Annual Report Open Ended Debt-1 - IDFC Mutual Fund

Annual Report Open Ended Debt-1 - IDFC Mutual Fund Annual Report Open Ended Debt-1 - IDFC Mutual Fund

ANNUAL REPORT 2006 11.7 Non-traded investments As at March 31, 2006 the aggregate fair value of non-traded/thinly traded investments (as defined by the Regulations) is as follows: Scheme Name March 31, 2006 March 31, 2005 GSSIF-IP 1,131,099,152 2,052,357,620 GSSIF-ST 1,291,786,968 725,073,108 GSSIF-MT 44,783,705 212,665,521 GDBF 256,652,757 899,600,997 GGSF-IP 12,510,106 2,019,192 GGSF-ST Nil Nil GGSF-PF Nil Nil 11.8 Income and expenditure The total income (net of loss on sale of investments and net change in unrealised depreciation in value of investments) and expenditure and these amounts as a percentage of the Scheme's average daily net assets: Scheme Name Income * March 31, 2006 March31,2005 Amount Percentage Amount Percentage GSSIF-IP 66,219,374 3.97 296,644,578 3.76 GSSIF-ST 141,405,689 3.64 224,045,880 4.89 GSSIF-MT (42,076,320) (74.82) 44,004,433 1.73 GDBF (41,267,233) (5.68) 120,147,609 1.71 GGSF-IP 7,306,459 6.21 (204,029) (0.05) GGSF-ST 483,347 3.60 176,638 0.89 GGSF-PF 21,337,340 6.77 3,121,066 0.72 Scheme Name Expenditure March 31, 2006 March31,2005 Plan A Plan B Plan C Amount % Amount % Amount % GSSIF-IP 35,969,313 2.15 - - - 119,022,566 1.91 12,463,518 1.40 1,002,266 0.89 GSSIF-ST 10,125,004 0.94 1,186,553 0.86 7,515,625 0.52 15,706,903 1.03 18,852,268 0.94 6,183,344 0.84 GSSIF-MT 1,239,621 2.20 - - - - 16,664,059 1.34 7,194,808 1.01 1,714,949 0.65 GDBF 8,610,076 1.17 - - - - 71,875,601 2.05 31,898,580 1.70 18,511,203 1.50 GGSF-IP 2,390,034 2.03 - - - - 3,511,550 1.88 1,129,936 0.69 - - GGSF-ST 94,032 0.70 - - - - 212,423 1.07 - - - - GGSF-PF 1,997,025 1.68 3,575,024 1.82 - - 2,251,569 1.51 3,015,482 1.07 - - 11.9 Segment reporting The schemes are a part of the Mutual Fund, which have been incorporated as a trust and is exclusively engaged in raising monies through the sale of units to the public for investing in securities. This business is considered to constitute one single primary segment in the context of Accounting Standard 17 on Segmental Reporting issued by the Institute of Chartered Accountants of India. There are no geographical reportable segments since the Fund provides investment management services to customers in the Indian market only and does not distinguish any reportable regions within India. 11.10Disclosure under regulation 25 (8) of SEBI Regulations a) Commission and charges incurred on security transactions with sponsor or any of its associates as defined in the regulation 25(8): Standard Chartered Bank, India branches is an associate of Standard Chartered Bank UK, the sponsor of the trust. Scheme Name Commission Paid / Payable to Standard Chartered Bank, India branches March 31, 2006 March 31, 2005 Amount Amount GSSIF-IP 2,165,219 11,162,989 GSSIF-ST 909,305 858,284 GSSIF-MT 94,850 2,541,122 GDBF 549,378 6,437,169 GGSF-IP 20,124 52,409 GGSF-ST 2,474 6,063 GGSF-PF 11,164 130,162 b) The investments made by the schemes during the year in issues lead managed by Standard Chartered Bank - India Branches: Nil 11.11 Details of investment in companies that hold more than 5% of NAV of any scheme of Standard Chartered Mutual Fund: Refer Annexure A 11.12 Details of large holdings Details of unit holdings over 25% of the net assets as on March 31, 2006 is Nil (Previous Year: Nil) 11.13 Portfolio holding (market / fair value) as at March 31, 2006: Refer Annexure B All investments, except for mutual fund units, are held in safe custody with Deutsche Bank AG, India /Reserve Bank of India. 11.14 Unpaid redemption and unclaimed dividend The details of unpaid redemption and unclaimed dividend as at March 31, 2006 as given in the table below are based on confirmations as received 29

