Download the booklet on SME - financing products for - Banking Info

Download the booklet on SME - financing products for - Banking Info

Download the booklet on SME - financing products for - Banking Info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Small and Medium Enterprises<br />

YOUR LOANS<br />

Small and Medium<br />

Enterprises –<br />

Financing Products <strong>for</strong><br />

Your Business<br />

A c<strong>on</strong>sumer educati<strong>on</strong> programme by:

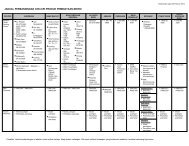

c<strong>on</strong>tents<br />

1 Introducti<strong>on</strong><br />

2 The right product <strong>for</strong><br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> right purpose<br />

Asset acquisiti<strong>on</strong>/<br />

business expansi<strong>on</strong><br />

– Term loan<br />

– Leasing<br />

– Industrial hire-purchase<br />

4 Working capital<br />

– Overdraft<br />

– Revolving credit<br />

– Factoring<br />

6 Trade <strong>financing</strong><br />

– Letter of credit or documentary credit<br />

– Trust receipts<br />

– Banker’s acceptance<br />

– Bills of exchange purchased<br />

– Foreign exchange c<strong>on</strong>tracts<br />

– Export credit <strong>financing</strong><br />

10 Trade services<br />

– Outward/inward bills <strong>for</strong> collecti<strong>on</strong><br />

11 Guarantees<br />

– Bank guarantee<br />

– Shipping guarantee<br />

Disclaimer<br />

This document is intended <strong>for</strong> your general in<strong>for</strong>mati<strong>on</strong><br />

<strong>on</strong>ly. It does not c<strong>on</strong>tain exhaustive advice or<br />

in<strong>for</strong>mati<strong>on</strong> relating to <str<strong>on</strong>g>the</str<strong>on</strong>g> subject matter nor should<br />

it be used as a substitute <strong>for</strong> legal advice.<br />

Date: 1 March 2004

Introducti<strong>on</strong><br />

Financial instituti<strong>on</strong>s offer a<br />

wide range<br />

of <strong>financing</strong> <strong>products</strong> to cater<br />

<strong>for</strong> your business needs<br />

To cater <strong>for</strong> your business needs, financial instituti<strong>on</strong>s offer a wide range of<br />

<strong>financing</strong> <strong>products</strong> <strong>for</strong> small and medium enterprises (<strong>SME</strong>s) under both<br />

c<strong>on</strong>venti<strong>on</strong>al and Islamic banking. You can choose from a wide variety of <strong>products</strong><br />

offered in <str<strong>on</strong>g>the</str<strong>on</strong>g> market, depending <strong>on</strong> your <strong>financing</strong> needs and <str<strong>on</strong>g>the</str<strong>on</strong>g> suitability of<br />

such <strong>financing</strong> to your business.<br />

This <str<strong>on</strong>g>booklet</str<strong>on</strong>g> will provide you with <str<strong>on</strong>g>the</str<strong>on</strong>g> basic knowledge <strong>on</strong> different types of<br />

<strong>products</strong> available, its uses and benefits <strong>for</strong> <strong>SME</strong>s. It aims to help you identify <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

<strong>products</strong> which are most suitable <strong>for</strong> your <strong>financing</strong> needs.

Your<br />

business<br />

would require<br />

<strong>financing</strong> <strong>for</strong> asset<br />

acquisiti<strong>on</strong> and<br />

working capital<br />

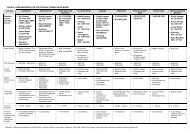

THE RIGHT PRODUCT FOR THE RIGHT<br />

PURPOSE<br />

In general, your business would require<br />

<strong>financing</strong> <strong>for</strong> asset acquisiti<strong>on</strong> and working<br />

capital. There are, however different<br />

types of <strong>financing</strong> that you can select from.<br />

For example, in acquiring business<br />

equipment, fixtures and fittings, you can<br />

choose to finance <str<strong>on</strong>g>the</str<strong>on</strong>g> acquisiti<strong>on</strong>s through<br />

an industrial hire purchase, leasing or a<br />

term loan. The final choice is yours to make.<br />

However, you may need to find out more<br />

about <str<strong>on</strong>g>the</str<strong>on</strong>g> suitability of <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>products</strong> be<strong>for</strong>e<br />

making a decisi<strong>on</strong> <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> type of <strong>financing</strong><br />

