GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

GUIDE TO THE TOURIST ACCOMMODATION TAX - Comune di Roma

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Dipartimento Risorse Economiche<br />

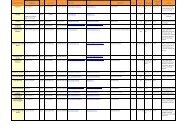

5. The communication and payment<br />

obligations<br />

The accommodation facilities must provide on-line<br />

communication as to the number of persons and the<br />

amount of tax collected by the 16th of the month<br />

after the end of each quarter<br />

The websites on which the<br />

accommodation facilities are to register,<br />

file the communication and make the<br />

payments are:<br />

for companies and legal entities<br />

www.tributi.comune.roma.it<br />

for in<strong>di</strong>viduals: www.comune.roma.it<br />

The accommodation tax is not subject to VAT. The<br />

various elements required for calculation of the tax<br />

must be specified in the receipt, invoice or separate<br />

release.