Directors' report on remuneration (PDF 174 KB) - Inchcape

Directors' report on remuneration (PDF 174 KB) - Inchcape

Directors' report on remuneration (PDF 174 KB) - Inchcape

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ <str<strong>on</strong>g>report</str<strong>on</strong>g> <strong>on</strong> remunerati<strong>on</strong> c<strong>on</strong>tinued<br />

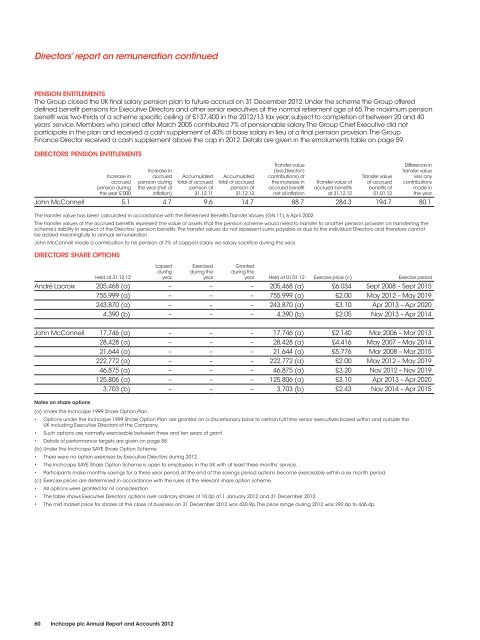

PENSION ENTITLEMENTS<br />

The Group closed the UK final salary pensi<strong>on</strong> plan to future accrual <strong>on</strong> 31 December 2012. Under the scheme the Group offered<br />

defined benefit pensi<strong>on</strong>s for Executive Directors and other senior executives at the normal retirement age of 65. The maximum pensi<strong>on</strong><br />

benefit was two-thirds of a scheme specific ceiling of £137,400 in the 2012/13 tax year, subject to completi<strong>on</strong> of between 20 and 40<br />

years’ service. Members who joined after March 2005 c<strong>on</strong>tributed 7% of pensi<strong>on</strong>able salary. The Group Chief Executive did not<br />

participate in the plan and received a cash supplement of 40% of base salary in lieu of a final pensi<strong>on</strong> provisi<strong>on</strong>. The Group<br />

Finance Director received a cash supplement above the cap in 2012. Details are given in the emoluments table <strong>on</strong> page 59.<br />

DIRECTORS’ PENSION ENTITLEMENTS<br />

Increase in<br />

accrued<br />

pensi<strong>on</strong> during<br />

the year £’000<br />

Increase in<br />

accrued<br />

pensi<strong>on</strong> during<br />

the year (net of<br />

inflati<strong>on</strong>)<br />

Accumulated<br />

total of accrued<br />

pensi<strong>on</strong> at<br />

31.12.11<br />

Accumulated<br />

total of accrued<br />

pensi<strong>on</strong> at<br />

31.12.12<br />

Transfer value<br />

(less Director’s<br />

c<strong>on</strong>tributi<strong>on</strong>s) of<br />

the increase in<br />

accrued benefit<br />

net of inflati<strong>on</strong><br />

Transfer value of<br />

accrued benefits<br />

at 31.12.12<br />

Transfer value<br />

of accrued<br />

benefits at<br />

01.01.12<br />

Difference in<br />

transfer value<br />

less any<br />

c<strong>on</strong>tributi<strong>on</strong>s<br />

made in<br />

the year<br />

John McC<strong>on</strong>nell 5.1 4.7 9.6 14.7 88.7 284.3 194.7 80.1<br />

The transfer value has been calculated in accordance with the Retirement Benefits Transfer Values (GN 11), 6 April 2002.<br />

The transfer values of the accrued benefits represent the value of assets that the pensi<strong>on</strong> scheme would need to transfer to another pensi<strong>on</strong> provider <strong>on</strong> transferring the<br />

scheme’s liability in respect of the Directors’ pensi<strong>on</strong> benefits. The transfer values do not represent sums payable or due to the individual Directors and therefore cannot<br />

be added meaningfully to annual remunerati<strong>on</strong>.<br />

John McC<strong>on</strong>nell made a c<strong>on</strong>tributi<strong>on</strong> to his pensi<strong>on</strong> of 7% of capped salary via salary sacrifice during the year.<br />

DIRECTORS’ SHARE OPTIONS<br />

Held at 31.12.12<br />

Lapsed<br />

during<br />

year<br />

Exercised<br />

during the<br />

year<br />

Granted<br />

during the<br />

year Held at 01.01.12 Exercise price (c) Exercise period<br />

André Lacroix 205,468 (a) – – – 205,468 (a) £6.034 Sept 2008 – Sept 2015<br />

755,999 (a) – – – 755,999 (a) £2.00 May 2012 – May 2019<br />

243,870 (a) – – – 243,870 (a) £3.10 Apr 2013 – Apr 2020<br />

4,390 (b) – – – 4,390 (b) £2.05 Nov 2013 – Apr 2014<br />

John McC<strong>on</strong>nell 17,746 (a) – – – 17,746 (a) £2.140 Mar 2006 – Mar 2013<br />

28,428 (a) – – – 28,428 (a) £4.416 May 2007 – May 2014<br />

21,644 (a) – – – 21,644 (a) £5.776 Mar 2008 – Mar 2015<br />

222,772 (a) – – – 222,772 (a) £2.00 May 2012 – May 2019<br />

46,875 (a) – – – 46,875 (a) £3.20 Nov 2012 – Nov 2019<br />

125,806 (a) – – – 125,806 (a) £3.10 Apr 2013 – Apr 2020<br />

3,703 (b) – – – 3,703 (b) £2.43 Nov 2014 – Apr 2015<br />

Notes <strong>on</strong> share opti<strong>on</strong>s<br />

(a) Under the <strong>Inchcape</strong> 1999 Share Opti<strong>on</strong> Plan.<br />

Opti<strong>on</strong>s under the <strong>Inchcape</strong> 1999 Share Opti<strong>on</strong> Plan are granted <strong>on</strong> a discreti<strong>on</strong>ary basis to certain full time senior executives based within and outside the<br />

UK including Executive Directors of the Company.<br />

Such opti<strong>on</strong>s are normally exercisable between three and ten years of grant.<br />

Details of performance targets are given <strong>on</strong> page 58.<br />

(b) Under the <strong>Inchcape</strong> SAYE Share Opti<strong>on</strong> Scheme.<br />

There were no opti<strong>on</strong> exercises by Executive Directors during 2012.<br />

The <strong>Inchcape</strong> SAYE Share Opti<strong>on</strong> Scheme is open to employees in the UK with at least three m<strong>on</strong>ths’ service.<br />

Participants make m<strong>on</strong>thly savings for a three year period. At the end of the savings period opti<strong>on</strong>s become exercisable within a six m<strong>on</strong>th period.<br />

(c) Exercise prices are determined in accordance with the rules of the relevant share opti<strong>on</strong> scheme.<br />

All opti<strong>on</strong>s were granted for nil c<strong>on</strong>siderati<strong>on</strong><br />

The table shows Executive Directors’ opti<strong>on</strong>s over ordinary shares of 10.0p at 1 January 2012 and 31 December 2012.<br />

The mid market price for shares at the close of business <strong>on</strong> 31 December 2012 was 430.9p. The price range during 2012 was 292.6p to 446.4p.<br />

60 <strong>Inchcape</strong> plc Annual Report and Accounts 2012