<strong>for</strong> your business.<br />

The in<strong>for</strong>mati<strong>on</strong> provided is aimed to be a<br />

guide, and as such you should c<strong>on</strong>sult your<br />

respective bankers <strong>for</strong> fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r clarificati<strong>on</strong><br />

and in<strong>for</strong>mati<strong>on</strong>.<br />

ASSET ACQUISITION/BUSINESS<br />

EXPANSION<br />

Your business requires assets in order<br />

to operate. These assets could be<br />

immovable properties such as factories,<br />

shophouses and buildings, or o<str<strong>on</strong>g>the</str<strong>on</strong>g>r assets<br />

such as vehicles, equipment, fixtures<br />

and machineries. Should you decide to<br />

purchase or lease <str<strong>on</strong>g>the</str<strong>on</strong>g>se assets, <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

available <strong>financing</strong> <strong>products</strong> are listed<br />

below:<br />

TERM LOAN<br />

• Usage<br />

To aquire fixed assets (immovable<br />

properties i.e. land and buildings, as<br />

well as commercial vehicles).<br />

• Features<br />

A loan granted <strong>for</strong> a predetermined<br />

length of time (tenure), with repayments<br />

by instalments.<br />

• Benefits<br />

Facilitate management of funds, as<br />

repayment amount is predetermined.<br />

2

LEASING<br />

• Usage<br />

To acquire capital assets such as equipment<br />

and machineries.<br />

• Features<br />

– A facility which allows <strong>SME</strong>s to lease<br />

equipment from financial instituti<strong>on</strong>s<br />

without having to purchase <str<strong>on</strong>g>the</str<strong>on</strong>g> equipment<br />

– There are 2 types of leasing facilities<br />

available:<br />

i. Operating Lease<br />

Ownership is held by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial<br />

instituti<strong>on</strong>s<br />

ii. Finance Lease<br />

Ownership is held by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial<br />

instituti<strong>on</strong>s. However, <str<strong>on</strong>g>the</str<strong>on</strong>g> lessee has<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> opti<strong>on</strong> to purchase <str<strong>on</strong>g>the</str<strong>on</strong>g> asset at<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> end of <str<strong>on</strong>g>the</str<strong>on</strong>g> tenure.<br />

• Benefits<br />

– Facilitate management of funds, as leasing<br />

instalments amount is predetermined<br />

– For an operating lease, maintenance cost is<br />

borne by <str<strong>on</strong>g>the</str<strong>on</strong>g> lessor (financial instituti<strong>on</strong>)<br />

– Instalments paid <strong>for</strong> leasing are eligible<br />

<strong>for</strong> full tax relief<br />

INDUSTRIAL HIRE-PURCHASE<br />

• Usage<br />

To acquire capital assets such as<br />

equipment and machineries.<br />

• Features<br />

– A <strong>for</strong>m of <strong>financing</strong> whereby <str<strong>on</strong>g>the</str<strong>on</strong>g> asset<br />

is purchased by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong><br />

and hired to <strong>SME</strong>s, with <str<strong>on</strong>g>the</str<strong>on</strong>g> ownership<br />

being retained by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial<br />

instituti<strong>on</strong> until <str<strong>on</strong>g>the</str<strong>on</strong>g> loan is repaid<br />

– <strong>SME</strong>s make periodic repayments to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

financial instituti<strong>on</strong><br />

• Benefits<br />

– Allow <strong>SME</strong>s to own equipment and<br />

machineries without having to pay <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

full amount upfr<strong>on</strong>t<br />

– Facilitate management of funds, as<br />

repayment amount is predetermined<br />

– Free up available funds <strong>for</strong> o<str<strong>on</strong>g>the</str<strong>on</strong>g>r<br />

purposes<br />

3

Although flexible,<br />

overdraft can be quite<br />

costly<br />

WORKING CAPITAL<br />

Besides asset <strong>financing</strong>, your business<br />

needs working capital <strong>for</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> day-to-day<br />

running of <str<strong>on</strong>g>the</str<strong>on</strong>g> business. Generally, <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

most c<strong>on</strong>venient <strong>for</strong>m of <strong>financing</strong> would<br />

be an overdraft facility from commercial<br />

banks. Although flexible, overdraft<br />

can be quite costly. You may be charged<br />

commitment fees <strong>for</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> unutilised<br />

porti<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> overdraft or revolving credit.<br />

