2013-2014 LBCC Catalog (complete PDF file) - LBCC Paperless ...

2013-2014 LBCC Catalog (complete PDF file) - LBCC Paperless ...

2013-2014 LBCC Catalog (complete PDF file) - LBCC Paperless ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

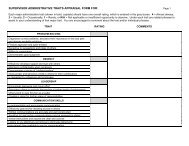

Grants<br />

Federal Pell Grants<br />

Oregon Opportunity<br />

Grants<br />

L I N N - B E N T O N C O M M U N I T Y C O L L E G E 2 0 1 3 - 2 0 1 4 C A T A L O G<br />

Financial Aid Programs and Sources *<br />

Eligibility Requirements Amounts Available Special Information<br />

• Be an undergraduate student at a<br />

2- or 4-year public or private college<br />

that participates in the federal Title 4<br />

programs.<br />

• Admitted, degree-seeking students<br />

enrolled for one or more credits may be<br />

eligible.<br />

• Complete and submit the FAFSA.<br />

• Be an Oregon resident.<br />

• Be an undergraduate student at a<br />

2- or 4-year public or private college<br />

that participates in the federal Title 4<br />

programs.<br />

• Be enrolled at least half time<br />

(six or more credits per term) in a<br />

certificate- or degree-granting program<br />

Fall Term.<br />

• Amounts are based on financial need as<br />

defined by FAFSA.<br />

• Awards are based on expected<br />

family contribution.<br />

• Beginning 2012-<strong>2013</strong>, the amount for eligile<br />

students is based on financial need and<br />

meeting the filing deadline as published<br />

by the Oregon Student Access Commission.<br />

Half of published amount is awarded to<br />

eligible students enrolled in 6-11 credits.<br />

• The Department of Education will send<br />

you a Student Aid Report (SAR) indicating<br />

your eligibility.<br />

13<br />

• Oregon Opportunity Grants are transferrable<br />

to other Oregon institutions and are<br />

renewable for a maximum of 12 quarters.<br />

• Amounts are awarded by Oregon Student<br />

Access Commission.<br />

• Grant is not available for summer terms.<br />

Federal Supplemental<br />

Educational Opportunity<br />

Grants (SEOG)<br />

• Be an undergraduate student at a 2- or<br />

4-year public or private college that<br />

participates in the federal Title 4 programs.<br />

• You must prove an exceptional financial<br />

need as defined by FAFSA.<br />

• Be enrolled at least half time (6 or more<br />

credits per term) in a certificate- or degreegranting<br />

program.<br />

• $220 per term of attendance.<br />

• $660 total for the year.<br />

• SEOG is linked with Pell Grant eligibility.<br />

Work Study<br />

Federal Work Study<br />

Program<br />

• Undergraduate students and students who<br />

have bachelor’s degrees are eligible to<br />

participate.<br />

• Be enrolled at least half time<br />

(six or more credits per term) in a<br />

certificate- or degree-granting program.<br />

• Students are paid current minimum wage<br />

for work performed. Higher wages are<br />

paid to returning student workers and for<br />

jobs requiring certain skills.<br />

• Employment during the school term may<br />

not exceed 20 hours<br />

per week.<br />

• When possible, the student is placed in<br />

a job compatible with his or her career<br />

goal.<br />

Student Loans<br />

Federal Direct student loans are available; however, THEY ALL REQUIRE REPAYMENT. Think before you borrow, and borrow only what you need for educational expenses;<br />

convenience now may result in financial hardship later. Failure to repay student loans results in a damaged credit rating and makes credit difficult to obtain in the future.<br />

Federal regulations require that subsequent loan disbursements be returned to the U.S. Department of Education if at any time you enroll for and <strong>complete</strong> less than six (6)<br />

credit hours during the period of the loan as indicated on your Direct Loan application. Your loan application will be voided, and you must start the loan application process<br />

over again.<br />

Federal Direct Student<br />

Loans<br />

* Information subject to change.<br />

• Eligibility is determined by the FAFSA.<br />

• Be enrolled at least half time<br />

(six or more credits per term) in a<br />

certificate- or degree-granting program.<br />

• Effective July 31, <strong>2013</strong>, there will be<br />

a new limit on eligibility for Direct<br />

Subsidized Loans for new borrowers on<br />

or after July 1, <strong>2013</strong>. New borrowers who<br />

begin their college enrollment on or<br />

after July 1, <strong>2013</strong> will not have access to<br />

subsidized loan funds beyond 150% of<br />

the credits required for their degree or<br />

certificate program.<br />

• Loans of up to $3,500 per year are available<br />

to first-year students through the<br />

U.S. Department of Education.<br />

• Students in the second year of their<br />

programs (45+ credits) may borrow up<br />

to $4,500 per academic year.<br />

• You must first apply for a Pell Grant by<br />

completing the FAFSA.<br />

• A separate application is required for this<br />

program.<br />

• You are strongly encouraged to apply<br />

for grants administered by the state aid<br />

agencies in your state of legal residence.<br />

• Nonresidents may pick up the addresses of<br />

their state grant programs from <strong>LBCC</strong>’s<br />

Financial Aid Office.<br />

• A 1% loan origination fee is charged. This<br />

rate may be affected by federal legislation.<br />

• The interest rate on a Federal Direct Loan<br />

is fixed at 6.8 percent.<br />

• Effective through June 30, <strong>2014</strong>, interet<br />

will begin to accrue after you cease to be<br />

enrolled at least half time.<br />

• Loan repayment begins six months after<br />

you cease to be enrolled at least half time.