European Outlet Sector Grows - Value Retail News

European Outlet Sector Grows - Value Retail News

European Outlet Sector Grows - Value Retail News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

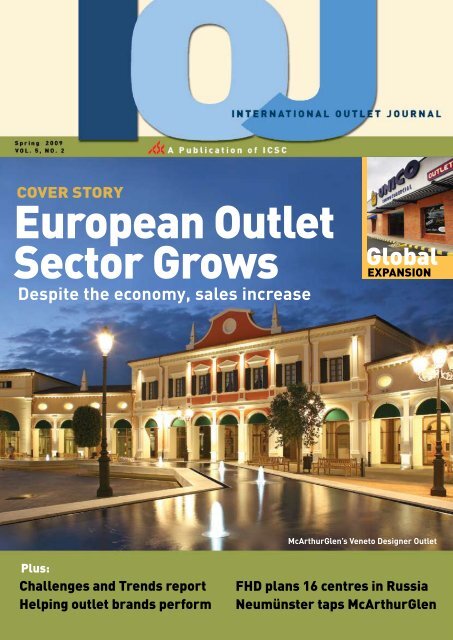

COVER STORY<br />

<strong>European</strong> <strong>Outlet</strong><br />

<strong>Sector</strong> <strong>Grows</strong><br />

Despite the economy, sales increase<br />

Plus:<br />

Challenges and Trends report<br />

Helping outlet brands perform<br />

Global<br />

EXPANSION<br />

McArthurGlen’s Veneto Designer <strong>Outlet</strong><br />

FHD plans 16 centres in Russia<br />

Neumünster taps McArthurGlen

PAGE 12<br />

STAFF<br />

MARY LOu FIALA<br />

ICSC ChaIrman<br />

JAAP GILLIS<br />

ICSC ChaIrman, EUrOPEan<br />

advISOry bOard<br />

MICHAEL P. KERCHEVAL<br />

ICSC PrESIdEnt and CEO<br />

RuDOLPH E. MILIAN, SCSM, SCMD<br />

ICSC SEnIOr vP<br />

JAY STARR<br />

ICSC SEnIOr vP<br />

ICSC EuROPE<br />

London, +44 20 7976 3100<br />

icsc.europe@icsc.org<br />

FLORIDA OFFICE<br />

29399 U.S. hwy. 19 n., Suite 370<br />

Clearwater, FL 33761<br />

+1 727 781 7557<br />

LINDA HuMPHERS<br />

Editor in Chief, ext. 472<br />

lhumphers@icsc.org<br />

TOM KIRwAN<br />

Senior Editor, ext. 471<br />

tkirwan@icsc.org<br />

RANDY GDOVIN<br />

art director, ext. 451<br />

rgdovin@icsc.org<br />

SALLY STEPHENSON<br />

Senior advertising Executive<br />

+1 847 835 1617<br />

Fax: +1 847 835 5196<br />

sstephenson@icsc.org<br />

KAREN KNObELOCH<br />

advertising Prod. mgr., ext. 441<br />

kknobeloch@icsc.org<br />

International <strong>Outlet</strong> Journal is a publication for the<br />

non-U.S. factory outlet industry. Copyright © 2008<br />

PAGE 18<br />

PAGE 22<br />

CONTENTS<br />

Vol. 5 No. 2 Spring 2009<br />

InsIde<br />

4 <strong>Outlet</strong> <strong>Sector</strong> <strong>Grows</strong> 5 Percent<br />

8 <strong>Outlet</strong> Industry Challenges & Trends<br />

12 Helping <strong>Outlet</strong> Brands Perform<br />

13 <strong>Outlet</strong> Sales Holding Strong<br />

16 Colombian <strong>Outlet</strong> Centre Opens<br />

16 FHD Plans 16 Centres in Russia<br />

17 McArthurGlen Tapped For Germany<br />

17 Planned Centre Updates<br />

18 Leasing <strong>News</strong> Throughout Europe<br />

20 <strong>News</strong> Notes: Marketing and Awards<br />

22 New Owners: Barberino, Zweibrucken<br />

23 New Neinver CEO, other People <strong>News</strong><br />

24 Report from Cannes<br />

26 With This In Mind: Clive Woodger<br />

26 IOJ 2009 Calendar<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl

EUrOpEAN SOi<br />

STATE OF THE OuTLET INDuSTRY<br />

<strong>European</strong> outlet sector<br />

grew 5 percent in 2008<br />

by LINDA HuMPHERS<br />

Editor in Chief<br />

Information gathered by IOJ from<br />

outlet-centre developers around the<br />

world shows that the industry in Europe<br />

is experiencing steady, stable growth,<br />

a sure sign the sector is maturing well. No<br />

longer a sector to be ignored and overlooked<br />

by the rest of the shopping centre<br />

industry, outlet retailing has proven itself a<br />

sturdy and reliable alternative distribution<br />

channel for brands. <strong>European</strong> executives<br />

and IOJ’s statistics also show that outlet retailing<br />

is still growing, and in this economy,<br />

new brands will support that growth by<br />

opening outlet divisions as they adapt to<br />

the changing consumer.<br />

InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

The following statistics come from<br />

the databases gathered for the Global<br />

<strong>Outlet</strong> Project Directory, published annually<br />

by ICSC. Bear in mind that ICSC/IOJ<br />

defines an outlet centre as one with at least<br />

50 percent outlet tenancy.<br />

Among the findings for 2008:<br />

n The total of 123 outlet centres<br />

comprising 25.9 million sf in 21 countries<br />

in Europe, Turkey and Dubai represents<br />

5 percent growth over 2007’s 117 centres<br />

that totaled 24.3 million sf.<br />

n The average <strong>European</strong> outlet centre<br />

GLA is 210,567 sf.<br />

n These 123 centres are owned by 63 different<br />

companies, so it is a diverse business.<br />

n Of the 63 owners, 13 companies own<br />

more than 50 percent of the centers and<br />

control more than 50 percent of the GLA.<br />

n The 20 largest centres total more<br />

than 8.2 million sf, or put another way, 16<br />

percent of the 123 centres account for 32<br />

percent of the total GLA. There are 14<br />

owners of the 20 largest projects, which<br />

means that one fifth of the owners control<br />

a third of the centres. The 20 largest centers<br />

are found in 11 countries.<br />

n 35 leasing firms handle leasing for<br />

one centre apiece, for a total of 6.8 million<br />

sf; 17 other leasing companies lease the<br />

other 88 centers totaling 19.1 million sf.<br />

n Eight companies are responsible<br />

for leasing more than 14.5 million sf of<br />

GLA in 63 outlet centers, thus, 15 percent<br />

of leasing companies lease more than 50<br />

percent of centers. c<br />

2008 largest <strong>European</strong> <strong>Outlet</strong> Center Portfolios<br />

Updated thru Feb. 6, 2008<br />

Portfolio owner leasing company Portfolio GlA no. of centers<br />

in portfolio<br />

Henderson Global Investors mcarthurGlen Europe 3,290,126 12<br />

<strong>Value</strong> <strong>Retail</strong> PLC value retail PLC 2,120,410 10<br />

Neinver neinver 1,863,190 10<br />

Concepts & Distribution Concepts & distribution 1,338,730 8<br />

Fashion District Group Fashion district Group 1,323,900 3<br />

Hermes Real Estate Investment rEaLm Limited 1,224,000 8<br />

Freeport Freeport 1,211,000 3<br />

McArthurGlen Europe mcarthurGlen Europe 1,004,554 5<br />

Al Ahli Group al ahli Group 750,000 1<br />

unibail-Rodamco Unibail-rodamco 742,000 4<br />

Fashion House Developments Cb richard Ellis 720,810 4<br />

DEGI Green Partners 659,100 2<br />

Land Securities hEad retail 500,000 2<br />

1 companies 16,7 7,820 72<br />

21% of the total number of 56% of total 59% of total<br />

european outlet-centre owners <strong>European</strong> number of<br />

outlet GLa <strong>European</strong><br />

* Includes dubai and turkey outlet centers<br />

Source: 2008 Global <strong>Outlet</strong> Project Directory

EUrOpEAN SOi<br />

20 Largest <strong>European</strong> <strong>Outlet</strong> Centers<br />

Center location Owner leasing Opened GlA<br />

Freeport Lisbon Lisbon, Freeport Freeport 2004 807,300<br />

Designer <strong>Outlet</strong> Portugal<br />

Dubai <strong>Outlet</strong> Mall dubai, United al ahli Group al ahli Group 2007 750,000<br />

arab Emirates<br />

Fashion District rome, Italy Fashion district Fashion district 2003 484,400<br />

Valmontone <strong>Outlet</strong> Group Group<br />

Optimum <strong>Outlet</strong> Center ankara, turkey volga dis. t/ C alkas Consulting 2004 457,500<br />

ve Eglence Merkezi ve dan. Ltd.<br />

Szi Consulting<br />

Fashion District bari, Italy Fashion district Fashion district 2005 430,500<br />

Molfetta <strong>Outlet</strong> Group Group<br />

Fashion District mantova Fashion district Fashion district 2003 409,000<br />

Mantova <strong>Outlet</strong> (bagnolo San vito), Group Group<br />

Italy<br />

Parndorf Designer <strong>Outlet</strong> vienna henderson Global mcarthurGlen 1998 405,800<br />

(Parndorf), austria Investors <strong>European</strong> dev. Co.<br />

Serravalle Designer <strong>Outlet</strong> milan henderson Global mcarthurGlen 2000 403,600<br />

(Serravalle), Italy Investors <strong>European</strong> dev. Co.<br />

Cheshire Oaks Designer <strong>Outlet</strong> Ellesmere Port, henderson Global mcarthurGlen 1995 395,613<br />

Cheshire, England Investors <strong>European</strong> dev. Co.<br />

Franciacorta <strong>Outlet</strong> Village milan (brescia), Italy dEGI Franciacorta Green Partners Srl 2003 380,000<br />

Festival Park Mallorca mallorca Es mirall Es mirall 2002 367,700<br />

(marratxi), Spain developments Sa developments Sa<br />

Marques Avenue Troyes troyes (Pont-Ste-marie), Concepts & Concepts & 1993 366,000<br />

France distribution distribution<br />

Olivium <strong>Outlet</strong> Center Istanbul, turkey Emintas-Ileri mensucat alkas Consulting 2000 363,800<br />

Galleria Moda Prague (tuchomerice), b.Consulting SrL b.Consulting SrL 2008 333,700<br />

at Praha Airport Czech republic<br />

Vicolungo <strong>Outlet</strong>s milan (novara - neinver Italy neinver 2004 322,900<br />

vicolungo), Italy<br />

The Galleria <strong>Outlet</strong> Centre hatfield, yorkshire, Land Securities hEad retail 1998 320,000<br />

England<br />

Troyes Designer <strong>Outlet</strong> troyes (Pont-Ste- henderson Global mcarthurGlen 1995 317,450<br />

marie), France Investors <strong>European</strong> dev. Co.<br />

<strong>Outlet</strong> Center Izmit Istanbul (Izmit), turkey bayraktar holding bayraktar Gayrimenkul 1997 309,800<br />

Gelistirme a.S.<br />

Roermond Designer <strong>Outlet</strong> roermond, henderson Global mcarthurGlen 2001 301,000<br />

netherlands Investors <strong>European</strong> dev. Co.<br />

Livingston Designer <strong>Outlet</strong> Edinburgh (Livingston), mcarthurGlen mcarthurGlen 2000 290,490<br />

Scotland <strong>European</strong> dev. Co. <strong>European</strong> dev. C<br />

Source: 2008 Global <strong>Outlet</strong> Project Directory<br />

Largest <strong>European</strong>* <strong>Outlet</strong> Center Leasing Companies<br />

(over 1 million sf)<br />

Company GlA leased no. of Centers leased<br />

mcarthurGlen Europe 4,095,580 16<br />

value retail PLC 2,120,410 10<br />

neinver 1,863,190 10<br />

Concepts & distribution 1,338,730 8<br />

Fashion district Group 1,323,900 3<br />

rEaLm Limited 1,310,000 9<br />

alkas Consulting 1,215,300 4<br />

Freeport 1,211,000 3<br />

8 companies 1 .5 million 6 centers<br />

* Includes turkey<br />

Source: 2008 Global <strong>Outlet</strong> Project Directory<br />

6 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

8,216,55

TrENDS & CHALLENgES<br />

<strong>Outlet</strong> execs speak out<br />

on challenges, trends<br />

In this most unusual of times, IOJ talked with<br />

several key outlet executives about the challenges<br />

their companies face in the coming<br />

months, as well as the trends they believe will<br />

shape the industry’s future.<br />

The executives are:<br />

Gary bond, CEO, McArthurGlen<br />

Development Co.,<br />

developer of 17<br />

designer outlet<br />

villages throughout<br />

Europe, with<br />

planned centres in<br />

Austria, Germany,<br />

Greece and Italy.<br />

Neil Thompson, CEO, Fashion<br />

House Development,<br />

four outlet<br />

centres in Poland<br />

and Romania;<br />

planned centres in<br />

Romania, Russia<br />

and the Ukraine.<br />

David williams, Fund Manager,<br />

Henderson Global<br />

Investors; operator<br />

of the <strong>European</strong><br />

<strong>Outlet</strong> Mall<br />

Fund, owner of<br />

12 outlet centres,<br />

including<br />

11 developed by<br />

McArthurGlen.<br />

8 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

Stefano Stroppiana, Managing<br />

Director/Partner,<br />

Premium<br />

<strong>Retail</strong>, Srl, startup<br />

development<br />

company in<br />

Italy.<br />

John Drummond, Managing<br />

Director, Guinea<br />

Group, developer<br />

of outlet<br />

centres in Belfast,<br />

N. Ireland,<br />

and Kendal,<br />

England.<br />

willem Veldhuizen, Managing<br />

Director, Stable<br />

International,<br />

developer of<br />

Batavia Stad in<br />

The Netherlands,<br />

and two<br />

planned centres<br />

in Germany.<br />

IOJ: What are the most pressing<br />

challenges facing your company<br />

in particular, and the outlet<br />

sector in general, in the coming<br />

months?<br />

GARY bOND: We’re lucky in<br />

that we have good development<br />

already under way. Venice is open<br />

and we’re into the second phase;<br />

Berlin opens in June; Naples and<br />

Salzburg open at the end of the<br />

year. We’re in ground work in<br />

Athens and waiting for approvals,<br />

and we’re opening a fourth phase<br />

at Parndorf. We have an amazing<br />

amount of work to keep us busy,<br />

but we have to focus on maximising<br />

the new projects and securing<br />

a good tenant line-up. The tenants<br />

are cautious about taking as much<br />

space as they used to, and they’re<br />

negotiating a bit harder.<br />

NEIL THOMPSON: There has not<br />

been as much effect on the Polish<br />

economy, but we are just starting<br />

to feel the effects of slowing<br />

manufacturing.<br />

DAVID wILLIAMS: The strength<br />

of the wider economy, especially<br />

its impact on rising unemployment,<br />

is the greatest challenge to<br />

the sector. Investors are naturally<br />

more cautious, and any new acquisition<br />

takes longer. Getting access<br />

to fresh bank finance remains<br />

challenging and we expect this to<br />

continue through 2009.<br />

STEFANO STROPPIANA: There

is a lack of consumer confidence<br />

that has led to a decline in purchasing.<br />

In this situation, most<br />

companies that have not been able<br />

to achieve financial strength in<br />

the last years are resizing and<br />

restructuring.<br />

JOHN DRuMMOND: The major<br />

challenge is the downturn in consumer<br />

discretionary spending<br />

coupled with the erosion of outletcentres’<br />

price advantage caused by<br />

full-price discounting in the high<br />

street and shopping malls. The<br />

high level of retail failures in the<br />

UK is both increasing the amount<br />

of vacant space available and<br />

reducing the number of tenants<br />

who are interested in expanding.<br />

The general economic situation<br />

is having a detrimental effect on<br />

the rental terms and overall deal<br />

terms that retailers/tenants are<br />

prepared to pay.<br />

wILLEM VELDHuIzEN: The biggest<br />

challenges for our outlet<br />

development is similar to those<br />

for the entire real estate industry:<br />

getting financing for new projects<br />

squared away.<br />

IOJ: What specifically is your<br />

company doing to meet those<br />

challenges?<br />

bOND: We’re focusing our efforts<br />

and being more cautious. We’re<br />

not going to rush into the higher<br />

risk locations like Turkey and<br />

Russia at this time.<br />

THOMPSON: We’re making some<br />

tactical changes to our marketing<br />

campaigns in Poland to place<br />

greater emphasis on the brand<br />

and value aspect of our offer, and<br />

to stress the differential between<br />

our offer and traditional shopping<br />

centres.<br />

wILLIAMS: The EOMF team has<br />

always maintained a positive relationship<br />

with its stakeholders. This<br />

good relationship is due to the<br />

strong returns the fund offered<br />

over recent years and their trust in<br />

our fund management programme.<br />

In 2009 we will be looking for more<br />

opportunities that meet our criteria.<br />

Working closely with our partners<br />

on the ground – McArthurGlen<br />

– we continue to invest in our current<br />

portfolio. The focus of our<br />

investment is asset management,<br />

as well as marketing and customer<br />

loyalty programmes to ensure<br />

we’re always the consumer’s first<br />

choice.<br />

STROPPIANA: Our group, as<br />

many others with a solid financial<br />

background, sees several opportunities<br />

to invest real money for<br />

substantial equity, thus reducing<br />

significantly the impact of debt<br />

for each project. This is the right<br />

time to acquire a relevant market<br />

advantage. Also property management<br />

is now more important than<br />

ever, so we will use our sophisticated<br />

solutions to minimize operational<br />

costs as we increase our<br />

marketing spend.<br />

DRuMMOND: We have refocused<br />

and amended our consumer<br />

marketing campaign, including<br />

shifting resources from below<br />

the line activity to above the line.<br />

We have devised totally new campaigns<br />

for key selling times such<br />

as Valentines Day, Mother’s Day<br />

and Easter. At Easter to widen the<br />

customer draw we will be holding<br />

a French Food Fayre in the centre<br />

with over 20 different French food<br />

providers/artisans, plus Northern<br />

Ireland producers. We are also<br />

increasing the number of initiatives<br />

that we operate jointly with<br />

our retail partners, with an aim to<br />

increasing turnover and profitability<br />

for both partners.<br />

IOJ: How are your company’s<br />

particular strengths helping to<br />

stay the course these days?<br />

bOND: We don’t have to expose<br />

ourselves to undue risks, and we<br />

watch our budgets and bank debt.<br />

As a developer and a manager,<br />

we’re in a strong position, whereas<br />

the one-offs will struggle.<br />

THOMPSON: We have a standard<br />

outlet concept in terms of<br />

brand and value but we believe we<br />

deliver it better for the consumer<br />

and our retail partners. We really<br />

help our retail partners manage<br />

their value message on a day-today<br />

basis. We have the balance<br />

right between international and<br />

domestic brands and our business<br />

concept is especially attractive for<br />

franchised brands as well as the<br />

brand owners themselves. We<br />

now work even more closely with<br />

our tenants, encouraging them to<br />

quickly move the growing surplus<br />

from their in-line stores into our<br />

outlet stores. This has been paying<br />

dividends for all of us.<br />

wILLIAMS: The strength of the<br />

EOMF is our strategy of continually<br />

investing in prime assets or selecting<br />

those that have the potential to<br />

be prime. We are entrepreneurial<br />

and are continually looking<br />

for opportunities. The <strong>Outlet</strong> Mall<br />

(Continued on page 10)<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl 9

EOC SESSiONS<br />

(Continued from page 9)<br />

Fund remains relatively stable even<br />

in these difficult times – we are<br />

still experiencing growth across<br />

our portfolio. We continue to stick<br />

to our business model, investing<br />

well in targeted marketing and<br />

maintaining a strong tenant mix<br />

to ensure the brand offer remains<br />

attractive to our loyal customers.<br />

VELDHuIzEN: We have a healthy<br />

equity base and equally healthy<br />

partners in all our projects.<br />

IOJ: How long do you expect<br />

challenges to affect how you operate<br />

your company?<br />

bOND: Approvals and the economy<br />

will always be a challenge.<br />

Approvals are the lifeblood for our<br />

expansions. We’re being countercyclical,<br />

so I think we’ll be okay<br />

through this period.<br />

THOMPSON: Difficult to tell for<br />

the economy, but we have 18-24<br />

months in mind.<br />

wILLIAMS: <strong>Retail</strong> is a fluid industry,<br />

always moving and changing.<br />

The Fund looks to anticipate change<br />

in both the economy and shopping<br />

patterns, and we recognise<br />

that these challenges will never<br />

stop. Right now our objective is to<br />

maintain income through investment<br />

and continue to work closely<br />

with McArthurGlen and our brand<br />

partners.<br />

STROPPIANA: We’re moving forward<br />

now. We’re planning and investing<br />

in several projects according to a<br />

four-year expansion plan.<br />

DRuMMOND: At this point I can<br />

see no reason to be optimistic in<br />

the short- or mid-term future, and I<br />

believe we are going to be in a very<br />

challenging economic climate for<br />

10 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

at least the next two years.<br />

VELDHuIzEN: Life could get back<br />

to normal within two or three years,<br />

but we could be in a much more<br />

prolonged economic downturn. In<br />

either situation the outlet industry<br />

will have great challenges, as well<br />

as opportunities that we intend on<br />

seizing.<br />

IOJ: On a scale of 1 to 10, how do<br />

you rate today’s challenges?<br />

bOND: It’s hard to rank them.<br />

We don’t worry about that. We just<br />

focus on dominating the market,<br />

staying the best and letting people<br />

know that we are the best.<br />

THOMPSON: We really see challenges<br />

as an opportunity. We have,<br />

in fact, benefited from the slowdown<br />

as it appears that consumer behavior<br />

is leading to a greater preference<br />

for outlet shopping – our centres are<br />

reporting double-digit growth. We<br />

view this as an opportunity to differentiate<br />

ourselves further.<br />

wILLIAMS: Of course the economy<br />

must rate as the biggest challenge<br />

to every business including<br />

the EOMF. However, I wouldn’t rate<br />

the challenges we face on a scale<br />

of 1 to 10 as we give all of them the<br />

highest priority to be able to succeed<br />

in the market.<br />

VELDHuIzEN: The economy is<br />

No. 1 for us, as it should be for<br />

everyone because it impacts everything.<br />

IOJ: What trends do you see for<br />

the european outlet industry in the<br />

foreseeable future?<br />

bOND: There will be less demand<br />

for new development from new<br />

companies, with only the bigger<br />

players succeeding. There is a<br />

lot of distressed property on the<br />

market, which in time will be worth<br />

looking at for acquisition.<br />

THOMPSON: We’ll see greater<br />

stock levels for the next two seasons<br />

before manufacturing levels<br />

eventually slow to meet the fall in<br />

demand. We’ll also see a change in<br />

the consumer mindset as value is<br />

placed at the forefront of purchasing<br />

decisions and branded bargains<br />

once more become sexy.<br />

wILLIAMS: The sector will<br />

emerge as one of the strongest<br />

when compared to other property<br />

asset classes. Once capital<br />

becomes more available I see<br />

an increase in new outlet supply<br />

across Europe. During the current<br />

economic environment I see an<br />

increase in the number of assets<br />

coming to the market. Seeing the<br />

success of major brands in our<br />

centres, other international brands<br />

will see the benefit of an outlet<br />

distribution channel as part of their<br />

overall business model.<br />

DRuMMOND: I believe the<br />

<strong>European</strong> outlet industry will continue<br />

to be a major retail force, but<br />

I anticipate some weak centres will<br />

fail if the current exchange rate<br />

situation continues to exist between<br />

the pound and the euro. <strong>Retail</strong>ers<br />

will suffer increased merchandise<br />

costs and shopping patterns within<br />

Europe will be varied by currency<br />

exchange rates. Also, there will be<br />

a trend for shorter-term lettings and<br />

all-inclusive turnover rent deals.<br />

VELDHuIzEN: Further consolidation<br />

will be inevitable, and the<br />

focus for growth and strength will<br />

be in Northwestern Europe. The<br />

outlet party in Central-Eastern<br />

Europe will end. c

THE ECONOMY<br />

top challenge this year:<br />

Helping brands perform<br />

<strong>Value</strong> <strong>Retail</strong>’s major<br />

focus in this economy<br />

is to enrich on-site<br />

tenant programmes.<br />

by LINDA HuMPHERS<br />

Editor in Chief<br />

Nobody is claiming clairvoyance,<br />

certainly not Scott Malkin<br />

and his <strong>Value</strong> <strong>Retail</strong> team. But<br />

the company’s long-term emphasis on<br />

coaxing top performances from tenants<br />

in their nine outlet villages looks like the<br />

developer has been preparing for an economic<br />

downturn for quite a while.<br />

“In response to the opportunities<br />

that we felt made the most sense in the<br />

market,” Malkin told IOJ, “we ceased<br />

new development three years ago and<br />

froze expansions of existing projects 18<br />

months ago. In this sense, we did perhaps<br />

unwittingly anticipate an economic<br />

downturn. Certainly, our focus for the<br />

past three years has been on driving productivity<br />

rather than increasing our size.<br />

“We do not build to sell to institutional<br />

owners, which is the norm in Europe.<br />

Therefore, the choices we make at the<br />

outset must last us a lifetime.”<br />

One facet in attaining that goal at each<br />

outlet village is an on-site retail team – as<br />

many as six staffers – whose primary purpose<br />

is to work with tenants, commencing<br />

before the brand opens its first store.<br />

When the global economy suddenly<br />

falters, the importance of maintaining a<br />

serene, supportive atmosphere for brands<br />

takes on new importance.<br />

“It’s the proverbial tsunami out there,”<br />

according to Malkin, chairman<br />

of London based <strong>Value</strong> <strong>Retail</strong>,<br />

developer of designer outlet<br />

villages in the major cities of<br />

Europe. “The brands are in<br />

a complicated state. They’re<br />

expressing anguish. They’re<br />

adapting or scrambling or in<br />

denial. So we’re working really<br />

hard to help them maintain<br />

their balance by upgrading our<br />

12 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

Eighteen months ago, <strong>Value</strong> <strong>Retail</strong> began preparing for the economic slowdown by<br />