The benefit and features of <str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>products</strong><br />

offered by financial instituti<strong>on</strong>s <strong>for</strong> working<br />

capital purposes are listed as follows:<br />

OVERDRAFT (OD)<br />

• Usage<br />

To meet working capital needs i.e. payment<br />

of salaries, purchases, utilities etc.<br />

• Features<br />

– A revolving loan made available to a<br />

business customer via a current account,<br />

whereby <str<strong>on</strong>g>the</str<strong>on</strong>g> borrower may withdraw<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> required amount each time by issuing<br />

cheques, as l<strong>on</strong>g as <str<strong>on</strong>g>the</str<strong>on</strong>g> OD limit is not<br />

exceeded<br />

– A commitment fee of 1% is charged <strong>on</strong><br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> unutilized porti<strong>on</strong> of <str<strong>on</strong>g>the</str<strong>on</strong>g> facility<br />

– Interest is calculated <strong>on</strong> a daily basis<br />

based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> balance outstanding at <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

end of each business day<br />

• Benefits<br />

Flexibility in funds management in view<br />

that <str<strong>on</strong>g>the</str<strong>on</strong>g> OD is c<strong>on</strong>tinuously available,<br />

provided <str<strong>on</strong>g>the</str<strong>on</strong>g> facilities are properly<br />

c<strong>on</strong>ducted and <str<strong>on</strong>g>the</str<strong>on</strong>g> business c<strong>on</strong>tinues to<br />

operate satisfactorily.<br />

4

REVOLVING CREDIT<br />

• Usage<br />

Similar to OD, it is short-term in nature<br />

and is used to meet short-term working<br />

capital requirements.<br />

• Features<br />

– A <strong>for</strong>m of loan granted <strong>for</strong> a fixed<br />

period which can be rolled over up<strong>on</strong><br />

expiry<br />

– A c<strong>on</strong>venient <strong>for</strong>m of short term<br />

<strong>financing</strong> <strong>for</strong> companies with good<br />

financial standing<br />

– Drawdowns by means of a letter from<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> <strong>SME</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong><br />

stating <str<strong>on</strong>g>the</str<strong>on</strong>g> period of <str<strong>on</strong>g>the</str<strong>on</strong>g> loan required<br />

• Benefits<br />

– Lower <strong>financing</strong> costs compared to<br />

c<strong>on</strong>venti<strong>on</strong>al <strong>financing</strong> instruments<br />

– C<strong>on</strong>tinuous availability of funds, as<br />

facility can be rolled over<br />

5

FACTORING<br />

• Usage<br />

To obtain short term <strong>financing</strong> of trade<br />

debts (sale of goods to customers <strong>on</strong><br />

credit terms).<br />

• Features<br />

A method of <strong>financing</strong>, where <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

financial instituti<strong>on</strong> purchases <str<strong>on</strong>g>the</str<strong>on</strong>g> client’s<br />

trade invoices at a discount from <str<strong>on</strong>g>the</str<strong>on</strong>g> face<br />

value of <str<strong>on</strong>g>the</str<strong>on</strong>g> invoices, and provide cash<br />

advances <strong>for</strong> business purposes.<br />

• Benefits<br />

– Cash advances are easily and quickly<br />

obtainable<br />

– No collateral required<br />

– Able to sell <strong>on</strong> more competitive terms<br />

to credit customers<br />

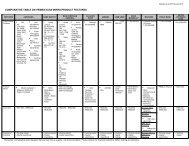

TRADE FINANCING<br />

In additi<strong>on</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g> working capital<br />

