2007 - April

2007 - April

2007 - April

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5.0<br />

Corporate Governance<br />

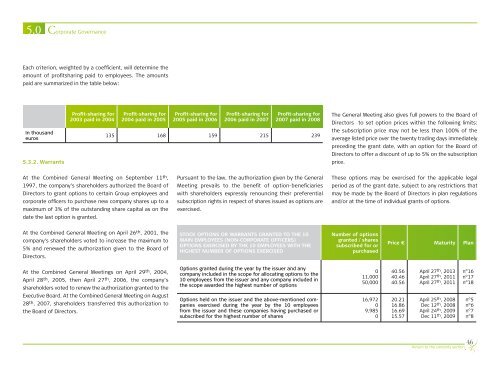

Each criterion, weighted by a coefficient, will determine the<br />

amount of profitsharing paid to employees. The amounts<br />

paid are summarized in the table below:<br />

In thousand<br />

euros<br />

5.3.2. Warrants<br />

Profit-sharing for<br />

2003 paid in 2004<br />

Profit-sharing for<br />

2004 paid in 2005<br />

Profit-sharing for<br />

2005 paid in 2006<br />

Profit-sharing for<br />

2006 paid in <strong>2007</strong><br />

Profit-sharing for<br />

<strong>2007</strong> paid in 2008<br />

135 168 159 215 239<br />

The General Meeting also gives full powers to the Board of<br />

Directors to set option prices within the following limits:<br />

the subscription price may not be less than 100% of the<br />

average listed price over the twenty trading days immediately<br />

preceding the grant date, with an option for the Board of<br />

Directors to offer a discount of up to 5% on the subscription<br />

price.<br />

At the Combined General Meeting on September 11 th ,<br />

1997, the company’s shareholders authorized the Board of<br />

Directors to grant options to certain Group employees and<br />

corporate officers to purchase new company shares up to a<br />

maximum of 3% of the outstanding share capital as on the<br />

date the last option is granted.<br />

Pursuant to the law, the authorization given by the General<br />

Meeting prevails to the benefit of option-beneficiaries<br />

with shareholders expressly renouncing their preferential<br />

subscription rights in respect of shares issued as options are<br />

exercised.<br />

These options may be exercised for the applicable legal<br />

period as of the grant date, subject to any restrictions that<br />

may be made by the Board of Directors in plan regulations<br />

and/or at the time of individual grants of options.<br />

At the Combined General Meeting on <strong>April</strong> 26 th , 2001, the<br />

company’s shareholders voted to increase the maximum to<br />

5% and renewed the authorization given to the Board of<br />

Directors.<br />

STOCK OPTIONS OR WARRANTS GRANTED TO THE 10<br />

MAIN EMPLOYEES (NON-CORPORATE OFFICERS)<br />

OPTIONS EXERCISED BY THE 10 EMPLOYEES WITH THE<br />

HIGHEST NUMBER OF OPTIONS EXERCISED<br />

Number of options<br />

granted / shares<br />

subscribed for or<br />

purchased<br />

Price € Maturity Plan<br />

At the Combined General Meetings on <strong>April</strong> 29 th , 2004,<br />

<strong>April</strong> 28 th , 2005, then <strong>April</strong> 27 th , 2006, the company’s<br />

shareholders voted to renew the authorization granted to the<br />

Executive Board. At the Combined General Meeting on August<br />

28 th , <strong>2007</strong>, shareholders transferred this authorization to<br />

the Board of Directors.<br />

Options granted during the year by the issuer and any<br />

company included in the scope for allocating options to the<br />

10 employees from the issuer and any company included in<br />

the scope awarded the highest number of options<br />

Options held on the issuer and the above-mentioned companies<br />

exercised during the year by the 10 employees<br />

from the issuer and these companies having purchased or<br />

subscribed for the highest number of shares<br />

0<br />

11,000<br />

50,000<br />

16,972<br />

0<br />

9,985<br />

0<br />

40.56<br />

40.46<br />

40.56<br />

20.21<br />

16.86<br />

16.69<br />

15.57<br />

<strong>April</strong> 27 th , 2013<br />

<strong>April</strong> 27 th , 2011<br />

<strong>April</strong> 27 th , 2011<br />

<strong>April</strong> 25 th , 2008<br />

Dec 12 th , 2008<br />

<strong>April</strong> 24 th , 2009<br />

Dec 11 th , 2009<br />

n°16<br />

n°17<br />

n°18<br />

n°5<br />

n°6<br />

n°7<br />

n°8<br />

46<br />

Return to the contents section