You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Capital Structure<br />

Managerial Finance, 2008<br />

Konan Chan<br />

Capital Structure and the Pie<br />

• The value of a firm is defined to be the sum of the<br />

value of the firm’s debt and the firm’s equity.<br />

V = B + S<br />

• If the goal of the firm’s<br />

management is to make the firm<br />

as valuable as possible, then the<br />

firm should pick the debt-equity<br />

ratio that makes the pie as big as<br />

possible.<br />

S B<br />

Value of the Firm<br />

Managerial Finance Konan Chan 2<br />

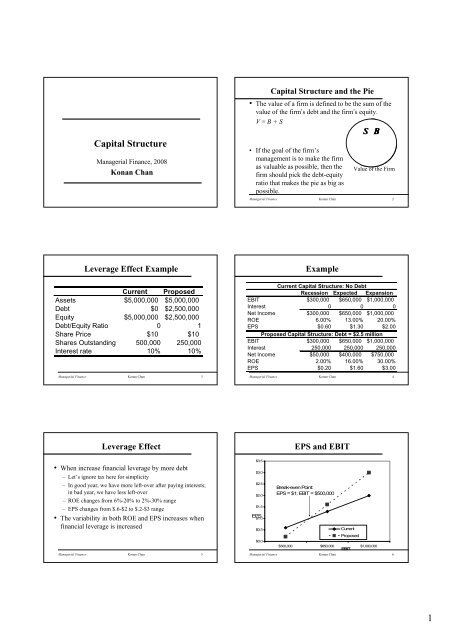

Leverage Effect Example<br />

Current Proposed<br />

Assets $5,000,000 $5,000,000<br />

Debt $0 $2,500,000<br />

Equity $5,000,000 $2,500,000<br />

Debt/Equity Ratio 0 1<br />

Share Price $10 $10<br />

Shares Outstanding 500,000 250,000<br />

Interest rate 10% 10%<br />

Managerial Finance Konan Chan 3<br />

Example<br />

Current Capital Structure: No Debt<br />

Recession Expected Expansion<br />

EBIT $300,000 $650,000 $1,000,000<br />

Interest 0 0 0<br />

Net Income $300,000 $650,000 $1,000,000<br />

ROE 6.00% 13.00% 20.00%<br />

EPS $0.60 $1.30 $2.00<br />

Proposed Capital Structure: Debt = $2.5 million<br />

EBIT $300,000 $650,000 $1,000,000<br />

Interest 250,000 250,000 250,000<br />

Net Income $50,000 $400,000 $750,000<br />

ROE 2.00% 16.00% 30.00%<br />

EPS $0.20 $1.60 $3.00<br />

Managerial Finance Konan Chan 4<br />

Leverage Effect<br />

EPS and EBIT<br />

• When increase financial leverage by more debt<br />

– Let’s ignore tax here for simplicity<br />

– In good year, we have more left-over after paying interests;<br />

in bad year, we have less left-over<br />

– ROE changes from 6%-20% to 2%-30% range<br />

– EPS changes from $.6-$2 to $.2-$3 range<br />

• The variability in both ROE and EPS increases when<br />

financial leverage is increased<br />

Managerial Finance Konan Chan 5<br />

$3.5<br />

$3.0<br />

$2.5<br />

$2.0<br />

$1.5<br />

EPS<br />

$1.0<br />

Break-even Point:<br />

EPS = $1; EBIT = $500,000<br />

$0.5<br />

Current<br />

Proposed<br />

$0.0<br />

$300,000 $650,000 $1,000,000<br />

EBIT<br />

Managerial Finance Konan Chan 6<br />

1

Capital Structure Theory<br />

• Modigliani & Miller Propositions<br />

– No tax (MM,1958)<br />

– With corporate tax (MM, 1963)<br />

– With both corporate and <strong>per</strong>sonal tax (Miller, 1977)<br />

• Trade-off theory<br />

• Pecking order theory (Myers and Majluf, 1984)<br />

• Free cash flow theory (Jensen, 1986)<br />

• Market timing (Baker and Wurgler, 2002)<br />

Managerial Finance Konan Chan 7<br />

Homemade Leverage<br />

Current Capital Structure<br />

• Investor borrows $500 and<br />

uses $500 of her own to buy<br />

100 shares of stock<br />

• Payoffs:<br />

– Recession: 100(0.60) -<br />

.1(500) = $10<br />

– Expected: 100(1.30) - .1(500)<br />

= $80<br />

– Expansion: 100(2.00) -<br />

.1(500) = $150<br />

• Mirrors the payoffs from<br />

purchasing 50 shares from the<br />

firm under the proposed<br />

capital structure<br />

Proposed Capital Structure<br />

• Investor buys $250 worth of<br />

stock (25 shares) and $250<br />

worth of bonds paying 10%.<br />

• Payoffs:<br />

– Recession: 25(.20) + .1(250) =<br />

$30<br />

– Expected: 25(1.60) + .1(250) =<br />

$65<br />