ceasing new developments and halting expansions at its nine outlet centers. Instead, it is<br />

helping tenants develop their brands.<br />

services and adding strength and quality<br />

to our staffing.”<br />

Unlike many shopping-centre landlords,<br />

<strong>Value</strong> <strong>Retail</strong> hasn’t been hit by tenant<br />

pressure to lower rents because it operates<br />

on percentage rents. The pressure of<br />

percentage rents, of course, is to make sure<br />

tenants continue to pump out strong sales.<br />

“Business has been good,” Malkin<br />

says. “Our tenants have good levels of<br />

product; we have increased footfall and<br />

increased spend. Our business has performed<br />

well, and continues to perform in<br />

line with our expectations.”<br />

In fact, the <strong>Value</strong> <strong>Retail</strong> portfolio performed<br />

strongly in 2008:<br />

n Fourth quarter comp sales rose<br />

again, resulting in an annual average<br />

increase of 8 percent<br />

“the brands<br />

are in a<br />

complicated<br />

state,”<br />

Malkin says.<br />

n Footfall increased 7.5 percent<br />

n Spend per visitor increased more<br />

than 8 percent<br />

In January, business continued to be<br />

solid, Malkin says, adding that despite<br />

steep, competing markdowns at full-price<br />

stores, <strong>Value</strong> <strong>Retail</strong> scored high double-digit<br />

growth in both footfall and comp sales.<br />

While the quality of the tenant mix,<br />

customer service and retail support clearly<br />

show the developer’s strength, <strong>Value</strong> <strong>Retail</strong><br />

sees hurdles ahead.<br />

“Our biggest challenge is to help those<br />

brands that don’t know how to deal with<br />

help,” Malkin says. “Finance directors<br />

are now making decisions, often cutting<br />

staff across the board, regardless of the<br />

productivity of individual locations.”<br />

Malkin says high-end, selective brands that<br />

haven’t previously entertained outlet retailing<br />

are now eying the outlet channel.<br />

“They’re saying, ‘okay, we see the world<br />

is headed toward greater efficiency<br />

in distribution, and that the high-end<br />

outlet village is the progressive path to<br />

take.’ They’re also now focusing on the<br />

aspirational shopper to drive productivity<br />

and cash flow while protecting their<br />

brand positioning.”<br />

Luxury brands particularly need

help redeploying their goods, he says,<br />

“because they don’t have a tradition of<br />

high-volume distribution. Last year the<br />

senior people in these brands were commuting<br />

to China and India envisioning<br />

huge new store openings. This year their<br />

priority, and ours, is to make their existing<br />

business more powerful.”<br />

Even existing outlet chains that have<br />

decreased expansion are opting to<br />

improve their operations, Malkin says,<br />

“which brings them back to what we do:<br />

help them improve their positions.”<br />

Although the future is an unknown, one<br />

thing is certain, he says: <strong>Retail</strong>ing will change.<br />

“Brands are already re-inventing their<br />

business models,” he says. “For the next<br />

several years we’ll be seeing a reconfiguration<br />

of the retail industry. We’re definitely<br />

seeing the trend of guilt-free shopping,<br />

which means that the shopper wants to<br />

believe in the brand and the quality it rep-<br />

resents. Department stores selling goods at<br />

70 percent off two months before Christmas<br />

hurts the brands, their equity and their image.”<br />

The message to the consumer, Malkin<br />

says, “is that value for money can still be<br />

found in outlets. It turns out that this is<br />

appealing to all three parts of our customer<br />

base, the domestic shopper, the<br />

large population of long-term ex-pats, and<br />

tourists. Everyone agrees that mindless<br />

consumption is over.” c<br />

Holiday, January sales are<br />

holding strong for outlets<br />

<strong>Outlet</strong> retailing has had the quiet<br />

reputation of being countercyclical<br />

to economic downturns – quiet because<br />

brands have so often been reluctant<br />

to discuss their outlet distribution channels.<br />

But just as so many things have changed<br />

in the last few months, the sector’s strong<br />

sales are now proudly on display.<br />

As Robert Hallworth, centre manager at<br />

Lowry <strong>Outlet</strong> Mall says, “The consumer is<br />

undoubtedly cautious at the moment, but<br />

with the extra income people are seeing<br />

from reduced mortgages, we’ve noticed<br />

that little luxuries haven’t gone out the<br />

window. For instance, people are enjoying<br />

a day out and sharing a meal.”<br />

Being countercyclical doesn’t mean that<br />

outlet chains and landlords are sitting back as<br />

the customers and money flow in. There’s<br />

hard work ahead and everyone knows it.<br />

Pieter van Voorst Vader, real estate<br />

manager of Nike Europe told IOJ, “We are<br />

re-structuring our existing portfolio with<br />

closures, downsizing, refitting and expanding<br />

existing units and developing new, alternative<br />

concepts, such as stand-alone units<br />

in retail parks. We are also standardising<br />

internal processes to improve our speed to<br />

market. And we’re exploring new markets<br />

in closer detail, such as opening the first<br />

Nike-owned outlet store in St. Petersburg.”<br />

McArthurGlen<br />

Sales at the seven UK designer outlet<br />

centres operated by McArthurGlen<br />

outperformed the UK’s retail sector in<br />

January. Like-for-like sales increased 10<br />

percent compared to the same period in<br />

2007, with sales of designer goods being<br />

one of the strongest performing categories,<br />

ING’s Dalton Park in England kicked off 2009 with healthy sales and footfall, probably<br />

