Mise en page 1 - UniCredit Bank Slovakia as

Mise en page 1 - UniCredit Bank Slovakia as Mise en page 1 - UniCredit Bank Slovakia as

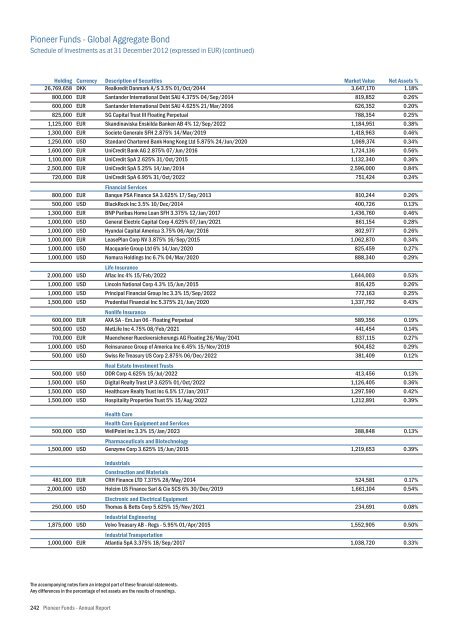

Pioneer Funds - Global Aggregate Bond Schedule of Investments as at 31 December 2012 (expressed in EUR) (continued) Holding Currency 26,769,658 DKK 800,000 EUR 600,000 EUR 825,000 EUR 1,125,000 EUR 1,300,000 EUR 1,250,000 USD 1,600,000 EUR 1,100,000 EUR 2,500,000 EUR 720,000 EUR Description of Securities Realkredit Danmark A/S 3.5% 01/Oct/2044 Santander International Debt SAU 4.375% 04/Sep/2014 Santander International Debt SAU 4.625% 21/Mar/2016 SG Capital Trust III Floating Perpetual Skandinaviska Enskilda Banken AB 4% 12/Sep/2022 Societe Generale SFH 2.875% 14/Mar/2019 Standard Chartered Bank Hong Kong Ltd 5.875% 24/Jun/2020 UniCredit Bank AG 2.875% 07/Jun/2016 UniCredit SpA 2.625% 31/Oct/2015 UniCredit SpA 5.25% 14/Jan/2014 UniCredit SpA 6.95% 31/Oct/2022 Market Value 3,647,170 819,852 626,352 788,354 1,184,951 1,418,963 1,069,374 1,724,136 1,132,340 2,596,000 751,424 Net Assets % 1.18% 0.26% 0.20% 0.25% 0.38% 0.46% 0.34% 0.56% 0.36% 0.84% 0.24% 800,000 500,000 1,300,000 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 EUR USD EUR USD USD EUR USD USD Financial Services Banque PSA Finance SA 3.625% 17/Sep/2013 BlackRock Inc 3.5% 10/Dec/2014 BNP Paribas Home Loan SFH 3.375% 12/Jan/2017 General Electric Capital Corp 4.625% 07/Jan/2021 Hyundai Capital America 3.75% 06/Apr/2016 LeasePlan Corp NV 3.875% 16/Sep/2015 Macquarie Group Ltd 6% 14/Jan/2020 Nomura Holdings Inc 6.7% 04/Mar/2020 810,244 400,726 1,436,760 861,154 802,977 1,062,870 825,459 888,340 0.26% 0.13% 0.46% 0.28% 0.26% 0.34% 0.27% 0.29% 2,000,000 1,000,000 1,000,000 1,500,000 USD USD USD USD Life Insurance Aflac Inc 4% 15/Feb/2022 Lincoln National Corp 4.3% 15/Jun/2015 Principal Financial Group Inc 3.3% 15/Sep/2022 Prudential Financial Inc 5.375% 21/Jun/2020 1,644,003 816,425 772,163 1,337,792 0.53% 0.26% 0.25% 0.43% 600,000 500,000 700,000 1,000,000 500,000 EUR USD EUR USD USD Nonlife Insurance AXA SA - Em.Jun 06 - Floating Perpetual MetLife Inc 4.75% 08/Feb/2021 Muenchener Rueckversicherungs AG Floating 26/May/2041 Reinsurance Group of America Inc 6.45% 15/Nov/2019 Swiss Re Treasury US Corp 2.875% 06/Dec/2022 589,356 441,454 837,115 904,452 381,409 0.19% 0.14% 0.27% 0.29% 0.12% 500,000 1,500,000 1,500,000 1,500,000 USD USD USD USD Real Estate Investment Trusts DDR Corp 4.625% 15/Jul/2022 Digital Realty Trust LP 3.625% 01/Oct/2022 Healthcare Realty Trust Inc 6.5% 17/Jan/2017 Hospitality Properties Trust 5% 15/Aug/2022 413,456 1,126,405 1,297,590 1,212,891 0.13% 0.36% 0.42% 0.39% 500,000 USD Health Care Health Care Equipment and Services WellPoint Inc 3.3% 15/Jan/2023 388,848 0.13% 1,500,000 USD Pharmaceuticals and Biotechnology Genzyme Corp 3.625% 15/Jun/2015 1,219,653 0.39% 481,000 2,000,000 EUR USD Industrials Construction and Materials CRH Finance LTD 7.375% 28/May/2014 Holcim US Finance Sarl & Cie SCS 6% 30/Dec/2019 524,581 1,661,104 0.17% 0.54% 250,000 USD Electronic and Electrical Equipment Thomas & Betts Corp 5.625% 15/Nov/2021 234,691 0.08% 1,875,000 USD Industrial Engineering Volvo Treasury AB - Regs - 5.95% 01/Apr/2015 1,552,905 0.50% 1,000,000 EUR Industrial Transportation Atlantia SpA 3.375% 18/Sep/2017 1,038,720 0.33% The accompanying notes form an integral part of these financial statements. Any differences in the percentage of net assets are the results of roundings. 242 Pioneer Funds - Annual Report

Pioneer Funds - Global Aggregate Bond Schedule of Investments as at 31 December 2012 (expressed in EUR) (continued) Holding Currency Description of Securities Market Value Net Assets % 200,000 USD Oil and Gas Oil and Gas Producers Canadian Natural Resources Ltd 5.9% 01/Feb/2018 182,911 0.06% 1,000,000 500,000 1,000,000 USD USD USD Oil Equipment, Services and Distribution Enterprise Products Operating LLC 4.05% 15/Feb/2022 Kinder Morgan Energy Partners LP 4.15% 01/Mar/2022 Weatherford International Ltd/Bermuda 4.5% 15/Apr/2022 835,073 409,932 806,679 0.27% 0.13% 0.26% 2,200,000 2,000,000 1,200,000 1,000,000 EUR EUR EUR USD Telecommunications Fixed Line Telecommunications AT&T Inc 6.125% 02/Apr/2015 Deutsche Telekom International Finance BV 4.25% 16/Mar/2020 Koninklijke KPN NV 6.5% 15/Jan/2016 Qtel International Finance Ltd - Regs - 6.5% 10/Jun/2014 2,473,416 2,312,510 1,370,568 812,288 0.80% 0.74% 0.44% 0.26% 800,000 2,100,000 439,000 1,245,000 1,000,000 3,000,000 1,600,000 EUR EUR EUR EUR EUR USD GBP Utilities Electricity Alliander NV Floating Perpetual Electricite de France SA 2.75% 10/Mar/2023 ESB Finance Ltd 4.375% 21/Nov/2019 ESB Finance Ltd 6.25% 11/Sep/2017 Eurogrid GmbH 3.875% 22/Oct/2020 Korea Development Bank 3.25% 09/Mar/2016 Scottish Power UK PLC 8.375% 20/Feb/2017 850,160 2,129,526 466,181 1,430,710 1,127,560 2,388,941 2,404,388 0.27% 0.69% 0.15% 0.46% 0.36% 0.77% 0.77% 350,000 350,000 218,000 EUR GBP EUR Gas, Water and Multiutilities Gas Natural Capital Markets SA 4.375% 02/Nov/2016 National Grid Gas PLC 6.375% 03/Mar/2020 Veolia Environnement SA 5.25% 24/Apr/2014 375,681 535,689 230,895 0.12% 0.17% 0.07% Total Bonds 106,163,696 34.20% Supranationals, Governments and Local Public Authorities, Debt Instruments 1,000,000 2,000,000 EUR EUR Supranationals European Financial Stability Facility 3.5% 04/Feb/2022 European Union 2.75% 21/Sep/2021 1,153,200 2,209,290 0.37% 0.71% 3,500,000 2,800,000 950,000 900,000 500,000 1,200,000 22,010,000 200,000 200,000 1,400,000 4,200,000 1,680,000 200,000 600,000 19,800,000 3,700,000 5,565,000 3,270,000 AUD AUD EUR EUR EUR EUR EUR EUR EUR CAD CAD CAD CAD CAD DKK DKK EUR EUR Governments Australia Government Bond 5.25% 15/Mar/2019 Australia Government Bond 6.5% 15/May/2013 Austria Government Bond 6.25% 15/Jul/2027 Belgium Government Bond 4% 28/Mar/2022 Belgium Government Bond 5% 28/Mar/2035 Bundesobligation 0.5% 13/Oct/2017 Bundesrepublik Deutschland Bundesobligation Inflation Linked Bond Floating 15/Apr/2013 Bundesrepublik Deutschland 4% 04/Jan/2037 Bundesrepublik Deutschland 5.5% 04/Jan/2031 Canadian Government Bond 3.5% 01/Jun/2020 Canadian Government Bond 4% 01/Jun/2017 Canadian Government Bond 4% 01/Jun/2041 Canadian Government Bond 5.25% 01/Jun/2013 Canadian Government Bond 8% 01/Jun/2023 Denmark Government Bond 4% 15/Nov/2015 Denmark Government Bond 5% 15/Nov/2013 Deutsche Bundesrepublik Inflation Linked Bond Floating 15/Apr/2023 France Government Bond OAT 4% 25/Apr/2055 3,116,678 2,234,189 1,433,954 1,058,895 667,725 1,211,790 24,894,616 270,910 305,350 1,206,350 3,560,657 1,714,785 154,990 722,301 2,964,580 518,058 6,001,483 3,915,498 1.00% 0.72% 0.46% 0.34% 0.22% 0.39% 8.02% 0.09% 0.10% 0.39% 1.15% 0.55% 0.05% 0.23% 0.95% 0.17% 1.93% 1.26% The accompanying notes form an integral part of these financial statements. Any differences in the percentage of net assets are the results of roundings. Pioneer Funds - Annual Report 243