<strong>financing</strong>, financial instituti<strong>on</strong>s also<br />

provide <strong>financing</strong> <strong>for</strong> <strong>SME</strong>s that are<br />

involved in domestic and internati<strong>on</strong>al<br />

trade. Some of <str<strong>on</strong>g>the</str<strong>on</strong>g> comm<strong>on</strong> trade<br />

<strong>financing</strong> facilities provided by financial<br />

instituti<strong>on</strong>s are as follows:<br />

LETTER OF CREDIT (LC) OR DOCUMENTARY<br />

CREDIT (DC)<br />

• Usage<br />

For import or local purchases of goods,<br />

materials or equipment.<br />

• Features<br />

A written undertaking by a financial<br />

instituti<strong>on</strong> to pay a seller a given amount<br />

of m<strong>on</strong>ey subject to <str<strong>on</strong>g>the</str<strong>on</strong>g> following<br />

c<strong>on</strong>diti<strong>on</strong>s:<br />

– On presentati<strong>on</strong> of specified documents<br />

as set out in <str<strong>on</strong>g>the</str<strong>on</strong>g> terms and c<strong>on</strong>diti<strong>on</strong>s<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> LC<br />

– Within a specified time limit<br />

– At a specified place<br />

6

• Benefits<br />

– Can assure payment is made to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

beneficiary<br />

– Able to obtain a lower purchase price of<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> goods and l<strong>on</strong>ger payment terms, as<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> LC provides an indicati<strong>on</strong> of payment<br />

assurance, from <str<strong>on</strong>g>the</str<strong>on</strong>g> sellers’ perspective<br />

– Documents presented will be examined<br />

by trade <strong>financing</strong> specialists<br />

– Do not have to communicate with <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

<strong>for</strong>eign seller so often since <str<strong>on</strong>g>the</str<strong>on</strong>g> whole<br />

transacti<strong>on</strong> will be routed through and<br />

handled by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong><br />

TRUST RECEIPTS<br />

• Usage<br />

Extends credit facility <strong>on</strong> bills drawn under<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong>’s own LC. As such,<br />

customers do not have to make immediate<br />

payments <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> LCs.<br />

• Features<br />

A <strong>financing</strong> facility that enables a<br />

customer to accept delivery of <str<strong>on</strong>g>the</str<strong>on</strong>g>ir<br />

local/<strong>for</strong>eign purchases prior to payment<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> sight bills being made by <str<strong>on</strong>g>the</str<strong>on</strong>g>m.<br />

• Benefits<br />

– Enables <str<strong>on</strong>g>the</str<strong>on</strong>g> customer to pay <str<strong>on</strong>g>the</str<strong>on</strong>g> seller<br />

promptly<br />

– Enables <str<strong>on</strong>g>the</str<strong>on</strong>g> customer to take delivery<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> goods without paying <strong>for</strong> it<br />

immediately<br />

– Able to ease cashflow<br />

BANKER’S ACCEPTANCE (BA)<br />

• Usage<br />

Financing of a b<strong>on</strong>a fide trade i.e. export,<br />

import or domestic trade transacti<strong>on</strong>.<br />

• Features<br />

– A draft (Bill of Exchange) drawn by<br />

customers to <str<strong>on</strong>g>the</str<strong>on</strong>g>ir order, payable <strong>on</strong> a<br />

specific future date and accepted by<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong> <strong>for</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> purpose<br />

of <strong>financing</strong> a b<strong>on</strong>a fide trade<br />

Financial<br />

instituti<strong>on</strong>s<br />

also provide<br />

<strong>financing</strong> <strong>for</strong> <strong>SME</strong>s<br />

that are involved in<br />

domestic and<br />

internati<strong>on</strong>al trade<br />

7

– The minimum amount of <strong>financing</strong> is<br />

RM50,000 and in multiples of RM1,000<br />

(Bunching is allowed)<br />

• Benefits<br />

– Provides cash flow be<strong>for</strong>e proceeds <strong>for</strong><br />

sale of goods <strong>on</strong> credit can be collected, or<br />

to finance purchases of raw materials <strong>for</strong><br />

producti<strong>on</strong><br />

– Can always be sold at <str<strong>on</strong>g>the</str<strong>on</strong>g> prevailing<br />

market rate should <str<strong>on</strong>g>the</str<strong>on</strong>g> customer need<br />

immediate funds<br />

– Provides two-way <strong>financing</strong> as BA <strong>financing</strong><br />

is applicable <strong>for</strong> sales and purchases<br />

BILLS OF EXCHANGE PURCHASED (BEP)<br />

• Usage<br />

As a means of working capital <strong>financing</strong><br />

<strong>for</strong> exporters.<br />

• Features<br />

A facility provided by <str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong><br />