– Expansion: 25(3.00) + .1(250) =<br />

$100<br />

• Mirrors the payoffs from<br />

purchasing 50 shares under the<br />

current capital structure<br />

Managerial Finance Konan Chan 8<br />

MM Propositions (no tax)<br />

• MM proposition I<br />

– Capital structure does affect not firm value or WACC<br />

– WACC keeps the same for any debt ratio<br />

• MM proposition II<br />

– Given proposition I, WACC keeps the same<br />

– WACC = R B (B/V) + R S (S/V) = R 0 where V=B+S<br />

– R S = R 0 + (B/S)(R 0 - R B )<br />

– the expected return on equity increases with the debt-equity<br />

ratio<br />

Managerial Finance Konan Chan 9<br />

Cost of capital: R (%)<br />

MM Proposition II (No Taxes)<br />

B<br />

RS<br />

= R 0<br />

+ × ( R 0<br />

− R B<br />

)<br />

S<br />

R B<br />

R 0 R<br />

WACC<br />

B S<br />

= × RB<br />

+ × RS<br />

B + S B + S<br />

R B<br />

Debt-to-equity Ratio<br />

B<br />

S<br />

Managerial Finance Konan Chan 10<br />

L<br />

Example: MM w/o Tax<br />

• Suppose required return on assets = 16%, cost of debt<br />

= 10%, debt/assets = 45%<br />

• What is the cost of equity<br />

– R S = 16% + (16% - 10%)(.45/.55) = 20.91%<br />

• Suppose the cost of equity is 25%, what is the debtto-equity<br />

ratio What is equity/assets<br />

– 25% = 16% + (16% - 10%)(B/S)<br />

– B/S = (25% - 16%) / (16% - 10%) = 1.5<br />

– S/V = 1 / 2.5 = 40%<br />

Managerial Finance Konan Chan 11<br />

Tax Shield<br />

• Compare unlevered (U) with levered firm (L: 4 million debt,<br />

r B<br />

= 10% )<br />

U L<br />

EBIT 1,000,000 1,000,000<br />

Interests (r B * B) 0 -400,000<br />

EBT 1,000,000 600,000<br />

Taxes (T C = 0.35) -350,000 -210,000<br />

Earnings 650,000 390,000 (EBIT - r B B)(1-T C )<br />

Total cash flows 650,000 790,000<br />

• The difference between 790,000 and 650,000 is 140,000<br />

(T C<br />

r B<br />

B = 0.35 * 0.1 * 4,000,000)<br />

• T C<br />

r B<br />

B: tax shield from debt - the advantage of using debt<br />

(disadvantage of equity financing)<br />

EBIT(1-T C ) + T C r B B<br />

Managerial Finance Konan Chan 12<br />

2

MM Theory with Taxes<br />

• If tax shield is <strong>per</strong>petual,<br />

PV of tax shield = B * R B * T C / R B = T C * B<br />

• Value of levered firm (V L )<br />

= unlevered firm value (V U ) + PV of tax shield<br />

= EBIT(1- T C ) / R 0 + T C * D<br />

• More debt is better, because the interest deduction<br />

generates extra value (save tax)<br />

• R WACC = (S/V)R S + (B/V)(R B )(1-T C )<br />

• R S = R 0 + (R 0 – R B )(B/S)(1-T C )<br />

Managerial Finance Konan Chan 13<br />

MM Propositions (with corp. tax)<br />

• MM proposition I (with tax)<br />

– Capital structure does matter<br />

EBIT (1 −TC<br />

) TC<br />

RBB<br />

– VL =<br />

+ = VU<br />

+ TC<br />

B<br />

R0<br />

RB<br />

• MM proposition II<br />

– The cost of equity is positively related to leverage<br />

– R<br />

S<br />

B<br />

= R0 + ( 1−TC<br />

)( r0<br />

− RB<br />

)<br />

S<br />

Managerial Finance Konan Chan 14<br />

Cost of capital: R<br />

(%)<br />

The Effect of Financial Leverage<br />

B<br />

RS<br />

= R 0<br />

+ × ( R 0<br />

− R B<br />

)<br />

S<br />

B<br />

RS<br />

= R0 + × ( 1−TC<br />

) × ( R0<br />

− RB<br />

)<br />

SL<br />

R 0<br />

R B<br />

B<br />

L<br />

R<br />

WACC<br />

