GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Guida al contributo <strong>di</strong> soggiorno<br />

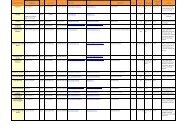

The reduction is not applicable if the<br />

accommodation contract for<br />

employers (i.e. pilots, hostess) is<br />

between the employer (i.e. airline)<br />

and the accommodation facility (n. 3<br />

Circular issued on 21 <strong>di</strong>cember<br />

2011)<br />

The tax is to be paid by the visitor for a maximum of<br />

10 nights (or 5 nights for open air facilities) total in<br />

any one solar year.<br />

Should the visitor move between <strong>di</strong>fferent<br />

accommodation facilities during the course of a<br />

solar year, it is not possible to deduct the amount<br />

of tax paid to the first facility but due and owing to<br />

the second facility<br />

In any case, the number of overnight<br />

stays accrued are reset at the end of<br />

the solar year