DIRECTORS' REPORT

DIRECTORS' REPORT

DIRECTORS' REPORT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIRECTORS’ <strong>REPORT</strong><br />

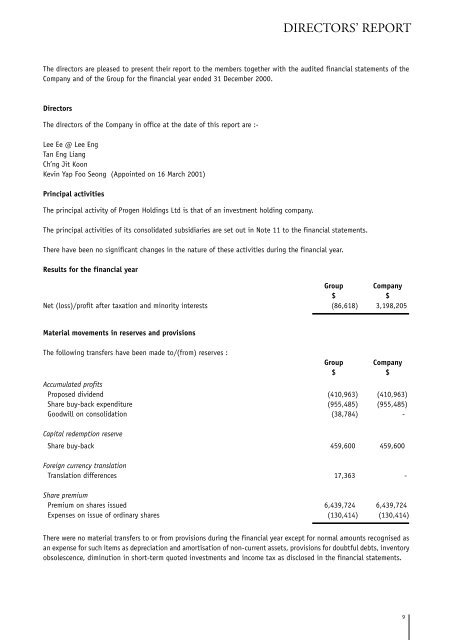

The directors are pleased to present their report to the members together with the audited financial statements of the<br />

Company and of the Group for the financial year ended 31 December 2000.<br />

Directors<br />

The directors of the Company in office at the date of this report are :-<br />

Lee Ee @ Lee Eng<br />

Tan Eng Liang<br />

Ch’ng Jit Koon<br />

Kevin Yap Foo Seong (Appointed on 16 March 2001)<br />

Principal activities<br />

The principal activity of Progen Holdings Ltd is that of an investment holding company.<br />

The principal activities of its consolidated subsidiaries are set out in Note 11 to the financial statements.<br />

There have been no significant changes in the nature of these activities during the financial year.<br />

Results for the financial year<br />

Group Company<br />

$ $<br />

Net (loss)/profit after taxation and minority interests (86,618) 3,198,205<br />

Material movements in reserves and provisions<br />

The following transfers have been made to/(from) reserves :<br />

Group Company<br />

$ $<br />

Accumulated profits<br />

Proposed dividend (410,963) (410,963)<br />

Share buy-back expenditure (955,485) (955,485)<br />

Goodwill on consolidation (38,784) -<br />

Capital redemption reserve<br />

Share buy-back 459,600 459,600<br />

Foreign currency translation<br />

Translation differences 17,363 -<br />

Share premium<br />

Premium on shares issued 6,439,724 6,439,724<br />

Expenses on issue of ordinary shares (130,414) (130,414)<br />

There were no material transfers to or from provisions during the financial year except for normal amounts recognised as<br />

an expense for such items as depreciation and amortisation of non-current assets, provisions for doubtful debts, inventory<br />

obsolescence, diminution in short-term quoted investments and income tax as disclosed in the financial statements.<br />

9

DIRECTORS’ <strong>REPORT</strong><br />

Acquisition and disposal of subsidiary companies<br />

During the year, the Group acquired additional shares in the following subsidiary companies :-<br />

Interest<br />

Attributable<br />

net tangible<br />

assets at<br />

Name of subsidiary acquired Consideration acquisition<br />

% $ $<br />

Progen Media Pte Ltd 30 7 7<br />

Dico International Pte Ltd 45 146,250 107,466<br />

No subsidiary companies were disposed of during the financial year.<br />

Issue of shares and debentures<br />

Issuance of ordinary shares<br />

On 3 February 2000, the holding company increased its issued and paid-up share capital from $14,310,499 to $18,603,649<br />

by the issue of 42,931,496 ordinary shares of $0.10 each through a rights issue at a premium of $0.15 each on the<br />

basis of three rights shares for every ten existing ordinary shares of $0.10 each in the capital of the Company. The<br />

proceeds were used to settle a subsidiary company’s revolving and term loans, bank overdraft and provide working<br />

capital for the Group.<br />

Progen Media Pte Ltd, a subsidiary company, increased its issued and paid-up share capital from $2 to $10 divided into<br />

10 ordinary shares of $1 each by the creation of 8 ordinary shares of $1 each. No other subsidiary companies issued any<br />

shares during the year.<br />

The holding company and its subsidiary companies did not issue any debentures during the financial year.<br />

Share Buy-Backs<br />

Pursuant to the share buyback scheme approved by the shareholders on 31 July 2000, the Company repurchased 2,596,000<br />

ordinary shares at an average price of $0.26 each in August 2000 and further repurchased 2,000,000 ordinary shares at<br />

an average price of $0.14 each in December 2000.<br />

Arrangements to enable directors to acquire shares and debentures<br />

Neither at the end of nor at any time during the financial year was the Company a party to any arrangement whose object<br />

is to enable the directors of the Company to acquire benefits by means of the acquisition of shares or debentures of the<br />

Company or any other body corporate.<br />

10

Directors’ interests in shares and debentures<br />

The following directors, who held office at the end of the financial year had, according to the register of directors’<br />

shareholdings required to be kept under section 164 of the Singapore Companies Act, an interest in shares of the holding<br />

company and related corporations as stated below :<br />

Held in the name<br />

of the directors Deemed interest<br />

At At At At At At<br />

Name of directors 1.1.2000 31.12.2000 21.1.2001 1.1.2000 31.12.2000 21.1.2001<br />

Progen Holdings Ltd<br />

(Company)<br />

Ordinary shares of $0.10 each<br />

Lee Ee @ Lee Eng 90,300,985 98,362,460 97,762,460 3,720,850 2,608,694 2,608,694<br />

Low Peng Chow - 150,000 150,000 - - -<br />

Progen Media Pte Ltd<br />

(Subsidiary company)<br />

Lee Ee @ Lee Eng - 1 1 - - -<br />

By virtue of section 7 of the Singapore Companies Act, Lee Ee @ Lee Eng, who has an interest in the shares of the<br />

Company, is deemed to have an interest in shares of the subsidiary companies of the Company at the beginning and end<br />

of the financial year.<br />

Dividends<br />

No dividend was paid during the financial year in respect of the previous financial year. The directors propose a first and<br />

final dividend of 0.30 cents per share (3%) less income tax, amounting to $410,963 be paid for the year ended 31<br />

December 2000.<br />

Bad and doubtful debts<br />

Before the profit and loss account and the balance sheet of the Company were made out, the directors took reasonable<br />

steps to ascertain that proper action had been taken in relation to the writing-off of bad debts and the making of<br />

provision for doubtful debts, and have satisfied themselves that all known bad debts had been written-off and that<br />

adequate provision had been made for doubtful debts.<br />

At the date of this report, the directors are not aware of any circumstances which would render any amount written-off<br />

or provided for bad and doubtful debts in the Group inadequate to any substantial extent.<br />

Current assets<br />

DIRECTORS’ <strong>REPORT</strong><br />

Before the profit and loss account and balance sheet of the Company were made out, the directors took reasonable steps<br />

to ascertain that any current assets which were unlikely to realise their book values in the ordinary course of business<br />

had been written down to their estimated realisable values or adequate provision had been made for the diminution in<br />

the values of such current assets.<br />

11

DIRECTORS’ <strong>REPORT</strong><br />

Current assets (cont’d)<br />

At the date of this report, the directors are not aware of any circumstances which would render the values attributed to<br />

current assets in the consolidated financial statements misleading.<br />

Charges on assets and contingent liabilities<br />

Since the end of the financial year, and up to the date of this report, no charge on the assets of the Company or any<br />

company in the Group has arisen which secures the liabilities of any other person and no contingent liability has arisen.<br />

Ability to meet obligations<br />

No contingent or other liability has become enforceable or is likely to become enforceable within the period of twelve<br />

months after the end of the financial year which, in the opinion of the directors, will or may substantially affect the<br />

ability of the Company and of the Group to meet their obligations as and when they fall due.<br />

Other circumstances affecting the financial statements<br />

At the date of this report, the directors are not aware of any circumstances not otherwise dealt with in this report or the<br />

consolidated financial statements which would render any amount stated in the financial statements of the Company and<br />

consolidated financial statements misleading.<br />

Unusual items<br />

In the opinion of the directors, the results of the operations of the Company and of the Group during the financial year<br />

have not been substantially affected by any item, transaction or event of a material and unusual nature.<br />

Unusual items after the financial year<br />

In the opinion of the directors, no item, transaction or event of a material and unusual nature has arisen in the interval<br />

between the end of the financial year and the date of this report which would affect substantially the results of the<br />

operations of the Company and of the Group for the financial year in which this report is made.<br />

Directors’ contractual benefits<br />

Since the end of the previous financial year, no director of the Company has received or has become entitled to receive<br />

a benefit by reason of a contract made by the Company or a related corporation with the director or with a firm of which<br />

the director is a member, or with a company in which the director has a substantial financial interest.<br />

