ANNUAL REPORT - Franklin Templeton Investments

ANNUAL REPORT - Franklin Templeton Investments

ANNUAL REPORT - Franklin Templeton Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

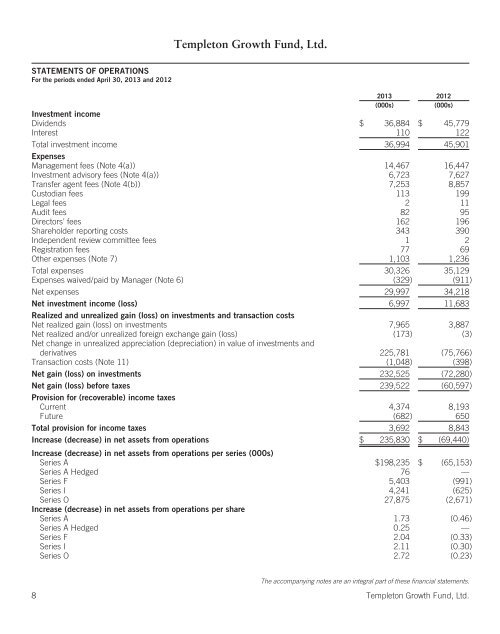

<strong>Templeton</strong> Growth Fund, Ltd.<br />

STATEMENTS OF OPERATIONS<br />

For the periods ended April 30, 2013 and 2012<br />

2013 2012<br />

(000s)<br />

(000s)<br />

Investment income<br />

Dividends $ 36,884 $ 45,779<br />

Interest 110 122<br />

Total investment income 36,994 45,901<br />

Expenses<br />

Management fees (Note 4(a)) 14,467 16,447<br />

Investment advisory fees (Note 4(a)) 6,723 7,627<br />

Transfer agent fees (Note 4(b)) 7,253 8,857<br />

Custodian fees 113 199<br />

Legal fees 2 11<br />

Audit fees 82 95<br />

Directors’ fees 162 196<br />

Shareholder reporting costs 343 390<br />

Independent review committee fees 1 2<br />

Registration fees 77 69<br />

Other expenses (Note 7) 1,103 1,236<br />

Total expenses 30,326 35,129<br />

Expenses waived/paid by Manager (Note 6) (329) (911)<br />

Net expenses 29,997 34,218<br />

Net investment income (loss) 6,997 11,683<br />

Realized and unrealized gain (loss) on investments and transaction costs<br />

Net realized gain (loss) on investments 7,965 3,887<br />

Net realized and/or unrealized foreign exchange gain (loss) (173) (3)<br />

Net change in unrealized appreciation (depreciation) in value of investments and<br />

derivatives 225,781 (75,766)<br />

Transaction costs (Note 11) (1,048) (398)<br />

Net gain (loss) on investments 232,525 (72,280)<br />

Net gain (loss) before taxes 239,522 (60,597)<br />

Provision for (recoverable) income taxes<br />

Current 4,374 8,193<br />

Future (682) 650<br />

Total provision for income taxes 3,692 8,843<br />

Increase (decrease) in net assets from operations $ 235,830 $ (69,440)<br />

Increase (decrease) in net assets from operations per series (000s)<br />

Series A $198,235 $ (65,153)<br />

Series A Hedged 76 —<br />

Series F 5,403 (991)<br />

Series I 4,241 (625)<br />

Series O 27,875 (2,671)<br />

Increase (decrease) in net assets from operations per share<br />

Series A 1.73 (0.46)<br />

Series A Hedged 0.25 —<br />

Series F 2.04 (0.33)<br />

Series I 2.11 (0.30)<br />

Series O 2.72 (0.23)<br />

The accompanying notes are an integral part of these financial statements.<br />

8 <strong>Templeton</strong> Growth Fund, Ltd.