Download Complete PDF - Informe Anual 2012

Download Complete PDF - Informe Anual 2012 Download Complete PDF - Informe Anual 2012

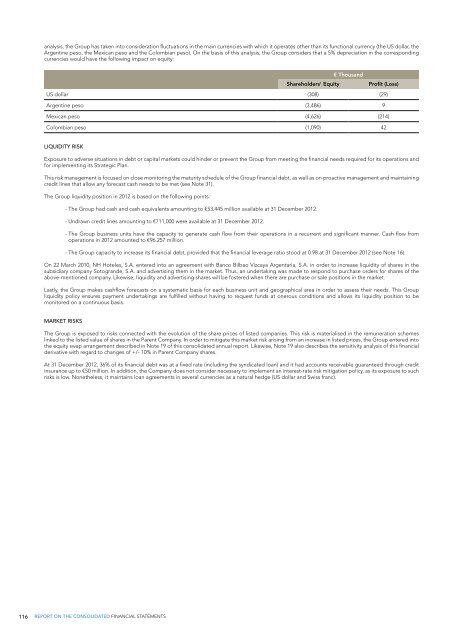

analysis, the Group has taken into consideration fluctuations in the main currencies with which it operates other than its functional currency (the US dollar, the Argentine peso, the Mexican peso and the Colombian peso). On the basis of this analysis, the Group considers that a 5% depreciation in the corresponding currencies would have the following impact on equity: € Thousand Shareholders' Equity Profit (Loss) US dollar (308) (29) Argentine peso (3,486) 9 Mexican peso (4,626) (214) Colombian peso (1,090) 42 Liquidity risk Exposure to adverse situations in debt or capital markets could hinder or prevent the Group from meeting the financial needs required for its operations and for implementing its Strategic Plan. This risk management is focused on close monitoring the maturity schedule of the Group financial debt, as well as on proactive management and maintaining credit lines that allow any forecast cash needs to be met (see Note 31). The Group liquidity position in 2012 is based on the following points: - The Group had cash and cash equivalents amounting to €53.445 million available at 31 December 2012. - Undrawn credit lines amounting to €711,000 were available at 31 December 2012. - The Group business units have the capacity to generate cash flow from their operations in a recurrent and significant manner. Cash flow from operations in 2012 amounted to €96.257 million. - The Group capacity to increase its financial debt, provided that the financial leverage ratio stood at 0.98 at 31 December 2012 (see Note 16). On 22 March 2010, NH Hoteles, S.A. entered into an agreement with Banco Bilbao Vizcaya Argentaria, S.A. in order to increase liquidity of shares in the subsidiary company Sotogrande, S.A. and advertising them in the market. Thus, an undertaking was made to respond to purchase orders for shares of the above-mentioned company. Likewise, liquidity and advertising shares will be fostered when there are purchase or sale positions in the market. Lastly, the Group makes cashflow forecasts on a systematic basis for each business unit and geographical area in order to assess their needs. This Group liquidity policy ensures payment undertakings are fulfilled without having to request funds at onerous conditions and allows its liquidity position to be monitored on a continuous basis. Market risks The Group is exposed to risks connected with the evolution of the share prices of listed companies. This risk is materialised in the remuneration schemes linked to the listed value of shares in the Parent Company. In order to mitigate this market risk arising from an increase in listed prices, the Group entered into the equity swap arrangement described in Note 19 of this consolidated annual report. Likewise, Note 19 also describes the sensitivity analysis of this financial derivative with regard to changes of +/- 10% in Parent Company shares. At 31 December 2012, 36% of its financial debt was at a fixed rate (including the syndicated loan) and it had accounts receivable guaranteed through credit insurance up to €50 million. In addition, the Company does not consider necessary to implement an interest-rate risk mitigation policy, as its exposure to such risks is low. Nonetheless, it maintains loan agreements in several currencies as a natural hedge (US dollar and Swiss franc). 116 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