in response to bright marketing, new promotions and outlet pricing.<br />

showing a 19 percent comp store increase.<br />

Meanwhile, total sales were up by 12<br />

percent and footfall by 9 percent for the<br />

UK portfolio.<br />

Cheshire Oaks Designer <strong>Outlet</strong> in<br />

Chester, the UK’s largest with 31,300 m 2<br />

of GLA and 140 units, recorded a 10percent<br />

increase; York Designer <strong>Outlet</strong>, a<br />

17-percent increase and Swindon Designer<br />

<strong>Outlet</strong>, a 13-percent increase.<br />

Henrik Madsen, McArthurGlen’s Managing<br />

Director for the UK and Northern Europe,<br />

said the strong January performance<br />

followed strong holiday like-for-like sales<br />

that increased by nearly 4 percent.<br />

“This increase comes despite strong<br />

competition from heavy discounting by<br />

retailers on the high street,” Madsen said.<br />

“Our centres are also benefiting from<br />

more AB customers experiencing our<br />

designer and fashion offer, which in turn<br />

is helping to push up sales.”<br />

For McArthurGlen’s entire portfolio of<br />

17 centres in the UK and Europe in January,<br />

total sales were up 17 percent, comp sales<br />

were up 8 percent and footfall by 7 percent.<br />

Dalton Park<br />

At ING’s Dalton Park in the UK, 2009<br />

kicked off with strong sales for the first five<br />

weeks with like-for-like sales increasing 13<br />

percent and visitor levels increasing 12 percent.<br />

A recent outdoor-wear promotion saw<br />

a lift of 22 percent on ski and outdoor wear<br />

with strong performances from Regatta,<br />

TOG 24, Mountain Warehouse, Lillywhites<br />

and Berghaus at Brand Fusion. Nike Factory<br />

store, Gap <strong>Outlet</strong> and Marks & Spencer<br />

outlet have also beaten forecast sales for the<br />

first five weeks with significant increases on<br />

last year, the developer says.<br />

Dalton Park puts its positive performance<br />

down to the consumers need for branded<br />

(Continued on page 14)<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl 1

THE ECONOMY<br />

(Continued from page 13)<br />

product at bargain prices as well as an aggressive<br />

marketing programme and launch of the<br />

new Dalton Park Web site: www.dalton-park.<br />

co.uk. With those initiatives, feedback from<br />

new tenants has been positive:<br />

n “Our Gap <strong>Outlet</strong> opening has been<br />

our best this year with sales far exceeding<br />

expectations.” – Rob Greene, district<br />

manager, Gap <strong>Outlet</strong><br />

n “Past Times is delighted. The shop<br />

has exceeded budget and we have had fantastic<br />

response from customers.” – Penny<br />

Tunnell, Product Director, Past Times<br />

n “We feel the help, support and marketing<br />

programme has enabled us to enjoy<br />

a very positive first year trading.” – David<br />

Waring, Area Manager, Sleepmasters<br />

Fashion House<br />

<strong>Outlet</strong> centres in Poland bucked the<br />

declining economy, according to Neil<br />

Thompson, CEO of Fashion House<br />

<strong>Outlet</strong> Centers, because “When customers<br />

count every penny, cent and zloty, they<br />

find ways to maintain their lifestyle.”<br />

Hello, outlet shopping.<br />

Bigger centres, including those in the Fashion<br />

House portfolio, also help drive sales, he<br />

said, because they “mean more shops and a<br />

wider offer for customers. Customers are<br />

first lured by clothing brands, but then start<br />

looking to the outlet for household articles,<br />

haberdashery and interior decoration. Polish<br />

consumers, in particular, know a good deal<br />

when they see one, and they’re even smarter<br />

shoppers when money matters.”<br />

Junction One<br />

Junction One achieved holiday compsales<br />

growth of 20 percent, which John<br />

Drummond, the scheme’s asset manager,<br />

attributes to tenants rising to the challenge<br />

and aggressive marketing.<br />

“Along with our retail partners we<br />

invested heavily in an integrated marketing<br />

campaign,” Drummond said, adding that<br />

“more than half of J1’s tenants recorded<br />

substantial double-digit growth.”<br />

Tenant comments include:<br />

n “Junction One was my second-best<br />

performing store throughout the whole of<br />

November and December, trading in double<br />

figures.” Jayne Everett- Brand Fusion<br />

n “Our store at Junction One was<br />

fourth out of the 11 in Northern Ireland.<br />

Bearing in mind the doom and gloom<br />

across the economy, this performance was<br />

very good.” Kirsty Waldrum, Thornton’s<br />

n “Very strong Christmas at J1 and in<br />

fact delighted with the trade for the last three<br />

months. We are very upbeat about the centre<br />

1 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

Counting on its aggressive management strategy, Resolution Properties predicts that<br />

its 215,278-sf Park Avenue Fashion <strong>Outlet</strong> near Bilbao, Spain will produce a 12 percent<br />

increase in sales this year.<br />

and feel it has a good mix which gives us a<br />

lot of confidence.” Paul Donoghue, M&S<br />

n “Our Junction One store had a<br />

fabulous Christmas. Customers flowed<br />

through the doors. We experienced a<br />

high level of repeat customers, which is<br />

very satisfying in the present economic<br />

climate.” Tracey Reynolds, Banana Books<br />

n “We are delighted. We experienced a<br />

significant increase in sales over the 6 week<br />

period against the previous year.” Darren<br />

Walker, asst. mgr., Camille<br />

“Motorcoach traffic at Christmas increased<br />

by 400 percent increase this year,”<br />

Drummond said, adding that more than 60<br />

percent of the coaches came from the South<br />

of Ireland, thus benefiting from the recent<br />

VAT reduction, as well as the bargain pricing.<br />

uK, europe, Middle east<br />

n The Lowry <strong>Outlet</strong> Mall said it has<br />

seen like-for-like sales increase 18 per cent<br />

in January. The Emerson Group-owned<br />

mall said it also saw a 20 percent increase<br />

in footfall in the period. During the first<br />

week of January like-for-like sales were up<br />

39 per cent with footfall up 48 per cent<br />

year on year. For the month of January,<br />

food-court & restaurants sales were up 20<br />

percent. For 2008, footfall increased 4.5<br />

per cent to 4 million customers.<br />

n Park Avenue, Resolution Property’s<br />

outlet scheme in Bilbao, says the beginning<br />

of 2009 is off to a promising start. If the<br />

scheme’s performance during the first two<br />

weeks of January are any indication, the<br />

centre is on target to meet its goal of 12<br />

percent growth for the year.<br />

n The credit crunch may be hitting the<br />

United Arab Emirates, but it hasn’t kept<br />

bargain-hunters from heading to Dubai<br />

<strong>Outlet</strong> Mall. More than 500,000 hit DOM in<br />

November, a 15 percent increase from 2007.<br />

“The downturn in the global economy<br />

is making customers consider every single<br />

dirham that they spend” DOM director<br />

Vishal Mahajan said.<br />

The number of visitors – who include<br />

UAE Nationals, Arab expats, Western<br />

expats and tourists from all over the world<br />

– jumped 40 percent for the year, which<br />

Mahajan attributes to greater awareness of<br />

the scheme, which has 240 stores and is<br />

planning a phase 2. c<br />

A year after opening, Al Alhi Group’s Dubai <strong>Outlet</strong> Mall has caught on with shoppers<br />

– more than 500,000 visited the 750,000-sf mall in November.

ArOUND THE gLOBE<br />

Unico opens third centre<br />

in barranquilla, Colombia<br />

unico, an outlet center developer<br />

based in Cali, Colombia, opened its<br />

third and largest outlet centre on 5<br />

December, 2008, in Barranquilla.<br />

The 200,000-sf Unico Barranquilla is an<br />

enclosed mall that executive director David<br />

Toledo said opened about 80 percent<br />

occupied.<br />

“The tenants are mostly local brands,”<br />

Toledo told IOJ. “There are many, many<br />

manufacturers of apparel and footwear<br />

in Colombia, so it’s natural that we tenant<br />

with the most popular ones, such as GEF,<br />

Americanino, Naf Naf, Tennis, Bosi, Velez,<br />

Studio F, Leonisa, Totto, Color Siete and<br />

Decko, among many others. But we also<br />

have plenty of international brands, too, including<br />

Adidas, Diesel, Esprit, Levi’s, Nike,<br />

Kenneth Cole, Puma and Quiksilver.<br />

The Colombian outlet sector is based<br />

on the U.S. model with local adaptations,<br />

Toledo says. “The outlet concept is wellestablished<br />

here and has been operating<br />

for more than 10 years. <strong>Retail</strong>ers and<br />

consumers both understand the concept.<br />

Unlike the rest of South America, Colombia<br />

does have an outlet industry that<br />

is developing along with the traditional<br />

shopping-center sector.”<br />

The developer’s first centre, Unico Cali,<br />

opened in 1997 as an adaptive re-use.<br />

Tenants at that center, also 200,000 sf, include<br />

Adidas, Calvin Klein, Levi’s, Puma,<br />

Skechers and Umbro.<br />

Unico Pereira, the developer’s second<br />

outlet centre, opened in 2004 with 60,000<br />

sf. Tenants include Levi’s, Skechers, USA<br />

Jeans, Mini People, Maxim’s and Sebastian.<br />

PLANNED CENTRE uPDATES<br />

FHD to develop<br />

as many as 16<br />

centres in Russia<br />

Fashion House Development (FHD),<br />

successor of The <strong>Outlet</strong> Company, and<br />

a partnership of GVA Grimley <strong>Outlet</strong><br />

Services and Liebrecht & Wood, has<br />

acquired its first outlet site in Russia. The<br />

site is next to Sheremetyevo International<br />

Airport, on the main highway connecting<br />

Moscow and St. Petersburg, just outside<br />

16 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

With an estimated 44.6 million people<br />

in 2008, Colombia is the fourth-most<br />

populous country in South America, after<br />

Brazil, Argentina and Peru. According to<br />

Toledo, everyone likes outlet shopping.<br />

“Who is our shopper? Everyone!” he<br />

says. “Colombian shoppers love well-<br />

of the Moscow city. FHD will partner<br />

with the Moscow development firm GVA<br />

Sawyer, who’ll serve as the local developer<br />

of the project.<br />

FHD CEO Neil Thompson says the<br />

developer intends to roll out 16 outlet<br />

centres in Russia because brand awareness<br />

is so great.<br />

Brendon O’Reilly, Director, GVA Grimley,<br />

says that Russia has no outlet centres,<br />

“yet there is potential for at least 20 based<br />

on population, brand awareness and potential<br />

spend. Interestingly, it was tenant<br />

unico barranquilla,<br />

above and left, is the<br />

third outlet scheme to<br />

open in Colombia that<br />

is based on the American/<strong>European</strong><br />

model<br />

that features manufacturer-operated<br />

stores<br />

in a new-construction<br />

setting.<br />

known brands but they want to pay the<br />

least they can. Unico shoppers always<br />

prefer the best price-quality equation, and<br />

they enjoy the exploration process. Also,<br />

our outlets are vibrant, exciting, and offer<br />

a secure environment, which Colombians<br />

definitely care about.” c<br />

demand that drove us to explore Russia.”<br />

Cameron Sawyer, Chairman of GVA<br />

Sawyer, says that just the fact that the<br />

deal was able to be closed so quickly in<br />

this economy “is a really positive sign and<br />

has given us an excellent foundation for<br />

achieving market dominance.”<br />

According to Patrick Van Den Bossche,<br />

co-founder Liebrecht & Wood and FHD,<br />

Fashion House Moscow “is the first of<br />

three plots we have the funding in place<br />

for in the Ukraine and Russia. The further<br />

two plots are currently being finalised.”

