Download Complete PDF - Informe Anual 2012

Download Complete PDF - Informe Anual 2012

Download Complete PDF - Informe Anual 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

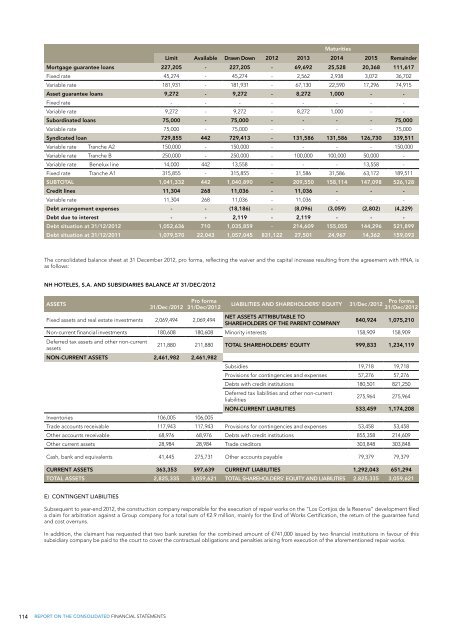

Maturities<br />

Limit Available Drawn Down <strong>2012</strong> 2013 2014 2015 Remainder<br />

Mortgage guarantee loans 227,205 - 227,205 - 69,692 25,528 20,368 111,617<br />

Fixed rate 45,274 - 45,274 - 2,562 2,938 3,072 36,702<br />

Variable rate 181,931 - 181,931 - 67,130 22,590 17,296 74,915<br />

Asset guarantee loans 9,272 - 9,272 - 8,272 1,000 - -<br />

Fixed rate - - - - - - - -<br />

Variable rate 9,272 - 9,272 - 8,272 1,000 - -<br />

Subordinated loans 75,000 - 75,000 - - - - 75,000<br />

Variable rate 75,000 - 75,000 - - - - 75,000<br />

Syndicated loan 729,855 442 729,413 - 131,586 131,586 126,730 339,511<br />

Variable rate Tranche A2 150,000 - 150,000 - - - - 150,000<br />

Variable rate Tranche B 250,000 - 250,000 - 100,000 100,000 50,000 -<br />

Variable rate Benelux line 14,000 442 13,558 - - - 13,558 -<br />

Fixed rate Tranche A1 315,855 - 315,855 - 31,586 31,586 63,172 189,511<br />

SUBTOTAL 1,041,332 442 1,040,890 - 209,550 158,114 147,098 526,128<br />

Credit lines 11,304 268 11,036 - 11,036 - - -<br />

Variable rate 11,304 268 11,036 - 11,036 - - -<br />

Debt arrangement expenses - - (18,186) - (8,096) (3,059) (2,802) (4,229)<br />

Debt due to interest - - 2,119 - 2,119 - - -<br />

Debt situation at 31/12/<strong>2012</strong> 1,052,636 710 1,035,859 - 214,609 155,055 144,296 521,899<br />

Debt situation at 31/12/2011 1,079,570 22,043 1,057,045 831,122 27,501 24,967 14,362 159,093<br />

The consolidated balance sheet at 31 December <strong>2012</strong>, pro forma, reflecting the waiver and the capital increase resulting from the agreement with HNA, is<br />

as follows:<br />

NH HOTELES, S.A. AND SUBSIDIARIES BALANCE AT 31/DEC/<strong>2012</strong><br />

ASSETS<br />

31/Dec /<strong>2012</strong><br />

Pro forma<br />

31/Dec/<strong>2012</strong><br />

Pro forma<br />

LIABILITIES AND SHAREHOLDERS’ EQUITY 31/Dec /<strong>2012</strong><br />

31/Dec/<strong>2012</strong><br />

Fixed assets and real estate investments 2,069,494 2,069,494<br />

NET ASSETS ATTRIBUTABLE TO<br />

SHAREHOLDERS OF THE PARENT COMPANY<br />

840,924 1,075,210<br />

Non-current financial investments 180,608 180,608 Minority interests 158,909 158,909<br />

Deferred tax assets and other non-current<br />

assets<br />

211,880 211,880 TOTAL SHAREHOLDERS' EQUITY 999,833 1,234,119<br />

NON-CURRENT ASSETS 2,461,982 2,461,982<br />

Subsidies 19,718 19,718<br />

Provisions for contingencies and expenses 57,276 57,276<br />

Debts with credit institutions 180,501 821,250<br />

Deferred tax liabilities and other non-current<br />

liabilities<br />

275,964 275,964<br />

NON-CURRENT LIABILITIES 533,459 1,174,208<br />

Inventories 106,005 106,005<br />

Trade accounts receivable 117,943 117,943 Provisions for contingencies and expenses 53,458 53,458<br />

Other accounts receivable 68,976 68,976 Debts with credit institutions 855,358 214,609<br />

Other current assets 28,984 28,984 Trade creditors 303,848 303,848<br />

Cash, bank and equivalents 41,445 275,731 Other accounts payable 79,379 79,379<br />

CURRENT ASSETS 363,353 597,639 CURRENT LIABILITIES 1,292,043 651,294<br />

TOTAL ASSETS 2,825,335 3,059,621 TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES 2,825,335 3,059,621<br />

e) Contingent liabilities<br />

Subsequent to year-end <strong>2012</strong>, the construction company responsible for the execution of repair works on the “Los Cortijos de la Reserva” development filed<br />

a claim for arbitration against a Group company for a total sum of €2.9 million, mainly for the End of Works Certification, the return of the guarantee fund<br />

and cost overruns.<br />

In addition, the claimant has requested that two bank sureties for the combined amount of €741,000 issued by two financial institutions in favour of this<br />

subsidiary company be paid to the court to cover the contractual obligations and penalties arising from execution of the aforementioned repair works.<br />

114 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS