m 2 center set<br />

to open in spring 2013. The site is<br />

southwest of the city limits on a major<br />

highway with easy access and near the<br />

Pulkovo airport.<br />

D1 <strong>Outlet</strong> developer<br />

invests in multi-use<br />

facilities at the site<br />

IPEC GROuP, which is developing D1<br />

<strong>Outlet</strong> Bratislava in Slovakia, is investing<br />

€18 million in two other projects<br />

surrounding the site. The first is an<br />

office park that can accommodate<br />

2,000 workers, to be constructed in<br />

two phases south and northeast of the<br />

(continued on page 24)

New Arrivals<br />

Specialized in management of Fashion <strong>Outlet</strong>s, Stable <strong>Outlet</strong> Management offers a full service package,<br />

allowing project developers and outlet centre owners to focus on their end of the business, while we focus<br />

on what we do best: building and managing strong Fashion <strong>Outlet</strong> Centres. With a team of brand and business<br />

professionals, experienced in leasing, retail and marketing management. Straight forward and hands-on,<br />

our team is dedicated and committed, determined to making any of our projects successful. Whether for new<br />

or existing projects, Stable <strong>Outlet</strong> Management provides a full range of services dedicated to successful and<br />

profitable management of Fashion <strong>Outlet</strong> Centres.<br />

Stable <strong>Outlet</strong> Management. Next level management and marketing support.<br />

www.stable.nl

EurOpEaN prOJECTS<br />

(continued from page 22)<br />

outlet center. The second project is<br />

a logistics park for a variety of uses,<br />

including office, retail, storage and light<br />

manufacturing. The new projects will<br />

open in 2013.<br />

GERMANy, HOllAND<br />

Stable reports<br />

on three centers<br />

THE NETHERlANDS-based developer<br />

has announced that obstacles delaying<br />

Montabaur Fashion <strong>Outlet</strong> near<br />

Frankfurt, Germany have been resolved<br />

and that construction will begin in early<br />

2012. The appeal lodged by the town of<br />

EURO BRIEFS<br />

Resolution acquires<br />

McArthurGlen Roubaix<br />

RESOluTION PROPERTy has<br />

acquired McArthurGlen Roubaix, the<br />

191,000-sf (17,325 m 2 ) outlet center<br />

near Lille, France, for €23 million.<br />

Resolution bought the project<br />

from the European <strong>Outlet</strong> Mall Fund<br />

(EOMF), managed by Henderson<br />

Global Investors.<br />

McArthurGlen, which opened the<br />

center in August 1999 as part of<br />

an urban revitalization, is a major<br />

shareholder in the fund and will<br />

continue to manage, market and<br />

lease the project for Resolution.<br />

According to Henderson, the purchase<br />

price represents a net initial<br />

yield of 8 percent.<br />

The center is 20 minutes from<br />

Lille and the Belgian border and less<br />

than an hour’s drive from Brussels.<br />

The population within a two-hour<br />

drive is 11.1 million.<br />

In 2010 Resolution acquired<br />

McArthurGlen’s Troyes <strong>Designer</strong><br />

<strong>Outlet</strong> in France from Henderson’s<br />

fund for €85.5 million. Like the<br />

Roubaix purchase, McArthurGlen<br />

Troyes continues to be managed, marketed<br />

and leased by McArthurGlen.<br />

The Roubaix center has 75 tenants,<br />

24 InternAtIOnAl <strong>Outlet</strong> JOurnAl Fall 2011<br />

Limburg against the 16,000-m2 project<br />

has been dismissed by the highest court<br />

in Germany and no further appeals are<br />

possible, Stable says.<br />

At Batavia Stad in Lelystad, Holland,<br />

sales have increased 14 percent over last<br />

summer and footfall has increased by<br />

6 percent. New tenants at the center<br />

include Hugo Boss, Daniel Hechter,<br />

Tommy Hilfiger and Gant. Stable is<br />

also planning an 8,000-m2 phase 4 at<br />

the 10-year-old center. Construction is<br />

planned to start 2012.<br />

Tom Tailer and Dutch retailer Topmerkschoenen<br />

have joined Rosada<br />

Factory <strong>Outlet</strong> in Roosendaal, Holland.<br />

Since Stable took over management,<br />

marketing and leasing, sales at the center<br />

have increased 11 percent and footfall is<br />

up by 8 percent. Plans are in the works<br />

including Adidas, Diesel, Kipling,<br />

Lacoste and Timberland.<br />

Gloucester Quays<br />

adds to its outlet<br />

tenancy<br />

lEASING HAS BEEN busy at<br />

Gloucester Quays this summer with<br />

four new tenants opening in the<br />

220,000-sf center: Pilot, one of the<br />

UK’s leading clothing brands for fashion-conscious<br />

teen to 20-something<br />

females; room, which specializes<br />

in home and gift products including<br />

for a 7,000-m2 expansion at the fiveyear-old<br />

center.<br />

Brehna <strong>Outlet</strong> Park<br />

gets a green light<br />

BREHNA OuTlET PARK, in the<br />

Halle/Leipzig region of Germany, has<br />

the green light to open as an outlet center.<br />

The structure is an existing mall that<br />

had received local approvals a year ago,<br />

but objections from the neighboring<br />

cities stalled the project. The developer,<br />

Amsterdam-based One <strong>Outlet</strong> Services,<br />

told VRN/IOJ that all objections have<br />

been cleared and reconstruction was<br />

expected to begin at the end of August.<br />

The 17,500-m2 center is about 40 percent<br />

preleased and is scheduled to open<br />

in the autumn of 2012. c<br />

The 17,325-m 2 McArthurGlen Roubaix, which opened in 1999 as part of an urban<br />

revitalization project, is less than one hour from Brussels.<br />

hand-made Indian furniture, picture<br />

frames, wall art, glassware, cushion<br />

covers, candles, silk flowers and<br />

incense; tefal, the global leader in<br />

cookware, pressure cookers, electrical<br />

cooking appliances, food and<br />

beverage preparation and irons; and<br />

Double two, a plus-size apparel<br />

retailer for men and women.<br />

Gloucester Quays is a joint venture<br />

between The Peel Group and<br />

British Waterways and is one of the<br />

largest mixed use waterside regeneration<br />

developments in the UK.<br />

Tenants include M & S <strong>Outlet</strong>, Next<br />

Clearance, Gap <strong>Outlet</strong>, Nike Factory

Store, Calvin Klein, LK Bennett, Le<br />

Creuset and Osprey London.<br />

land Rover Bikes<br />

arrive at Royal Quays<br />

BICyClES, OuTDOOR GEAR and coffee<br />

are among a range of products on<br />

sale at the new Land Rover Bikes outlet<br />

store that recently opened at Royal<br />

Quays <strong>Outlet</strong> Centre, Newcastle.<br />

Royal Quays is owned by North<br />

Shields Investment Properties and<br />

managed by WD Limited. Tenants at<br />

the 137,000-sf center, which opened<br />

in 1996, include The Body Shop,<br />

Clarks, GAP, Le Creuset, Marks &<br />

Spencer, Moss, Next, Nike, Trespass<br />

and Pagazzi Lighting, the UK’s largest<br />

decorative lighting retailer.<br />

The center, which from above<br />

appears to be shaped like a grand<br />

piano, is close to both the A19 and<br />

the International Ferry Terminal as<br />

well as to Royal Quays Marina on the<br />

River Tyne. DW Sports Fitness and a<br />

50-room Premier Inn hotel are nearby,<br />

as is a 740-space car park.<br />

Dutch developer<br />

launches outlet<br />

management<br />

company<br />