- Page 193 and 194: Pioneer Funds - Euro Corporate Shor

- Page 195 and 196: Pioneer Funds - Euro Corporate Shor

- Page 197 and 198: Pioneer Funds - U.S. Dollar Short-T

- Page 199 and 200: Pioneer Funds - U.S. Dollar Short-T

- Page 201 and 202: Pioneer Funds - U.S. Dollar Short-T

- Page 203 and 204: Pioneer Funds - U.S. Dollar Short-T

- Page 205 and 206: Pioneer Funds - Euro Bond Schedule

- Page 207 and 208: Pioneer Funds - Euro Bond Schedule

- Page 209 and 210: Pioneer Funds - Euro Aggregate Bond

- Page 211 and 212: Pioneer Funds - Euro Aggregate Bond

- Page 213 and 214: Pioneer Funds - Euro Aggregate Bond

- Page 215 and 216: Pioneer Funds - Euro Aggregate Bond

- Page 217 and 218: Pioneer Funds - Euro Corporate Bond

- Page 219 and 220: Pioneer Funds - Euro Corporate Bond

- Page 221 and 222: Pioneer Funds - Euro Corporate Bond

- Page 223 and 224: Pioneer Funds - Euro Corporate Tren

- Page 225 and 226: Pioneer Funds - Euro Corporate Tren

- Page 227 and 228: Pioneer Funds - U.S. Dollar Aggrega

- Page 229 and 230: Pioneer Funds - U.S. Dollar Aggrega

- Page 231 and 232: Pioneer Funds - U.S. Dollar Aggrega

- Page 233 and 234: Pioneer Funds - U.S. Dollar Aggrega

- Page 235 and 236: Pioneer Funds - U.S. Dollar Aggrega

- Page 237 and 238: Pioneer Funds - U.S. Dollar Aggrega

- Page 239 and 240: Pioneer Funds - U.S. Dollar Aggrega

- Page 241 and 242: Pioneer Funds - U.S. Dollar Aggrega

- Page 243: Pioneer Funds - Global Aggregate Bo

- Page 247 and 248: Pioneer Funds - Global Aggregate Bo

- Page 249 and 250: Pioneer Funds - Global Aggregate Bo

- Page 251 and 252: Pioneer Funds - Obbligazionario Eur

- Page 253 and 254: Pioneer Funds - Obbligazionario Eur

- Page 255 and 256: Pioneer Funds - Obbligazionario Eur

- Page 257 and 258: Pioneer Funds - Obbligazionario Eur

- Page 259 and 260: Pioneer Funds - U.S. Credit Recover

- Page 261 and 262: Pioneer Funds - U.S. Credit Recover

- Page 263 and 264: Pioneer Funds - High Yield & Emergi

- Page 265 and 266: Pioneer Funds - Emerging Markets Co

- Page 267 and 268: Pioneer Funds - Emerging Markets Co

- Page 269 and 270: Pioneer Funds - Euro Strategic Bond

- Page 271 and 272: Pioneer Funds - Euro Strategic Bond

- Page 273 and 274: Pioneer Funds - Euro Strategic Bond

- Page 275 and 276: Pioneer Funds - Euro Strategic Bond

- Page 277 and 278: Pioneer Funds - Strategic Income Sc

- Page 279 and 280: Pioneer Funds - Strategic Income Sc

- Page 281 and 282: Pioneer Funds - Strategic Income Sc

- Page 283 and 284: Pioneer Funds - Strategic Income Sc

- Page 285 and 286: Pioneer Funds - Strategic Income Sc

- Page 287 and 288: Pioneer Funds - Strategic Income Sc

- Page 289 and 290: Pioneer Funds - Strategic Income Sc

- Page 291 and 292: Pioneer Funds - Strategic Income Sc

- Page 293 and 294: Pioneer Funds - Strategic Income Sc

Pioneer Funds - Global Aggregate Bond<br />

Schedule of Investm<strong>en</strong>ts <strong>as</strong> at 31 December 2012 (expressed in EUR) (continued)<br />

Holding Curr<strong>en</strong>cy<br />

26,769,658 DKK<br />

800,000 EUR<br />

600,000 EUR<br />

825,000 EUR<br />

1,125,000 EUR<br />

1,300,000 EUR<br />

1,250,000 USD<br />

1,600,000 EUR<br />

1,100,000 EUR<br />

2,500,000 EUR<br />

720,000 EUR<br />

Description of Securities<br />

Realkredit Danmark A/S 3.5% 01/Oct/2044<br />

Santander International Debt SAU 4.375% 04/Sep/2014<br />

Santander International Debt SAU 4.625% 21/Mar/2016<br />

SG Capital Trust III Floating Perpetual<br />

Skandinaviska Enskilda <strong>Bank</strong><strong>en</strong> AB 4% 12/Sep/2022<br />