=<br />

B + S<br />

L<br />

× RB<br />

× (1 −TC<br />

) + ×<br />

B + SL<br />

L<br />

S<br />

R<br />

S<br />

Example - MM with Tax<br />

• Suppose EBIT is 25 million, tax rate 35%, debt $75<br />

million, cost of debt 9%, unlevered cost of capital 12%<br />

• V U = 25(1-.35) / .12 = $135.42 million<br />

• V L = 135.42 + 75(.35) = $161.67 million<br />

• S = 161.67 – 75 = $86.67 million<br />

• R S = 12% + (12%-9%)(75/86.67)(1-.35) = 13.69%<br />

• R WACC = (86.67/161.67)(13.69%) +<br />

(75/161.67)(9%)(1-.35) = 10.05%<br />

Debt-to-equity<br />

ratio (B/S)<br />

Managerial Finance Konan Chan 15<br />

Managerial Finance Konan Chan 16<br />

Example - MM with Tax<br />

• Suppose that the firm changes its capital structure so<br />

that the debt-to-equity ratio becomes 1.<br />

• What will happen to the cost of equity under the new<br />

capital structure<br />

– R S = 12% + (12% - 9%)(1)(1-.35) = 13.95%<br />

• What will happen to the weighted average cost of<br />

capital<br />

– R WACC = .5(13.95%) + .5(9%)(1-.35) = 9.9%<br />

Miller Theory<br />

• Allow both corporate and <strong>per</strong>sonal tax to exist<br />

⎛ (1 − TC<br />

)(1 − TS<br />

) ⎞<br />

V<br />

⎜<br />

⎟<br />

L<br />

= VU<br />

+ B 1−<br />

⎝ (1 − TB<br />

) ⎠<br />

• The cost of equity is positively related to leverage<br />

B ⎛ (1 − TC<br />

)(1 − TS<br />

) ⎞<br />

rS<br />

= r0 +<br />

( r0<br />

rB<br />

)<br />

S<br />

⎜<br />

(1 TB<br />

)<br />

⎟ −<br />

⎝ − ⎠<br />

• In some cases, capital structure will not matter; i.e.,<br />

back to original MM propositions w/o tax<br />

Managerial Finance Konan Chan 17<br />

Managerial Finance Konan Chan 18<br />

3

MM in Reality and Trade-off<br />

• In reality, no firm takes the extreme step of using<br />

100% debt financing as implied by MM with tax<br />

• MM ignored the costs of bankruptcy in their analysis<br />

of MM with taxes<br />

• By including the cost of bankruptcy, there is a tradeoff<br />

between the benefits of debt financing (tax<br />

shields) against costs of debt financing (increased<br />

risk of bankruptcy)<br />

• Firm value = unlevered firm value + PV tax shield -<br />

PV of financial distress costs<br />

Costs of Financial Distress<br />

• Direct costs<br />

– Legal and administrative costs (lawyers, accountants,<br />

professional witness, …etc.)<br />

– About 3% of market value (Warner, 1977)<br />

• Indirect costs<br />

– Impaired ability to conduct business (lost sales)<br />

– Agency costs of debt (over-investment (Jensen and<br />

Meckling, 1976), under-investment (Myers and Majluf,<br />

1984))<br />

– Costly managerial efforts<br />

– Employee’s unwillingness to work (wage reduction, search<br />

new jobs)<br />

Managerial Finance Konan Chan 19<br />

Managerial Finance Konan Chan 20<br />

Trade-off Theory<br />

• Trade-off between the benefits (tax shields) and costs<br />

(financial distress) of using debt<br />

• There exists an optimal level of debt which maximizes the<br />

firm value<br />

Firm Value<br />

V U<br />

PV(costs of financial distress)<br />

B*<br />

V L = V U + T C B<br />

PV(tax shields)<br />

Debt<br />

Managerial Finance Konan Chan 21<br />

Factors Affect Trade-off<br />

• Growth<br />

– high growth firms should use less debt<br />

– because their growth potential will be easily destroyed by<br />

