Download manual (631K PDF) - DefaultRisk.com

Download manual (631K PDF) - DefaultRisk.com Download manual (631K PDF) - DefaultRisk.com

CDO models: Opening the black box – Part four Redistribution of risk across the tranches ..and more losses for senior tranches ► ► ► ► For the expected losses (EL) of the tranches we observe the same pattern as for the spreads In general it makes sense to look at ELs as a fraction of the corresponding tranche’s notional We also show below tranche ELs as a fraction of the portfolio notional As a further remark, we point out that the differences for the portfolio EL are very small and only due to the Monte Carlo approach. The portfolio EL should stay the same between these two copulas Tranche ELs as a fraction of portfolio notional 2.50% 2.00% Expected losses EL (as fraction of tranche notional) Normal Stud. t (df10) Stud. t (df3) Normal EL (as fraction of index notional) Stud. t (df10) Stud. t (df3) 1.50% Index 0-3% 4.32% 69.51% 4.31% 62.52% 4.27% 50.05% 4.32% 2.09% 4.31% 1.88% 4.27% 1.50% 1.00% 3-6% 6-9% 35.93% 18.67% 33.35% 19.29% 29.15% 19.51% 1.08% 0.56% 1.00% 0.58% 0.87% 0.59% 0.50% 9-12% 12-22% 9.80% 2.78% 11.57% 4.29% 13.62% 6.62% 0.29% 0.28% 0.35% 0.43% 0.41% 0.66% 0.00% 0-3% 3-6% 6-9% 9-12% 12-22% 22-100% 22-100% 0.04% Source: Dresdner Kleinwort Research 0.10% 0.30% 0.03% 0.08% 0.23% Normal Stud. t (df10) Stud. t (df3) Source: Dresdner Kleinwort Research 19

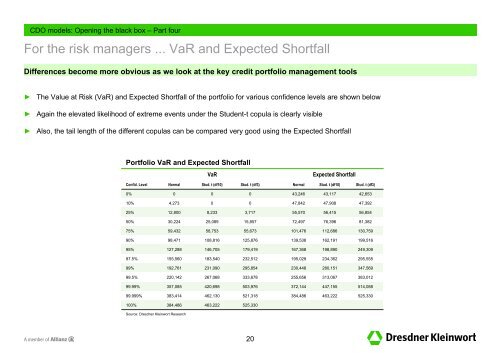

CDO models: Opening the black box – Part four For the risk managers ... VaR and Expected Shortfall Differences become more obvious as we look at the key credit portfolio management tools ► ► ► The Value at Risk (VaR) and Expected Shortfall of the portfolio for various confidence levels are shown below Again the elevated likelihood of extreme events under the Student-t copula is clearly visible Also, the tail length of the different copulas can be compared very good using the Expected Shortfall Portfolio VaR and Expected Shortfall VaR Expected Shortfall Confid. Level Normal Stud. t (df10) Stud. t (df3) Normal Stud. t (df10) Stud. t (df3) 0% 0 0 0 43,246 43,117 42,653 10% 4,273 0 0 47,842 47,908 47,392 25% 12,800 8,233 3,717 55,570 56,415 56,854 50% 30,224 25,089 15,857 72,497 76,396 81,382 75% 59,432 58,753 55,673 101,476 112,686 130,759 90% 98,471 108,816 125,876 139,538 162,191 199,516 95% 127,288 146,705 179,419 167,368 198,890 249,309 97.5% 155,560 183,540 232,512 195,029 234,362 295,555 99% 192,761 231,090 295,854 230,448 280,151 347,569 99.5% 220,142 267,068 333,678 255,656 313,067 383,012 99.99% 357,085 420,698 503,976 372,144 447,155 514,088 99.999% 383,414 462,130 521,318 384,486 463,222 525,330 100% 384,486 463,222 525,330 Source: Dresdner Kleinwort Research 20

- Page 1 and 2: CDO models: Opening the black box -

- Page 3 and 4: Keep in mind the fine difference be

- Page 5 and 6: CDO models: Opening the black box -

- Page 7 and 8: CDO models: Opening the black box -

- Page 9 and 10: CDO models: Opening the black box -

- Page 11 and 12: CDO models: Opening the black box -

- Page 13 and 14: CDO models: Opening the black box -

- Page 15 and 16: CDO models: Opening the black box -

- Page 17 and 18: CDO models: Opening the black box -

- Page 19: CDO models: Opening the black box -

- Page 23 and 24: CDO models: Opening the black box -

- Page 25 and 26: CDO models: Opening the black box -

- Page 27: Disclaimer This presentation has be

CDO models: Opening the black box – Part four<br />

For the risk managers ... VaR and Expected Shortfall<br />

Differences be<strong>com</strong>e more obvious as we look at the key credit portfolio management tools<br />

►<br />

►<br />

►<br />

The Value at Risk (VaR) and Expected Shortfall of the portfolio for various confidence levels are shown below<br />

Again the elevated likelihood of extreme events under the Student-t copula is clearly visible<br />

Also, the tail length of the different copulas can be <strong>com</strong>pared very good using the Expected Shortfall<br />

Portfolio VaR and Expected Shortfall<br />

VaR<br />

Expected Shortfall<br />

Confid. Level<br />

Normal<br />

Stud. t (df10)<br />

Stud. t (df3)<br />

Normal<br />

Stud. t (df10)<br />

Stud. t (df3)<br />

0%<br />

0<br />

0<br />

0<br />

43,246<br />

43,117<br />

42,653<br />

10%<br />

4,273<br />

0<br />

0<br />

47,842<br />

47,908<br />

47,392<br />

25%<br />

12,800<br />

8,233<br />

3,717<br />

55,570<br />

56,415<br />

56,854<br />

50%<br />

30,224<br />

25,089<br />

15,857<br />

72,497<br />

76,396<br />

81,382<br />

75%<br />

59,432<br />

58,753<br />

55,673<br />

101,476<br />

112,686<br />

130,759<br />

90%<br />

98,471<br />

108,816<br />

125,876<br />

139,538<br />

162,191<br />

199,516<br />

95%<br />

127,288<br />

146,705<br />

179,419<br />

167,368<br />

198,890<br />

249,309<br />

97.5%<br />

155,560<br />

183,540<br />

232,512<br />

195,029<br />

234,362<br />

295,555<br />

99%<br />

192,761<br />

231,090<br />

295,854<br />

230,448<br />

280,151<br />

347,569<br />

99.5%<br />

220,142<br />

267,068<br />

333,678<br />

255,656<br />

313,067<br />

383,012<br />

99.99%<br />

357,085<br />

420,698<br />

503,976<br />

372,144<br />

447,155<br />

514,088<br />

99.999%<br />

383,414<br />

462,130<br />

521,318<br />

384,486<br />

463,222<br />

525,330<br />

100%<br />

384,486<br />

463,222<br />

525,330<br />

Source: Dresdner Kleinwort Research<br />

20