Contemporary Business Studies - Academy of Knowledge Process ...

Contemporary Business Studies - Academy of Knowledge Process ...

Contemporary Business Studies - Academy of Knowledge Process ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

International Journal <strong>of</strong> <strong>Contemporary</strong> <strong>Business</strong> <strong>Studies</strong><br />

Vol: 3, No: 1. January, 2012 ISSN 2156-7506<br />

Available online at http://www.akpinsight.webs.com<br />

enjoys tax shield. In other words, tax reduces the effective cost <strong>of</strong> debt. Cost <strong>of</strong> debt can be calculated by<br />

applying the following formula:<br />

Cost <strong>of</strong> Debt = (Total Interest Expense / Beginning Total Borrowings) × (1−t) × 100<br />

Calculation <strong>of</strong> Cost <strong>of</strong> Equity (Ke):<br />

11 The cost <strong>of</strong> equity can be calculated by the Capital Asset Pricing Model (CAPM). The CAPM is<br />

normally used to determine minimum required rates <strong>of</strong> return from investment in risky assets. Stewart<br />

also used CAPM consistently as a measure for cost <strong>of</strong> equity in his methodology for computing EVA.<br />

The expected return on equity can be calculated under CAPM by applying the formula given below:<br />

Rj = Rf + b (Rm − Rf )<br />

Where Rj = Expected Return on Scrip j,<br />

Rf = Risk free rate <strong>of</strong> return,<br />

b = Beta representing the volatility <strong>of</strong> scrip j against market volatility.<br />

Rm = Expected stock market return.<br />

4.2 EVA Calculation for Indian Private Sector banks<br />

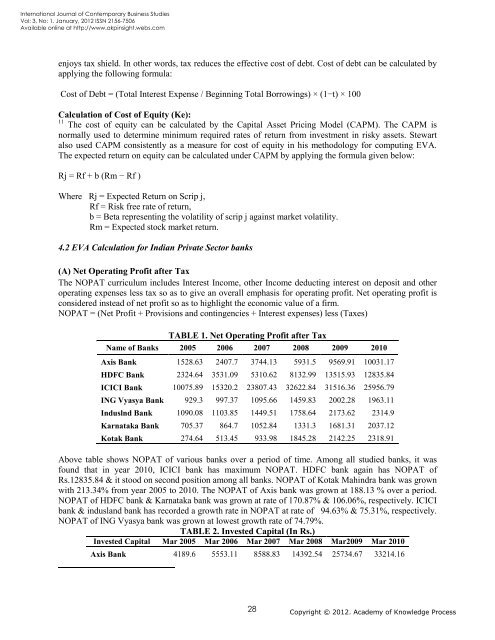

(A) Net Operating Pr<strong>of</strong>it after Tax<br />

The NOPAT curriculum includes Interest Income, other Income deducting interest on deposit and other<br />

operating expenses less tax so as to give an overall emphasis for operating pr<strong>of</strong>it. Net operating pr<strong>of</strong>it is<br />

considered instead <strong>of</strong> net pr<strong>of</strong>it so as to highlight the economic value <strong>of</strong> a firm.<br />

NOPAT = (Net Pr<strong>of</strong>it + Provisions and contingencies + Interest expenses) less (Taxes)<br />

TABLE 1. Net Operating Pr<strong>of</strong>it after Tax<br />

Name <strong>of</strong> Banks 2005 2006 2007 2008 2009 2010<br />

Axis Bank 1528.63 2407.7 3744.13 5931.5 9569.91 10031.17<br />

HDFC Bank 2324.64 3531.09 5310.62 8132.99 13515.93 12835.84<br />

ICICI Bank 10075.89 15320.2 23807.43 32622.84 31516.36 25956.79<br />

ING Vyasya Bank 929.3 997.37 1095.66 1459.83 2002.28 1963.11<br />

Induslnd Bank 1090.08 1103.85 1449.51 1758.64 2173.62 2314.9<br />

Karnataka Bank 705.37 864.7 1052.84 1331.3 1681.31 2037.12<br />

Kotak Bank 274.64 513.45 933.98 1845.28 2142.25 2318.91<br />

Above table shows NOPAT <strong>of</strong> various banks over a period <strong>of</strong> time. Among all studied banks, it was<br />

found that in year 2010, ICICI bank has maximum NOPAT. HDFC bank again has NOPAT <strong>of</strong><br />

Rs.12835.84 & it stood on second position among all banks. NOPAT <strong>of</strong> Kotak Mahindra bank was grown<br />

with 213.34% from year 2005 to 2010. The NOPAT <strong>of</strong> Axis bank was grown at 188.13 % over a period.<br />

NOPAT <strong>of</strong> HDFC bank & Karnataka bank was grown at rate <strong>of</strong> 170.87% & 106.06%, respectively. ICICI<br />

bank & indusland bank has recorded a growth rate in NOPAT at rate <strong>of</strong> 94.63% & 75.31%, respectively.<br />

NOPAT <strong>of</strong> ING Vyasya bank was grown at lowest growth rate <strong>of</strong> 74.79%.<br />

TABLE 2. Invested Capital (In Rs.)<br />

Invested Capital Mar 2005 Mar 2006 Mar 2007 Mar 2008 Mar2009 Mar 2010<br />

Axis Bank 4189.6 5553.11 8588.83 14392.54 25734.67 33214.16<br />

28<br />

Copyright © 2012. <strong>Academy</strong> <strong>of</strong> <strong>Knowledge</strong> <strong>Process</strong>