RLBs Proforma for Gram Panchayats

RLBs Proforma for Gram Panchayats

RLBs Proforma for Gram Panchayats

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

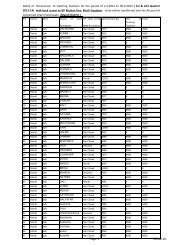

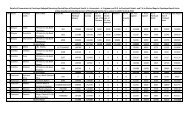

Per<strong>for</strong>ma <strong>for</strong> Rural Local Bodies Accounts<br />

District : …………………, Block…........................., Name of <strong>Gram</strong> Panchayat…………………………….<br />

Population………….., Male…………………., Female………………………, No. of Household………….<br />

No. of .BPL Families………………..., No. Village………………………, Area of Villages…………………<br />

State : Himachal Pradesh<br />

Detail of Receipts of <strong>RLBs</strong><br />

Reference year……………………….<br />

Description of Item 2008-09 2009-10 2010-11<br />

1 2 3<br />

I Total Receipts (A+B) ( )<br />

A. Income from own Resources (1-9)<br />

1 Tax Receipts<br />

2 Fees & Misc. Receipts<br />

3 Property Receipts<br />

4 Interest<br />

5 Commercial receipts (Rent<br />

Shop/bldg./land)<br />

6 Sale of Assets<br />

7 Sale of Land<br />

8 Withdrawal from Deposits/ Funds<br />

9 Other (Specify) (i.e. liquor cess, fines etc.)<br />

B. Income from Other Sources (1to 2)<br />

1. Grants<br />

a) Centre<br />

b) State<br />

c) Foreign<br />

d) NPI<br />

e) Others<br />

f) Capital<br />

2. Loans<br />

a) Centre<br />

b) State<br />

c) Foreign<br />

d) NPI<br />

e) Others<br />

Contd………

Detail of Expenditure of <strong>RLBs</strong><br />

Description of Items 2008-09 2009-10 2010-11<br />

II Total Expenditure ( )<br />

A. Current Expenditure ( 1 to 6)<br />

1 Salaries & Wages (a to h)<br />

a) Construction<br />

b) Water Supply<br />

c) Education<br />

d) Health<br />

e) Sanitation<br />

f) Welfare<br />

g) Recreation<br />

h) Others<br />

2 Purchase of Goods & Services<br />

3 Maintenance (a to c)<br />

a) Buildings<br />

b) Roads<br />

c) Others<br />

4 Current Transfers (a to f)<br />

a) Construction<br />

b) Water Supply<br />

c) Education<br />

d) Health<br />

e) Sanitation<br />

f) Welfare<br />

g) Recreation<br />

h) Others<br />

5 Interest Payments<br />

6 Loan Repayments<br />

B. Capital Expenditure (1 to 8)<br />

1 Buildings<br />

2 Roads<br />

3 Other Constructions<br />

4 Transport<br />

5 Machinery<br />

6 Capital Transfers<br />

7 Financial Assets<br />

8 Non-Financial Assets<br />

III Closing Balance (I – II)<br />

Signatures & Contact No. of PS……………………………………………

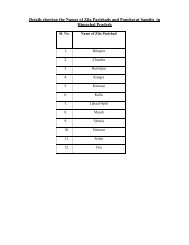

GENERAL INSTRUCTION TO FILL IN THE PERFORMA FOR <strong>RLBs</strong> ACCOUNTS<br />

Receipts<br />

1. Tax Receipts include<br />

1.1 Land revenue,<br />

1.2 Professional tax,<br />

1.3 Water tax,<br />

1.4 House tax,<br />

1.5 Drainage tax,<br />

1.6 Share of state taxes etc.<br />

1.2 Cess is a type of tax on tax , so is a part of tax receipts.,<br />

2. Fees and Miscellaneous receipts includes, Market & fairs, cattle pond, ferry ghat, License fees,<br />

Slaughter house & Cart Stand, Issue of Certificates, Fee <strong>for</strong> approval of maps,and Other charges n.e.c.<br />

3. Property Receipts includes Rent and Income from Orchards, Waste lands, Pisci-culture etc.<br />

4. Interest Receipts against deposits or loans to others.<br />

5. Commercial receipts include rent from Shops, Buildings and Land.<br />

6. Sale of Assets include Financial and Non-Finance Assets including 2 nd hand assets.<br />

7. Sale of Land direct receipts after sale.<br />

8. Withdrawal from deposits & funds.<br />

9. Financial Assets An asset that derives value because of a contractual claim. Stocks, bonds, bank<br />

deposits, and the like are all examples of financial assets.<br />

10. Non-Financial Assets An asset with a physical value such as real estate, equipment, machinery,<br />

gold or oil. For example, gold is considered a nonfinancial asset because it has inherent value based<br />

on its use in jewelry, electronics, dentistry, ornamentation and historically as currency. Cash, on the<br />

other hand, is a financial asset because its value is based on what it represents. The paper the cash is<br />

printed on has very little value by itself.<br />

Expenditure of LBs can be traced as follow:<br />

1. Salary & Wages, under different purposes (Other than regular employees of Block Office)<br />

1.1 Pay & allowances and honorarium other than TA & DA.<br />

1.2 Contribution to PF by the <strong>Panchayats</strong>, if any.<br />

1.3 Payment in kind like cost of liveries and uni<strong>for</strong>ms; ration supplied etc.<br />

1.4 Pension payment to (pan.) employees, if any.<br />

1.5 Leave Travel Concessions claims payment. ..continued..

1.6 Medical charges & reimbursement of medical expenditure.<br />

1.7 Cost of textbooks to the children of employees<br />

2. Purchase of goods & services (to be given purpose-wise) includes the expenditure made towards<br />

contingency and general expenditure, travel expences etc.<br />

3. Maintenance is the expense towards maintenance of buildings roads, machinery etc.<br />

4. Current transfers (to be given purpose-wise) include both current as well as capital transfers to<br />

private non-government organization./Indi.<br />

5. Loan & Advances given to organizations, employees and others.<br />

6. Buildings and Other Construction: Buildings include all expenditure on new construction and<br />

major alterations to residential and non-residential buildings during the year. It includes construction<br />

cost of the buildings together with cost of external and internal fixtures during the year.<br />

Other construction include mostly expenditure on construction includes mostly expenditure on<br />

construction of roads , bridges and works on power and irrigation projects, flood control, <strong>for</strong>est<br />

clearance, land reclamation, water supply and sanitation.<br />

7. Machinery and Equipment include expenditure incurred on the purchase of various equipment <strong>for</strong><br />

such as buses, jeeps, trucks, tractors <strong>for</strong> road haulage, power generating machinery, agricultural<br />

machinery and implements, office furniture, machinery and equipment and instruments used by<br />

professional men, artisans etc.<br />

8. Other expenditure includes expenditure on financial assets, deposits of funds and interest paid to<br />

non-Government bodies or individuals and Central/State Governments.<br />

Most important: to be considered while distinguishing major expenditure on construction activities.<br />

Current transfer and Capital transfer may be distinguished from each other in the following manner:<br />

Current transfer is made out of the current income of the donor. While<br />

capital expenditure is paid out of the past income, viz. wealth or saving of the donor.(may be GOI,<br />

GoHP, GPs or any individual)<br />

Current transfer is added to the current income of the recipient. But capital transfer contributes to<br />

the capital <strong>for</strong>mation of a State. Current transfer is used <strong>for</strong> consumption expenditure, which is shortrun<br />

in nature. But capital transfer is used <strong>for</strong> the long-term expenditure of the recipient.