Original GBL Prospectus - Gabelli

Original GBL Prospectus - Gabelli Original GBL Prospectus - Gabelli

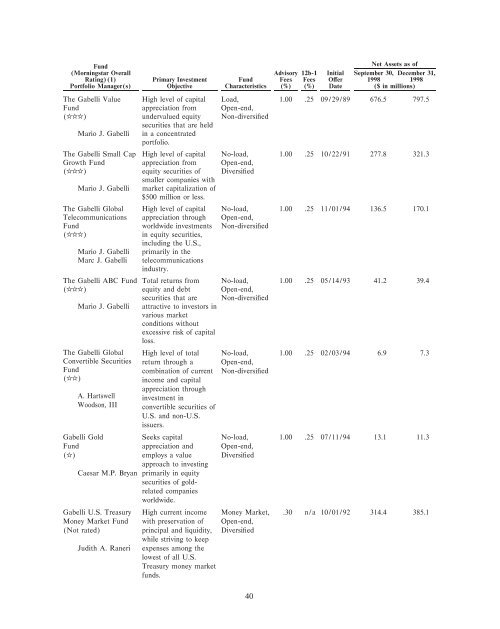

Fund Net Assets as of (Morningstar Overall Advisory 12b-1 Initial September 30, December 31, Rating)(1) Primary Investment Fund Fees Fees OÅer 1998 1998 Portfolio Manager(s) Objective Characteristics (%) (%) Date ($ in millions) The Gabelli Value High level of capital Load, 1.00 .25 09/29/89 676.5 797.5 Fund appreciation from Open-end, (rrr) undervalued equity Non-diversiÑed securities that are held Mario J. Gabelli in a concentrated portfolio. The Gabelli Small Cap High level of capital No-load, 1.00 .25 10/22/91 277.8 321.3 Growth Fund appreciation from Open-end, (rrr) equity securities of DiversiÑed smaller companies with Mario J. Gabelli market capitalization of $500 million or less. The Gabelli Global High level of capital No-load, 1.00 .25 11/01/94 136.5 170.1 Telecommunications appreciation through Open-end, Fund worldwide investments Non-diversiÑed (rrr) in equity securities, including the U.S., Mario J. Gabelli Marc J. Gabelli primarily in the telecommunications industry. The Gabelli ABC Fund Total returns from No-load, 1.00 .25 05/14/93 41.2 39.4 (rrr) equity and debt Open-end, securities that are Non-diversiÑed Mario J. Gabelli attractive to investors in various market conditions without excessive risk of capital loss. The Gabelli Global High level of total No-load, 1.00 .25 02/03/94 6.9 7.3 Convertible Securities return through a Open-end, Fund combination of current Non-diversiÑed (rr) income and capital appreciation through A. Hartswell investment in Woodson, III convertible securities of U.S. and non-U.S. issuers. Gabelli Gold Seeks capital No-load, 1.00 .25 07/11/94 13.1 11.3 Fund appreciation and Open-end, (r) employs a value DiversiÑed approach to investing Caesar M.P. Bryan primarily in equity securities of goldrelated companies worldwide. Gabelli U.S. Treasury High current income Money Market, .30 n/a 10/01/92 314.4 385.1 Money Market Fund with preservation of Open-end, (Not rated) principal and liquidity, DiversiÑed while striving to keep Judith A. Raneri expenses among the lowest of all U.S. Treasury money market funds. 40

Fund Net Assets as of (Morningstar Overall Advisory 12b-1 Initial September 30, December 31, Rating)(1) Primary Investment Fund Fees Fees OÅer 1998 1998 Portfolio Manager(s) Objective Characteristics (%) (%) Date ($ in millions) Gabelli Capital Asset Capital appreciation No-load, .75 n/a 05/01/95 134.3 155.8 Fund from equity securities Open-end, (Not rated) of companies selling at DiversiÑed a signiÑcant discount to Variable Mario J. Gabelli their private market Annuity value. The Gabelli Global High level of capital No-load, 1.00 .25 05/11/98 5.0 5.9 Opportunity Fund appreciation through Open-end, (Not rated) worldwide investments Non-diversiÑed in equity securities. Caesar M.P. Bryan Marc J. Gabelli GABELLI WESTWOOD OPEN-END FUNDS: Gabelli Westwood Capital appreciation Retail Class: 1.00 .25 01/02/87 177.9 202.1 Equity Fund through a diversiÑed No-load, (rrrr) portfolio of equity Open-end, securities using a top- DiversiÑed Susan M. Byrne down approach that Service Class: .50 1/28/94 begins with an analysis Load, of the broad, long-term Open-end, trends in the economy DiversiÑed and an assessment of the business cycle which identiÑes sectors that will beneÑt from that environment. Gabelli Westwood Both capital Retail Class: .75 .25 10/01/91 142.8 153.5 Balanced Fund appreciation and No-load, (rrrr) current income using Open-end, portfolios containing DiversiÑed Susan M. Byrne stocks, bonds, and cash Service Class: .50 4/6/93 Patricia K. Fraze as appropriate in light Load, Openof current economic end, DiversiÑed and business conditions. Gabelli Westwood Total return and No-load, .60 .25 04/06/93 7.6 7.9 Intermediate Bond current income, while Open-end, Fund limiting risk to DiversiÑed (rrr) principal. Pursues higher yields than Patricia K. Fraze shorter maturity funds, and has more price stability than generally higher yielding longterm funds. 41