Share options<br />

Progen Employees’ Share Option Scheme (“Scheme”).<br />

The Scheme was approved in principle by the members of the Company at the Extraordinary General Meeting on 31 July<br />

2000. Under the Scheme, selected full-time employees of the Company and its subsidiaries including Executive Directors<br />

of the Company but excluding Non-Executive Directors, Controlling Shareholders and their Associates are eligible to<br />

participate in the Scheme at the discretion of the Committee administering the Scheme.<br />

Pursuant to Clause 947 (Practice Note No. 9h) of the Listing Manual of the Singapore Exchange Securities Trading<br />

Limited, it is reported that during the financial year, members of the Committee administering the Scheme are directors<br />

Lee Ee @ Lee Eng and Tan Eng Liang.<br />

12

No share was issued pursuant to the exercise of any option to subscribe for shares in the Company.<br />

During the financial year, there were :<br />

(a) no options granted by the Company or its subsidiary companies to any person to take up unissued shares in the<br />

Company or its subsidiary companies; and<br />

(b) no shares were issued by virtue of any exercise of options to take up unissued shares in the Company or its<br />

subsidiary companies;<br />

As at the end of the financial year, there were no unissued shares in the Company or its subsidiary companies<br />

under option.<br />

Subsequent events<br />

Pursuant to the share buyback scheme approved by the shareholders on 31 July 2000, the Company made a further<br />

repurchase of 805,000 ordinary shares from 31 March to 11 April 2001 at a total cost, including brokerage, of $85,030.<br />

The total amount spent under the scheme as at the date of this report amounted to $1,040,515 for 5,401,000 ordinary<br />

shares.<br />

Auditor<br />

Ernst & Young have expressed their willingness to accept reappointment as auditor.<br />

On behalf of the directors:<br />

Lee Ee @ Lee Eng<br />

Director<br />

Tan Eng Liang<br />

Director<br />

Singapore<br />

16 April 2001<br />

DIRECTORS’ <strong>REPORT</strong><br />

13

STATEMENT BY THE DIRECTORS<br />

We, Lee Ee @ Lee Eng and Tan Eng Liang, being two of the directors of Progen Holdings Ltd, do hereby state that, in the<br />

opinion of the directors :<br />

(i) the accompanying balance sheets, profit and loss accounts, statements of changes in equity and consolidated cash<br />

flow statement together with the notes thereto are drawn up so as to give a true and fair view of the state of affairs<br />

of the Company and of the Group as at 31 December 2000 and of the results and changes in equity of the Company<br />

and the Group and the cash flows of the Group for the year then ended, and<br />

(ii) at the date of this statement there are reasonable grounds to believe that the Company will be able to pay its debts<br />

as and when they fall due.<br />

On behalf of the directors:<br />

Lee Ee @ Lee Eng<br />

Director<br />

Tan Eng Liang<br />

Director<br />

Singapore<br />

16 April 2001<br />

14

Progen Holdings Ltd is committed to maintaining a high standard of corporate governance within the Group. Good<br />

corporate governance establishes and maintains a legal and ethical environment in the Group, which operates to preserve<br />

the interests of shareholders.<br />

1) Board of Directors<br />

The Board oversees the business affairs of the Group, approves the financial objectives and the business strategies<br />

and monitors standards of performance, both directly and through its committees.<br />

The Board comprises four directors, two of whom hold executive positions :-<br />

Executive Directors :<br />

Lee Ee @ Lee Eng<br />

Kevin Yap Foo Seong (Appointed on 16 March 2001)<br />

Independent Non-Executive Directors :<br />

Tan Eng Liang<br />

Ch’ng Jit Koon<br />

The Board holds at least four meetings each year. The Board approves the Group’s strategic plans, key business<br />

initiatives, major investments and funding decisions; it reviews the Group’s financial performance and determines<br />

the compensation of senior management. These functions are carried out by the Board directly or through committees<br />

of the Board which have been set up to support its work.<br />

The following has been set up by the Board :<br />

Audit Committee<br />

The Audit Committee comprises three Board members, two of whom are independent non-executive directors :<br />

1. Tan Eng Liang (Chairman)<br />

2. Lee Ee @ Lee Eng<br />

3. Ch’ng Jit Koon<br />

The Committee holds at least two meetings each year and discharges the following delegated functions :<br />

(1) Reviews the external auditor’s audit plan;<br />

(2) Reviews with the external auditor their evaluation of internal controls together with management’s responses;<br />

(3) Reviews the assistance given by the Company’s officers to the external auditor;<br />

(4) Reviews the financial statements of the Company and the Group before their submission to the Board, together<br />

with the external auditor’s report thereon;<br />

(5) Reviews the interim and annual announcements of the Company and the Group before they are submitted to the<br />

Board for approval;<br />

(6) Nominates the external auditor;<br />

(7) Reviews interested person transactions; and<br />

<strong>REPORT</strong> ON CORPORATE GOVERNANCE<br />

15

<strong>REPORT</strong> ON CORPORATE GOVERNANCE<br />

16<br />

Audit Committee (cont’d)<br />

(8) Reviews the remuneration packages of employees who are related to the directors and substantial shareholders<br />

of the Company.<br />

In the opinion of the directors, Progen Holdings Ltd complies with the Best Practices Guide, with respect to Audit<br />

Committees.<br />

The Committee has full access to and co-operation by the Company’s management and the auditors and has full<br />

discretion to invite any director or executive officer to attend its meetings. The auditors have unrestricted access to<br />

the Audit Committee. The Audit Committee has reasonable resources to enable it to discharge its functions properly.<br />

Remuneration packages of employees who are related to the directors and substantial shareholders of<br />

the Company<br />

For the current financial year, there were two employees of the Group who are related to Lee Ee @ Lee Eng, who is<br />

a director and substantial shareholder of the Company. The aggregate remuneration (including CPF contributions thereon<br />

and benefits) of these employees amounted to approximately $68,260 for the year ended 31 December 2000.<br />

The Audit Committee has reviewed and ensured that their remuneration packages are in line with the Group’s staff<br />

remuneration guidelines, and commensurate with their respective job scope and level of responsibilities.<br />

The Audit Committee may examine whatever aspects it deems appropriate of the Group’s financial affairs, its audits<br />

and its exposure to risks of a regulatory or legal nature. It keeps under review the effectiveness of the Company’s<br />

system of accounting and internal financial controls, for which the directors are responsible. It also keeps under<br />

review the Company’s programme to monitor compliance with its legal, regulatory and contractual obligations.<br />

2) Securities Transactions<br />

The Group has issued a Policy on Share Dealings to all employees of the Group, setting out the implications of insider<br />

trading and the recommendations of the Best Practices Guide issued by the Singapore Exchange Securities Trading<br />

Limited. The Group has adopted a code of conduct to provide guidance to its officers with regard to dealing in the<br />

Company’s shares.<br />

On behalf of the Board :<br />

Lee Ee @ Lee Eng<br />

Director<br />

Tan Eng Liang<br />

Director<br />

Singapore<br />

16 April 2001

We have audited the financial statements of Progen Holdings Ltd and the consolidated financial statements of the Group<br />

set out on pages 18 to 40, comprising the balance sheets of the Company and of the Group as at 31 December 2000, the<br />

profit and loss accounts and statements of changes in equity of the Company and of the Group and cash flow of the Group<br />

for the year ended 31 December 2000, and notes thereto. These financial statements are the responsibility of the<br />

Company’s directors. Our responsibility is to express an opinion on these financial statements based on our audit.<br />

We conducted our audit in accordance with Singapore Standards on Auditing. Those Standards require that we plan and<br />

perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement.<br />

An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements.<br />

An audit also includes assessing the accounting principles used and significant estimates made by the directors, as well<br />

as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our<br />

opinion.<br />

In our opinion,<br />

(a) the financial statements and consolidated financial statements are properly drawn up in accordance with the provisions<br />

of the Singapore Companies Act (Act) and Singapore Statements of Accounting Standard and so as to give a true and<br />

fair view of:-<br />

(i) the state of affairs of the Company and of the Group as at 31 December 2000 and of the results and changes in<br />

equity of the Company and of the Group and cash flows of the Group for the year ended on that date; and<br />

(ii) the other matters required by section 201 of the Act to be dealt with in the financial statements and consolidated<br />

financial statements;<br />

(b) the accounting and other records, and the registers required by the Act to be kept by the Company and by those<br />

subsidiary companies incorporated in Singapore of which we are the auditors have been properly kept in accordance<br />

with the provisions of the Act.<br />

We have considered the financial statements of Engpro Sdn Bhd, being the only financial statements included in the<br />

consolidated financial statements for which we have not acted as auditor, and the auditor’s report on that subsidiary<br />

company. The name of this subsidiary audited by our associated firm is stated in Note 11 to the financial statements.<br />

We are satisfied that the financial statements of the subsidiary companies that have been consolidated with the financial<br />

statements of the Company are in a form and content appropriate and proper for the purposes of the preparation of the<br />

consolidated financial statements and we have received satisfactory information and explanations as required by us for<br />

those purposes.<br />

The auditors’ reports on the financial statements of the subsidiary companies were not subject to any qualification and in<br />

respect of subsidiary companies incorporated in Singapore did not include any comment made under section 207(3) of<br />

the Act.<br />

ERNST & YOUNG<br />

Certified Public Accountants<br />

Singapore<br />

16 April 2001<br />

AUDITOR’S <strong>REPORT</strong> TO THE<br />

MEMBERS OF PROGEN HOLDINGS LTD<br />

17

BALANCE SHEETS<br />

As at 31 December 2000<br />

Group Company<br />

Notes 2000 1999 2000 1999<br />

$ $ $ $<br />

Fixed assets 9 33,497,095 33,869,020 7,564 8,634<br />

Intangible assets 10 34,134 14,500 8,333 14,500<br />

Subsidiary companies 11 - - 10,184,755 10,038,497<br />

Associated company 12 - 1 - 1<br />

Current assets<br />

Cash and cash equivalents 3,457,495 1,931,141 24,079 17,362<br />

Trade and other<br />

receivables, net 13 7,442,553 15,402,039 2,783,681 144,767<br />

Amounts due from subsidiaries 14 - - 27,878,070 15,986,485<br />

Short-term quoted<br />

investments 15 49,253 223,667 - -<br />

Inventories 16 379,243 662,136 - -<br />

Contracts work-in-progress 17 847,749 133,727 - -<br />

18<br />

12,176,293 18,352,710 30,685,830 16,148,614<br />

Current liabilities<br />

Trade and other payables 18 3,068,636 4,112,867 360,383 312,884<br />

Amounts due to subsidiaries 19 - - 1,846,792 63,235<br />

Loans and borrowings 20 - 7,689,055 - -<br />

Provision for taxation 233,483 218,218 - -<br />

Hire purchase creditors 21 31,125 758,968 - -<br />

Contracts work-in-progress 17 49,139 276,065 - -<br />

Proposed dividend 22 410,963 - 410,963 -<br />

3,793,346 13,055,173 2,618,138 376,119<br />

Net current assets<br />

Non-current liabilities<br />

8,382,947 5,297,537 28,067,692 15,772,495<br />

Loans and borrowings 20 - 5,183,496 - -<br />

Hire purchase creditors 21 72,229 1,108,337 - -<br />

Deferred taxation 23 87,226 116,226 - -<br />

159,455 6,408,059 - -<br />

41,754,721 32,772,999 38,268,344 25,834,127<br />

Shareholders equity<br />

Issued capital 18,144,049 14,310,499 18,144,049 14,310,499<br />

Share premium 19,422,989 13,113,679 19,422,989 13,113,679<br />

Capital redemption reserve 459,600 - 459,600 -<br />

Foreign currency translation (105,765) (123,128) - -<br />

Accumulated profits/(losses) 3,833,846 5,325,696 241,706 (1,590,051)<br />

41,754,719 32,626,746 38,268,344 25,834,127<br />

Minority interests 2 146,253 - -<br />

41,754,721 32,772,999 38,268,344 25,834,127<br />

The accounting policies and explanatory notes on pages 23 through 40 form an integral part of the financial statements.

Group Company<br />

Notes 2000 1999 2000 1999<br />

$ $ $ $<br />

Revenues<br />

Products and installation 3,878,821 7,296,777 - -<br />

Services and maintenance 1,905,117 605,554 - -<br />

Dividend income 4 4,213 1,787 3,425,503 -<br />

Other revenue 5 1,641,335 1,102,424 1,816,524 -<br />

Total revenues 7,429,486 9,006,542 5,242,027 -<br />

Costs and expenses<br />

Cost of products and<br />

installation 2,816,034 3,876,881 - -<br />

Purchase of consumables 267,201 270,295 - -<br />

Rental expenses 405,215 379,984 - -<br />

Salaries and employee<br />

benefits 988,707 1,066,661 159,516 -<br />

Depreciation of fixed assets 9 763,883 703,657 1,070 1,070<br />

Other operating expenses 5 1,823,521 2,187,230 781,268 663,638<br />

Total costs and expenses 7,064,561 8,484,708 941,854 664,708<br />

Profit/(loss) from operating<br />

activities 364,925 521,834 4,300,173 (664,708)<br />

Finance costs 5 (243,779) (761,518) (1,465) (10)<br />

121,146 (239,684) 4,298,708 (664,718)<br />

Share of profit of<br />

associated company - 1,334,752 - -<br />

Profit/(loss) from<br />

operations before taxes<br />

and minority interests 121,146 1,095,068 4,298,708 (664,718)<br />

Taxation 6 (246,554) (267,584) (1,100,503) -<br />

________ ________ ________ ________<br />

(125,408) 827,484 3,198,205 (664,718)<br />

Minority interests,<br />

net of taxes 38,790 (5,169) - -<br />

________ ________ ________ ________<br />

Net (loss)/profit before<br />

extraordinary items, net (86,618) 822,315 3,198,205 (664,718)<br />

Extraordinary items, net 7 - 349,463 - -<br />

Net (loss)/profit (86,618) 1,171,778 3,198,205 (664,718)<br />

Earnings/(loss) per share in cents<br />

Before extraordinary items<br />

Basic 8 (0.05) 0.59<br />

After extraordinary items<br />

Basic 8 (0.05) 0.85<br />

PROFIT AND LOSS ACCOUNTS<br />

for the year ended 31 December 2000<br />

The accounting policies and explanatory notes on pages 23 through 40 form an integral part of the financial statements.<br />

19

STATEMENTS OF CHANGES IN EQUITY<br />

for the year ended 31 December 2000<br />

Group 2000 1999 2000 1999<br />

Authorised share capital<br />

Ordinary shares at $0.10 each<br />

Balance, beginning and end<br />

$ $ Shares<br />

of year 50,000,000 50,000,000 500,000,000 500,000,000<br />

Issued capital (1)<br />

Balance, beginning of year 14,310,499 13,118,499 143,104,990 131,184,990<br />

Issuance of ordinary shares 4,293,150 1,192,000 42,931,496 11,920,000<br />

Share buy-back (2) (459,600) - (4,596,000) -<br />

Balance, end of year 18,144,049 14,310,499 181,440,486 143,104,990<br />

Share premium<br />

Balance, beginning of year 13,113,679 8,627,282<br />

Shares issued during the year 6,439,724 4,589,200<br />

Expenses related to issue<br />

of ordinary shares (130,414) (102,803)<br />

Balance, end of year 19,422,989 13,113,679<br />

Capital redemption reserve<br />

Balance, beginning of year - -<br />

Share buy-back (2) 459,600 -<br />

Balance, end of year 459,600 -<br />

Foreign currency translation<br />

Balance, beginning of year (123,128) (696,630)<br />

Adjustment for the year 17,363 573,502<br />

Balance, end of year (105,765) (123,128)<br />

Accumulated profits<br />

Balance, beginning of year 5,325,696 4,284,692<br />

Net (loss)/profit (86,618) 1,171,778<br />

Share buy-back expenditure (2) (955,485) -<br />

Goodwill on consolidation (38,784) (130,774)<br />

Proposed dividend (Note 22) (410,963) -<br />

Balance, end of year 3,833,846 5,325,696<br />

Total equity and shares<br />

outstanding 41,754,719 32,626,746 181,440,486 143,104,990<br />

(1) The holders of ordinary shares are entitled to receive dividends as and when declared by the Company. All ordinary<br />

shares carry one vote per share without restriction.<br />

(2) Consequent to the share buyback programme approved by the shareholders during the year, the Company repurchased<br />

4,596,000 ordinary shares at an average price of $0.21 per share, amounting to a total cost, including brokerage, of<br />

$955,485.<br />

Refer to Note 28 on subsequent events.<br />

The accounting policies and explanatory notes on pages 23 through 40 form an integral part of the financial statements.<br />