financial distress<br />

• Types of assets<br />

– firms with more intangible assets should have less debt<br />

(high-tech. vs. airlines) because firms with tangible assets<br />

can sell assets to recover from financial distress<br />

• Uncertainty of o<strong>per</strong>ating income<br />

– firms with more uncertain o<strong>per</strong>ating income should have<br />

less debt (software vs. utilities) because these firms have a<br />

high probability of ex<strong>per</strong>iencing financial distress<br />

Managerial Finance Konan Chan 22<br />

Pecking Order Theory<br />

• Theory<br />

– Firms heavily rely on internally generated funds<br />

– When needs external financing is necessary, debt is the<br />

primary way to get financing<br />

– Equity is the last resort to finance projects<br />

• Rationale<br />

– Information asymmetry causes difficulty in pricing equity<br />

– Firm will issue over-valued shares only and thus investors<br />

discount shares<br />

– Firms prefer to use internally generated funds<br />

– Bonds are safer than equity because valuation of bonds is<br />

less affected by information asymmetry<br />

Managerial Finance Konan Chan 23<br />

Implications from Pecking Order<br />

• Theory<br />

– No defined target (optimal) capital structure<br />

– Most profitable firms generally borrow less is not because they have<br />

low target debt ratios but because they don’t need outside money<br />

– Less profitable firms issue debt because debt financing is first on the<br />

pecking order of external financing<br />

– Firms will avoid external financing, if with enough internal funds<br />

• Financial slack<br />

– Cash buildup, low debt level, and ready access to debt financing<br />

– Financial slack is valuable because it avoids the costs of financial<br />

distress and external financing during bad times<br />

– It’s more valuable if firms with more positive NPV projects<br />

– Explains why growth firms have low debt ratios<br />

– Time the issues in good times to reserve financial slack<br />

Managerial Finance Konan Chan 24<br />

4

Agency Costs<br />

• What is the agency relationship<br />

– The relationship between the principal and agent<br />

– The agent is hired by the principal to act on behalf of the<br />

principal<br />

– Examples: stockholders and the manager, investors and<br />

fund manager, landlord and tenant<br />

• Is there any problem<br />

– Will the agent always act in the interests of the principal<br />

Why<br />

– Conflict of interests ⇒ agency costs<br />

Managerial Finance Konan Chan 25<br />

Types of Agency Problems<br />

• Agency problem between stockholders and the manager<br />

(agency costs of equity)<br />

– Shirking<br />

– Perquisites<br />

– Over-investment<br />

– Wasting free cash flows (free cash flows are cash flows in excess of<br />

that required to fund all positive NPV projects)<br />

• Agency problem between stockholders and bondholders<br />

(agency costs of debt)<br />

– Over-investment (risk-shifting/asset substitution)<br />

– Under-investment (pass out positive NPV projects)<br />

– Milking the pro<strong>per</strong>ty (cash in and run)<br />

– Bait and switch (promise to do safe project,but invest in risky project)<br />

Managerial Finance Konan Chan 26<br />

Over-Investment Problem<br />

