Download Complete PDF - Informe Anual 2012

Download Complete PDF - Informe Anual 2012

Download Complete PDF - Informe Anual 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

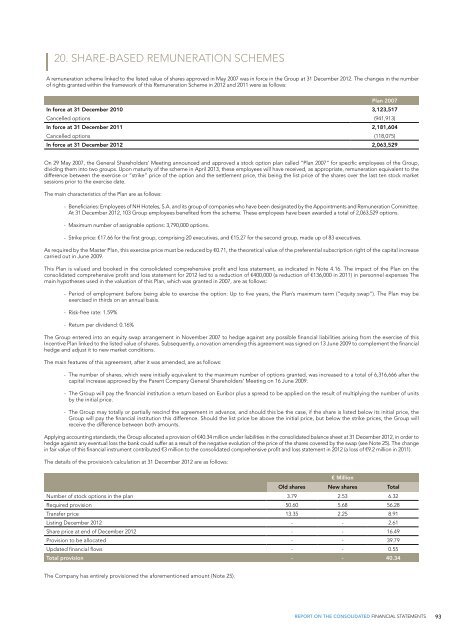

20. SHARE-BASED REMUNERATION SCHEMES<br />

A remuneration scheme linked to the listed value of shares approved in May 2007 was in force in the Group at 31 December <strong>2012</strong>. The changes in the number<br />

of rights granted within the framework of this Remuneration Scheme in <strong>2012</strong> and 2011 were as follows:<br />

Plan 2007<br />

In force at 31 December 2010 3,123,517<br />

Cancelled options (941,913)<br />

In force at 31 December 2011 2,181,604<br />

Cancelled options (118,075)<br />

In force at 31 December <strong>2012</strong> 2,063,529<br />

On 29 May 2007, the General Shareholders’ Meeting announced and approved a stock option plan called “Plan 2007” for specific employees of the Group,<br />

dividing them into two groups. Upon maturity of the scheme in April 2013, these employees will have received, as appropriate, remuneration equivalent to the<br />

difference between the exercise or “strike” price of the option and the settlement price, this being the list price of the shares over the last ten stock market<br />

sessions prior to the exercise date.<br />

The main characteristics of the Plan are as follows:<br />

- Beneficiaries: Employees of NH Hoteles, S.A. and its group of companies who have been designated by the Appointments and Remuneration Committee.<br />

At 31 December <strong>2012</strong>, 103 Group employees benefited from the scheme. These employees have been awarded a total of 2,063,529 options.<br />

- Maximum number of assignable options: 3,790,000 options.<br />

- Strike price: €17.66 for the first group, comprising 20 executives, and €15.27 for the second group, made up of 83 executives.<br />

As required by the Master Plan, this exercise price must be reduced by €0.71, the theoretical value of the preferential subscription right of the capital increase<br />

carried out in June 2009.<br />

This Plan is valued and booked in the consolidated comprehensive profit and loss statement, as indicated in Note 4.16. The impact of the Plan on the<br />

consolidated comprehensive profit and loss statement for <strong>2012</strong> led to a reduction of €400,000 (a reduction of €136,000 in 2011) in personnel expenses The<br />

main hypotheses used in the valuation of this Plan, which was granted in 2007, are as follows:<br />

- Period of employment before being able to exercise the option: Up to five years, the Plan’s maximum term (“equity swap”). The Plan may be<br />

exercised in thirds on an annual basis.<br />

- Risk-free rate: 1.59%<br />

- Return per dividend: 0.16%<br />

The Group entered into an equity swap arrangement in November 2007 to hedge against any possible financial liabilities arising from the exercise of this<br />

Incentive Plan linked to the listed value of shares. Subsequently, a novation amending this agreement was signed on 13 June 2009 to complement the financial<br />

hedge and adjust it to new market conditions.<br />

The main features of this agreement, after it was amended, are as follows:<br />

- The number of shares, which were initially equivalent to the maximum number of options granted, was increased to a total of 6,316,666 after the<br />

capital increase approved by the Parent Company General Shareholders’ Meeting on 16 June 2009.<br />

- The Group will pay the financial institution a return based on Euribor plus a spread to be applied on the result of multiplying the number of units<br />

by the initial price.<br />

- The Group may totally or partially rescind the agreement in advance, and should this be the case, if the share is listed below its initial price, the<br />

Group will pay the financial institution this difference. Should the list price be above the initial price, but below the strike prices, the Group will<br />

receive the difference between both amounts.<br />

Applying accounting standards, the Group allocated a provision of €40.34 million under liabilities in the consolidated balance sheet at 31 December <strong>2012</strong>, in order to<br />

hedge against any eventual loss the bank could suffer as a result of the negative evolution of the price of the shares covered by the swap (see Note 25). The change<br />

in fair value of this financial instrument contributed €3 million to the consolidated comprehensive profit and loss statement in <strong>2012</strong> (a loss of €9.2 million in 2011).<br />

The details of the provision’s calculation at 31 December <strong>2012</strong> are as follows:<br />

€ Million<br />

Old shares New shares Total<br />

Number of stock options in the plan 3.79 2.53 6.32<br />

Required provision 50.60 5.68 56.28<br />

Transfer price 13.35 2.25 8.91<br />

Listing December <strong>2012</strong> - - 2.61<br />

Share price at end of December <strong>2012</strong> - - 16.49<br />

Provision to be allocated - - 39.79<br />

Updated financial flows - - 0.55<br />

Total provision - - 40.34<br />

The Company has entirely provisioned the aforementioned amount (Note 25).<br />

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS 93