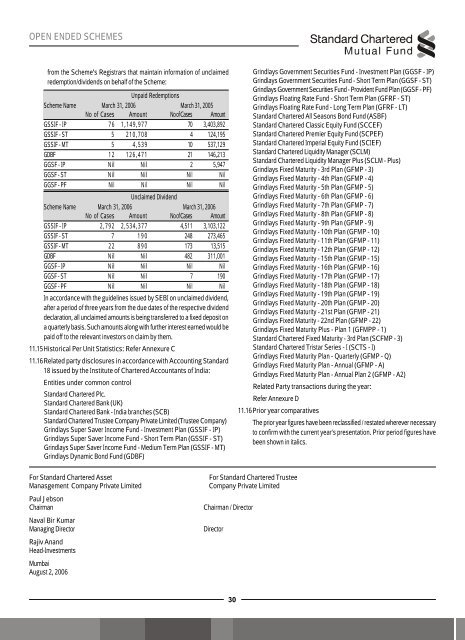

OPEN ENDED SCHEMES from the Scheme’s Registrars that maintain information of unclaimed redemption/dividends on behalf of the Scheme: Unpaid Redemptions Scheme Name March 31, 2006 March 31, 2005 No of Cases Amount NoofCases Amount GSSIF - IP 76 1,149,977 70 3,403,892 GSSIF - ST 5 210,708 4 124,195 GSSIF - MT 5 4,539 10 537,129 GDBF 12 126,471 21 146,213 GGSF - IP Nil Nil 2 5,947 GGSF - ST Nil Nil Nil Nil GGSF-PF Nil Nil Nil Nil Unclaimed Dividend Scheme Name March 31, 2006 March 31, 2006 No of Cases Amount NoofCases Amount GSSIF - IP 2,792 2,534,377 4,511 3,103,122 GSSIF - ST 7 190 248 273,465 GSSIF - MT 22 890 173 13,515 GDBF Nil Nil 482 311,001 GGSF - IP Nil Nil Nil Nil GGSF - ST Nil Nil 7 190 GGSF - PF Nil Nil Nil Nil In accordance with the guidelines issued by SEBI on unclaimed dividend, after a period of three years from the due dates of the respective dividend declaration, all unclaimed amounts is being transferred to a fixed deposit on a quarterly basis. Such amounts along with further interest earned would be paid off to the relevant investors on claim by them. 11.15Historical Per Unit Statistics: Refer Annexure C 11.16Related party disclosures in accordance with Accounting Standard 18 issued by the Institute of Chartered Accountants of India: Entities under common control Standard Chartered Plc. Standard Chartered Bank (UK) Standard Chartered Bank - India branches (SCB) Standard Chartered Trustee Company Private Limited (Trustee Company) Grindlays Super Saver Income Fund - Investment Plan (GSSIF - IP) Grindlays Super Saver Income Fund - Short Term Plan (GSSIF - ST) Grindlays Super Saver Income Fund - Medium Term Plan (GSSIF - MT) Grindlays Dynamic Bond Fund (GDBF) Grindlays Government Securities Fund - Investment Plan (GGSF - IP) Grindlays Government Securities Fund - Short Term Plan (GGSF - ST) Grindlays Government Securities Fund - Provident Fund Plan (GGSF - PF) Grindlays Floating Rate Fund - Short Term Plan (GFRF - ST) Grindlays Floating Rate