PLANNED CENTRE uPDATES Continued<br />

FHD’s portfolio includes three outlet<br />

centres in Poland and one in Romania. A<br />

second for Romania is also planned.<br />

McArthurGlen finds<br />

traction in Germany<br />

McArthurGlen Group has been given the<br />

go-ahead to develop a 20,000-m2 designer<br />

outlet village in Neumünster, in the North<br />

German state of Schleswig-Holstein.<br />

The city of Neumünster selected McArthurGlen<br />

as its preferred partner following<br />

a <strong>European</strong>-wide bidding process. The<br />

site of the new village is on the B205, the<br />

main access road to Neumünster from the<br />

A7/E45 motorway linking Denmark with<br />

Southern Germany. The site is 40 minutes<br />

north of Hamburg, the second largest city<br />

in Germany and the wealthiest city in that<br />

country. The state of Schleswig-Holstein is<br />

the third most important tourist destination<br />

in Germany for national tourists,<br />

receiving over 5.5 million visitors a year.<br />

The 15,000-m 2 phase 1 will open in<br />

2011, followed by a 5,000-m 2 phase 2.<br />

McArthurGlen operates 17 outlet<br />

centres throughout Europe and the UK<br />

and is in the process of redeveloping the<br />

former B5 centre near Berlin. That center,<br />

renamed Designer <strong>Outlet</strong> Berlin, is owned<br />

by Henderson Global Investors and is<br />

scheduled to reopen in May.<br />

Alpenrhein set for<br />

late 2009 opening<br />

The Countdown has begun: In 10<br />

months’ time ING’s Alpenrhein <strong>Outlet</strong><br />

Village in Landquart, Switzerland, will<br />

become reality. The south end of the<br />

site, where the majority of the shops<br />

has already been completed, is significantly<br />

advanced and the two-level parking<br />

deck is finished. At the end of January,<br />

leases had been signed with more than 30<br />

brands. BVS <strong>Outlet</strong> Villages is handling<br />

leasing, management and marketing of<br />

the 226,020-sf outlet centre. For closer<br />

updates of the progress, check out the<br />

centre’s Web site at www.alpenrheinoutlet.<br />

com and click on the two Web cams.<br />

Freeport steps up<br />

growth into France<br />

Alsace International <strong>Outlet</strong> is the<br />

latest Freeport centre, scheduled to open<br />

in October 2010 with 106 stores. Located<br />

45 km north of Strasbourg, on the<br />

German/France border it has a 90-minute<br />

catchment comprising 65 percent German<br />

and 35 percent French; 9 million tourists<br />

visit Alsace every year. The outlet centre<br />

has been designed as a circular ‘race track’<br />

and whilst it is costing more to build,<br />

Freeport thinks that the higher design will<br />

pay back in the longer term.<br />

Freeport’s Le Cannet <strong>Outlet</strong> Centre in the<br />

South of France is planned to open in 2011.<br />

Since Freeport was bought out by<br />

CEREP Investment II Sarl, part of the Carlyle<br />

Group in September 2007, the company<br />

has installed local people to run its outlets.<br />

Chris Milliken, Freeport leasing director,<br />

said: “Whilst being owned by a private<br />

equity company we do feel under pressure<br />

to perform. Carlyle has given us tough<br />

targets but they also seem to be allowing<br />

us to plan for the long term.”<br />

Miller Group will<br />

complete Kendal<br />

Riverside build-out<br />

The Miller Group has been named the<br />

principal contractor of the €113 million<br />

Kendal Riverside regeneration project.<br />

The UK-based developer will complete<br />

the superstructure works on the 4.8 acre<br />

site, including erecting over 2,500 tons<br />

of steel frame, laying floors, building all<br />

internal and external walls and raising the<br />

roof structure.<br />

John Drummond, Kendal Riverside Ltd<br />

project director, says that Miller already<br />

has steelwork well advanced. “The company<br />

will be working with us right to the<br />

end of the project as they are also contracted<br />

to carry out the internal fitting out<br />

of the apartments and offices, delivering a<br />

turnkey development in spring 2010.”<br />

Kendal Riverside Ltd is a partnership<br />

comprising CUSP and The Guinea Group.<br />

During construction K Village continues<br />

to trade as an outlet centre.<br />

Other planned<br />

projects to watch:<br />

■ With its fast growing economy,<br />

and its independence of the <strong>European</strong><br />

economy, Norway has one of the strongest<br />

economies in the world. So it’s not<br />

surprising that, despite a small population<br />

(4.8 million), it is about to get its first<br />

outlet centre. Castelar Corporate<br />

Finance is seeking to open the first outlet<br />

centre in Norway, gaining first-mover<br />

advantage in the country. Strategically<br />

located at Vestby, equidistant between<br />

Drammen and Oslo, with good visibility<br />

and easy access, Norway <strong>Outlet</strong> will<br />

have 13,000 m 2 and contain 50 brands.<br />

“We will not have a catchment of 2 million<br />

but we will be the only outlet centre<br />

there,” reports Ådne Søndrål of Castelar<br />

Corporate Finance. 50% of the centre is<br />

already leased.<br />

■ France-based Advantail, founded by<br />

former directors of McArthurGlen and<br />

<strong>Value</strong> <strong>Retail</strong>, has three projects underway<br />