ANNEX I: SUBSIDIARIES Data on the Company’s subsidiaries at 31 December 2012 are presented below: Investee company Registered address of investee company Main activity of the Investee Company Parent company's % stake in investee company % of voting rights controlled by parent company Net book value at parent company € Thousand Assets Liabilities Equity (Profit) Loss for the year Airport Hotel Frankfurt-Raunheim, GmbH & Co. Munich Real Estate 94% 100% 5,267 22,448 (16,845) (4,400) (1,203) NH Aguamarina S.A. Santo Domingo Hotel Business 94% 100% 963 1,208 (183) (780) (245) Artos Beteiligungs, GmbH Munich Holding 94% 100% 45,369 104,721 (56,456) (49,159) 894 Astron Immobilien, GmbH Munich Holding 100% 100% 25,597 38,752 (13,155) (25,597) - Astron Kestrell, Ltd. (*) Plettenberg Bay Hotel Business 100% 100% (1,263) 647 (1,910) 1,147 116 Atlantic Hotel Exploitatie, B.V. The Hague Hotel Business 100% 100% 94 - 94 - (94) Blacom, S.A. Buenos Aires Investment 100% 100% 1,443 1,445 (2) (1,444) 0 Borokay Beach, S.L. Barcelona Hotel Business 50% 50% 4,245 15,711 (7,221) (8,810) 321 Caribe Puerto Morelos, S.A. de C.V. (*) Mexico City Hotel Business 100% 100% 4,704 4,665 39 (4,814) 110 Chartwell de México, S.A. de C.V. (*) Mexico City Hotel Business 100% 100% 5,007 5,223 (216) (4,837) (170) Chartwell de Nuevo Laredo, S.A. de C.V. (*) Nuevo Laredo Hotel Business 100% 100% 1,787 3,700 (1,913) (1,546) (240) Chartwell Inmobiliaria de Coatzacoalcos, S.A. de C.V. (*) Coatzacoalcos Hotel Business 100% 100% 2,967 3,836 (869) (2,865) (102) City Hotel, S.A. (*) Buenos Aires Hotel Business 50% 50% 4,399 11,528 (2,731) (8,262) (535) Club Deportivo Sotogrande, S.A. San Roque Tourist Services 93% 93% 3,618 4,067 (195) (3,977) 105 Cofir, S.L. Madrid Corporate services 100% 100% 55 55 - (57) 2 Columbia Palace Hotel, S.A. (*) Montevideo Hotel Business 100% 100% 6,437 9,699 (3,262) (6,040) (397) Coperama Servicios a la Hosteleria, S.L. (*) Barcelona Procurement network 75% 75% 8,050 18,645 (7,912) (3,878) (6,855) De Sparrenhorst, B.V. Nunspeet Hotel Business 100% 100% (46) - (46) - 46 Desarrollo Inmobiliario Santa Fe, S.A. de C.V. (*) Mexico City Hotel Business 50% 50% 3,595 12,097 (4,906) (6,260) (930) Donnafugata Resort, S.R.L (*) Italy Tourist Services 89% 89% 3,371 78,643 (74,847) (10,179) 6,383 Edificio Metro, S.A. (*) Buenos Aires Hotel Business 100% 100% 9,005 9,903 (898) (8,655) (349) Establecimientos Complementarios Hoteleros, S.A. Barcelona Hotel Business 100% 100% (3,253) 659 (3,912) 2,265 988 Expl. mij. Grand Hotel Krasnapolsky, B.V. Amsterdam Hotel Business 100% 100% 11,999 16,067 (4,068) (12,131) 132 Expl. Mij. Hotel Best, B.V. Best Hotel Business 100% 100% 127 295 (168) (312) 185 Expl. mij. Hotel Doelen, B.V. Amsterdam Hotel Business 100% 100% 6,870 7,441 (571) (5,988) (883) Expl. Mij. Hotel Naarden, B.V. Naarden Hotel Business 100% 100% (539) (355) (185) 54 485 Expl. mij. Hotel Schiller, B.V. Amsterdam Hotel Business 100% 100% 7,943 9,223 (1,280) (7,090) (853) Exploitatiemaatschappij Caransa Hotel, B.V. Amsterdam Without activity 100% 100% 311 - 311 (311) - Exploitatiemij. Tropenhotel, B.V. Hilversum Hotel Business 100% 100% (3) 242 (245) 4 (1) Fast Good Islas Canarias, S.A. Las Palmas Catering 100% 100% (1,559) (1,552) (7) 1,524 35 Fast Good Península Ibérica, S.A. Madrid Catering 100% 100% (22,981) 10,846 (33,827) 22,940 41 Franquicias Lodge, S.A. de C.V. (*) Mexico City Hotel Business 100% 100% 177 178 (1) (172) (6) Gran Círculo de Madrid, S.A. (*) Madrid Catering 99% 99% 24,088 27,661 (3,266) (38,680) 14,285 Grupo Financiero de Intermediacion y Estudios, S.A. Madrid Corporate services 100% 100% (18,872) 257 (19,129) 18,844 27 Grupo Hotelero Monterrey, S.A. de C.V. Mexico City Hotel Business 100% 100% 1,132 2,380 (1,248) (1,049) (83) Grupo Hotelero Queretaro, S.A. de C.V. Querétaro Hotel Business 69% 69% 2,947 7,252 (2,956) (3,832) (464) Hanuman Investment, S.L. Tenerife Hotel Business 50% 50% 1,490 3,277 (296) (3,201) 220 Heiner Gossen Hotelbetrieb, GmBH Mannheim Hotel Business 100% 100% (779) (781) 3 765 14 HEM Atlanta Rotterdam, B.V. Hilversum Hotel Business 100% 100% 5,802 6,408 (605) (5,494) (308) HEM Epen Zuid Limburg, B.V. Wittem Hotel Business 100% 100% (1,904) (1,269) (635) 1,679 225 HEM Forum Maastricht, B.V. Maastricht Hotel Business 100% 100% 2,041 2,817 (776) (1,717) (324) HEM Jaarbeursplein Utrecht, B.V. Utrecht Hotel Business 100% 100% 7,511 9,415 (1,904) (7,094) (417) HEM Janskerkhof Utrecht, B.V. Hilversum Hotel Business 100% 100% 957 1,347 (390) (920) (37) REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS 117