• When a firm is in financial distress, and there is a<br />

risky project (high payoff with very small chance)<br />

• What will the shareholders do<br />

Over-Investment (Risk-Shifting)<br />

• Stockholders have only limited liabilities<br />

• Given financial distress, shareholders will be<br />

forced to give up the ownership<br />

• If head I win, if tail you lose:<br />

– Stockholders shift the project risks to bondholders. So,<br />

stockholders gain at the expense of bondholders<br />

• Financial distress leads stockholders to take high<br />

risks<br />

Managerial Finance Konan Chan 27<br />

Managerial Finance Konan Chan 28<br />

Under-Investment Problem<br />

• The firm is in financial distress and has a safe<br />

positive project, but it is short of cash<br />

• What will shareholders do Raise money to take the<br />

project or not<br />

Under-Investments<br />

• Stockholders and bondholders share the benefits of<br />

positive NPV projects<br />

• So, shareholders will pass up the positive NPV<br />

project<br />

• Financial distress destroys the investment policy<br />

Managerial Finance Konan Chan 29<br />

Managerial Finance Konan Chan 30<br />

5

Ways to Reduce Agency Costs:<br />

• Align interests of the manager and stockholders<br />

– The threat of firing<br />

– (Hostile) Takeover<br />

– Managerial compensation<br />

– Leveraged buyouts (LBOs): pro and con<br />

• Align interests of the stockholders and bondholders<br />

– Protective covenants<br />

– Consolidation of debt<br />

– Strip financing<br />

RJR Nabisco LBOs:<br />

Stock price Bond value<br />

• Oct. 27, 1988 (before ann.) $56 $5.0 billion<br />

• Oct. 28, 1988 (after ann.) $75 $4.4 billion<br />

• Nov. 30, 1988 (final bid) $109<br />

• KKR won the bid (25 billion in total), even though<br />

the management bid $3 more<br />

Managerial Finance Konan Chan 31<br />

Managerial Finance Konan Chan 32<br />

Free Cash Flow Theory<br />

• Managers have incentives to not distribute free cash<br />

flows and cause their firms to grow beyond the<br />

optimal size<br />

• The use of debt and corporate market control<br />

(takeovers, LBOs) can help to reduce the agency<br />

costs of free cash flows<br />

– benefits of using debt<br />

– ways to reduce the agency cost of equity<br />

• Example: Oil industry in 80’s<br />

Agency Cost of Equity<br />

• An individual will work harder for a firm if he is one of the<br />

owners than if he is one of the “hired help.”<br />

• While managers may have motive to partake in <strong>per</strong>quisites,<br />

they also need opportunity. Free cash flow provides this<br />

opportunity.<br />

• The free cash flow hypothesis says that an increase in<br />

dividends should benefit the stockholders by reducing the<br />

ability of managers to pursue wasteful activities.<br />

• The free cash flow hypothesis also argues that an increase in<br />

debt will reduce the ability of managers to pursue wasteful<br />

activities more effectively than dividend increases.<br />

Managerial Finance Konan Chan 33<br />

Managerial Finance Konan Chan 34<br />

Market Timing Theory<br />

Market Value Debt Ratios, 2002<br />

• Managers “time” the market and issue equity when<br />

the market price is high<br />

– Loughran and Ritter (1995) find issuers under<strong>per</strong>form after<br />

equity issuance<br />

• The market timing has long and <strong>per</strong>sistent effect on<br />

capital structure<br />

– Capital structure is the outcome of managers’ past attempt<br />

to issue equity opportunistically<br />

Company<br />

Microsoft<br />

Intel<br />

ExxonMobil<br />

Merck<br />

Procter & Gamble<br />

Boeing<br />

Walt Disney<br />

Debt/Assets<br />

0<br />

0<br />

0.04<br />

0.08<br />

0.12<br />

0.27<br />

0.27<br />

LT debt/capital<br />

0<br />

0<br />

0.03<br />

0.04<br />

0.07<br />

0.24<br />

0.25<br />

M/B<br />

5.54<br />

4.03<br />

3.72<br />

7.18<br />

10.13<br />

3.65<br />

1.92<br />

American Electric Power<br />

0.54<br />

0.36<br />

1.62<br />

Delta Air Lines<br />

0.77<br />

0.75<br />

0.82<br />

General Motors<br />

0.84<br />

0.83<br />

4.12<br />

Managerial Finance Konan Chan 35<br />

Managerial Finance Konan Chan 36<br />

6

Country<br />

Leverage Ratios<br />

Total debt to<br />

total asset<br />

(Book value %)<br />

LT debt to total<br />

assets<br />

(Book value %)<br />

LT debt to total<br />

capital<br />

(Market value %)<br />

United States 58% 37% 28%<br />

Japan 69 53 29<br />

Germany 73 38 23<br />

France 71 48 41<br />

Italy 70 47 46<br />

UK 54 28 35<br />

Canada 56 39 35<br />

India 67 34 35<br />

South Korea 73 49 64<br />

Capital Structure Patterns Worldwide<br />

• Capital structures have strong industry patterns<br />

– High: utilities, transport, and capital-intensive manufacture<br />

– Low: service, mining, most rapidly growing or high-tech<br />

– The industry's asset mix and variability affect capital structure<br />

• Capital structures vary across countries<br />

– US, UK, Canadian firms have lower book debt ratios than firms<br />

in Japan, France, and Italy<br />

– US & German firms have lower market value debt ratios<br />

– Leverage in developing countries is less than developed ones<br />

– Historical, institutional, & cultural factors may play a part<br />

Managerial Finance Konan Chan 37<br />

Managerial Finance Konan Chan 38<br />

Capital Structure Patterns Worldwide<br />

• Leverage ratios are inversely related to the <strong>per</strong>ceived costs of<br />

financial distress.<br />

– Both across industries & across countries, the more costly is financial<br />

distress, the less debt will be used.<br />

– Companies rich in collateralizeable assets have higher leverage than<br />

firms rich in growth options.<br />

• Within industries, leverage is inversely related to profitability<br />

– In all industries, the most profitable firms typically borrow the least<br />

• Taxes influence capital structures, but they cannot explain the<br />

differences in leverage across industries and countries<br />

– Increased corporate tax rates yield increased debt usage<br />

– It’s not clear firms in US use more debt now<br />

Capital Structure Patterns Worldwide<br />

• Existing shareholders consider leverage-increasing events<br />

"good news" and leverage-decreasing events "bad news"<br />

– Stock prices rise when leverage-increasing events announced, but fall<br />

for leverage-decreasing events.<br />

• Corporations that are forced away from a preferred capital<br />

structure tend to return to that structure over time<br />

– Has occurred frequently, particularly for US firms that have taken on<br />

large amounts of new debt to finance takeovers.<br />

– More generally, corporations like to o<strong>per</strong>ate within target leverage<br />