<strong>for</strong> exporters, whereby <str<strong>on</strong>g>the</str<strong>on</strong>g> financial<br />

instituti<strong>on</strong> may purchase customers’ outward<br />

bills <strong>for</strong> collecti<strong>on</strong> and <str<strong>on</strong>g>the</str<strong>on</strong>g> customers’ account<br />

is credited immediately with <str<strong>on</strong>g>the</str<strong>on</strong>g> proceeds.<br />

• Benefits<br />

– Able to obtain immediate funds up<strong>on</strong><br />

presentati<strong>on</strong> of necessary documents<br />

– Able to improve cash flow of <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

business since <strong>SME</strong>s can obtain<br />

immediate funds from <str<strong>on</strong>g>the</str<strong>on</strong>g> financial<br />

instituti<strong>on</strong><br />

FOREIGN EXCHANGE CONTRACTS (FEC)<br />

• Usage<br />

Generally <strong>for</strong> businesses, with <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

following features:<br />

– Regularly importing or exporting in<br />

<strong>for</strong>eign currencies<br />

– Of a sizeable level<br />

– With credit standing that is acceptable<br />

to <str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong><br />

• Features<br />

The buying and selling of <strong>for</strong>eign<br />

exchange <strong>on</strong> a spot or <strong>for</strong>ward basis, in<br />

respect of <strong>for</strong>eign proceeds or payments<br />

to be made at sight or at a future<br />

determinable date.<br />

8

• Benefits<br />

– Customers are able to fix <str<strong>on</strong>g>the</str<strong>on</strong>g>ir exchange<br />

rates <strong>for</strong> purpose of costing/hedging<br />

– No fur<str<strong>on</strong>g>the</str<strong>on</strong>g>r exposure to exchange risk<br />

fluctuati<strong>on</strong>s especially in volatile markets<br />

or c<strong>on</strong>diti<strong>on</strong>s<br />

EXPORT CREDIT FINANCING (ECR)<br />

• Usage<br />

– Comm<strong>on</strong>ly used by exporters with <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

following criteria:<br />

i. Exporting <strong>products</strong> with a value<br />

added of at least 20% and uses a<br />

minimum of 30% domestic raw<br />

materials/input c<strong>on</strong>tent (a tolerance<br />

allowance of 2% is permitted) and<br />

not in <str<strong>on</strong>g>the</str<strong>on</strong>g> negative list as provided<br />

by Bank Negara Malaysia<br />

ii. Direct exporter must have exported<br />

at least RM3 milli<strong>on</strong> of eligible<br />

goods per annum in <str<strong>on</strong>g>the</str<strong>on</strong>g> last<br />

financial year and RM3 milli<strong>on</strong> in<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> preceding 12 m<strong>on</strong>ths<br />

– For agricultural <strong>products</strong>, <str<strong>on</strong>g>the</str<strong>on</strong>g> amount<br />

is a minimum of RM1 milli<strong>on</strong> in <str<strong>on</strong>g>the</str<strong>on</strong>g> last<br />

financial year and preceding 12 m<strong>on</strong>ths<br />

• Features<br />

– Administered by <str<strong>on</strong>g>the</str<strong>on</strong>g> EXIM Bank.<br />