20

STATEMENTS OF CHANGES IN EQUITY<br />

Company 2000 1999 2000 1999<br />

$ $ Shares<br />

Authorised share capital<br />

Ordinary shares at $0.10 each<br />

Balance, beginning and end<br />

of year 50,000,000 50,000,000 500,000,000 500,000,000<br />

Issued capital (1)<br />

Balance, beginning of year 14,310,499 13,118,499 143,104,990 131,184,990<br />

Issuance of ordinary shares 4,293,150 1,192,000 42,931,496 11,920,000<br />

Share buy-back (2) (459,600) - (4,596,000) -<br />

Balance, end of year 18,144,049 14,310,499 181,440,486 143,104,990<br />

Share premium<br />

Balance, beginning of year 13,113,679 8,627,282<br />

Shares issued during the year 6,439,724 4,589,200<br />

Expenses related to issue<br />

of ordinary shares (130,414) (102,803)<br />

Balance, end of year 19,422,989 13,113,679<br />

Capital redemption reserve<br />

Balance, beginning of year - -<br />

Share buy-back (2) 459,600 -<br />

Balance, end of year 459,600 -<br />

Accumulated profits/(losses)<br />

Balance, beginning of year (1,590,051) (925,333)<br />

Net profit/(loss) 3,198,205 (664,718)<br />

Share buy-back expenditure (2) (955,485) -<br />

Proposed dividend (Note 22) (410,963) -<br />

Balance, end of year 241,706 (1,590,051)<br />

Total equity and shares<br />

outstanding 38,268,344 25,834,127 181,440,486 143,104,990<br />

(1) The holders of ordinary shares are entitled to receive dividends as and when declared by the Company. All ordinary<br />

shares carry one vote per share without restriction.<br />

(2) Consequent to the share buyback programme approved by the shareholders during the year, the Company repurchased<br />

4,596,000 ordinary shares at an average price of $0.21 per share, amounting to a total cost, including brokerage, of<br />

$955,485.<br />

Refer to Note 28 on subsequent events.<br />

The accounting policies and explanatory notes on pages 23 through 40 form an integral part of the financial statements.<br />

for the year ended 31 December 2000<br />

21

CONSOLIDATED CASH FLOW STATEMENT<br />

for the year ended 31 December 2000<br />

2000 1999<br />

$ $<br />

Cash flows from operating activities<br />

Operating profit/(loss)<br />

Adjustments for :<br />

121,146 (239,684)<br />

Interest income (103,278) (2,305)<br />

Interest expense 243,779 761,518<br />

Gain on disposal of fixed assets (30,498) (367,863)<br />

Foreign exchange gains 17,369 2,498<br />

Dividends from short-term quoted investments (4,213) (1,787)<br />

Depreciation of fixed assets 763,883 703,657<br />

Amortisation of expenditure carried forward<br />

Provision/(write-back) of diminution in<br />

6,167 500<br />

value of short-term quoted investments 37,901 (70,236)<br />

Loss on disposal of short-term quoted investments 1,332 -<br />

Operating income before working capital changes 1,053,588 786,298<br />

Decrease/(increase) in trade and other receivables 7,732,486 (10,376,080)<br />

Decrease in inventories 282,893 132,047<br />

Decrease in trade and other payables (1,044,231) (4,863,723)<br />

(Increase)/decrease in contracts work-in-progress (940,948) 2,061,657<br />

Net cash flows from/(used in) operating activities 7,083,788 (12,259,801)<br />

Payment of taxes (33,289) (153,293)<br />

22<br />

7,050,499 (12,413,094)<br />

Cash flows from investing activities<br />

Deferred expenditure incurred (25,801) -<br />

Expenditure carried forward paid - (15,000)<br />

Purchase of fixed assets (418,260) (2,046,848)<br />

Proceeds from disposal of fixed assets 56,800 426,086<br />

Dividends received from short-term quoted investments 4,213 1,787<br />

Proceeds from disposal of short-term quoted investment 135,181 -<br />

Increase in shares of a subsidiary (146,250) (4)<br />

Disposal of subsidiary, net of cash disposed - 70,679<br />

Acquisition of associated company - (1)<br />

Dividends received from associated company - 1,446,825<br />

Repayment from associated company - (794,925)<br />

Proceeds from sale of associated company - 10,577,113<br />

Net cash flows (used in)/from investing activities (394,117) 9,665,712<br />

Cash flows from financing activities<br />

Share buy-backs (955,485) -<br />

Net decrease in interest bearing loans and borrowings (12,872,551) (370,396)<br />

Proceeds from issuance of shares 10,602,460 5,678,397<br />

Repayment of hire purchase (1,763,951) (220,016)<br />

Interest expense paid (243,779) (761,518)<br />

Interest income received 103,278 2,305<br />

Net cash (used in)/from financing activities (5,130,028) 4,328,772<br />

Net increase in cash and cash equivalents 1,526,354 1,581,390<br />

Cash and cash equivalent at beginning of the year 1,931,141 349,751<br />

Cash and cash equivalent at end of the year 3,457,495 1,931,141<br />

The accounting policies and explanatory notes on pages 23 through 40 form an integral part of the financial statements.

1. Corporate information<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

The consolidated financial statements of Progen Holdings Ltd for the year ended 31 December 2000 were authorised<br />

for issue in accordance with a resolution of the directors on 16 April 2001. The Company is a limited liability<br />

company which is incorporated in Singapore.<br />

The registered office of Progen Holdings Ltd is located at 12 Woodlands Loop, Singapore 738283.<br />

The principal activity of Progen Holdings Ltd is that of an investment holding company.<br />

The principal activities of its consolidated subsidiaries are set out in Note 11 to the financial statements.<br />

There have been no significant changes in the nature of these activities during the financial year.<br />

The Group operates in two countries and employed 36 employees as of 31 December 2000.<br />

2. Significant accounting policies<br />

Basis of preparation<br />

The consolidated financial statements of the Group have been prepared in accordance with Singapore Statements of<br />

Accounting Standard and applicable requirements of Singapore law.<br />

The financial statements of the Company and of the Group, which are presented in Singapore dollars, are prepared<br />

under the historical cost convention.<br />

Principles of consolidation<br />

The consolidated financial statements comprise the financial statements of Progen Holdings Ltd and its controlled<br />

subsidiary companies, after the elimination of all material intercompany transactions.<br />

The accounting year of the Company and all its subsidiaries in the Group ends on 31 December and the consolidated<br />

financial statements incorporate the financial statements of the Company and all its subsidiaries. The results of<br />

subsidiaries acquired or disposed of during the year are included in or excluded from the group results from the<br />

respective dates of acquisition or disposal, as applicable.<br />

Goodwill represents the excess of the cost of the acquisition over the fair value of identifiable net assets of a subsidiary<br />

or associate at the date of acquisition. Goodwill is written off against shareholders equity in the year of acquisition.<br />

Investments in subsidiary companies<br />

Shares in subsidiary companies are stated at cost unless, in the opinion of the directors, there has been a permanent<br />

diminution in value, in which case they are written down to a valuation as determined by the directors.<br />

Investments in associated companies<br />

An associated company is defined as a company, not being a subsidiary, in which the Group has a long-term interest of not<br />

less than 20% of the equity and in whose financial and operating policy decisions the Group exercises significant influence.<br />

The Group’s share of the results of associated companies is included in the consolidated profit and loss account. The Group’s share<br />

of the post-acquisition reserves of associated companies is included in the investments in the consolidated balance sheet.<br />

Foreign currencies<br />

Transactions arising in foreign currencies during the year are translated at rates closely approximating those ruling on the<br />

transaction dates. Foreign currency monetary assets and liabilities are translated into local currency at exchange rates ruling<br />

at the balance sheet date. All exchange differences arising from translation are included in the profit and loss accounts.<br />

23

NOTES TO THE FINANCIAL STATEMENTS<br />

Significant accounting policies (cont’d)<br />

24<br />

For inclusion in the consolidated financial statements, all assets and liabilities of foreign subsidiaries and associated<br />

companies are translated into Singapore dollars at the exchange rates ruling at the balance sheet date and the results<br />

of foreign subsidiaries and associated companies are translated into Singapore dollars at the average exchange rates.<br />

Exchange differences due to such currency translations are taken directly to foreign currency translation reserve as a<br />

separate component of the shareholders equity.<br />

Fixed assets<br />

Fixed assets are stated at cost less accumulated depreciation. The cost of an asset comprises its purchase price and any<br />

directly attributable costs of bringing the asset to working condition for its intended use. Expenditure for additions,<br />

improvements and renewals are capitalised and expenditure for maintenance and repairs are charged to the profit and<br />

loss account. When assets are sold or retired, their cost and accumulated depreciation are removed from the financial<br />

statements and any gain or loss resulting from their disposal is included in the profit and loss account.<br />

Depreciation<br />

Depreciation is calculated on the straight line method to write-off the cost of fixed assets over their estimated useful<br />

lives. The estimated useful lives of fixed assets are as follows:-<br />

Leasehold properties - over the term of the leases<br />

Plant and machinery - 10 years<br />

Showroom, furniture, fittings and equipment - 10 years<br />

Motor vehicles - 5 years<br />

Computers - 3 years<br />

Fully depreciated assets are retained in the financial statements until they are no longer in use and no further charge<br />

for depreciation is made in respect of these assets.<br />

Contracts-in-progress<br />

Contracts-in-progress are stated at cost plus a proportion of estimated profits earned to date, less progress payments<br />

received or receivable. Full provision is made for the estimated losses to completion where applicable. Cost includes<br />

all direct material and labour costs and those indirect costs related to contract performance.<br />

Profits on contracts-in-progress are recognised on the percentage of completion method by reference to actual contract<br />

costs incurred on each contract with adjustments made to include only those costs which reflect work performed.<br />

Short-term quoted investments<br />

Short-term quoted investments are stated at market value determined on an aggregate basis. Market value is the<br />

closing market price at the balance sheet date. The changes in market value are taken to the profit and loss account.<br />

Dividend income is recognised on an accrual basis.<br />

Intangible assets<br />

Intangible assets consist of pre-operating and preliminary expenses and expenditure carried forward. These are<br />

stated at cost less amortisation and are written off to the profit and loss account on a straight-line basis over a<br />

three-year period upon commencement of operation.