zones, and will issue new equity when debt ratios get too high and<br />

will issue debt if they fall too low.<br />

Managerial Finance Konan Chan 39<br />

Managerial Finance Konan Chan 40<br />

Negative news for Equity offerings<br />

Positive news for leverage-increasing<br />

Security type<br />

Common stock<br />

Preferred stock<br />

Convertible preferred stock<br />

Straight bonds<br />

Convertible bonds<br />

Two-day announcement<strong>per</strong>iod<br />

abnormal return<br />

-3.14%<br />

-0.19%<br />

-1.44%<br />

-0.26%<br />

-2.07%<br />

Managerial Finance Konan Chan 41<br />

Managerial Finance Konan Chan 42<br />

7

Rajan and Zingales (1995)<br />

US Financing Pattern<br />

90<br />

Historical US financing patterns<br />

60<br />

30<br />

0<br />

-30<br />

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02<br />

Internal Debt Equity<br />

Managerial Finance Konan Chan 43<br />

Managerial Finance Konan Chan 44<br />

Junk Bonds<br />

• Low-grade bonds, with high default risks, but offer high<br />

yield.<br />

• Prior to 1970, most junk bonds are “Fallen Angels”.<br />

• From late 1970, Michael Milken of Drexel Burnham Lambert<br />

changed the market by creating the demand and supply of the<br />

junk bonds.<br />

• Junk bonds grew rapidly from 1984 to 1989, changing the<br />

corporate finance in 80s.<br />

• Small firms can get a huge amount of financing through junk<br />

bonds, where they were not allowed to do so in the past<br />

• Threat of hostile takeover, wave of mergers and acquisitions,<br />

popularity of share repurchases<br />

LBOs<br />

• The acquisition by a small group of investors<br />

financed primarily with debt.<br />

• Going private transaction, usually with very high<br />

debt ratio after LBOs.<br />

• Top ten LBOs happened in 1986-1989.<br />

• Too much money was chasing too few good deals<br />

Managerial Finance Konan Chan 45<br />

Managerial Finance Konan Chan 46<br />

The Development<br />

• The increasing defaulted events in late 80s increased<br />

the burden of DBL.<br />

• Milken was charged for securities fraud, and DBL<br />

filed bankruptcy in 1990.<br />

• Junk bond market collapsed in 1990, so as the<br />

decline of LBOs.<br />

Junk Bonds and M&A<br />

Amount<br />

Junk Bonds Issues<br />

160000<br />

80%<br />

140000<br />

70%<br />

120000<br />

60%<br />

100000<br />

50%<br />

80000<br />

40%<br />

60000<br />

30%<br />

40000<br />

20%<br />

20000<br />

10%<br />

0<br />

0%<br />

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99<br />

Amount M&A%<br />

Year<br />

Managerial Finance Konan Chan 47<br />

Managerial Finance Konan Chan 48<br />

8

Junk Bonds and Default<br />

Amount<br />

Junk Bonds Issues<br />

800<br />

12%<br />

700<br />

10%<br />

600<br />

8%<br />

500<br />

400<br />

6%<br />

300<br />

4%<br />

200<br />

2%<br />

100<br />

0<br />

0%<br />

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99<br />

New issues Default<br />

Year<br />

Testing Trade-off<br />

• Supportive<br />

– Significant negative relationship between R&D and debt<br />

– Leverage is positively related to tangibility of assets, but<br />

negatively related to growth opportunity. Leverage is also<br />

positively related to sales (firm size)<br />

• Against<br />

– Profitability is negatively related to leverage<br />

– Stock prices increase for leverage-increasing<br />

announcements, and stock prices decrease for leveragedecreasing<br />

announcements<br />

Managerial Finance Konan Chan 49<br />

Managerial Finance Konan Chan 50<br />

Testing Pecking Order<br />

• Supportive<br />

– Inverse relationship between profitability and financial<br />

leverage within industries<br />

– Stock prices increase for leverage-increasing<br />

announcements, and stock prices decrease for leveragedecreasing<br />

announcements<br />

– Leverage is positively related to firm size<br />

• Against<br />

– Cannot explain the inter-industry differences in debt ratios<br />

– Leverage is positively related to tangibility of assets<br />

Testing Free Cash Flow<br />

• Supportive<br />

– Stock prices increase for leverage-increasing<br />