Societe G<strong>en</strong>erale SFH 2.875% 14/Mar/2019<br />

Standard Chartered <strong>Bank</strong> Hong Kong Ltd 5.875% 24/Jun/2020<br />

<strong>UniCredit</strong> <strong>Bank</strong> AG 2.875% 07/Jun/2016<br />

<strong>UniCredit</strong> SpA 2.625% 31/Oct/2015<br />

<strong>UniCredit</strong> SpA 5.25% 14/Jan/2014<br />

<strong>UniCredit</strong> SpA 6.95% 31/Oct/2022<br />

Market Value<br />

3,647,170<br />

819,852<br />

626,352<br />

788,354<br />

1,184,951<br />

1,418,963<br />

1,069,374<br />

1,724,136<br />

1,132,340<br />

2,596,000<br />

751,424<br />

Net Assets %<br />

1.18%<br />

0.26%<br />

0.20%<br />

0.25%<br />

0.38%<br />

0.46%<br />

0.34%<br />

0.56%<br />

0.36%<br />

0.84%<br />

0.24%<br />

800,000<br />

500,000<br />

1,300,000<br />

1,000,000<br />

1,000,000<br />

1,000,000<br />

1,000,000<br />

1,000,000<br />

EUR<br />

USD<br />

EUR<br />

USD<br />

USD<br />

EUR<br />

USD<br />

USD<br />

Financial Services<br />

Banque PSA Finance SA 3.625% 17/Sep/2013<br />

BlackRock Inc 3.5% 10/Dec/2014<br />

BNP Parib<strong>as</strong> Home Loan SFH 3.375% 12/Jan/2017<br />

G<strong>en</strong>eral Electric Capital Corp 4.625% 07/Jan/2021<br />

Hyundai Capital America 3.75% 06/Apr/2016<br />

Le<strong>as</strong>ePlan Corp NV 3.875% 16/Sep/2015<br />

Macquarie Group Ltd 6% 14/Jan/2020<br />

Nomura Holdings Inc 6.7% 04/Mar/2020<br />

810,244<br />

400,726<br />

1,436,760<br />

861,154<br />

802,977<br />

1,062,870<br />

825,459<br />

888,340<br />

0.26%<br />

0.13%<br />

0.46%<br />

0.28%<br />

0.26%<br />

0.34%<br />

0.27%<br />

0.29%<br />

2,000,000<br />

1,000,000<br />

1,000,000<br />

1,500,000<br />

USD<br />

USD<br />

USD<br />

USD<br />

Life Insurance<br />

Aflac Inc 4% 15/Feb/2022<br />

Lincoln National Corp 4.3% 15/Jun/2015<br />

Principal Financial Group Inc 3.3% 15/Sep/2022<br />

Prud<strong>en</strong>tial Financial Inc 5.375% 21/Jun/2020<br />

1,644,003<br />

816,425<br />

772,163<br />

1,337,792<br />

0.53%<br />

0.26%<br />

0.25%<br />

0.43%<br />

600,000<br />

500,000<br />

700,000<br />

1,000,000<br />

500,000<br />

EUR<br />

USD<br />

EUR<br />

USD<br />

USD<br />

Nonlife Insurance<br />

AXA SA - Em.Jun 06 - Floating Perpetual<br />

MetLife Inc 4.75% 08/Feb/2021<br />

Mu<strong>en</strong>ch<strong>en</strong>er Rueckversicherungs AG Floating 26/May/2041<br />

Reinsurance Group of America Inc 6.45% 15/Nov/2019<br />

Swiss Re Tre<strong>as</strong>ury US Corp 2.875% 06/Dec/2022<br />

589,356<br />

441,454<br />

837,115<br />

904,452<br />

381,409<br />

0.19%<br />

0.14%<br />

0.27%<br />

0.29%<br />

0.12%<br />

500,000<br />

1,500,000<br />

1,500,000<br />

1,500,000<br />

USD<br />

USD<br />

USD<br />

USD<br />

Real Estate Investm<strong>en</strong>t Trusts<br />

DDR Corp 4.625% 15/Jul/2022<br />

Digital Realty Trust LP 3.625% 01/Oct/2022<br />

Healthcare Realty Trust Inc 6.5% 17/Jan/2017<br />

Hospitality Properties Trust 5% 15/Aug/2022<br />

413,456<br />

1,126,405<br />

1,297,590<br />

1,212,891<br />

0.13%<br />

0.36%<br />

0.42%<br />

0.39%<br />

500,000<br />

USD<br />

Health Care<br />

Health Care Equipm<strong>en</strong>t and Services<br />

WellPoint Inc 3.3% 15/Jan/2023<br />

388,848<br />

0.13%<br />

1,500,000<br />

USD<br />

Pharmaceuticals and Biotechnology<br />

G<strong>en</strong>zyme Corp 3.625% 15/Jun/2015<br />

1,219,653<br />

0.39%<br />

481,000<br />

2,000,000<br />

EUR<br />

USD<br />

Industrials<br />

Construction and Materials<br />

CRH Finance LTD 7.375% 28/May/2014<br />

Holcim US Finance Sarl & Cie SCS 6% 30/Dec/2019<br />

524,581<br />

1,661,104<br />

0.17%<br />

0.54%<br />

250,000<br />

USD<br />

Electronic and Electrical Equipm<strong>en</strong>t<br />

Thom<strong>as</strong> & Betts Corp 5.625% 15/Nov/2021<br />

234,691<br />

0.08%<br />

1,875,000<br />

USD<br />

Industrial Engineering<br />

Volvo Tre<strong>as</strong>ury AB - Regs - 5.95% 01/Apr/2015<br />

1,552,905<br />

0.50%<br />

1,000,000<br />

EUR<br />

Industrial Transportation<br />

Atlantia SpA 3.375% 18/Sep/2017<br />

1,038,720<br />

0.33%<br />

The accompanying notes form an integral part of these financial statem<strong>en</strong>ts.<br />

Any differ<strong>en</strong>ces in the perc<strong>en</strong>tage of net <strong>as</strong>sets are the results of roundings.<br />

242 Pioneer Funds - Annual Report