in France. The first, at Moulin de Nailloux<br />

Village (Toulouse), is due to open<br />

in April 2010. This site is strategically<br />

located on one of the main highways into<br />

Spain. The outlet centre will be environmentally<br />

sustainable with 130 stores, five<br />

restaurants and a cafe. It will also have<br />

a children’s nursery, a tourism office and<br />

self-storage facilities for tenants. In late<br />

2008 it was 20 percent leased. Other Advantail<br />

projects are: Parc du Cubzac Village<br />

(Bordeaux): opening 3 April 2012,<br />

and another outlet village in South-East<br />

France, the site for which is still under<br />

negotiation.<br />

■ With three outlet centres already<br />

operating across Italy, Italian property<br />

management company Promos opened<br />

Palmanova, its latest outlet centre, in late<br />

2008, on the border of Italy, Germany,<br />

Austria and Slovenia. A further three<br />

outlet centres are due to open: in 2009<br />

the first outlet village in Abruzzi, half way<br />

down the eastern coast of Italy, on the<br />

Adriatic coast, in 2010, Pisa <strong>Outlet</strong> Village<br />

in Tuscany; also in 2010, Timisoara<br />

<strong>Outlet</strong> Village in Romania, close to the<br />

Serbian and Hungarian borders.<br />

■ Gloucester Quays, part of the €1<br />

billion regeneration of one of the UK’s<br />

most historic cities, will include one of<br />

the last large, regionally dominant outlet<br />

centres in the UK. The outlet centre will<br />

house 100 shops and a large area of waterside<br />

bars, cafes and restaurants. Next<br />

to the centre is a new hotel, supermarket<br />

and office space. Whilst already a thriving<br />

retail centre, the city of Gloucester is also<br />

a major tourist destination with over 6 million<br />

visitors per annum. The centre is due<br />

to open on 21 May. To make sure just the<br />

right people know about it, the developer,<br />

Gloucester Quays LLP, has taken a fourpage<br />

spread in the February edition of<br />

Vogue magazine. c<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl 17

LEASiNg<br />

Fashion House Gdansk<br />

breaks new ground<br />

wORK HAS STARTED on phase 2 of<br />

Fashion House <strong>Outlet</strong> Centre Gdansk in<br />

Poland, to be completed by November.<br />

The expansion of the 101,800-sf centre<br />

will cost about €15 million and has a build<br />

area of 107,639 sf with a GLA of 78,576<br />

sf, adding 50 new outlet stores to the<br />

scheme.<br />

The building contract has been undertaken<br />

by Hochtief Polska and is south<br />

of phase 1. The expansion will continue<br />

the centre’s theme of a fishing village<br />

with colourful shop fronts and its own<br />

lighthouse.<br />

Phase 1 opened in 2005 with tenants<br />

Adidas, Big Star, Gino Rossi, Levi’s,<br />

Mexx, Lee Cooper and Wolczanka, followed<br />

by brands like Mexx, Converse,<br />

18 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

Puma and Nike.<br />

“Leasing at the expansion is already<br />

well underway,” says Neil Thompson,<br />

CEO of Fashion House Developments.<br />

Fashion House Developments is a partnership<br />

between Liebrecht & Wood and<br />

GVA Grimley <strong>Outlet</strong> Services. The leasing<br />

agents are CB Richard Ellis and GVA<br />

Grimley <strong>Outlet</strong> Services, and the operator<br />

is GVA Grimley <strong>Outlet</strong> Services.<br />

The project is in northern Poland, in<br />

the Szadolki district near the Baltic coast,<br />

one of the most popular tourist areas in<br />

the country, with over 1.7 million within<br />

a 90-minute catchment area and a further<br />

1.5 million visitors.<br />

Recent tenant additions at other Fashion<br />

House <strong>Outlet</strong> Centre schemes include<br />

Mustang Jeans in Sosnowiec, Poland; IC<br />

Company and Eastpack & Envy Sport in<br />

Prague in the Czech Republic; and Olymp<br />

in Budapest, Hungary.<br />

Osprey to open two more outlets in UK<br />

uK bAG MAKER Osprey Graeme<br />

Ellisdon Ltd has instructed GVA<br />

Grimley <strong>Outlet</strong> Services <strong>Retail</strong><br />

Development to find two more outlet<br />

store sites that could open in 2009.<br />

“We opened the first Osprey London<br />

<strong>Outlet</strong> store at MacArthur Glen<br />

York in October 2008,” managing<br />

director/designer Graeme Ellisdon<br />

explains, “which has proved to be a<br />

great success. This was part of the<br />

development and implementation of<br />

the new UK outlet strategy for our<br />

luxury leather brands to be exposed<br />

to a wider range of consumers and<br />

to ensure the best possible route<br />

to market for excess stock, thereby<br />

strengthening the overall position of<br />

the company.”<br />

A new channel for the upscale bag<br />

designer, outlet retail has proved to<br />

be “spot on,” he says, adding “that<br />

there is huge potential for us within<br />

this sector and a strong demand<br />

from a new customer base that we<br />

can develop further.”<br />

The new locations haven’t yet been<br />

named. c<br />

Tom Tailor is new<br />

in Junction One<br />

GERMAN FASHION brand Tom Tailor,<br />

which is sold in more than 35 countries,<br />

opened its first UK store in September<br />

in the 200,000-sf Junction One, an outlet<br />

project in Antrim, Northern Ireland.<br />

Created in Hamburg in early 1960s, the<br />

premium label’s fashion portfolio includes<br />

a range of high quality casual wear along<br />

with a denim male and female collection,<br />

which targets shoppers aged 15 to 25.<br />

The 4,300-sf store also supplies tots<br />

and teenagers with its range of Tom Tailor<br />

Minis and Kids for boys and girls aged<br />

18 months to 14 years.<br />

Unlike other high street or outlet<br />

brands, Tom Tailor seeks to regularly<br />

refresh its stock on a monthly basis with<br />

new collections launched in store 12<br />

times a year. “Therefore savvy outlet<br />

shoppers are acquiring contemporary<br />

styles at bargain prices,” says Tom<br />

Tailor, area manager Richard Holder, “a<br />

major plus in today’s more challenging<br />

retail market.”<br />

Centre manager Leona Barr says “whilst<br />

Tom Tailor already operates a high street<br />

franchise at Rushmere Shopping Centre<br />

and another unit is soon to open at Victoria<br />

Square, the name is still relatively new<br />

to the Northern Ireland consumer.”<br />

Also making its debut at Junction One<br />

is UK-based outlet retailer Event Jewellery,<br />

which opened its first outlet store<br />

on the island of Ireland in October. The<br />

store offers a range of gold and silver<br />

jewellery and premium brand watches.<br />

And shoe brand Staccato is growing, having<br />

taken on a new 10-year lease with Junction<br />

One. It is relocating to a similar-sized<br />

unit adjacent to its parent company Pavers.<br />

The Guinea Group opened the centre<br />

in 2004.<br />

New food<br />

vendors at<br />

Lowry <strong>Outlet</strong> Mall<br />

THE LOwRY OuTLET MALL near Manchester,<br />

UK, has signed two new restaurant<br />

operators.<br />

Deli-Fresh and Chicken Cottage have<br />

both taken more than 500 sf in the<br />

205,867-sf centre’s food court. Sales at<br />

Deli-Fresh, a salad bar run by a local<br />

operator, “so far have smashed expectation<br />

and the turnover has increased week<br />

on week since opening — a positive

eport during a tough economic climate,”<br />

a spokesperson for the mall says.<br />

Robert Hallworth, centre manager at<br />

Lowry <strong>Outlet</strong> Mall, says the credit crunch<br />

is benefiting the mall.<br />

“It is clear,” he says, “that people’s<br />

disposable income is being squeezed and<br />

outlet shopping is growing in popularity<br />

as a result.”<br />

Hallworth said that new retailers, which<br />

include Nike and The Earth Collection,<br />

have been reporting positive sales figures.<br />

Three new tenants<br />

at Gunwharf Quays<br />

THREE NEw TENANTS have joined<br />

Gunwharf Quays, Land Securities’ £200<br />

million mixed-use development on the waterfront<br />

at Portsmouth Harbour in the UK.<br />

They are:<br />

n globally renowned sportswear manufacturer<br />

and retailer Canterbury New<br />

Zealand, which opened its first outlet<br />

store in Europe<br />

n US surf wear store Hurley, which also<br />

opened its first UK outlet store<br />

n and Artigiano, the luxury Italian<br />

woman fashion clothing brand that offers<br />

reduced prices up to 70 percent off<br />

original prices and a selection of exclusive,<br />

one-off samples.<br />

The 180,000-sf Gunwharf Quays<br />

opened in 2000.<br />

GVA Grimley<br />

adds tenants<br />

to four centres<br />

GVA GRIMLEY <strong>Outlet</strong> Services leasing<br />

team started 2009 with five new tenants at<br />

four centres:<br />

n Eastpak & Envy Sport opened a 323m<br />

2 unit at Fashion Arena <strong>Outlet</strong> Centre<br />

in Prague. The retailer carries outdoor<br />

sports fashion and bags.<br />

n Also at Fashion Arena in Prague, IC<br />

Companies opened a 252-m 2 unit. IC<br />

brands include Jackpot, Cottonfield,<br />

InWear, Matinque, Part Two and Peak<br />

Performance.<br />

n Mustang Jeans opened a 182-m 2 unit at<br />

Fashion House <strong>Outlet</strong> Centre Sosnowiec<br />

in Poland in February with a five-year<br />

lease; at age 75, Mustang Jeans is one of<br />

the oldest manufacturers in Europe.<br />

n Miss Sixty opened a 162-m 2 shop at<br />

Premier <strong>Outlet</strong> Centre Ringsted in Copenhagen.<br />

Also recently opened in the centre<br />

is Hugo Boss.<br />

n Olymp has opened a 250-m 2 store at<br />

Premier <strong>Outlet</strong> Centre Budapest; Olymp’s<br />

brands include Olymp, Maryelis, Maybach,<br />

Brezner, Marty’s and Shirt House.<br />

Spain’s Park Avenue<br />

signs global brands<br />

PARK AVENuE, which opened in<br />

northern Spain in mid-2007, said its first<br />

calendar year was successful. The Bilbao<br />

scheme, owned and managed by Resolution<br />

Property, reported signing new inter-<br />