Fund - Long Term Plan (GFRF - LT) Standard Chartered All Seasons Bond Fund (ASBF) Standard Chartered Classic Equity Fund (SCCEF) Standard Chartered Premier Equity Fund (SCPEF) Standard Chartered Imperial Equity Fund (SCIEF) Standard Chartered Liquidity Manager (SCLM) Standard Chartered Liquidity Manager Plus (SCLM - Plus) Grindlays Fixed Maturity - 3rd Plan (GFMP - 3) Grindlays Fixed Maturity - 4th Plan (GFMP - 4) Grindlays Fixed Maturity - 5th Plan (GFMP - 5) Grindlays Fixed Maturity - 6th Plan (GFMP - 6) Grindlays Fixed Maturity - 7th Plan (GFMP - 7) Grindlays Fixed Maturity - 8th Plan (GFMP - 8) Grindlays Fixed Maturity - 9th Plan (GFMP - 9) Grindlays Fixed Maturity - 10th Plan (GFMP - 10) Grindlays Fixed Maturity - 11th Plan (GFMP - 11) Grindlays Fixed Maturity - 12th Plan (GFMP - 12) Grindlays Fixed Maturity - 15th Plan (GFMP - 15) Grindlays Fixed Maturity - 16th Plan (GFMP - 16) Grindlays Fixed Maturity - 17th Plan (GFMP - 17) Grindlays Fixed Maturity - 18th Plan (GFMP - 18) Grindlays Fixed Maturity - 19th Plan (GFMP - 19) Grindlays Fixed Maturity - 20th Plan (GFMP - 20) Grindlays Fixed Maturity - 21st Plan (GFMP - 21) Grindlays Fixed Maturity - 22nd Plan (GFMP - 22) Grindlays Fixed Maturity Plus - Plan 1 (GFMPP - 1) Standard Chartered Fixed Maturity - 3rd Plan (SCFMP - 3) Standard Chartered Tristar Series - I (SCTS - I) Grindlays Fixed Maturity Plan - Quarterly (GFMP - Q) Grindlays Fixed Maturity Plan - Annual (GFMP - A) Grindlays Fixed Maturity Plan - Annual Plan 2 (GFMP - A2) Related Party transactions during the year: Refer Annexure D 11.16Prior year comparatives The prior year figures have been reclassified / restated wherever necessary to confirm with the current year's presentation. Prior period figures have been shown in italics. For Standard Chartered Asset Manasgement Company Private Limited Paul Jebson Chairman Naval Bir Kumar Managing Director Rajiv Anand Head-Investments Mumbai August 2, 2006 For Standard Chartered Trustee Company Private Limited Chairman / Director Director 30