announcements, and stock prices decrease for leveragedecreasing<br />

announcements<br />

• Against<br />

– Leverage is positively related to tangibility of assets<br />

– Profitability is negatively related to leverage<br />

Managerial Finance Konan Chan 51<br />

Managerial Finance Konan Chan 52<br />

Testing Market Timing<br />

• (M/B) efwa is the weighted average of historical<br />

market-to-book ratios, giving more weight when<br />

firms issue more equity<br />

Graham and Harvey (2001)<br />

• Survey on 392 corporate managers (CFOs) to see if<br />

theories match practice<br />

• For each question, managers rate their answers from<br />

0~4<br />

– 0 means they never care about it<br />

– 4 means it’s important<br />

– Summarized by <strong>per</strong>centage of CFOs answer 3 or 4<br />

Managerial Finance Konan Chan 53<br />

Managerial Finance Konan Chan 54<br />

9

Survey on Debt Issue Decision<br />

Trade-Off in Practice<br />

• CFOs think that the corporate tax advantage of debt<br />

is moderately important (rating: 2.07, 45%)<br />

– It’s more important for large, higher levered, dividendpaying,<br />

manufacturing, regulated, public firms<br />

• Distress is not very important (rating: 1.24, 21%)<br />

• Almost 60% CFOs think flexibility and credit rating<br />

are important factors in raising debt, an evidence<br />

saying that they want to avoid distress<br />

• Earnings volatility is important when making debt<br />

decisions (rating: 2.32, 48%)<br />

Managerial Finance Konan Chan 55<br />

Managerial Finance Konan Chan 56<br />

Target Debt Ratio<br />

Trade-Off in Practice<br />

• Targets that are tight or somewhat strict are more<br />

common for<br />

– large firms (55%) than for small firms (36%)<br />

– investment-grade (64%) than speculative firms (41%)<br />

– regulated (67%) than unregulated firms (43%)<br />

• Given large investment-grade firms represent the big<br />

portion of the economy, the evidence fairly strongly<br />

supports the trade-off theory<br />

Managerial Finance Konan Chan 57<br />

Managerial Finance Konan Chan 58<br />

Pecking Order in Practice<br />

• Financial flexibility is the most important item about<br />

corporate debt decisions (rating: 2.59, 59%)<br />

• Insufficient internal funds is important in debt<br />

issuance decisions (rating: 2.13, 47%)<br />

• Flexibility is more important for dividend-paying<br />

firms, which are thought to have less information<br />

asymmetry<br />

• No strong evidence that firms issue equity because<br />

recent profits are insufficient to fund activities, or<br />

because the ability to obtain funds from debt is<br />

diminished<br />

Managerial Finance Konan Chan 59<br />

Pecking Order in Practice<br />

• The importance of financial flexibility (financial<br />

slack) and insufficient internal fund to security<br />

issuance decisions is generally consistent with the<br />

pecking-order model<br />

• But, the desire for flexibility and the claim of<br />

insufficient funds are not driven by information<br />

asymmetry, the factors behind the pecking order<br />

theory<br />

Managerial Finance Konan Chan 60<br />

10

Survey on Equity Issue Decision<br />

Pecking Order and Equity Issue<br />

• Undervaluation is important when firms avoid to<br />

issue equity, consistent with pecking order<br />

• But, large, dividend-paying firms are more likely to<br />

think this is important than small, nondividendpaying<br />

firms<br />

Managerial Finance Konan Chan 61<br />

Managerial Finance Konan Chan 62<br />

Agency Cost in Practice<br />

• Jensen (1986) argue that when a firm has ample free<br />

cash flow, its managers tend to waste<br />

• Firms can use debt to commit to pay out free cash<br />

flow and discipline management to work efficiently<br />

• Little evidence that firms discipline managers in this<br />

way. It is important to note, that<br />

– managers might be unwilling to admit to using debt in this<br />

manner<br />

– <strong>per</strong>haps a low rating on this question reflects an<br />

unwillingness of firms to adopt Jensen’s solution more<br />

than a weakness in Jensen’s argument<br />

Managerial Finance Konan Chan 63<br />

11