2. Significant accounting policies (cont’d)<br />

Cash and cash equivalents<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Cash and cash equivalents are defined as cash on hand, demand deposits and short-term, highly liquid investments<br />

readily convertible to known amounts of cash and subject to insignificant risk of changes in value.<br />

For the purposes of the Consolidated Cash Flow Statement, cash and cash equivalents consist of cash on hand and in banks.<br />

Trade and other receivables<br />

Trade receivables, which generally have 30 - 90 day terms, are recognised and carried at original invoice amount less<br />

an allowance for any uncollectible amounts. An estimate for doubtful debts is made when collection of the full<br />

amount is no longer probable. Bad debts are written-off as incurred.<br />

Receivables from related corporations are recognised and carried at cost.<br />

Inventories<br />

Inventories are stated at the lower of cost, (valued on a weighted average basis) and net realisable value. Net<br />

realisable value is the estimated selling price less estimated costs of disposal and after making allowance for<br />

damaged, obsolete and slow-moving items.<br />

Leases<br />

Finance leases, which effectively transfer to the Group substantially all the risks and benefits incidental to ownership of<br />

the leased item, are capitalised at the present value of the minimum lease payments at the inception of the lease term<br />

and disclosed as fixed assets. Lease payments are treated as consisting of capital and interest elements and the interest<br />

is charged to profit and loss account. Depreciation on the relevant assets is charged to profit and loss account.<br />

Revenue recognition<br />

Revenue from the sale of products and installation is recognised on the percentage of completion method. Any losses<br />

are provided for as they become known. Claims for additional contract compensation are not recognised until resolved.<br />

Revenue from the provision of services is recognised upon the performance of service to the customer.<br />

Revenue from such services which is billed or collected in advance of the services being rendered, is deferred and<br />

reflected as deferred revenue.<br />

Revenue from the sale of products is recognised upon passage of title to the customer which generally coincides with<br />

their delivery and acceptance.<br />

Revenue from rental of leasehold building space is recognised based on the period of rental during the financial year.<br />

Borrowing costs<br />

Borrowing costs are recognised as expenses in the period in which they are incurred.<br />

Deferred taxation<br />

Deferred taxation is accounted for under the liability method whereby the tax charge for the year is based on the<br />

disclosed book profit after adjusting for all permanent differences. The amount of taxation deferred on account of all<br />

timing differences is reflected in the deferred taxation account, except where the timing differences are not expected<br />

to reverse in the foreseeable future. Deferred tax benefits are not recognised unless there is reasonable expectation<br />

of their realisation.<br />

25

NOTES TO THE FINANCIAL STATEMENTS<br />

3. Segment information<br />

26<br />

The following tables present revenue and profit information regarding business segments and certain asset and<br />

liability information regarding industry segments as at 31 December 2000 and 1999.<br />

Business segments<br />

Products and Services and<br />

installation maintenance Corporate<br />

2000 1999 2000 1999 2000 1999<br />

$ $ $ $ $ $<br />

Segment Revenue<br />

Sales to external<br />

customers 3,878,821 7,161,355 1,905,117 740,972 - -<br />

Intersegment sales<br />

Unallocated revenue<br />

418,926 4,135,102 330,840 291,280 5,237,243 -<br />

Total revenue<br />

Segment Result (522,077) 2,685,248 223,301 343,494 4,300,173 (641,708)<br />

Finance costs<br />

Share of profit of<br />

associated company<br />

Profit from operations<br />

before taxes and<br />

minority interests<br />

Tax expense<br />

Minority interests,<br />

net of taxes<br />

Net (loss)/profit before<br />

extraordinary items, net<br />

Extraordinary items, net<br />

Net (loss)/profit<br />

Segment assets 35,033,420 53,526,838 8,037,066 2,516,515 40,649,444 16,016,515<br />

Unallocated assets<br />

Total assets<br />

Segment liabilities<br />

Unallocated liabilities<br />

Total liabilities<br />

25,803,437 37,623,983 5,430,317 1,440,688 2,618,138 376,119<br />

Capital expenditure 670,264 2,085,015 290,004 586,423 - -<br />

Depreciation 443,605 665,671 188,067 58,847 1,070 1,070

3. Segment information (cont’d)<br />

Business segments<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Rental Eliminations Group<br />

2000 1999 2000 1999 2000 1999<br />

$ $ $ $ $ $<br />

Segment Revenue<br />

Sales to external<br />

customers 967,134 336,918 - - 6,751,072 8,239,245<br />

Intersegment sales - 381,715 (5,987,009) (4,808,097) - -<br />

Unallocated revenue 678,414 767,297<br />

Total revenue 7,429,486 9,006,542<br />

Segment Result (96,872) 184,379 (3,539,600) (2,049,579) 364,925 521,834<br />

Finance costs (243,779) (761,518)<br />

121,146 (239,684)<br />

Share of profit of<br />

associated company - 1,334,752<br />

Profit from operations<br />

before taxes and<br />

minority interests 121,146 1,095,068<br />

Tax expense (246,554) (267,584)<br />

(125,408) 827,484<br />

Minority interests,<br />

net of taxes 38,790 (5,169)<br />

Net (loss)/profit before<br />

extraordinary items, net (86,618) 822,315<br />

Extraordinary items, net - 349,463<br />

Net (loss)/profit (86,618) 1,171,778<br />

Segment assets 9,133,268 3,611,943 (47,683,957) (23,619,847) 45,169,241 52,051,964<br />

Unallocated assets 538,281 184,267<br />

Total assets 45,707,522 52,236,231<br />

Segment liabilities 6,201,405 2,409,177 (36,421,205) (22,721,178) 3,632,092 19,128,788<br />

Unallocated liabilities 320,709 334,444<br />

Total liabilities 3,952,801 19,463,232<br />

Capital expenditure 220,251 - (120,982) (624,590) 1,059,537 2,046,848<br />

Depreciation 131,141 36 - (21,967) 763,883 703,657<br />

Products and installation relates to trading and contracting of engineering works, cooling towers, air-conditioning and<br />

mechanical ventilation systems.<br />

Services and maintenance relates to cleaning and washing of recycled containers used for storage of computer disks and other<br />

sensitive electronic components, and servicing and repairing of air-conditioners, cooling towers and other cooling equipment.<br />

27

NOTES TO THE FINANCIAL STATEMENTS<br />

28<br />

3. Segment information (cont’d)<br />

Geographical segments<br />

Singapore Malaysia<br />

Corporate &<br />

other eliminations Consolidated<br />

2000 1999 2000 1999 2000 1999 2000 1999<br />

$ $ $ $ $ $ $ $<br />

Segment revenue<br />

Sales to external<br />

customers 6,744,549 8,187,887 6,523 51,358 - - 6,751,072 8,239,245<br />

Intersegment sales 5,987,009 4,808,097 - - (5,987,009) (4,808,097) - -<br />

Unallocated revenue 678,414 767,297<br />

Total revenue 7,429,486 9,006,542<br />

Segment assets 92,601,596 75,248,217 789,883 607,861 (47,683,957) (23,619,847) 45,707,522 52,236,231<br />

Segment liabilities 40,122,596 42,095,232 251,410 89,179 (36,421,205) (22,721,178) 3,952,801 19,463,233<br />

4. Dividend income<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Short-term quoted investments 4,213 1,787 - -<br />

Subsidiaries - - 3,425,503 -<br />

5. Other revenues, operating expenses and finance costs<br />

4,213 1,787 3,425,503 -<br />

Other revenue, other operating expenses and finance costs included the following for the years ended 31 December :<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Other revenues<br />

Bad debts recovered - 130,165 - -<br />

Foreign exchange gain 288,372 26,926 - -<br />

Gain on disposal of fixed assets<br />

Gain on disposal of short-term<br />

30,498 367,863 - -<br />

quoted investments<br />

Interest income<br />

6,228 - - -<br />

- subsidiaries - - 959,562 -<br />

- fixed deposits 77,768 - - -<br />

- banks 25,510 2,305 4,784 -<br />

Management fees<br />

Rental of leasehold building<br />

- - 650,550 -<br />

space 967,134 336,131 - -<br />

Share of common expenses<br />

Write-back of diminution in<br />

value of short-term quoted<br />

- - 201,628 -<br />

investments - 70,236 - -

5. Other revenues, operating expenses and finance costs (cont’d)<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Other operating expenses<br />

Amortisation of expenditure<br />

carried forward<br />

Auditors’ remuneration<br />

Auditors of the Group<br />

6,167 500 6,167 500<br />

- current year<br />

- underprovision in<br />

65,000 38,500 30,000 15,000<br />

respect of prior year<br />

Other services<br />

34,000 18,000 15,000 18,000<br />

- current year<br />

- underprovision in<br />

22,000 28,500 10,500 17,500<br />

respect of prior year 3,000 - 3,000 -<br />

Other auditors 874 1,755 - -<br />

Directors’ fees 114,540 80,000 80,000 80,000<br />

Directors’ remuneration 400,200 352,593 400,200 352,593<br />

Foreign exchange loss<br />

Provision for trade doubtful<br />

15,245 38,495 - -<br />

debts<br />

Provision for inventory<br />

201,680 752,306 - -<br />

obsolescence<br />

Provision for diminution<br />

in value of short-term<br />

128,158 21,842 - -<br />

quoted investments<br />

Write-off of short-term<br />

37,901 - - -<br />

quoted investments 7,560 - - -<br />

Write-off of bad debts - trade 23,854 11,757 - -<br />

Finance costs<br />

Interest expense :<br />

Term loans 64,197 309,446 - -<br />

Bank overdrafts 43,450 246,271 1,465 10<br />

Hire purchase 136,132 113,363 - -<br />

Others - 92,438 - -<br />

6. Income tax<br />

243,779 761,518 1,465 10<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Provision for income tax in<br />

respect of profit for the year :-<br />

Current taxation 274,000 29,906 1,100,503 -<br />

Deferred taxation (29,000) 45,000 - -<br />

Underprovision in respect of previous years 1,554 - - -<br />

246,554 74,906 1,100,503 -<br />

Share of taxation of associated company - 192,678 - -<br />

246,554 267,584 1,100,503 -<br />

29

NOTES TO THE FINANCIAL STATEMENTS<br />

6. Income tax (cont’d)<br />

30<br />

The income tax charge for the Group materially differs from the amount determined by applying the Singapore<br />

income tax rate of 25.5% (1999 : 26%) to profit before income tax due to :-<br />

(i) certain non-deductible expenses; and<br />

(ii) no group offset relief available for losses incurred by certain subsidiaries.<br />

This is partially offset by the utilisation of tax losses and capital allowances brought forward by certain<br />

subsidiaries amounting to $612,000 and $275,000 respectively, which resulted in tax savings of<br />

approximately $226,000.<br />

At 31 December 2000, certain subsidiaries had unutilised capital allowances and tax losses amounting to<br />

approximately $439,000 and $1,902,721 (1999 : $58,000 and $852,000 respectively) available for set-off<br />

against future taxable profits subject to sections 23 and 37 of the Income Tax Act and agreement by the<br />

tax authorities.<br />

7. Extraordinary items, net<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Loss on disposal of shares in subsidiary,<br />

Shaoxing Prome Special Cooling<br />

Equipment Co., Ltd<br />

Gain on disposal of shares in associated<br />

company, Zhejiang Shangfeng<br />

- (92,346) - -<br />

Industrial Holdings Co. Ltd - 441,809 - -<br />

8. (Loss)/Earnings per share<br />

- 349,463 - -<br />

Basic (loss)/earning per share before extraordinary items are calculated by dividing the net loss before extraordinary<br />

items of $86,618 (1999 : profit of $822,315) by the weighted average of 184,394,613 ordinary shares (1999 :<br />

138,634,990 ordinary shares) in issue during the year.<br />

Basic (loss)/earnings per share after extraordinary items are calculated by dividing the net loss after extraordinary<br />

items of $86,618 (1999 : profit of $1,171,778) with the weighted average of 184,394,613 ordinary shares (1999 :<br />

138,634,990 ordinary shares) in issue during the year.<br />

Diluted earnings per share is not computed as there is no adjustment for the effects of dilution.

9. Fixed assets<br />

Plant<br />

Showroom,<br />

furniture,<br />

Leasehold and fittings and Motor<br />

properties machinery equipment vehicles Computers Total<br />

Group<br />

Cost<br />

$ $ $ $ $ $<br />

At 1 January 2000 28,942,698 5,580,663 568,788 232,500 139,301 35,463,950<br />

Additions 495,815 69,265 454,315 39,697 445 1,059,537<br />

Disposals - (26,542) - (7,500) - (34,042)<br />

Adjustment (599,089) (42,188) - - - (641,277)<br />

At 31 December 2000 28,839,424 5,581,198 1,023,103 264,697 139,746 35,848,168<br />

Accumulated depreciation<br />

At 1 January 2000 1,112,929 175,892 146,369 48,817 110,923 1,594,930<br />

Charge for the year 500,254 135,704 56,184 52,537 19,204 763,883<br />

Disposals - (240) - (7,500) - (7,740)<br />

At 31 December 2000 1,613,183 311,356 202,553 93,854 130,127 2,351,073<br />

Charge for 1999 498,961 104,236 37,063 42,601 20,796 703,657<br />

Net book value<br />

At 31 December 2000 27,226,241 5,269,842 820,550 170,843 9,619 33,497,095<br />

At 31 December 1999 27,829,769 5,404,771 422,419 183,683 28,378 33,869,020<br />

(a) Leasehold properties include :-<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

(i) a building situated at Riverside Road on leasehold land from the Housing Development Board. The tenure of<br />

the lease is 30 years from 1 February 1992, with an option to renew for another 30 years.<br />

(ii) a 4-storey factory cum office premise situated at Woodlands Loop on leasehold land from Jurong Town<br />

Corporation. The tenure of the lease is 30 years from 16 January 1996 with an option to renew for another<br />

30 years subject to the Company meeting certain investment conditions. The directors have, based on<br />

professional appraisals by Henry Butcher Appraisal Group Pte. Ltd. on 21 March 2001, valued the leasehold<br />

property at $30,000,000.<br />

(b) No depreciation charge has been provided on plant and machinery amounting to $4,051,872 (1999 :<br />

$3,764,862) as the subsidiary company has not commenced the business in which the assets are intended<br />

to be utilised.<br />

(c) Adjustment relates to over-accrual of costs of fixed assets at completion.<br />

31

NOTES TO THE FINANCIAL STATEMENTS<br />

9. Fixed assets (cont’d)<br />

32<br />

(d) At the balance sheet date, the net book value of fixed assets of the Group under finance lease<br />

comprise :-<br />

2000 1999<br />

$ $<br />

Plant & machinery - 4,267,770<br />

Furniture, fittings and equipment 8,547 9,862<br />

Motor vehicles 135,947 179,967<br />

144,494 4,457,599<br />

Company<br />

Furniture, fittings<br />

and equipment Computers Total<br />

Cost<br />

Balance as at 1 January 2000<br />

$ $ $<br />

and 31 December 2000 10,000 210 10,210<br />

Accumulated depreciation<br />

Balance as at 1 January 2000 1,500 76 1,576<br />

Charge for the year 1,000 70 1,070<br />

Balance as at 31 December 2000 2,500 146 2,646<br />

Charge for 1999 1,000 70 1,070<br />

Net book value<br />

At 31 December 2000 7,500 64 7,564<br />

At 31 December 1999 8,500 134 8,634<br />

10. Intangible assets<br />

Group Company<br />

$ $<br />

Cost<br />

At 1 January 2000 15,000 15,000<br />

Increase during the year 25,801 -<br />

At 31 December 2000 40,801 15,000<br />

Accumulated amortisation<br />

At 1 January 2000 500 500<br />

Charge for the year 6,167 6,167<br />

At 31 December 2000 6,667 6,667<br />

Charge for 1999 500 500<br />

Net book value<br />

At 31 December 2000 34,134 8,333<br />

At 31 December 1999 14,500 14,500

11. Subsidiary companies<br />

The consolidated financial statements include the financial statements of the Company and the consolidated subsidiaries<br />

stated as follows:<br />

Name of company Principal activities Cost<br />

Percentage of<br />

equity held by<br />

the Group<br />

(Country of incorporation) (Place of business) 2000 1999 2000 1999<br />

Held by the Company :<br />

$ $ % %<br />

Progen Pte Ltd Trading, contracting of 8,067,397 8,067,397 100 100<br />

(Singapore) engineering works and<br />

rental of building space<br />

(Singapore)<br />

Progen Engineering Trading and contracting 625,000 625,000 100 100<br />

Pte Ltd of engineering works,<br />

(Singapore) cooling towers, airconditioning<br />

and<br />

mechanical ventilation<br />

systems (Singapore)<br />

D.B. Progen Servicing Servicing and repairing of 199,260 199,260 100 100<br />

Pte Ltd air-conditioners, cooling<br />

(Singapore) towers and other cooling<br />

equipment (Singapore)<br />

Polacel Manufacturing Supply and installation 229,524 229,524 100 100<br />

(S.E. Asia) Pte Ltd of cooling fans, cooling<br />

(Singapore) towers and air-conditioners<br />

(Singapore)<br />

Sinsino Fan Pte Ltd Dormant 180,724 180,724 100 100<br />

(Singapore) (Singapore)<br />

Engpro Sdn Bhd (1) Installation and maintenance 626,592 626,592 100 100<br />

(Malaysia) of air-conditioning systems<br />

(Malaysia)<br />

Dico International Cleaning and washing of 256,250 110,000 100 55<br />

Pte Ltd recycled containers used<br />

(Singapore) for storage of computer<br />

disks and other sensitive<br />

electronic components<br />

(Singapore)<br />

Progen Media Pte Ltd Dormant 8 - 80 -<br />

(Singapore) (Singapore)<br />

Unquoted equity shares, at cost 10,184,755 10,038,497<br />

Held by a subsidiary :<br />

(Progen Pte Ltd)<br />

Progen Industrial Pte Ltd Sale and distribution of 10 10 100 100<br />

(Singapore) motorcycles, household<br />

electrical appliances and<br />

air-conditioners<br />

(Singapore)<br />

(1) Audited by an associated firm of Ernst & Young, Singapore.<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

33

NOTES TO THE FINANCIAL STATEMENTS<br />

12. Associated company<br />

34<br />

The Company’s investment in associated company in 1999 consisted of a 50% ownership interest in Progen Media Pte<br />

Ltd. This associated company became a subsidiary company in the current financial year (Note 11).<br />

13. Trade and other receivables<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Trade receivables, net 4,862,013 6,869,274 2,262 2,262<br />

Prepayments 64,157 31,964 714 1,772<br />

Sundry deposits 15,876 62,337 - -<br />

Advance to subcontractors - 2,478 - -<br />

Section 44 tax prepayments 504,147 169,767 228,705 130,071<br />

Dividend receivable - - 2,552,000 -<br />

Other receivables 40,261 66,688 - 10,662<br />

Amount receivable for the<br />

disposal of shares in a former<br />

associated company 1,956,099 8,199,531 - -<br />

7,442,553 15,402,039 2,783,681 144,767<br />

Trade receivables are stated after<br />

deducting provision for doubtful<br />

debts of 920,268 1,160,252 - -<br />

Analysis of provision for doubtful debts :-<br />

Balance at beginning of year 1,160,252 407,977 - -<br />

Provision for the year 201,680 752,306 - -<br />

Bad debts written off (441,664) (31) - -<br />

Balance at end of year 920,268 1,160,252 - -<br />

Bad debts written directly to<br />

profit and loss account 23,854 11,757 - -<br />

Bad debts recovered and<br />

credited to profit and loss account - (130,165) - -<br />

Included in trade receivable balance is an amount of $2,096,051 (1999 : $2,129,000) receivable from a debtor which<br />

relates to several projects undertaken in 1997. No provision for doubtful debts has been made in respect of this amount.<br />

The directors are of the opinion that no loss will be incurred and they have taken active steps to recover the debt.

14. Amounts due from subsidiaries<br />

Company<br />

2000 1999<br />

$ $<br />

Trade 7,838,928 7,184,874<br />

Non-trade 20,039,142 8,801,611<br />

27,878,070 15,986,485<br />

Except for the non-trade amount due from a subsidiary which bears interest at 5.5% (1999 : Nil) per annum and is<br />

repayable on demand, all other amounts are unsecured, interest-free and have no fixed terms of repayment.<br />

15. Short-term quoted investments<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Quoted shares, at cost<br />

Less : Provision for diminution<br />

522,042 1,006,367 - -<br />

in value (472,789) (788,677) - -<br />

49,253 217,690 - -<br />

Warrants, at cost - 12,533 - -<br />

Less : Provision for diminution<br />

in value - (6,556) - -<br />

- 5,977 - -<br />

49,253 223,667 - -<br />

Market value of :<br />

Quoted shares 49,253 218,437 - -<br />

Quoted warrants - 5,230 - -<br />

49,253 223,667 - -<br />

Analysis of provision for<br />

diminution in value of<br />

short-term quoted investments :<br />

Balance at beginning of year 795,233 865,469 - -<br />

Provision/(write-back) during<br />

the year 37,901 (70,236) - -<br />

Disposals (360,345) - - -<br />

Balance at end of year 472,789 795,233 - -<br />

35

NOTES TO THE FINANCIAL STATEMENTS<br />

16. Inventories<br />

36<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Consumables and spares 17,642 21,438 - -<br />

Trading stocks 361,601 640,698 - -<br />

379,243 662,136 - -<br />

Inventories are stated at cost<br />

and after deducting provision<br />

for obsolescence of 150,000 21,842 - -<br />

Analysis of provision for<br />

obsolescence :<br />

Balance at beginning of year 21,842 - - -<br />

Provision 128,158 21,842 - -<br />

Balance at end of year 150,000 21,842 - -<br />

17. Contracts work-in-progress<br />

Costs incurred and attributable<br />

profits 17,033,558 36,088,503 - -<br />

Less : Progress billings (16,234,948) (36,230,841) - -<br />

798,610 (142,338) - -<br />

Included in progress billings is retention receivables amounting to $541,433 (1999: $499,078)<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

This can be analysed as follows :<br />

Current assets<br />

Being costs and attributable profits<br />

in excess of progress billings<br />

Current liabilities<br />

Being progress billings in excess<br />

847,749 133,727 - -<br />

of costs and attributable profits (49,139) (276,065) - -<br />

798,610 (142,338) - -

18. Trade and other payables<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Trade payables 1,629,314 2,609,949 166,614 110,294<br />

Accruals 174,714 27,513 - -<br />

Deferred revenue 71,002 60,907 - -<br />

Deposits received 218,747 83,045 - -<br />

Retention sums payables<br />

Payables in respect of<br />

356,069 429,070 - -<br />

contracts work-in-progress 37,002 402,378 - -<br />

Purchase of fixed assets 3,750 178,698 - -<br />

Other payables 498,038 212,804 113,769 108,590<br />

Amount due to Directors 80,000 86,000 80,000 74,000<br />

Others - 22,503 - 20,000<br />

19. Amounts due to subsidiaries<br />

3,068,636 4,112,867 360,383 312,884<br />

Company<br />

2000 1999<br />

$ $<br />

Trade 2,132 654<br />

Non-trade 1,844,660 62,581<br />

The amounts are unsecured, interest-free and have no fixed terms of repayment.<br />

20. Interest-bearing loans and borrowings<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

1,846,792 63,235<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Short-term<br />

Bank loans, secured<br />

Current portion of long-term<br />

- 3,000,000 - -<br />

bank loans, secured - 667,644 - -<br />

Bank overdrafts, secured - 4,021,411 - -<br />

- 7,689,055 - -<br />

Long-term<br />

Bank loans, secured - 5,851,140 - -<br />

Deduct : Repayments due within<br />

twelve months included<br />

in current liabilities - (667,644) - -<br />

- 5,183,496 - -<br />

37

NOTES TO THE FINANCIAL STATEMENTS<br />

20. Interest-bearing loans and borrowings (cont’d)<br />

38<br />

The short-term bank borrowings and long-term loans, which were fully repaid during the year, were secured by :-<br />

(i) legal mortgages over the Group’s leasehold buildings (note 9(a));<br />

(ii) joint and several guarantee of two major shareholders.<br />

The interest on the short-term loans were charged at the bank’s prevailing prime rate.<br />

21. Hire purchase creditors<br />

The leases expire over five years and the average discount rate implicit in the lease is 5% (1999 : 4.2%) :-<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Present value are as follows :<br />

Repayable within one year<br />

Repayable after one year but<br />

31,125 758,968 - -<br />

not more than five years 72,229 1,108,337 - -<br />

The future minimum lease payments<br />

under hire purchase creditors are as follows :-<br />

103,354 1,867,305 - -<br />

Repayable within one year 37,766 875,700 - -<br />

Repayable after one year but<br />

not more than five year 90,770 1,286,478 - -<br />

128,536 2,162,178 - -<br />

Amount representing interest (25,182) (294,873) - -<br />

Present value of minimum lease payments 103,354 1,867,305 - -<br />

22. Proposed dividend<br />

First and final dividend of 0.30 cents (3%)<br />

per share, less income tax of 24.5% 410,963 - 410,963 -<br />

23. Deferred income tax<br />

Balance at beginning of year 116,226 71,226 - -<br />

(Write-back)/provision during year (29,000) 45,000 - -<br />

Balance at end of year 87,226 116,226 - -<br />

The deferred taxation arises as a result of :-<br />

Excess of net book value over tax<br />

written down value of fixed assets 87,226 64,689 - -<br />

Other timing differences - 51,537 - -<br />

87,226 116,226 - -

24. Operating commitments<br />

The Group leases certain properties under lease agreements that are non-cancellable within a year. The leases expire<br />

on various dates till 2026 and contain provisions for rental adjustments. Rental expense was $279,533 and $279,533<br />

for the years ended 31 December 2000 and 1999, respectively.<br />

Future minimum lease payments for all leases with initial or remaining terms of one year or more are as follows :-<br />

Group<br />

2000 1999<br />

$ $<br />

Within one year 279,533 279,533<br />

After one year but not more than five years 1,118,132 1,118,132<br />

More than five years 5,285,214 5,564,747<br />

25. Related party transactions<br />

6,682,879 6,962,412<br />

The Company and the Group had the following significant related party transactions and the effects of these transactions<br />

on the basis determined between the parties are reflected in the financial statements :-<br />

Group Company<br />

2000 1999 2000 1999<br />

$ $ $ $<br />

Subsidiaries<br />

Dividend income - - 3,425,503 -<br />

Management fees income - - 650,550 -<br />

Interest income on amount due<br />

Share of common expenses<br />

- - 959,562 -<br />

recovered - - 201,628 -<br />

Director-related company<br />

Share of common expenses<br />

recovered - 16,511 - -<br />

26. Contingent liabilities<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Group and Company<br />

2000 1999<br />

$ $<br />

(a) Guarantees given to banks and<br />

finance companies in respect<br />

of facilities granted to subsidiaries,<br />

unsecured 2,248,488 2,248,488<br />

(b) The Group has received claims from its suppliers amounting to $1.5 million (1999 : $1.5 million) which has<br />

not been accrued for in the financial statements. The Group has made a counter-claim amounting to $953,919<br />

(1999 : $987,000). No provision against this claim has been made, as the directors are of the opinion that<br />

the claims from the suppliers are unsustainable and no loss will be suffered by the Group.<br />

(c) A customer has made claims of backcharges, amounting to approximately $488,000 (1999 : $600,000) (of which<br />

$230,991 has been provided for in the financial statements), against a subsidiary. The directors are of the<br />

opinion that the provision is adequate as negotiations with the customer are in progress, and the likelihood of<br />

a further loss to the subsidiary is unlikely.<br />

39

NOTES TO THE FINANCIAL STATEMENTS<br />

27. Directors’ remuneration<br />

40<br />

In compliance with the requirements of the Singapore Exchange Securities Trading Limited, the directors’ remuneration<br />

in bands were as follow :-<br />

Number of Directors<br />

2000 1999<br />

$500,000 and above - -<br />

$250,000 to $499,999 1 -<br />

Below $250,000 3 5<br />

28. Subsequent events<br />

4 5<br />

Pursuant to the share buyback scheme approved by the shareholders on 31 July 2000, the Company made a further<br />

repurchase of 805,000 ordinary shares from 31 March to 11 April 2001 at a total cost, including brokerage, of<br />

$85,030. The total amount spent under the scheme as at the date of this report amounted to $1,040,515 for<br />

5,401,000 ordinary shares.<br />

29. Comparative figures<br />

The presentation and classification of items in the financial statements have been changed due to the adoption of<br />

the requirements of SAS 1 (Revised 1999) “Presentation of financial statements”, SAS 15 (Revised 1999) “Leases”<br />

and SAS 23 “Segment Reporting”. As a result, additional line items have been included on the face of the profit and<br />

loss accounts, and statements of changes in equity have been presented as required by SAS 1 (Revised 1999).<br />

Finance lease obligations have been analysed to disclose a reconciliation of the total minimum lease payments at the<br />

balance sheet date, and their present value, for periods not later than one year, later than one year and not later than<br />

five years, and later than five years as required by SAS 15 (Revised 1999). Segment information has also been<br />

analysed to include additional information and segment assets and liabilities, capital expenditure and depreciation.<br />

Certain comparative figures have been reclassified to conform with the current year’s presentation.

Properties held by the Group as at 31 December 2000<br />

PROPERTIES<br />

Tenure of land Land area<br />

1. Head office/factory/ 12 Woodlands Loop 30 + 30 years 152,903 sq ft<br />

commercial warehouse Singapore leasehold (14,205 sq m)<br />

from<br />

16-01-1996<br />

The above property was appraised on 21 March 2001 by Henry Butcher Appraisal Group Pte. Ltd. at $30 million.<br />

Tenure of land Land area<br />

2. Office/industrial 28 Riverside Road 30 + 30 years 41,076 sq ft<br />

warehouse Singapore leasehold (3,816 sq m)<br />

from<br />

01-02-1992<br />

41

STATISTICS OF SHAREHOLDINGS<br />

As at 16th April 2001<br />

Distribution of Shareholdings<br />

Size of Holdings<br />

No. of<br />

Shareholders % No. of Shares %<br />

1 - 1,000 131 5.29 112,342 0.06<br />

1,001 - 10,000 1,384 55.87 8,270,300 4.56<br />

10,001 - 1,000,000 943 38.07 47,512,369 26.19<br />

1,000,001 and above 19 0.77 125,545,475 69.19<br />

Total 2,477 100.00 181,440,486 100.00<br />

Twenty Largest Shareholders<br />

Name No. of Shares %<br />

1. Mayban Nominees (Singapore) Pte Ltd 35,747,500 19.70<br />

2. SBS Nominees Pte Ltd 17,178,000 9.47<br />

3. Phillip Securities Pte Ltd 14,600,500 8.05<br />

4. Lee Ee @ Lee Eng 13,673,460 7.54<br />

5. Overseas Union Bank Nominees Pte Ltd 8,318,300 4.58<br />

6. United Overseas Bank Nominees Pte Ltd 6,706,500 3.70<br />

7. OUB Securities Pte Ltd 6,200,000 3.42<br />

8. DBS Nominees Pte Ltd 3,045,890 1.68<br />

9. William Teng Guido 2,900,000 1.60<br />

10. Koh Moi Huang 2,838,694 1.56<br />

11. Overseas Union Trust (Nominees) Pte Ltd 2,604,000 1.44<br />

12. Goh Kia Ling Kenneth 2,200,000 1.21<br />

13. Ko Beng Soo 2,095,000 1.15<br />

14. Tan Gek Suan 1,523,000 0.84<br />

15. Marine Park Development (Pte) Ltd 1,400,000 0.77<br />

16. Chan Wan Hoi 1,250,000 0.69<br />

17. ICB Nominees (Pte) Ltd 1,232,000 0.68<br />

18. Citibank Consumer Nominees Pte Ltd 1,024,631 0.56<br />

19. OCBC Securities Private Ltd 1,008,000 0.56<br />

20. Forte Engineering Pte Ltd 970,000 0.53<br />

Substantial Shareholders<br />

(As recorded in the Register of Substantial Shareholders)<br />

42<br />

126,515,475 69.73<br />

Direct Interest Deemed Interest Total Interest<br />

Name of Shareholder No of Shares % No of Shares % No of Shares %<br />

Lee Ee @ Lee Eng 97,162,460 53.8 2,608,694 1.4 99,771,154 55.2

NOTICE OF ANNUAL GENERAL MEETING<br />

NOTICE IS HEREBY GIVEN that the Annual General Meeting of Progen Holdings Ltd (“the Company”) will be held at 12<br />

Woodlands Loop, Singapore 738283 on Friday, 25 May 2001 at 10.00 a.m. for the following purposes:<br />

AS ORDINARY BUSINESS<br />

1. To receive and adopt the Directors’ Report and Audited Accounts of the Company for the year ended 31 December<br />

2000 together with the Auditors’ Report thereon. (Resolution 1)<br />

2. To declare a first and final dividend of 3% less tax for the year ended 31 December 2000. (Resolution 2)<br />

3. To re-elect the following Directors pursuant to Articles 109 and 119 of the Company’s Articles of Association:<br />

Mr Ch’ng Jit Koon (Retiring under Article 109) (Resolution 3)<br />

Mr Yap Foo Seong (Retiring under Article 119) (Resolution 4)<br />

Mr Ch’ng Jit Koon will, upon re-election as a Director of the Company, remain a member of the Audit Committee and<br />

will be considered independent for the purposes of Clause 902 (4)(a) of the Listing Manual of the Singapore Exchange<br />

Securities Trading Limited.<br />

4. To approve the payment of Directors’ fees of S$80,000 for the year ended 31 December 2000 (1999: S$80,000).<br />

(Resolution 5)<br />