Section 6 - IMRF

Section 6 - IMRF Section 6 - IMRF

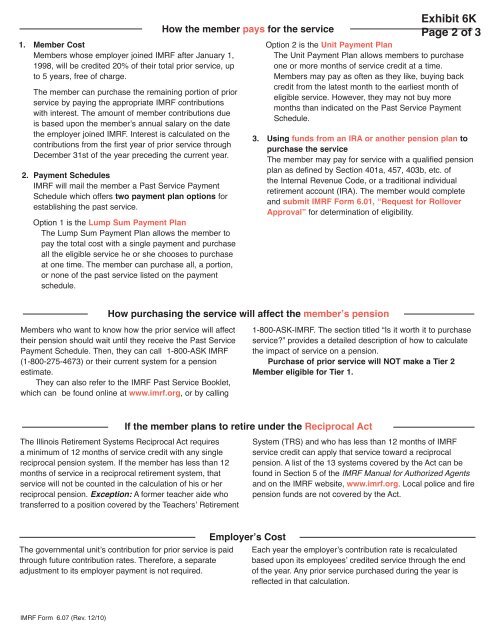

1. Member Cost Mem bers whose employer joined IMRF after January 1, 1998, will be credit ed 20% of their total prior service, up to 5 years, free of charge. The member can purchase the remaining portion of prior service by paying the appropriate IMRF contributions with interest. The amount of member contributions due is based upon the member’s annual salary on the date the employer joined IMRF. Interest is calculated on the contributions from the first year of prior service through December 31st of the year preceding the current year. 2. Payment Schedules IMRF will mail the member a Past Service Payment Schedule which offers two payment plan options for establishing the past service. Option 1 is the Lump Sum Payment Plan The Lump Sum Payment Plan allows the member to pay the total cost with a single payment and purchase all the eligible service he or she chooses to purchase at one time. The member can purchase all, a portion, or none of the past service listed on the payment schedule. How the member pays for the service Exhibit 6K Page 2 of 3 Option 2 is the Unit Payment Plan The Unit Payment Plan allows members to purchase one or more months of service credit at a time. Members may pay as often as they like, buying back credit from the latest month to the earliest month of eligible service. However, they may not buy more months than indicated on the Past Service Payment Schedule. 3. Using funds from an IRA or another pension plan to purchase the service The member may pay for service with a qualified pension plan as defined by Section 401a, 457, 403b, etc. of the Internal Revenue Code, or a traditional individual retirement account (IRA). The member would complete and submit IMRF Form 6.01, “Request for Rollover Approval” for determination of eligibility. How purchasing the service will affect the member’s pension Members who want to know how the prior service will affect their pension should wait until they receive the Past Service Payment Schedule. Then, they can call 1-800-ASK IMRF (1-800-275-4673) or their current system for a pension estimate. They can also refer to the IMRF Past Service Booklet, which can be found online at www.imrf.org, or by calling 1-800-ASK-IMRF. The section titled “Is it worth it to purchase service” provides a detailed description of how to calculate the impact of service on a pension. Purchase of prior service will NOT make a Tier 2 Member eligible for Tier 1. If the member plans to retire under the Reciprocal Act The Illinois Retirement Systems Reciprocal Act requires a minimum of 12 months of service credit with any single reciprocal pension system. If the member has less than 12 months of service in a reciprocal retirement system, that service will not be counted in the calculation of his or her reciprocal pension. Exception: A former teacher aide who transferred to a position covered by the Teachers’ Retirement System (TRS) and who has less than 12 months of IMRF service credit can apply that service toward a reciprocal pension. A list of the 13 systems covered by the Act can be found in Section 5 of the IMRF Manual for Authorized Agents and on the IMRF website, www.imrf.org. Local police and fire pension funds are not covered by the Act. The governmental unit’s contribution for prior service is paid through future contribution rates. Therefore, a separate adjustment to its employer payment is not required. Employer’s Cost Each year the employer’s contribution rate is recalculated based upon its employees’ credited service through the end of the year. Any prior service purchased during the year is reflected in that calculation. IMRF Form 6.07 (Rev. 12/10)

APPLICATION FOR PRIOR SERVICE CREDIT IMRF Form 6.07 (Rev. 12/10) PLEASE PRINT OR TYPE -- USE BLACK INK 1. MEMBER’S LAST NAME MIDDLE INITIAL FIRST NAME JR., SR., II, ETC. SOCIAL SECURITY NUMBER STREET (MAILING) ADDRESS CITY, STATE AND ZIP + 4 TELEPHONE NO ____________ - __________ - ____________ ( ) EMPLOYER NAME EMPLOYER IMRF I.D. NUMBER OPTIONAL: ANTICIPATED RETIREMENT DATE 2. PRIOR SERVICE PERIOD Do not enter any information in Columns A, B, or C. Your IMRF Field Representative will help you complete these columns. (Indicate service credit in months, e.g., 3 years 4 months = 40 months; 8 years 2 months = 98 months) NON-CONTRIBUTORY SERVICE: SERVICE CREDIT A MEMBER RECEIVES AT NO COST; LIMITED TO A MAXIMUM OF 60 MONTHS CONTRIBUTORY SERVICE: SERVICE CREDIT A MEMBER MAY PURCHASE BY PAYING THE APPROPRIATE MEMBER CONTRIBUTIONS PLUS INTEREST A B C DATE EMPLOYER JOINED IMRF___________ 1, ______ MONTH YEAR DATE EMPLOYEE ELIGIBLE FOR IMRF_______________ (MO/YR) THRU END OF MONTH PRIOR TO MONTH EMPLOYER JOINED IMRF_________________________ (MO/YR) EQUALS TOTAL SERVICE CREDIT (MONTHS)_________________ ACTUAL EARNINGS PRIOR TO SERVICE CREDIT, IF CONTINUOUSLY EMPLOYED, ENTER START M/D/Y AND CURRENT M/D/Y. YEAR DATE EMPLOYER JOINED IMRF IN MONTHS IF EMPLOYMENT TERMINATED & EMPLOYEE RETURNED, ENTER AS SEPARATE PERIODS. TOTALS: $ TOTAL SERVICE CREDIT_ _________________________ (e.g., 8 years 2 months = 98 months) EQUALS NON-CONTRIBUTORY SERVICE 1) 2) 3) 4) _________________________ MULTIPLIED BY 20% ________________________ (60 MONTH MAX) 3. MOST RECENT SALARY/SERVICE 4 EMPLOYMENT PERIODS Exhibit 6K Page 3 of 3 Roe J. Henry 0 0 0 0 0 0 0 0 0 123 Ash Street Anywhere, IL 60000 0 0 0 0 0 0 - 0 0 0 0 City of Anywhere 00000 2009 10,000.00 8 2008 11,000.00 12 2007 12,000.00 12 33,000.00 12 TOTAL SERVICE CREDIT_ _________________________ LESS NON-CONTRIBUTORY SERVICE_ ___________________ EQUALS CONTRIBUTORY SERVICE______________________ FROM THROUGH POSITION NO. OF MONTHS (MM/DD/YY) (MM/DD/YY) 5/1/01 12/31/01 Meter Reader 8 1/1/02 12/31/02 Meter Reader 12 1/1/03 12/31/03 Meter Reader 12 $ ______________ 33,000.00 ÷ MONTHS___________ 32 = __________________ $1,032.00 AVERAGE MONTHLY WAGE FOR BENEFIT ANNUAL GROSS EARNINGS 13,000.00 ON DATE EMPLOYER JOINED IMRF: $________________ 5) 6) 7) 8) CERTIFICATION BY AUTHORIZED AGENT I certify that the preceding statement of earnings and service for the above member is in agreement with the governmental unit’s payroll records and represents the entire qualifying employment period determined by the governing body. x CERTIFICATION BY MEMBER This is to certify that I was employed and received the above earnings from the above governmental unit and; that I agree, or disagree (if disagree, please send letter of explanation) with the period verified by the Authorized Agent. x Signature of Authorized Agent NOTE: Any person who knowingly makes any false statement or falsifies or permits to be falsified any record of the Illinois Municipal Retirement Fund in an attempt to defraud IMRF is guilty of a Class 3 felony (40 ILCS 5/1-135). Signature of Member August 15, 2009 For FIELD REP CALC AUDIT CONTRIBUTORY PRIOR SERVICE NON-CONTRIBUTORY PRIOR SERVICE Use by IMRF Illinois Municipal Retirement Fund 2211 York Road, Suite 500, Oak Brook Illinois 60523-2337 IMRF Form 6.07 (Rev. 12/10) Member Services Representatives 1-800-ASK-IMRF (1-800-275-4673) www.imrf.org Date August 15, 2009 Date

- Page 21 and 22: Illinois Municipal Retirement Fund

- Page 23 and 24: Illinois Municipal Retirement Fund

- Page 25 and 26: Illinois Municipal Retirement Fund

- Page 27 and 28: Illinois Municipal Retirement Fund

- Page 29 and 30: Illinois Municipal Retirement Fund

- Page 31 and 32: Illinois Municipal Retirement Fund

- Page 33 and 34: Illinois Municipal Retirement Fund

- Page 35 and 36: Illinois Municipal Retirement Fund

- Page 37 and 38: Illinois Municipal Retirement Fund

- Page 39 and 40: Illinois Municipal Retirement Fund

- Page 41 and 42: Illinois Municipal Retirement Fund

- Page 44 and 45: This page intentionally left blank.

- Page 46 and 47: This page intentionally left blank.

- Page 48 and 49: This page intentionally left blank.

- Page 50 and 51: Request For Rollover Approval for P

- Page 52 and 53: Application for Military Service Cr

- Page 54 and 55: IMRF will mail you a Past Service P

- Page 56 and 57: This page intentionally left blank.

- Page 58 and 59: Exhibit 6G - Page 2 of 3 “Instruc

- Page 60 and 61: This page intentionally left blank.

- Page 62 and 63: This page intentionally left blank.

- Page 64 and 65: 3. Authorized Agent Certification S

- Page 66 and 67: This page intentionally left blank.

- Page 68 and 69: “How to pay...” continued from

- Page 70 and 71: This page intentionally left blank.

- Page 74 and 75: This page intentionally left blank.

- Page 76 and 77: This page intentionally left blank.

- Page 78 and 79: X NOTICE OF ENROLLMENT IN IMRF IMRF

- Page 80 and 81: Exhibit 6O Page 2 of 4 If you are n

- Page 82 and 83: Exhibit 6O Conditions of IMRF Desig

- Page 84 and 85: • “PLAN” refers to either Reg

- Page 86 and 87: This page intentionally left blank.

- Page 88 and 89: This page intentionally left blank.

- Page 90 and 91: Instructions EXHIBIT 6S Page 1 of 2

- Page 92 and 93: This page intentionally left blank.

- Page 94 and 95: This page intentionally left blank.

- Page 96 and 97: This page intentionally left blank.

- Page 98 and 99: This page intentionally left blank.

- Page 100 and 101: EXPLANATION AND INCOME TAX INFORMAT

- Page 102 and 103: How do you pay for the Leave Exhibi

- Page 104 and 105: This page intentionally left blank.

- Page 106 and 107: OUT-OF-STATE SERVICE CREDIT AUTHORI

- Page 108 and 109: This page intentionally left blank.

- Page 110 and 111: This page intentionally left blank.

- Page 112 and 113: This page intentionally left blank.

- Page 114 and 115: This page intentionally left blank.

- Page 116 and 117: This page intentionally left blank.

- Page 118 and 119: A RESOLUTION RELATING TO PARTICIPAT

- Page 120 and 121: This page intentionally left blank.

1. Member Cost<br />

Mem bers whose employer joined <strong>IMRF</strong> after January 1,<br />

1998, will be credit ed 20% of their total prior service, up<br />

to 5 years, free of charge.<br />

The member can purchase the remaining portion of prior<br />

service by paying the appropriate <strong>IMRF</strong> contributions<br />

with interest. The amount of member contributions due<br />

is based upon the member’s annual salary on the date<br />

the employer joined <strong>IMRF</strong>. Interest is calculated on the<br />

contributions from the first year of prior service through<br />

December 31st of the year preceding the current year.<br />

2. Payment Schedules<br />

<strong>IMRF</strong> will mail the member a Past Service Payment<br />

Schedule which offers two payment plan options for<br />

establishing the past service.<br />

Option 1 is the Lump Sum Payment Plan<br />

The Lump Sum Payment Plan allows the member to<br />

pay the total cost with a single payment and purchase<br />

all the eligible service he or she chooses to purchase<br />

at one time. The member can purchase all, a portion,<br />

or none of the past service listed on the payment<br />

schedule.<br />

How the member pays for the service<br />

Exhibit 6K<br />

Page 2 of 3<br />

Option 2 is the Unit Payment Plan<br />

The Unit Payment Plan allows members to purchase<br />

one or more months of service credit at a time.<br />

Members may pay as often as they like, buying back<br />

credit from the latest month to the earliest month of<br />

eligible service. However, they may not buy more<br />

months than indicated on the Past Service Payment<br />

Schedule.<br />

3. Using funds from an IRA or another pension plan to<br />

purchase the service<br />

The member may pay for service with a qualified pension<br />

plan as defined by <strong>Section</strong> 401a, 457, 403b, etc. of<br />

the Internal Revenue Code, or a traditional individual<br />

retirement account (IRA). The member would complete<br />

and submit <strong>IMRF</strong> Form 6.01, “Request for Rollover<br />

Approval” for determination of eligibility.<br />

How purchasing the service will affect the member’s pension<br />

Members who want to know how the prior service will affect<br />

their pension should wait until they receive the Past Service<br />

Payment Schedule. Then, they can call 1-800-ASK <strong>IMRF</strong><br />

(1-800-275-4673) or their current system for a pension<br />

estimate.<br />

They can also refer to the <strong>IMRF</strong> Past Service Booklet,<br />

which can be found online at www.imrf.org, or by calling<br />

1-800-ASK-<strong>IMRF</strong>. The section titled “Is it worth it to purchase<br />

service” provides a detailed description of how to calculate<br />

the impact of service on a pension.<br />

Purchase of prior service will NOT make a Tier 2<br />

Member eligible for Tier 1.<br />

If the member plans to retire under the Reciprocal Act<br />

The Illinois Retirement Systems Reciprocal Act requires<br />

a minimum of 12 months of service credit with any single<br />

reciprocal pension system. If the member has less than 12<br />

months of service in a reciprocal retirement system, that<br />

service will not be counted in the calculation of his or her<br />

reciprocal pension. Exception: A former teacher aide who<br />

transferred to a position covered by the Teachers’ Retirement<br />

System (TRS) and who has less than 12 months of <strong>IMRF</strong><br />

service credit can apply that service toward a reciprocal<br />

pension. A list of the 13 systems covered by the Act can be<br />

found in <strong>Section</strong> 5 of the <strong>IMRF</strong> Manual for Authorized Agents<br />

and on the <strong>IMRF</strong> website, www.imrf.org. Local police and fire<br />

pension funds are not covered by the Act.<br />

The governmental unit’s contribution for prior service is paid<br />

through future contribution rates. Therefore, a separate<br />

adjustment to its employer payment is not required.<br />

Employer’s Cost<br />

Each year the employer’s contribution rate is recalculated<br />

based upon its employees’ credited service through the end<br />

of the year. Any prior service purchased during the year is<br />

reflected in that calculation.<br />

<strong>IMRF</strong> Form 6.07 (Rev. 12/10)