DTIS, Volume I - Enhanced Integrated Framework (EIF)

DTIS, Volume I - Enhanced Integrated Framework (EIF)

DTIS, Volume I - Enhanced Integrated Framework (EIF)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

C. HIRING AND FIRING WORKERS<br />

Employment of both nationals and expatriates is also uncomplicated although there is<br />

legislation in place requiring businesses to maintain a workforce that is at least 50 per<br />

cent Maldivian. In practice, many establishments do not meet this target due to labour<br />

market rigidities e.g. skill shortages in management and financial services or aversion to<br />

certain types of employment for cultural reasons e.g. hotel maids, restaurant waiters, bar<br />

tenders in tourism and hospitality services. The overall rigidity of employment index is 7<br />

(of 100) indicating the presence of only limited numbers of restricting regulations (see<br />

Table 5.3).<br />

Work permits authorizations and other entry issues are not difficult to obtain or settle.<br />

Government policy allows foreign workers to make salary remittances to home countries.<br />

There is no personal income tax.<br />

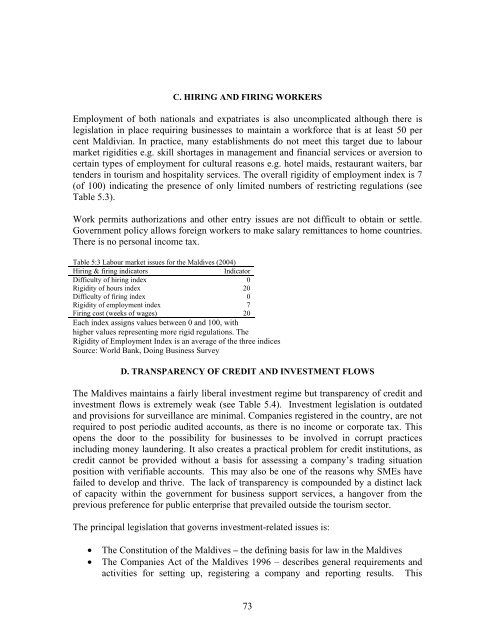

Table 5:3 Labour market issues for the Maldives (2004)<br />

Hiring & firing indicators<br />

Indicator<br />

Difficulty of hiring index 0<br />

Rigidity of hours index 20<br />

Difficulty of firing index 0<br />

Rigidity of employment index 7<br />

Firing cost (weeks of wages) 20<br />

Each index assigns values between 0 and 100, with<br />

higher values representing more rigid regulations. The<br />

Rigidity of Employment Index is an average of the three indices<br />

Source: World Bank, Doing Business Survey<br />

D. TRANSPARENCY OF CREDIT AND INVESTMENT FLOWS<br />

The Maldives maintains a fairly liberal investment regime but transparency of credit and<br />

investment flows is extremely weak (see Table 5.4). Investment legislation is outdated<br />

and provisions for surveillance are minimal. Companies registered in the country, are not<br />

required to post periodic audited accounts, as there is no income or corporate tax. This<br />

opens the door to the possibility for businesses to be involved in corrupt practices<br />

including money laundering. It also creates a practical problem for credit institutions, as<br />

credit cannot be provided without a basis for assessing a company’s trading situation<br />

position with verifiable accounts. This may also be one of the reasons why SMEs have<br />

failed to develop and thrive. The lack of transparency is compounded by a distinct lack<br />

of capacity within the government for business support services, a hangover from the<br />

previous preference for public enterprise that prevailed outside the tourism sector.<br />

The principal legislation that governs investment-related issues is:<br />

• The Constitution of the Maldives – the defining basis for law in the Maldives<br />

• The Companies Act of the Maldives 1996 – describes general requirements and<br />

activities for setting up, registering a company and reporting results. This<br />

73