- Page 1 and 2: OPEN ENDED DEBT SCHEMES GRINDLAYS S

- Page 3 and 4: OPEN ENDED SCHEMES TRUSTEE REPORT R

- Page 5 and 6: OPEN ENDED SCHEMES in the equity ma

- Page 7 and 8: OPEN ENDED SCHEMES of the NFO. The

- Page 9 and 10: OPEN ENDED SCHEMES AUDITORS’ REPO

- Page 11 and 12: OPEN ENDED SCHEMES Balance Sheet as

- Page 13 and 14: OPEN ENDED SCHEMES Revenue Account

- Page 15 and 16: OPEN ENDED SCHEMES Schedules to the

- Page 17 and 18: OPEN ENDED SCHEMES Schedules to the

- Page 19 and 20: OPEN ENDED SCHEMES Schedules to the

- Page 21 and 22: OPEN ENDED SCHEMES Schedules to the

- Page 23 and 24: OPEN ENDED SCHEMES Schedules to the

- Page 25 and 26: OPEN ENDED SCHEMES Schedules to the

- Page 27 and 28: OPEN ENDED SCHEMES Schedules to the

- Page 29: OPEN ENDED SCHEMES 11. NOTES TO ACC

- Page 33 and 34: OPEN ENDED SCHEMES Annexure A (Cont

- Page 35 and 36: OPEN ENDED SCHEMES Annexure A (Cont

- Page 37 and 38: OPEN ENDED SCHEMES Annexure B Portf

- Page 39 and 40: OPEN ENDED SCHEMES March 31, 2006 M

- Page 41 and 42: OPEN ENDED SCHEMES March 31, 2006 M

- Page 43 and 44: OPEN ENDED SCHEMES Annexure C: Hist

- Page 45 and 46: OPEN ENDED SCHEMES Annexure C: Hist

- Page 47 and 48: OPEN ENDED SCHEMES Annexure C: Hist

- Page 49 and 50: OPEN ENDED SCHEMES Annexure C: Hist

- Page 51 and 52: OPEN ENDED SCHEMES Annexure C: Hist

- Page 53 and 54: OPEN ENDED SCHEMES Annexure - D: Re

- Page 55 and 56: OPEN ENDED SCHEMES Annexure - D: Re

- Page 57 and 58: OPEN ENDED SCHEMES Annexure - D: Re

- Page 59 and 60: OPEN ENDED SCHEMES Annexure - D: Re

- Page 61 and 62: OPEN ENDED SCHEMES Annexure - D: Re

- Page 63 and 64: OPEN ENDED SCHEMES Annexure - D: Re

- Page 65: ANNUAL REPORT 2006 RISK FACTORS Ris

OPEN ENDED SCHEMES<br />

from the Scheme’s Registrars that maintain information of unclaimed<br />

redemption/dividends on behalf of the Scheme:<br />

Unpaid Redemptions<br />

Scheme Name March 31, 2006 March 31, 2005<br />

No of Cases Amount NoofCases Amount<br />

GSSIF - IP 76 1,149,977 70 3,403,892<br />

GSSIF - ST 5 210,708 4 124,195<br />

GSSIF - MT 5 4,539 10 537,129<br />

GDBF 12 126,471 21 146,213<br />

GGSF - IP Nil Nil 2 5,947<br />

GGSF - ST Nil Nil Nil Nil<br />

GGSF-PF Nil Nil Nil Nil<br />

Unclaimed Dividend<br />

Scheme Name March 31, 2006 March 31, 2006<br />

No of Cases Amount NoofCases Amount<br />

GSSIF - IP 2,792 2,534,377 4,511 3,103,122<br />

GSSIF - ST 7 190 248 273,465<br />

GSSIF - MT 22 890 173 13,515<br />

GDBF Nil Nil 482 311,001<br />

GGSF - IP Nil Nil Nil Nil<br />

GGSF - ST Nil Nil 7 190<br />

GGSF - PF Nil Nil Nil Nil<br />

In accordance with the guidelines issued by SEBI on unclaimed dividend,<br />

after a period of three years from the due dates of the respective dividend<br />

declaration, all unclaimed amounts is being transferred to a fixed deposit on<br />

a quarterly basis. Such amounts along with further interest earned would be<br />

paid off to the relevant investors on claim by them.<br />

11.15Historical Per Unit Statistics: Refer Annexure C<br />

11.16Related party disclosures in accordance with Accounting Standard<br />

18 issued by the Institute of Chartered Accountants of India:<br />

Entities under common control<br />

Standard Chartered Plc.<br />

Standard Chartered Bank (UK)<br />

Standard Chartered Bank - India branches (SCB)<br />

Standard Chartered Trustee Company Private Limited (Trustee Company)<br />

Grindlays Super Saver Income <strong>Fund</strong> - Investment Plan (GSSIF - IP)<br />

Grindlays Super Saver Income <strong>Fund</strong> - Short Term Plan (GSSIF - ST)<br />

Grindlays Super Saver Income <strong>Fund</strong> - Medium Term Plan (GSSIF - MT)<br />