- Page 1 and 2: PROSPECTUS 6,000,000 Shares Gabelli

- Page 3 and 4: PROSPECTUS SUMMARY The following su

- Page 5 and 6: The Company's subsidiary, Gabelli &

- Page 7 and 8: ‚ Increasing Marketing for Instit

- Page 9 and 10: Summary Historical and Pro Forma Fi

- Page 11 and 12: Nine Months Year Ended Ended Decemb

- Page 13 and 14: ecause the Company did not pursue t

- Page 15 and 16: Competition and Competitors with Gr

- Page 17 and 18: additional Class B Common Stock cou

- Page 19 and 20: THE COMPANY The Company is a holdin

- Page 21 and 22: USE OF PROCEEDS The net proceeds to

- Page 23 and 24: CAPITALIZATION The following table

- Page 25 and 26: Gabelli Funds, Inc. and Subsidiarie

- Page 27 and 28: MANAGEMENT'S DISCUSSION AND ANALYSI

- Page 29 and 30: Commission revenues for the nine mo

- Page 31 and 32: As a result of increased agency tra

- Page 33 and 34: functions, such as pricing its secu

- Page 35 and 36: As of December 31, 1998, the Compan

- Page 37 and 38: ‚ Widely Recognized ""Gabelli'' B

- Page 39: The following table lists the Mutua

- Page 43 and 44: Fund Net Assets as of (Morningstar

- Page 45 and 46: assigned to a speciÑc client from

- Page 47 and 48: StaÅ At December 31, 1998, the Com

- Page 49 and 50: MANAGEMENT Directors and Executive

- Page 51 and 52: (Insurance), the International Coun

- Page 53 and 54: accepted accounting principles (bef

- Page 55 and 56: Transferability Except as otherwise

- Page 57 and 58: Prior to the OÅering, the Company

- Page 59 and 60: 1997, which loan accrued interest a

- Page 61 and 62: Stock. No shares of Common Stock ar

- Page 63 and 64: Stock''), voting together as a sing

- Page 65 and 66: Under the CertiÑcate of Incorporat

- Page 67 and 68: SHARES ELIGIBLE FOR FUTURE SALE Imm

- Page 69 and 70: The Underwriters propose to oÅer t

- Page 71 and 72: LEGAL MATTERS Certain legal matters

- Page 73 and 74: REPORT OF INDEPENDENT AUDITORS The

- Page 75 and 76: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 77 and 78: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 79 and 80: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 81 and 82: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 83 and 84: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 85 and 86: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 87 and 88: GABELLI FUNDS, INC. AND SUBSIDIARIE

- Page 89 and 90: GABELLI FUNDS, INC. AND SUBSIDIARIE

Fund<br />

Net Assets as of<br />

(Morningstar Overall Advisory 12b-1 Initial September 30, December 31,<br />

Rating)(1) Primary Investment Fund Fees Fees OÅer 1998 1998<br />

Portfolio Manager(s) Objective Characteristics (%) (%) Date ($ in millions)<br />

The <strong>Gabelli</strong> Value High level of capital Load, 1.00 .25 09/29/89 676.5 797.5<br />

Fund appreciation from Open-end,<br />

(rrr) undervalued equity Non-diversiÑed<br />

securities that are held<br />

Mario J. <strong>Gabelli</strong> in a concentrated<br />

portfolio.<br />

The <strong>Gabelli</strong> Small Cap High level of capital No-load, 1.00 .25 10/22/91 277.8 321.3<br />

Growth Fund appreciation from Open-end,<br />

(rrr) equity securities of DiversiÑed<br />

smaller companies with<br />

Mario J. <strong>Gabelli</strong> market capitalization of<br />

$500 million or less.<br />

The <strong>Gabelli</strong> Global High level of capital No-load, 1.00 .25 11/01/94 136.5 170.1<br />

Telecommunications appreciation through Open-end,<br />

Fund worldwide investments Non-diversiÑed<br />

(rrr)<br />

in equity securities,<br />

including the U.S.,<br />

Mario J. <strong>Gabelli</strong><br />

Marc J. <strong>Gabelli</strong><br />

primarily in the<br />

telecommunications<br />

industry.<br />

The <strong>Gabelli</strong> ABC Fund Total returns from No-load, 1.00 .25 05/14/93 41.2 39.4<br />

(rrr) equity and debt Open-end,<br />

securities that are Non-diversiÑed<br />

Mario J. <strong>Gabelli</strong> attractive to investors in<br />

various market<br />

conditions without<br />

excessive risk of capital<br />

loss.<br />

The <strong>Gabelli</strong> Global High level of total No-load, 1.00 .25 02/03/94 6.9 7.3<br />

Convertible Securities return through a Open-end,<br />

Fund combination of current Non-diversiÑed<br />

(rr)<br />

income and capital<br />

appreciation through<br />

A. Hartswell investment in<br />

Woodson, III convertible securities of<br />

U.S. and non-U.S.<br />

issuers.<br />

<strong>Gabelli</strong> Gold Seeks capital No-load, 1.00 .25 07/11/94 13.1 11.3<br />

Fund appreciation and Open-end,<br />

(r) employs a value DiversiÑed<br />

approach to investing<br />

Caesar M.P. Bryan primarily in equity<br />

securities of goldrelated<br />

companies<br />

worldwide.<br />

<strong>Gabelli</strong> U.S. Treasury High current income Money Market, .30 n/a 10/01/92 314.4 385.1<br />

Money Market Fund with preservation of Open-end,<br />

(Not rated) principal and liquidity, DiversiÑed<br />

while striving to keep<br />

Judith A. Raneri expenses among the<br />

lowest of all U.S.<br />

Treasury money market<br />

funds.<br />

40