Tax Brochure - Caseware International Inc.

Tax Brochure - Caseware International Inc.

Tax Brochure - Caseware International Inc.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Closing the <strong>Tax</strong> Gap<br />

with CaseWare IDEA ®<br />

The U.S. Internal Revenue Service (IRS) estimates more<br />

than $350 billion goes uncollected in taxes, or into the<br />

underground economy. Known as the “tax gap,” the majority<br />

of these unpaid taxes are caused by individuals and companies<br />

understating or misreporting incomes. Other contributing factors include:<br />

Limited Resources<br />

Federal, state and local governments all face budget and staff reductions, resulting in fewer resources<br />

available to examine a greater percentage of tax returns. Staff attrition also creates gaps in expertise<br />

leading to less effective assessments and the ability to stay in front of emerging threats.<br />

Data Conundrum<br />

When it comes to tax data, variety is the norm. For example, performing a tax assessment for the<br />

restaurant industry involves examination of bank account data from numerous financial institutions,<br />

employer identification numbers (EIN), and/or numerous types of point-of-sale (POS) system data.<br />

Without a solution to bring data in from disparate systems, tax administrators are unable to analyse<br />

the full population of data.<br />

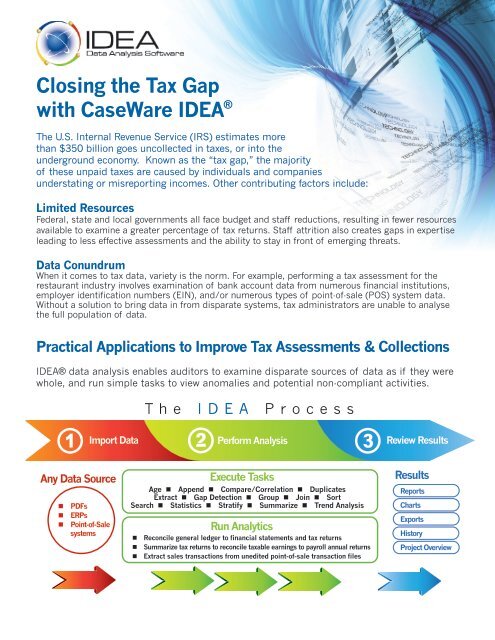

Practical Applications to Improve <strong>Tax</strong> Assessments & Collections<br />

IDEA® data analysis enables auditors to examine disparate sources of data as if they were<br />

whole, and run simple tasks to view anomalies and potential non-compliant activities.<br />

The<br />

IDEA Process<br />

Import Data<br />

Perform Analysis<br />

Review Results<br />

Any Data Source<br />

• PDFs<br />

• ERPs<br />

• Point-of-Sale<br />

systems<br />

Execute Tasks<br />

Age • Append • Compare/Correlation • Duplicates<br />

Extract • Gap Detection • Group • Join • Sort<br />

Search • Statistics • Stratify • Summarize • Trend Analysis<br />

Run Analytics<br />

• Reconcile general ledger to financial statements and tax returns<br />

• Summarize tax returns to reconcile taxable earnings to payroll annual returns<br />

• Extract sales transactions from unedited point-of-sale transaction files<br />

Results<br />

Reports<br />

Charts<br />

Exports<br />

History<br />

Project Overview

Benefits of Using IDEA ® for <strong>Tax</strong> Analysis<br />

Get the<br />

Complete Picture<br />

• Import an infinite amount<br />

of records from practically<br />

any source, including<br />

bank account details,<br />

EIN, POS system data,<br />

ERPs, spreadsheets, etc.<br />

• Read-only access to data<br />

helps ensure data integrity<br />

and accurate assessments<br />

Simplified<br />

Analysis<br />

• <strong>Tax</strong> audit specific<br />

commands that easily<br />

identify duplicates, detect<br />

gaps in numeric sequences,<br />

group data by categories<br />

and filter numerous rows<br />

and columns of data in<br />

seconds.<br />

• Automatically record<br />

every analytic step<br />

to automate repeatable<br />

processes<br />

Collaborative<br />

Analytics<br />

• One platform to gather data<br />

from disparate systems to<br />

allow entire audit team to<br />

access data and analytics<br />

from a centralized source<br />

• Synchronized decisions based<br />

on up-to-date accurate data<br />

• Audit skills and expertise<br />

can now be kept long term in<br />

a central repository.<br />

Zapper Fraud – Emerging Threat to Global <strong>Tax</strong> Revenues<br />

Clever fraudsters have discovered a way to make electronic sales transactions disappear, thus eliminating taxes owed on<br />

that revenue. An automated sales suppression device, referred to as a Zapper, is a software program designed to falsify<br />

electronic records of point of sale (POS) systems for the purpose of tax evasion. Zappers are commonly used in the<br />

restaurant and retail industries to delete electronic transactions, and have become problematic to tax administrations<br />

worldwide.<br />

The Canadian Restaurant and Food Services Association estimated suppressed sales in restaurant sector could add up<br />

to nearly CAD $2.4 billion. In a South African case the wholesalers had expatriated EUR 22 million out of South Africa.<br />

Zappers modify sales records in the POS to make it appear as though fewer transactions actually took place. It produces<br />

two sets of accounting records; one accurate set is created so the business owner can check for internal theft, and<br />

another adjusted version provided to tax authorities. Easy to conceal and install, Zappers can be accessed through USB<br />

drives, removable CDs or deployed via the Internet.<br />

Using data analysis to un-zap hidden (suppressed) sales<br />

Facing potential revenue loss due to Zapper fraud, the Canada Revenue Agency (CRA) used data analysis techniques to<br />

find hidden sales by examining raw POS system data. The CRA searched for unusual trends, such as low cash sales and<br />

low average cash bills. The agency was able to use a number of unique identifiers such as transaction ID to detect bill<br />

numbers not in sequence and analyse cash vs. non-cash ratios. The agency was able to find unreported sales of about<br />

$70 million; however a significant portion was recoverable.*<br />

*Electronic Sales Suppression: A threat to tax revenues, Organization for Economic Co-operation & Development (OECD) 2013<br />

CaseWare IDEA <strong>Inc</strong>.<br />

1 800 265 IDEA (4332) ext. 2803<br />

sales@caseware-idea.com<br />

CaseWare <strong>Inc</strong>. has over 400,000 users worldwide and is an industry leader<br />

in providing data analysis and continuous monitoring technologies for<br />

auditors, accountants and finance professionals. IDEA ® is a user-friendly<br />

tool designed for tax auditors to help extend auditing capabilities and<br />

improve revenue collections. CaseWare’s head office is in Toronto, Canada<br />

and has regional sales centers in the US, Latin America, Netherlands, China<br />

and 40 distributor partners serving 90 countries.<br />

www.caseware.com/products/idea<br />

For more information about how CaseWare IDEA can help you perform<br />

more efficient and effective <strong>Tax</strong> Analysis, contact us for a free live demonstration.