ANNUAL REPORT - Franklin Templeton Investments

ANNUAL REPORT - Franklin Templeton Investments

ANNUAL REPORT - Franklin Templeton Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Templeton</strong> Growth Fund, Ltd.<br />

NOTES TO FINANCIAL STATEMENTS<br />

For the periods ended April 30, 2013 and 2012 (Continued)<br />

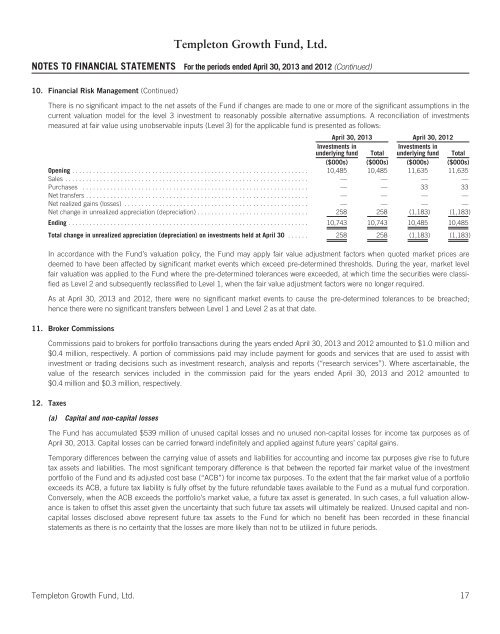

10. Financial Risk Management (Continued)<br />

There is no significant impact to the net assets of the Fund if changes are made to one or more of the significant assumptions in the<br />

current valuation model for the level 3 investment to reasonably possible alternative assumptions. A reconciliation of investments<br />

measured at fair value using unobservable inputs (Level 3) for the applicable fund is presented as follows:<br />

April 30, 2013 April 30, 2012<br />

<strong>Investments</strong> in<br />

<strong>Investments</strong> in<br />

underlying fund Total underlying fund Total<br />

($000s) ($000s) ($000s) ($000s)<br />

Opening .................................................................... 10,485 10,485 11,635 11,635<br />

Sales ...................................................................... — — — —<br />

Purchases ................................................................. — — 33 33<br />

Net transfers ................................................................ — — — —<br />

Net realized gains (losses) ..................................................... — — — —<br />

Net change in unrealized appreciation (depreciation) ................................ 258 258 (1,183) (1,183)<br />

Ending ..................................................................... 10,743 10,743 10,485 10,485<br />

Total change in unrealized appreciation (depreciation) on investments held at April 30 ...... 258 258 (1,183) (1,183)<br />

In accordance with the Fund’s valuation policy, the Fund may apply fair value adjustment factors when quoted market prices are<br />

deemed to have been affected by significant market events which exceed pre-determined thresholds. During the year, market level<br />

fair valuation was applied to the Fund where the pre-determined tolerances were exceeded, at which time the securities were classified<br />

as Level 2 and subsequently reclassified to Level 1, when the fair value adjustment factors were no longer required.<br />

As at April 30, 2013 and 2012, there were no significant market events to cause the pre-determined tolerances to be breached;<br />

hence there were no significant transfers between Level 1 and Level 2 as at that date.<br />

11. Broker Commissions<br />

Commissions paid to brokers for portfolio transactions during the years ended April 30, 2013 and 2012 amounted to $1.0 million and<br />

$0.4 million, respectively. A portion of commissions paid may include payment for goods and services that are used to assist with<br />

investment or trading decisions such as investment research, analysis and reports (“research services”). Where ascertainable, the<br />

value of the research services included in the commission paid for the years ended April 30, 2013 and 2012 amounted to<br />

$0.4 million and $0.3 million, respectively.<br />

12. Taxes<br />

(a)<br />

Capital and non-capital losses<br />

The Fund has accumulated $539 million of unused capital losses and no unused non-capital losses for income tax purposes as of<br />

April 30, 2013. Capital losses can be carried forward indefinitely and applied against future years’ capital gains.<br />

Temporary differences between the carrying value of assets and liabilities for accounting and income tax purposes give rise to future<br />

tax assets and liabilities. The most significant temporary difference is that between the reported fair market value of the investment<br />

portfolio of the Fund and its adjusted cost base (“ACB”) for income tax purposes. To the extent that the fair market value of a portfolio<br />

exceeds its ACB, a future tax liability is fully offset by the future refundable taxes available to the Fund as a mutual fund corporation.<br />

Conversely, when the ACB exceeds the portfolio’s market value, a future tax asset is generated. In such cases, a full valuation allowance<br />

is taken to offset this asset given the uncertainty that such future tax assets will ultimately be realized. Unused capital and noncapital<br />

losses disclosed above represent future tax assets to the Fund for which no benefit has been recorded in these financial<br />

statements as there is no certainty that the losses are more likely than not to be utilized in future periods.<br />

<strong>Templeton</strong> Growth Fund, Ltd. 17