NEw TENANTS continue to flourish<br />

at Batavia Stad <strong>Outlet</strong> Shopping, the<br />

village-style center that opened in<br />

Lelystad, Flevoland, Netherlands in<br />

2001.<br />

The project’s new phase 3 held<br />

its soft opening on 14 Feb., with its<br />

grand opening set for 2 April. The<br />

new addition is the second expansion<br />

to the scheme in two years.<br />

Two American brands are among<br />

its new tenants: Calvin Klein fashions<br />

and Fossil watch. Other new tenants<br />

include Arrow, Converse, Eager<br />

Beaver, GK Mayer (shoes), Jack &<br />

Jones, Melka, Miss Sixty, Only, Pall<br />

Mall, Protest, Rags Industry, Tom Tailor,<br />

national brands, including Lindt, Geox,<br />

Converse (listed as Hoax), Pikolinos, Gold<br />

and North Company, Fox and Puma.<br />

Leading Spanish brand Desigual says<br />

its Park Avenue unit has become the most<br />

profitable of the company’s outlet stores.<br />

Calvin Klein, another tenant, is in discussions<br />

to lease space for its CK Jeans brand<br />

following the success of the company’s<br />

underwear outlet. New tenants will<br />

emerge this year, too: Negotiations are<br />

ongoing with a number of Italian, French,<br />

American and English retailers. c<br />

new brands open at batavia Stad’s phase 3<br />

Turnover, Vero Moda and Vingino.<br />

Centra Star, a high-quality bed<br />

and bath brand from Germany, and<br />

Kuyichi, a Dutch brand that uses<br />

organic denim, also opened, as did<br />

Seidensticker, an international apparel<br />

company based in Germany, and<br />

Dutch premium denim label Blue<br />

Blood.<br />

The centre’s third phase of 53,820<br />

sf brought the project’s gross leasable<br />

area to 274,500 sf.<br />

The Stable International scheme is<br />

about 30 minutes from Amsterdam,<br />

on the waterfront with tourist attractions<br />

that include Batavia Wharf and<br />

two museums. c<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl 19

NEWS NOTES<br />

Campaign subtly<br />

plugs outlets over<br />

high street<br />

MCARTHuRGLEN launched a new<br />

UK advertising campaign that touts<br />

year-round savings and designer<br />

brands as it differentiates outlet<br />

shopping from high street. The<br />

strapline, “Up to 60% off every day.<br />

100 % more desirable,” explicitly targets<br />

the cost-conscious customer<br />

who doesn’t want to compromise on<br />

quality branded goods.<br />

The campaign, which was launched<br />

in February, will run throughout the<br />

year across regional radio, press, outdoor<br />

and digital media. Ads will feature<br />

seasonal updates and will be upweighted<br />

during key trading periods.<br />

The campaign will be adapted to<br />

ensure resonance with each of the<br />

seven UK designer outlet centres<br />

operated by McArthurGlen: Cheshire<br />

Fashion House <strong>Outlet</strong> Centre warsaw was named Factory <strong>Outlet</strong> of the Year at the inaugural Europa Property CEE <strong>Retail</strong><br />

Real Estate Awards in February. The awards honor companies in Central and Eastern Europe, including Poland, the Czech Republic,<br />

Romania, Bulgaria, Serbia and Croatia. The 24,000-m 2 Fashion House Warsaw has 130 tenants, including Nike, Puma, Gino Rossi,<br />

Venezia, Monnari, Levis, Wólczanka, Timberland, Ecco, Mexx, Almi Decor, Salamander and Triumph. The developer is Fashion<br />

House Development; the leasing agents are CB Richard Ellis & GVA Grimley; and the operator is GVA Grimley <strong>Outlet</strong> Services.<br />

20 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

McArthurGlen’s new ad campaign telegraphs fashion, but at a steep discount.<br />

Oaks Designer <strong>Outlet</strong>; Ashford<br />

Designer <strong>Outlet</strong>; Bridgend Designer<br />

<strong>Outlet</strong>; East Midlands Designer<br />

<strong>Outlet</strong>; Livingston Designer <strong>Outlet</strong>;<br />

Swindon Designer <strong>Outlet</strong>; and York<br />

Designer <strong>Outlet</strong>.<br />

Shannon Luxford, UK regional mar-<br />

keting manager, says: “We have a<br />

very clear proposition for customers<br />

of 60% savings every day of the year,<br />

which differentiates us from the high<br />

street. The campaign retains our core<br />

brand values of style and quality while<br />

delivering a clear price message.” c

Dalton Park<br />

achieves green<br />

accreditation;<br />

honors top tenants<br />

DALTON PARK, ING Real Estate’s<br />

160,000-sf scheme near Newcastle,<br />

England, has become the first outlet<br />

centre in the Northeast to be<br />

awarded the prestigious ISO 14001<br />

accreditation for successful environmental<br />

management.<br />

Dalton Park achieved the standard<br />

through its “going green” campaign<br />

launched in 2008. The campaign<br />

introduced energy-saving initiatives<br />

and a series of open workshops<br />

to encourage community participation<br />

in recycling and regeneration.<br />

Additionally, Dalton Park is<br />

n Recycling cardboard, printer cartridges,<br />

plastic coat hangers, stationery,<br />

newspapers, magazines, fluorescent<br />

tubes and light bulbs<br />

n Reducing landfill waste<br />

n Encouraging staff to switch off lights<br />

and appliances when not needed<br />

n Using LED lights for Christmas<br />

decorations<br />

In other news, Dalton Park in<br />

February honored its top retailers<br />

in appreciation for the centre’s continuing<br />

to trade positively and add<br />

new tenants, including Gap, Subway<br />

and Past Times, despite the economic<br />

downturn.<br />

The top performers at Dalton Park<br />

include:<br />

n Mountain Warehouse: best comparable<br />

sales growth<br />

n Past Times: best newcomer<br />

n Bags etc: most improved tenant<br />

n Regatta: best customer service<br />

n Nike Factory Store: best overall<br />

contribution to centre<br />

n Nike Factory Store: best contribution<br />

to marketing events<br />

n Levi’s: best team player<br />

n Amanda Bate from At Your Service:<br />

personality of the year c<br />

New brands that have joined the recently opened phase 3 of <strong>Value</strong> <strong>Retail</strong>’s Bicester<br />

Village in Oxfordshire, England include Diane von Furstenberg, Matthew Williamson,<br />

Smythson’s, Marni, Alexander McQueen, Theory, D&G, Wolford, Luella,<br />

Joseph and 7 For All Mankind.<br />

<strong>Outlet</strong> Sveta Helena opened in Croatia in late 2008 about 70 percent occupied<br />

after months of delay. The €45 million project, owned by Israel-based Prigan Holding,<br />

has a 12,500-m 2 first phase; a second phase of the same size is planned.<br />

SpriNg 2009 InternAtIOnAl <strong>Outlet</strong> JOurnAl 21

OWNErSHip CHANgES<br />

henderson Global Investors<br />

buys barberino scheme<br />

On 27 January, Henderson Global<br />

Investors’ <strong>European</strong> <strong>Outlet</strong> Mall<br />

Fund acquired McArthurGlen’s<br />

Barberino Designer <strong>Outlet</strong> Village, 15.5<br />

miles north of Florence, Italy, for €125<br />

million.<br />

The 100-tenant centre, which opened<br />

in March 2006, has 226,000 sf of GLA.<br />

Tenants include D&G, Polo Ralph Lauren,<br />

Prada, Roberto Cavalli and Richmond.<br />

Phase 2 is scheduled to open in 2010,<br />

adding another 64,583 sf.<br />

Including the acquisition of Barberino,<br />

Henderson Global directly owns nine outlet<br />

centres in Europe and three in the UK,<br />

with an overall portfolio valued at €1.2<br />

billion. Eleven of the 12 properties were<br />

purchased from McArthurGlen Group, a<br />

co-investor in the fund.<br />

Established to acquire outlet properties<br />

in primary locations, the fund has raised<br />

more than €625 million of equity since its<br />

launch in February 2004.<br />

McArthurGlen manages all the assets in<br />

the fund’s portfolio, and will continue to<br />

manage Barberino Designer <strong>Outlet</strong>.<br />

David Williams, manager of the fund,<br />

said the outlet industry is performing<br />

robustly despite the economic downturn as<br />

people are more careful with their discre-<br />

In early February, Madrid-based<br />

Neinver said that it had acquired, on<br />

behalf of its IRUS fund, Germany’s<br />

largest designer outlet centre, the 23,500m<br />

2 Designer <strong>Outlet</strong>s Zweibrücken (DOZ)<br />

from Kenmore Property Group and<br />

Revcap. <strong>Outlet</strong> Centres International<br />

developed and opened the centre in 2001<br />

and had continued to manage it.<br />

Neinver, which manages 260,000 m2 of<br />

retail GLA in Europe, bought DOZ for<br />

€110 million. The objective of IRUS fund is<br />

to reach €1.4 million in the next three years<br />

The Spanish company will manage, develop<br />

and promote the fourth phase of the<br />

project, which will include 32 new shops.<br />

Located on the border of France,<br />

Germany and Luxemburg, DOZ has a<br />

22 InternAtIOnAl <strong>Outlet</strong> JOurnAl SpriNg 2009<br />

The Italian centre is scheduled to grow to 290,000 sf when phase 2 opens in 2010.<br />

tionary income. “Across Europe, skilled<br />

specialist managers such as Henderson and<br />

McArthurGlen are able to drive outperformance<br />

for investors in this sector…We still<br />

intend to grow [the portfolio] over time<br />

with carefully selected acquisitions and the<br />

continued development of existing assets.”<br />

Julia Calabrese, CEO of McArthur-<br />

Glen, says the outlet business in Europe<br />

is maturing. “We introduced the concept<br />

of designer outlet retailing to Europe in<br />

1995,” she says, “and now more than ever<br />

Distinctively designed, the center brims<br />

with glass.<br />

catchment area of more than 15 million<br />

people.<br />

Manuel Lagares, Neinver’s CEO, commented,<br />

“This acquisition ends a year<br />

we are seeing the sector really coming of<br />

age as consumers gain a better understanding<br />

of the concept and how it can help<br />

them through tougher economic times.”<br />

McArthur Glen has five <strong>European</strong><br />