Hist and Proj Operating Receipts FY 2011 2 17 2010 - DC Water

Hist and Proj Operating Receipts FY 2011 2 17 2010 - DC Water

Hist and Proj Operating Receipts FY 2011 2 17 2010 - DC Water

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

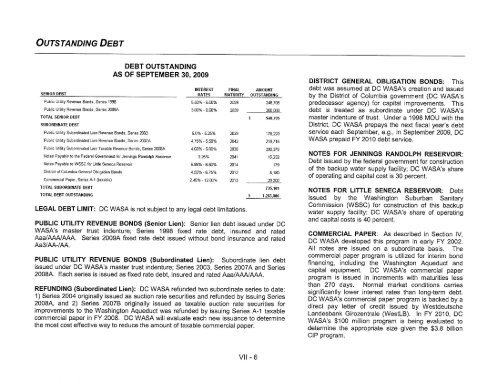

OursreuilNa Deer<br />

SEIIIOR DEBT<br />

Public Utility Revenue Bonds, Series 1998<br />

Public l.Jt¡lity Rerenue Bonds, Series ãIÞA<br />

TOTAI. SEN¡OR DEET<br />

SUBORDINATE DEBT<br />

Public l.ltility Subordinated Lien Rerenue Bonds, Sedes 2üB<br />

DEBT OUTSTANDING<br />

AS OF SEPTEMBER 30,2OO9<br />

Public tltility Subord¡neted L¡en Rerenue Bonds, Senes ãI]7A<br />

Public Utility Subord¡nated Uen Taxable Revenue Bonds, Series 2ffi4<br />

Notes Payable to the Federal Govemment for Jenn¡ngs Rândolph Reservoit<br />

Noles Payable to \ÂISSC for Uttle Seneca Reseruoir<br />

D¡slricl ofColumbia General Obligat¡on Bonds<br />

Commercial Paper, Sedes Àl (taxable)<br />

TOTAT SUBORDIilATE DEBT<br />

TOTAL DEBT OUTSTANDI]IG<br />

II{TEREST FINÄL AflOUI{T<br />

RATES NATURITY OUTSTAIIDIIIG<br />

5.50% - 6.00% Tâ 2ß/É<br />

3.00% - 6.00% zIp<br />

3m.m<br />

s.Oo/o-s.X% ZIB<br />

4.75%-5.æ% n42<br />

4.æ% - 5.m0/o ãrË<br />

3.å% ru1<br />

5.98% - 6.607o ZJ11<br />

4.æ%-6.750/o zJ12<br />

2.45oÁ - 12.ú!o fJ13<br />

LEGAL DEBT LIMIT: <strong>DC</strong> WASA is not subject to any legal debt timitations.<br />

I 5t8.705<br />

<strong>17</strong>6ø<br />

218715<br />

m375<br />

ß,m<br />

<strong>17</strong>9<br />

5,1&l<br />

Bffi<br />

735.101<br />

f 1.283.806<br />

PUBLIC UTILITY REVENUE BONDS (Senior Lien): Senior lien debt issued under <strong>DC</strong><br />

WASA's master trust indenture; Series 1998 fixed rate debt, insured <strong>and</strong> rated<br />

Aaa/AAA/AAA. Series 20094 fixed rate debt issued without bond insurance <strong>and</strong> rated<br />

Aa3/AA-/AA.<br />

PUBLIC UTILIW REVENUE BONDS (Subordinated Lien): Subordinate lien debt<br />

issued under <strong>DC</strong> WASA's master trust indenture; Series 2003, Series 20074 <strong>and</strong> Series<br />

20084. Each series is issued as fixed rate debt, insured <strong>and</strong> rated Aaa/A/fuA/AAA.<br />

REFUNDING (Subordinated Lien): <strong>DC</strong> WASA refunded two subordinate series to date:<br />

1) Series 2004 originally issued as auction rate securities <strong>and</strong> refunded by issuing Series<br />

20084, <strong>and</strong> 2) Series 20078 originally issued as taxable auction rate securities for<br />

improvements to the Washington Aqueduct was refunded by issuing Series A-1 taxable<br />

commercial paper in <strong>FY</strong> 2008. <strong>DC</strong> WASA will evaluate each new issuance to determine<br />

the most cost effective way to reduce the amount of taxable commercial paper.<br />

DISTRICT GENERAL OBLIGATION BONDS: This<br />

debt was assumed at <strong>DC</strong> WASAs creation <strong>and</strong> issued<br />

by the District of Columbia government (<strong>DC</strong> WASA's<br />

predecessor agency) for capital improvements. This<br />

debt is treated as subordinate under <strong>DC</strong> WASA's<br />

master indenture of trust. Under a 1998 MOU with the<br />

District, <strong>DC</strong> WASA prepays the next fiscal year's debt<br />

service each September, e.9., in September 2009, <strong>DC</strong><br />

WASA prepaid <strong>FY</strong> <strong>2010</strong> debt service.<br />

NOTES FOR JENNINGS RANDOLPH RESERVOIR:<br />

Debt issued by the federal government for construction<br />

of the backup water supply facility; <strong>DC</strong> WASA's share<br />

of operating <strong>and</strong> capital cost is 30 percent.<br />

NOTES FOR LITTLE SENECA RESERVOIR: Debt<br />

issued by the Washington Suburban Sanitary<br />

Commission (WSSC) for construction of this backup<br />

water supply facility; <strong>DC</strong> WASA's share of operating<br />

<strong>and</strong> capitalcosts is 40 percent.<br />

COMMERCIAL PAPER: As described in Section lV,<br />

<strong>DC</strong> WASA developed this program in early <strong>FY</strong> 2OO2.<br />

All notes are issued on a subordinate basis. The<br />

commercial paper program is utilized for interim bond<br />

financing, including the Washington Aqueduct <strong>and</strong><br />

capital equipment. <strong>DC</strong> WASA'S commercial paper<br />

program is issued in increments with maturities less<br />

than 270 days. Normal market conditions carries<br />

sígnificantly lower interest rates than long-term debt.<br />

<strong>DC</strong> WASA's commercial paper program is backed by a<br />

direct pay letter of credit issued by Westdeutsche<br />

L<strong>and</strong>esbank Girozentrale (WestLB). ln <strong>FY</strong> <strong>2010</strong>, <strong>DC</strong><br />

WASA's $100 million program is being evaluated to<br />

determine the appropriate size given the $3.8 billion<br />

CIP program.<br />

vil-6