Pension Annuity Deferral Declaration - Aviva

Pension Annuity Deferral Declaration - Aviva

Pension Annuity Deferral Declaration - Aviva

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

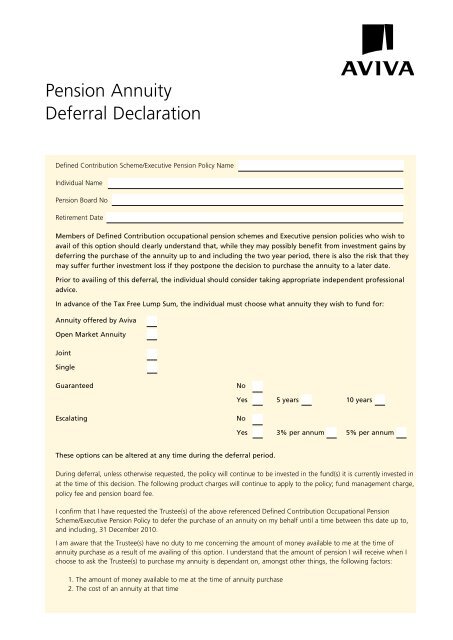

<strong>Pension</strong> <strong>Annuity</strong><br />

<strong>Deferral</strong> <strong>Declaration</strong><br />

Defined Contribution Scheme/Executive <strong>Pension</strong> Policy Name<br />

Individual Name<br />

<strong>Pension</strong> Board No<br />

Retirement Date<br />

Members of Defined Contribution occupational pension schemes and Executive pension policies who wish to<br />

avail of this option should clearly understand that, while they may possibly benefit from investment gains by<br />

deferring the purchase of the annuity up to and including the two year period, there is also the risk that they<br />

may suffer further investment loss if they postpone the decision to purchase the annuity to a later date.<br />

Prior to availing of this deferral, the individual should consider taking appropriate independent professional<br />

advice.<br />

In advance of the Tax Free Lump Sum, the individual must choose what annuity they wish to fund for:<br />

<strong>Annuity</strong> offered by <strong>Aviva</strong><br />

Open Market <strong>Annuity</strong><br />

Joint<br />

Single<br />

Guaranteed<br />

No<br />

Yes 5 years 10 years<br />

Escalating<br />

No<br />

Yes 3% per annum 5% per annum<br />

These options can be altered at any time during the deferral period.<br />

During deferral, unless otherwise requested, the policy will continue to be invested in the fund(s) it is currently invested in<br />

at the time of this decision. The following product charges will continue to apply to the policy; fund management charge,<br />

policy fee and pension board fee.<br />

I confirm that I have requested the Trustee(s) of the above referenced Defined Contribution Occupational <strong>Pension</strong><br />

Scheme/Executive <strong>Pension</strong> Policy to defer the purchase of an annuity on my behalf until a time between this date up to,<br />

and including, 31 December 2010.<br />

I am aware that the Trustee(s) have no duty to me concerning the amount of money available to me at the time of<br />

annuity purchase as a result of me availing of this option. I understand that the amount of pension I will receive when I<br />

choose to ask the Trustee(s) to purchase my annuity is dependant on, amongst other things, the following factors:<br />

1. The amount of money available to me at the time of annuity purchase<br />

2. The cost of an annuity at that time

I am aware that the above factors may be less favourable to me when purchasing an annuity at a later date, on or<br />

before 31 December 2010. Therefore, the future pension I will receive may be less than the pension I could purchase<br />

today.<br />

The Trustee(s) agree that should I request them in writing to purchase an annuity at any time within the deferred<br />

period they shall do so on the date set out in my request.<br />

Signed - Individual<br />

Signed - Trustee(s)<br />

Date<br />

Date<br />

<strong>Aviva</strong> Life & <strong>Pension</strong>s Ireland Limited. A private company limited by shares. Registered in Ireland No. 252737<br />

Registered Office One Park Place, Hatch Street, Dublin 2.<br />

Member of the Irish Insurance Federation. <strong>Aviva</strong> Life & <strong>Pension</strong>s Ireland Limited is regulated by the Central Bank of Ireland.<br />

Life & <strong>Pension</strong>s One Park Place, Hatch Street, Dublin 2. Phone (01) 898 7000 Fax (01) 898 7329<br />

www.aviva.ie<br />

Telephone calls may be recorded for quality assurance purposes.<br />

22.39.02.13