Grindlays Dynamic Bond <strong>Fund</strong> (GDBF)<br />

Grindlays Government Securities <strong>Fund</strong> - Investment Plan (GGSF - IP)<br />

Grindlays Government Securities <strong>Fund</strong> - Short Term Plan (GGSF - ST)<br />

Grindlays Government Securities <strong>Fund</strong> - Provident <strong>Fund</strong> Plan (GGSF - PF)<br />

Grindlays Floating Rate <strong>Fund</strong> - Short Term Plan (GFRF - ST)<br />

Grindlays Floating Rate <strong>Fund</strong> - Long Term Plan (GFRF - LT)<br />

Standard Chartered All Seasons Bond <strong>Fund</strong> (ASBF)<br />

Standard Chartered Classic Equity <strong>Fund</strong> (SCCEF)<br />

Standard Chartered Premier Equity <strong>Fund</strong> (SCPEF)<br />

Standard Chartered Imperial Equity <strong>Fund</strong> (SCIEF)<br />

Standard Chartered Liquidity Manager (SCLM)<br />

Standard Chartered Liquidity Manager Plus (SCLM - Plus)<br />

Grindlays Fixed Maturity - 3rd Plan (GFMP - 3)<br />

Grindlays Fixed Maturity - 4th Plan (GFMP - 4)<br />

Grindlays Fixed Maturity - 5th Plan (GFMP - 5)<br />

Grindlays Fixed Maturity - 6th Plan (GFMP - 6)<br />

Grindlays Fixed Maturity - 7th Plan (GFMP - 7)<br />

Grindlays Fixed Maturity - 8th Plan (GFMP - 8)<br />

Grindlays Fixed Maturity - 9th Plan (GFMP - 9)<br />

Grindlays Fixed Maturity - 10th Plan (GFMP - 10)<br />

Grindlays Fixed Maturity - 11th Plan (GFMP - 11)<br />

Grindlays Fixed Maturity - 12th Plan (GFMP - 12)<br />

Grindlays Fixed Maturity - 15th Plan (GFMP - 15)<br />

Grindlays Fixed Maturity - 16th Plan (GFMP - 16)<br />

Grindlays Fixed Maturity - 17th Plan (GFMP - 17)<br />

Grindlays Fixed Maturity - 18th Plan (GFMP - 18)<br />

Grindlays Fixed Maturity - 19th Plan (GFMP - 19)<br />

Grindlays Fixed Maturity - 20th Plan (GFMP - 20)<br />

Grindlays Fixed Maturity - 21st Plan (GFMP - 21)<br />

Grindlays Fixed Maturity - 22nd Plan (GFMP - 22)<br />

Grindlays Fixed Maturity Plus - Plan 1 (GFMPP - 1)<br />

Standard Chartered Fixed Maturity - 3rd Plan (SCFMP - 3)<br />

Standard Chartered Tristar Series - I (SCTS - I)<br />

Grindlays Fixed Maturity Plan - Quarterly (GFMP - Q)<br />

Grindlays Fixed Maturity Plan - <strong>Annual</strong> (GFMP - A)<br />

Grindlays Fixed Maturity Plan - <strong>Annual</strong> Plan 2 (GFMP - A2)<br />

Related Party transactions during the year:<br />

Refer Annexure D<br />

11.16Prior year comparatives<br />

The prior year figures have been reclassified / restated wherever necessary<br />

to confirm with the current year's presentation. Prior period figures have<br />

been shown in italics.<br />

For Standard Chartered Asset<br />

Manasgement Company Private Limited<br />

Paul Jebson<br />

Chairman<br />

Naval Bir Kumar<br />

Managing Director<br />

Rajiv Anand<br />

Head-Investments<br />

Mumbai<br />

August 2, 2006<br />

For Standard Chartered Trustee<br />

Company Private Limited<br />

Chairman / Director<br />

Director<br />

30