- Page 65 and 66: CONSOLIDATED STATEMENTS OF CHANGES

- Page 67 and 68: REPORT ON THE CONSOLIDATED FINANCIA

- Page 69 and 70: The Directors have assessed the pot

- Page 71 and 72: The fair value of Resco Sotogrande,

- Page 73 and 74: Intangible assets with an indefinit

- Page 75 and 76: 4.7.4 Equity instruments An equity

- Page 77 and 78: year-end are likewise charged to th

- Page 79 and 80: The basic hypotheses used to estima

- Page 81 and 82: In Italy, the most significant addi

- Page 83 and 84: 11. NON-CURRENT FINANCIAL INVESTMEN

- Page 85 and 86: As a general rule, these receivable

- Page 87 and 88: iii) Other non-available reserves

- Page 89 and 90: Mortgage guarantee loans, whether s

- Page 91 and 92: On 26 October 2012, the Court of Ar

- Page 93 and 94: 20. SHARE-BASED REMUNERATION SCHEME

- Page 95 and 96: Provisions for pensions and similar

- Page 97 and 98: Total Corporate Tax Income or Expen

- Page 99 and 100: Year of origin Amount Offsetting De

- Page 101 and 102: Contingent assets and liabilities T

- Page 103 and 104: 27.3 Personnel expenses This item i

- Page 105 and 106: 27.6 Financial expenses and changes

- Page 107 and 108: FUNDING AGREEMENTS € Thousand 201

- Page 109 and 110: 29.1 Information on main segments

- Page 111 and 112: Holder Investee company Activity Nu

- Page 113 and 114: After the capital increase, the sha

- Page 115: Similarly, the owners’ associatio

- Page 119 and 120: Investee company Registered address

- Page 121 and 122: ANNUAL REPORT OF THE AUDIT COMMITTE

- Page 124: websites OF INTEREST: ITP INTERNATI

analysis, the Group has taken into consideration fluctuations in the main currencies with which it operates other than its functional currency (the US dollar, the<br />

Argentine peso, the Mexican peso and the Colombian peso). On the basis of this analysis, the Group considers that a 5% depreciation in the corresponding<br />

currencies would have the following impact on equity:<br />

€ Thousand<br />

Shareholders' Equity<br />

Profit (Loss)<br />

US dollar (308) (29)<br />

Argentine peso (3,486) 9<br />

Mexican peso (4,626) (214)<br />

Colombian peso (1,090) 42<br />

Liquidity risk<br />

Exposure to adverse situations in debt or capital markets could hinder or prevent the Group from meeting the financial needs required for its operations and<br />

for implementing its Strategic Plan.<br />

This risk management is focused on close monitoring the maturity schedule of the Group financial debt, as well as on proactive management and maintaining<br />

credit lines that allow any forecast cash needs to be met (see Note 31).<br />

The Group liquidity position in <strong>2012</strong> is based on the following points:<br />

- The Group had cash and cash equivalents amounting to €53.445 million available at 31 December <strong>2012</strong>.<br />

- Undrawn credit lines amounting to €711,000 were available at 31 December <strong>2012</strong>.<br />

- The Group business units have the capacity to generate cash flow from their operations in a recurrent and significant manner. Cash flow from<br />

operations in <strong>2012</strong> amounted to €96.257 million.<br />

- The Group capacity to increase its financial debt, provided that the financial leverage ratio stood at 0.98 at 31 December <strong>2012</strong> (see Note 16).<br />

On 22 March 2010, NH Hoteles, S.A. entered into an agreement with Banco Bilbao Vizcaya Argentaria, S.A. in order to increase liquidity of shares in the<br />

subsidiary company Sotogrande, S.A. and advertising them in the market. Thus, an undertaking was made to respond to purchase orders for shares of the<br />

above-mentioned company. Likewise, liquidity and advertising shares will be fostered when there are purchase or sale positions in the market.<br />

Lastly, the Group makes cashflow forecasts on a systematic basis for each business unit and geographical area in order to assess their needs. This Group<br />

liquidity policy ensures payment undertakings are fulfilled without having to request funds at onerous conditions and allows its liquidity position to be<br />

monitored on a continuous basis.<br />

Market risks<br />

The Group is exposed to risks connected with the evolution of the share prices of listed companies. This risk is materialised in the remuneration schemes<br />

linked to the listed value of shares in the Parent Company. In order to mitigate this market risk arising from an increase in listed prices, the Group entered into<br />

the equity swap arrangement described in Note 19 of this consolidated annual report. Likewise, Note 19 also describes the sensitivity analysis of this financial<br />

derivative with regard to changes of +/- 10% in Parent Company shares.<br />

At 31 December <strong>2012</strong>, 36% of its financial debt was at a fixed rate (including the syndicated loan) and it had accounts receivable guaranteed through credit<br />

insurance up to €50 million. In addition, the Company does not consider necessary to implement an interest-rate risk mitigation policy, as its exposure to such<br />

risks is low. Nonetheless, it maintains loan agreements in several currencies as a natural hedge (US dollar and Swiss franc).<br />

116 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS