Mise en page 1 - UniCredit Bank Slovakia as

Mise en page 1 - UniCredit Bank Slovakia as Mise en page 1 - UniCredit Bank Slovakia as

Pioneer Funds Notes to the Financial Statements as at 31 December 2012 (continued) 1. Description of the Fund (continued) Pioneer Funds - Latin American Equity Class A Non - Distributing; Class B Non - Distributing; Class C Non - Distributing; Class E Non - Distributing; Class F Non - Distributing; Class H Non - Distributing; Class I Non - Distributing Pioneer Funds - China Equity Class A Non - Distributing; Class B Non - Distributing; Class C Non - Distributing; Class E Non - Distributing; Class F Non - Distributing; Class H Non - Distributing; Class I Non - Distributing Pioneer Funds - Indian Equity Class A Non - Distributing; Class C Non - Distributing; Class E Non - Distributing; Class F Non - Distributing; Class H Non - Distributing; Class I Non - Distributing Pioneer Funds - Russian Equity Class A Non - Distributing; Class C Non - Distributing; Class E Non - Distributing; Class F Non - Distributing; Class H Non - Distributing; Class I Non - Distributing Commodities Sub-Fund Pioneer Funds - Commodity Alpha Class A Non - Distributing; Class A Hedge Non - Distributing; Class B Non - Distributing; Class C Non - Distributing; Class E Non - Distributing; Class E Hedge Non - Distributing; Class F Non - Distributing; Class H Non - Distributing; Class I Non - Distributing; Class I Hedge Distributing Annually; Class I Hedge Non Distributing 2. Significant Accounting Policies Presentation of financial statements These financial statements are prepared in accordance with Luxembourg legal and regulatory requirements relating to undertakings for collective investment in transferable securities. The financial statements reflect the Net Asset Values as calculated on 31 December 2012 based on market prices of the investments as at 31 December 2012. Where Stock Exchanges were closed on Monday 31 December 2012, the last available prices were used. Valuation of investments and other investments The following accounting policies apply: Valuation of investments Investments which are quoted or dealt in on a stock exchange or on a Regulated Market or any Other Regulated Market are valued at the last available price at 6.00 p.m. Luxembourg Time of the relevant Valuation Day except for the Sub-Funds listed below: 1. Pioneer Funds - Euro Strategic Bond, 2. Pioneer Funds - Euro High Yield, 3. Pioneer Funds - Strategic Income, 4. Pioneer Funds - U.S. High Yield, 5. Pioneer Funds - Global High Yield, 6. Pioneer Funds - Emerging Markets Bond Local Currencies, 7. Pioneer Funds - Emerging Markets Bond, 8. Pioneer Funds - Global Multi-Asset, 9. Pioneer Funds - U.S. Pioneer Fund, 10. Pioneer Funds - U.S. Research, 11. Pioneer Funds - U.S. Fundamental Growth, 12. Pioneer Funds - U.S. Research Value, 13. Pioneer Funds - North American Basic Value, 14. Pioneer Funds - U.S. Mid Cap Value, 15. Pioneer Funds - U.S. Small Companies (liquidated on 17 December 2012), 16. Pioneer Funds - Global Equity Target Income, 17. Pioneer Funds - Global Select, 18. Pioneer Funds - Global Ecology, 19. Pioneer Funds - Gold and Mining, 20. Pioneer Funds - Emerging Markets Equity, 21. Pioneer Funds - Latin American Equity, 22. Pioneer Funds - Emerging Markets Corporate High Yield Bond, 23. Pioneer Funds - Emerging Markets Corporate Bond. For these Sub-Funds, the underlying assets are valued at the last available prices at 10.00 p.m. Luxembourg time. 486 Pioneer Funds - Annual Report

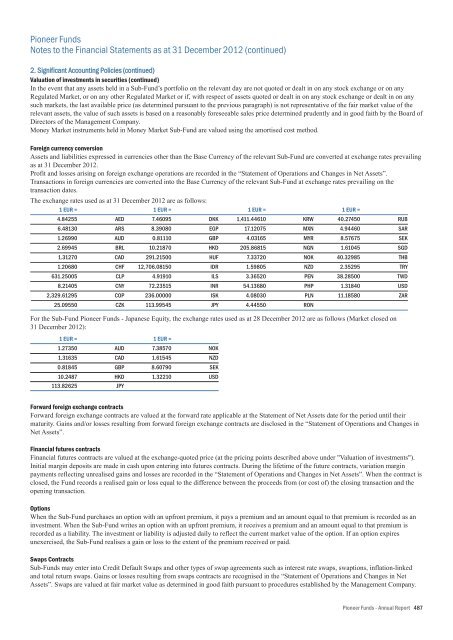

Pioneer Funds Notes to the Financial Statements as at 31 December 2012 (continued) 2. Significant Accounting Policies (continued) Valuation of investments in securities (continued) In the event that any assets held in a Sub-Fund’s portfolio on the relevant day are not quoted or dealt in on any stock exchange or on any Regulated Market, or on any other Regulated Market or if, with respect of assets quoted or dealt in on any stock exchange or dealt in on any such markets, the last available price (as determined pursuant to the previous paragraph) is not representative of the fair market value of the relevant assets, the value of such assets is based on a reasonably foreseeable sales price determined prudently and in good faith by the Board of Directors of the Management Company. Money Market instruments held in Money Market Sub-Fund are valued using the amortised cost method. Foreign currency conversion Assets and liabilities expressed in currencies other than the Base Currency of the relevant Sub-Fund are converted at exchange rates prevailing as at 31 December 2012. Profit and losses arising on foreign exchange operations are recorded in the “Statement of Operations and Changes in Net Assets”. Transactions in foreign currencies are converted into the Base Currency of the relevant Sub-Fund at exchange rates prevailing on the transaction dates. The exchange rates used as at 31 December 2012 are as follows: 1 EUR = 1 EUR = 1 EUR = 1 EUR = 4.84255 AED 7.46095 DKK 1,411.44610 KRW 40.27450 RUB 6.48130 ARS 8.39080 EGP 17.12075 MXN 4.94460 SAR 1.26990 AUD 0.81110 GBP 4.03165 MYR 8.57675 SEK 2.69945 BRL 10.21870 HKD 205.86815 NGN 1.61045 SGD 1.31270 CAD 291.21500 HUF 7.33720 NOK 40.32985 THB 1.20680 CHF 12,706.08150 IDR 1.59805 NZD 2.35295 TRY 631.25005 CLP 4.91910 ILS 3.36520 PEN 38.28500 TWD 8.21405 CNY 72.23515 INR 54.13680 PHP 1.31840 USD 2,329.61295 COP 236.00000 ISK 4.08030 PLN 11.18580 ZAR 25.09550 113.99545 JPY 4.44550 RON CZK For the Sub-Fund Pioneer Funds - Japanese Equity, the exchange rates used as at 28 December 2012 are as follows (Market closed on 31 December 2012): 1 EUR = 1 EUR = 1.27350 AUD 7.38570 NOK 1.31635 CAD 1.61545 NZD 0.81845 GBP 8.60790 SEK 10.2487 HKD 1.32210 USD 113.82625 JPY Forward foreign exchange contracts Forward foreign exchange contracts are valued at the forward rate applicable at the Statement of Net Assets date for the period until their maturity. Gains and/or losses resulting from forward foreign exchange contracts are disclosed in the “Statement of Operations and Changes in Net Assets”. Financial futures contracts Financial futures contracts are valued at the exchange-quoted price (at the pricing points described above under "Valuation of investments"). Initial margin deposits are made in cash upon entering into futures contracts. During the lifetime of the future contracts, variation margin payments reflecting unrealised gains and losses are recorded in the “Statement of Operations and Changes in Net Assets”. When the contract is closed, the Fund records a realised gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the opening transaction. Options When the Sub-Fund purchases an option with an upfront premium, it pays a premium and an amount equal to that premium is recorded as an investment. When the Sub-Fund writes an option with an upfront premium, it receives a premium and an amount equal to that premium is recorded as a liability. The investment or liability is adjusted daily to reflect the current market value of the option. If an option expires unexercised, the Sub-Fund realises a gain or loss to the extent of the premium received or paid. Swaps Contracts Sub-Funds may enter into Credit Default Swaps and other types of swap agreements such as interest rate swaps, swaptions, inflation-linked and total return swaps. Gains or losses resulting from swaps contracts are recognised in the “Statement of Operations and Changes in Net Assets”. Swaps are valued at fair market value as determined in good faith pursuant to procedures established by the Management Company. Pioneer Funds - Annual Report 487

- Page 437 and 438: Pioneer Funds - U.S. Mid Cap Value

- Page 439 and 440: Pioneer Funds - Global Equity Targe

- Page 441 and 442: Pioneer Funds - Global Equity Targe

- Page 443 and 444: Pioneer Funds - Global Select Sched

- Page 445 and 446: Pioneer Funds - Global Select Sched

- Page 447 and 448: Pioneer Funds - Global Select Sched

- Page 449 and 450: Pioneer Funds - Global Ecology Sche

- Page 451 and 452: Pioneer Funds - Gold and Mining Sch

- Page 453 and 454: Pioneer Funds - Japanese Equity Sch

- Page 455 and 456: Pioneer Funds - Japanese Equity Sch

- Page 457 and 458: Pioneer Funds - Japanese Equity Sch

- Page 459 and 460: Pioneer Funds - Emerging Markets Eq

- Page 461 and 462: Pioneer Funds - Emerging Markets Eq

- Page 463 and 464: Pioneer Funds - Emerging Europe and

- Page 465 and 466: Pioneer Funds - Emerging Europe and

- Page 467 and 468: Pioneer Funds - Asia (Ex. Japan) Eq

- Page 469 and 470: Pioneer Funds - Asia (Ex. Japan) Eq

- Page 471 and 472: Pioneer Funds - Latin American Equi

- Page 473 and 474: Pioneer Funds - China Equity Schedu

- Page 475 and 476: Pioneer Funds - China Equity Schedu

- Page 477 and 478: Pioneer Funds - Indian Equity Sched

- Page 479 and 480: Pioneer Funds - Indian Equity Sched

- Page 481 and 482: Pioneer Funds - Russian Equity Sche

- Page 483 and 484: Pioneer Funds Notes to the Financia

- Page 485 and 486: Pioneer Funds Notes to the Financia

- Page 487: Pioneer Funds Notes to the Financia

- Page 491 and 492: Pioneer Funds Notes to the Financia

- Page 493 and 494: Pioneer Funds Notes to the Financia

- Page 495 and 496: Pioneer Funds Notes to the Financia

- Page 497 and 498: Pioneer Funds Notes to the Financia

- Page 499 and 500: Pioneer Funds Notes to the Financia

- Page 501 and 502: Management and Administration Manag

- Page 503 and 504: Management and Administration (cont

Pioneer Funds<br />

Notes to the Financial Statem<strong>en</strong>ts <strong>as</strong> at 31 December 2012 (continued)<br />

2. Significant Accounting Policies (continued)<br />

Valuation of investm<strong>en</strong>ts in securities (continued)<br />

In the ev<strong>en</strong>t that any <strong>as</strong>sets held in a Sub-Fund’s portfolio on the relevant day are not quoted or dealt in on any stock exchange or on any<br />

Regulated Market, or on any other Regulated Market or if, with respect of <strong>as</strong>sets quoted or dealt in on any stock exchange or dealt in on any<br />

such markets, the l<strong>as</strong>t available price (<strong>as</strong> determined pursuant to the previous paragraph) is not repres<strong>en</strong>tative of the fair market value of the<br />

relevant <strong>as</strong>sets, the value of such <strong>as</strong>sets is b<strong>as</strong>ed on a re<strong>as</strong>onably foreseeable sales price determined prud<strong>en</strong>tly and in good faith by the Board of<br />

Directors of the Managem<strong>en</strong>t Company.<br />

Money Market instrum<strong>en</strong>ts held in Money Market Sub-Fund are valued using the amortised cost method.<br />

Foreign curr<strong>en</strong>cy conversion<br />

Assets and liabilities expressed in curr<strong>en</strong>cies other than the B<strong>as</strong>e Curr<strong>en</strong>cy of the relevant Sub-Fund are converted at exchange rates prevailing<br />

<strong>as</strong> at 31 December 2012.<br />

Profit and losses arising on foreign exchange operations are recorded in the “Statem<strong>en</strong>t of Operations and Changes in Net Assets”.<br />

Transactions in foreign curr<strong>en</strong>cies are converted into the B<strong>as</strong>e Curr<strong>en</strong>cy of the relevant Sub-Fund at exchange rates prevailing on the<br />

transaction dates.<br />

The exchange rates used <strong>as</strong> at 31 December 2012 are <strong>as</strong> follows:<br />

1 EUR =<br />

1 EUR =<br />

1 EUR =<br />

1 EUR =<br />

4.84255<br />

AED<br />

7.46095<br />

DKK 1,411.44610<br />

KRW<br />

40.27450<br />

RUB<br />

6.48130<br />

ARS<br />

8.39080<br />

EGP<br />

17.12075<br />

MXN<br />

4.94460<br />

SAR<br />

1.26990<br />

AUD<br />

0.81110<br />

GBP<br />

4.03165<br />

MYR<br />

8.57675<br />

SEK<br />

2.69945<br />

BRL<br />

10.21870<br />

HKD 205.86815<br />

NGN<br />

1.61045<br />

SGD<br />

1.31270<br />

CAD 291.21500<br />

HUF<br />

7.33720<br />

NOK<br />

40.32985<br />

THB<br />

1.20680<br />

CHF 12,706.08150<br />

IDR<br />

1.59805<br />

NZD<br />

2.35295<br />

TRY<br />

631.25005<br />

CLP<br />

4.91910<br />

ILS<br />

3.36520<br />

PEN<br />

38.28500<br />

TWD<br />

8.21405<br />

CNY<br />

72.23515<br />

INR<br />

54.13680<br />

PHP<br />

1.31840<br />

USD<br />

2,329.61295<br />

COP 236.00000<br />

ISK<br />

4.08030<br />

PLN<br />

11.18580<br />

ZAR<br />

25.09550<br />

113.99545<br />

JPY<br />

4.44550<br />

RON<br />

CZK<br />

For the Sub-Fund Pioneer Funds - Japanese Equity, the exchange rates used <strong>as</strong> at 28 December 2012 are <strong>as</strong> follows (Market closed on<br />

31 December 2012):<br />

1 EUR =<br />

1 EUR =<br />

1.27350<br />

AUD<br />

7.38570<br />

NOK<br />

1.31635<br />

CAD<br />

1.61545<br />

NZD<br />

0.81845<br />

GBP<br />

8.60790<br />

SEK<br />

10.2487<br />

HKD<br />

1.32210<br />

USD<br />

113.82625<br />

JPY<br />

Forward foreign exchange contracts<br />

Forward foreign exchange contracts are valued at the forward rate applicable at the Statem<strong>en</strong>t of Net Assets date for the period until their<br />

maturity. Gains and/or losses resulting from forward foreign exchange contracts are disclosed in the “Statem<strong>en</strong>t of Operations and Changes in<br />

Net Assets”.<br />

Financial futures contracts<br />

Financial futures contracts are valued at the exchange-quoted price (at the pricing points described above under "Valuation of investm<strong>en</strong>ts").<br />

Initial margin deposits are made in c<strong>as</strong>h upon <strong>en</strong>tering into futures contracts. During the lifetime of the future contracts, variation margin<br />

paym<strong>en</strong>ts reflecting unrealised gains and losses are recorded in the “Statem<strong>en</strong>t of Operations and Changes in Net Assets”. Wh<strong>en</strong> the contract is<br />

closed, the Fund records a realised gain or loss equal to the differ<strong>en</strong>ce betwe<strong>en</strong> the proceeds from (or cost of) the closing transaction and the<br />

op<strong>en</strong>ing transaction.<br />

Options<br />

Wh<strong>en</strong> the Sub-Fund purch<strong>as</strong>es an option with an upfront premium, it pays a premium and an amount equal to that premium is recorded <strong>as</strong> an<br />

investm<strong>en</strong>t. Wh<strong>en</strong> the Sub-Fund writes an option with an upfront premium, it receives a premium and an amount equal to that premium is<br />

recorded <strong>as</strong> a liability. The investm<strong>en</strong>t or liability is adjusted daily to reflect the curr<strong>en</strong>t market value of the option. If an option expires<br />

unexercised, the Sub-Fund realises a gain or loss to the ext<strong>en</strong>t of the premium received or paid.<br />

Swaps Contracts<br />

Sub-Funds may <strong>en</strong>ter into Credit Default Swaps and other types of swap agreem<strong>en</strong>ts such <strong>as</strong> interest rate swaps, swaptions, inflation-linked<br />

and total return swaps. Gains or losses resulting from swaps contracts are recognised in the “Statem<strong>en</strong>t of Operations and Changes in Net<br />

Assets”. Swaps are valued at fair market value <strong>as</strong> determined in good faith pursuant to procedures established by the Managem<strong>en</strong>t Company.<br />

Pioneer Funds - Annual Report 487