– 2 types of facilities available:<br />

• Benefits<br />

i. Pre-shipment<br />

Amount of <strong>financing</strong> can be<br />

calculated using 2 methods:<br />

Order Base<br />

80% of value of export order or<br />

sales c<strong>on</strong>tract rounded to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

nearest thousand.<br />

Certificate of Per<strong>for</strong>mance (CP)<br />

Eligible amount specified in <str<strong>on</strong>g>the</str<strong>on</strong>g> CP.<br />

ii. Post-shipment<br />

Amount of <strong>financing</strong> can be up to<br />

100% of <str<strong>on</strong>g>the</str<strong>on</strong>g> export bill, rounded<br />

to <str<strong>on</strong>g>the</str<strong>on</strong>g> nearest thousand.<br />

Cheap source of <strong>financing</strong> exports.<br />

9

TRADE SERVICES<br />

To assist customers in trade transacti<strong>on</strong>s,<br />

financial instituti<strong>on</strong>s also provide<br />

payment services. The outward/inward<br />

bills <strong>for</strong> collecti<strong>on</strong> services is listed below.<br />

OUTWARD/INWARD BILLS FOR<br />

COLLECTION (OBC/IBC)<br />

• Usage<br />

Assist customer in making payments<br />

<strong>for</strong> trade transacti<strong>on</strong>s.<br />

• Features<br />

– Documents are channeled through<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong> with specific<br />

instructi<strong>on</strong>s<br />

– Financial instituti<strong>on</strong>s handle documents<br />

<strong>on</strong> instructi<strong>on</strong>s received (from customer<br />

or ano<str<strong>on</strong>g>the</str<strong>on</strong>g>r branch or financial instituti<strong>on</strong>)<br />

to:<br />

• Benefits<br />

– Buyer:<br />

i. A safe method of payment as <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

payment can be deferred by <str<strong>on</strong>g>the</str<strong>on</strong>g> buyer<br />

until <str<strong>on</strong>g>the</str<strong>on</strong>g> goods arrive or even later<br />

if delayed payment arrangements are<br />

agreed to<br />

ii. Customers will have time to inspect <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

documents be<strong>for</strong>e paying/accepting<br />

– Seller:<br />

i. Documents of value, i.e. title<br />

documents, are not released to <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

buyer (drawee) until payment or<br />

acceptance has been affected<br />

ii. Once <str<strong>on</strong>g>the</str<strong>on</strong>g> bill is accepted by <str<strong>on</strong>g>the</str<strong>on</strong>g> buyer<br />

(drawee), <str<strong>on</strong>g>the</str<strong>on</strong>g> seller (drawer) can seek<br />

legal remedy in case of n<strong>on</strong>-payment<br />

<strong>on</strong> maturity date<br />

i. obtain acceptance and/or payment<br />

ii. deliver commercial documents against<br />

acceptance and/or against payment<br />

iii. deliver documents <strong>on</strong> o<str<strong>on</strong>g>the</str<strong>on</strong>g>r terms<br />

and c<strong>on</strong>diti<strong>on</strong>s<br />

10

GUARANTEES<br />

In additi<strong>on</strong> to <strong>financing</strong> your business,<br />

you may need guarantee facilities <strong>for</strong><br />

various purposes. A guarantee is basically<br />

a legal undertaking by a financial<br />

instituti<strong>on</strong> <strong>on</strong> your behalf (<str<strong>on</strong>g>the</str<strong>on</strong>g> third party),<br />

where it guarantees <str<strong>on</strong>g>the</str<strong>on</strong>g> payment of a<br />

certain sum of m<strong>on</strong>ey up to a certain limit<br />

to a beneficiary, in <str<strong>on</strong>g>the</str<strong>on</strong>g> event that your<br />

business fails to settle a debt or per<strong>for</strong>m a<br />

legal obligati<strong>on</strong>. This is however subject to<br />

full compliance of all terms specified in <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

relevant guarantee. There are several types<br />

of guarantees which can be arranged by<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> financial instituti<strong>on</strong> depending <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

specific requirements of <str<strong>on</strong>g>the</str<strong>on</strong>g> borrower.<br />

A financial instituti<strong>on</strong> may take into<br />

account a number of factors be<strong>for</strong>e issuing<br />

a guarantee, such as, <str<strong>on</strong>g>the</str<strong>on</strong>g> extent of liability,<br />

period and expiry, and credit standing<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> customer. The normal types of<br />

guarantees are:<br />

BANK GUARANTEE (BG)<br />

• Usage<br />

– Provides guarantee favouring a third<br />

party <strong>for</strong> per<strong>for</strong>mance, payment etc<br />

– Generally, businesses that have a<br />

particular need <strong>for</strong> BGs are c<strong>on</strong>tractors,<br />

such as building and supplier c<strong>on</strong>tractors.<br />

On <str<strong>on</strong>g>the</str<strong>on</strong>g> corporate side, BGs could also<br />

be given <strong>for</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g> issuance of private<br />

debt securities<br />

• Features<br />

– Types of guarantees:<br />

i. Tender Guarantee or Bid B<strong>on</strong>d<br />

ii. Per<strong>for</strong>mance Guarantee<br />

iii.Advance Payment Guarantee<br />

iv. Warranty of Maintenance Guarantee<br />

v. Retenti<strong>on</strong> Guarantee<br />

vi.Security Guarantee<br />

– Commissi<strong>on</strong> is charged based <strong>on</strong> <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

amount and period of <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantee<br />

A financial instituti<strong>on</strong><br />

will c<strong>on</strong>sider<br />

a number of<br />

factors be<strong>for</strong>e<br />

issuing a guarantee<br />

11

– Maximum period of guarantee is<br />

guided by <str<strong>on</strong>g>the</str<strong>on</strong>g> rules of <str<strong>on</strong>g>the</str<strong>on</strong>g> Associati<strong>on</strong><br />

of Banks in Malaysia i.e. guarantee<br />

should not be issued <strong>for</strong> more than<br />

1 year except <strong>for</strong> Government c<strong>on</strong>tracts.<br />

The expiry of <str<strong>on</strong>g>the</str<strong>on</strong>g> guarantee must not<br />

be more than 12 m<strong>on</strong>ths after <str<strong>on</strong>g>the</str<strong>on</strong>g> expiry<br />

of <str<strong>on</strong>g>the</str<strong>on</strong>g> original c<strong>on</strong>tract<br />

• Benefits<br />

– Shows <str<strong>on</strong>g>the</str<strong>on</strong>g> customer’s/applicant’s<br />

capability to per<strong>for</strong>m work as specified<br />

in <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>tract<br />

– Able to obtain more favourable<br />

trade terms from <str<strong>on</strong>g>the</str<strong>on</strong>g> beneficiary if a<br />

BG is produced<br />

– There is no necessity to raise cash to<br />

meet <str<strong>on</strong>g>the</str<strong>on</strong>g> deposit requirements and<br />

funds could be used to support working<br />

capital requirements<br />

SHIPPING GUARANTEE (SG)<br />

• Usage<br />

To expedite <str<strong>on</strong>g>the</str<strong>on</strong>g> release of goods<br />

which have arrived be<strong>for</strong>e <str<strong>on</strong>g>the</str<strong>on</strong>g> original<br />

transport documents.<br />

• Features<br />

– Guarantee or undertaking by <str<strong>on</strong>g>the</str<strong>on</strong>g> issuing<br />

financial instituti<strong>on</strong> to <str<strong>on</strong>g>the</str<strong>on</strong>g> shipping agent<br />

to release <str<strong>on</strong>g>the</str<strong>on</strong>g> goods without producti<strong>on</strong><br />

of original transport documents<br />

– Usually issued where <str<strong>on</strong>g>the</str<strong>on</strong>g> goods are<br />

initially imported under LC and is to be<br />

earmarked against TR/BA facilities<br />

• Benefits<br />

Facilitate meeting of producti<strong>on</strong> or<br />

c<strong>on</strong>tract deadlines.<br />

– Allow customers to have access to funds<br />

especially where BG is issued <strong>for</strong> advance<br />

payment or release of retenti<strong>on</strong> funds<br />

under c<strong>on</strong>tracts<br />

12

Design Copyright © 2004 by Free<strong>for</strong>m Design Sdn Bhd. All rights reserved.

FOR MORE INFORMATION<br />

LOG ON TO<br />

www.bankinginfo.com.my<br />

OR VISIT OUR KIOSK AT MOST BANKS<br />

First Editi<strong>on</strong>