Financial Statement - Aztech Group Ltd - Investor Relations

Financial Statement - Aztech Group Ltd - Investor Relations Financial Statement - Aztech Group Ltd - Investor Relations

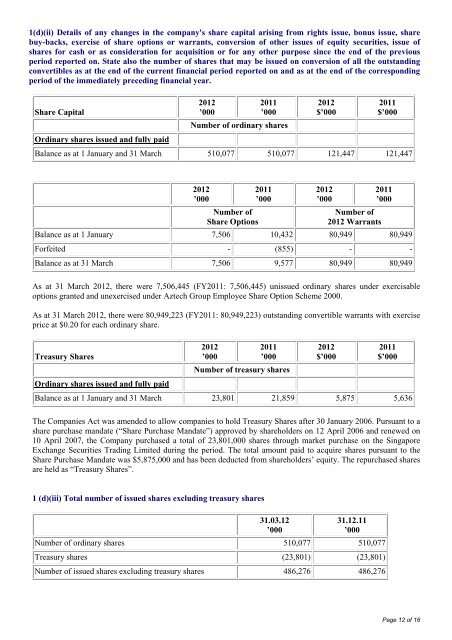

1(d)(ii) Details of any changes in the company's share capital arising from rights issue, bonus issue, share buy-backs, exercise of share options or warrants, conversion of other issues of equity securities, issue of shares for cash or as consideration for acquisition or for any other purpose since the end of the previous period reported on. State also the number of shares that may be issued on conversion of all the outstanding convertibles as at the end of the current financial period reported on and as at the end of the corresponding period of the immediately preceding financial year. Share Capital Ordinary shares issued and fully paid 2012 ’000 2011 ’000 Number of ordinary shares 2012 $’000 2011 $’000 Balance as at 1 January and 31 March 510,077 510,077 121,447 121,447 2012 ’000 Number of Share Options 2011 ’000 2012 ’000 Number of 2012 Warrants Balance as at 1 January 7,506 10,432 80,949 80,949 Forfeited - (855) - - Balance as at 31 March 7,506 9,577 80,949 80,949 2011 ’000 As at 31 March 2012, there were 7,506,445 (FY2011: 7,506,445) unissued ordinary shares under exercisable options granted and unexercised under Aztech Group Employee Share Option Scheme 2000. As at 31 March 2012, there were 80,949,223 (FY2011: 80,949,223) outstanding convertible warrants with exercise price at $0.20 for each ordinary share. Treasury Shares Ordinary shares issued and fully paid 2012 ’000 2011 ’000 Number of treasury shares 2012 $’000 2011 $’000 Balance as at 1 January and 31 March 23,801 21,859 5,875 5,636 The Companies Act was amended to allow companies to hold Treasury Shares after 30 January 2006. Pursuant to a share purchase mandate (“Share Purchase Mandate”) approved by shareholders on 12 April 2006 and renewed on 10 April 2007, the Company purchased a total of 23,801,000 shares through market purchase on the Singapore Exchange Securities Trading Limited during the period. The total amount paid to acquire shares pursuant to the Share Purchase Mandate was $5,875,000 and has been deducted from shareholders’ equity. The repurchased shares are held as “Treasury Shares”. 1 (d)(iii) Total number of issued shares excluding treasury shares 31.03.12 ’000 31.12.11 ’000 Number of ordinary shares 510,077 510,077 Treasury shares (23,801) (23,801) Number of issued shares excluding treasury shares 486,276 486,276 Page 12 of 16

1 (d)(iv) Statement showing all sales, transfers, disposal, cancellation and/or use of treasury shares as at the end of the current financial period reported on. Please refer to 1(d)(ii) 2. Whether the figures have been audited, or reviewed and in accordance with which auditing standard or practice. These figures have not been audited nor reviewed by the auditors. 3. Where the figures have been audited or reviewed, the auditors' report (including any qualifications or emphasis of a matter). Not applicable. 4. Whether the same accounting policies and methods of computation as in the issuer's most recently audited annual financial statements have been applied. The same accounting policies and methods of computation have been applied in the financial statements as in the most recently audited annual financial statements as at 31 December 2011 except for the adoption of Financial Reporting Standards (“FRSs”) which are relevant to the Group’s operations and became effective for the financial years beginning on or after 1 January 2012. 5. If there are any changes in the accounting policies and methods of computation, including any required by an accounting standard, what has changed, as well as the reasons for, and the effect of, the change. The adoption of the new and revised FRSs have no material effect on the Group’s and Company’s accounting policies or have any significant impact on the financial statements. 6. Earnings per ordinary share of the group for the current financial period reported on and the corresponding period of the immediately preceding financial year, after deducting any provision for preference dividends. Earnings (Loss) per share (EPS) GROUP 31.03.12 31.03.11 (in cents) (in cents) (a) Based on weighted average number of ordinary shares in issue 0.42 (4.30) (b) On a fully diluted basis 0.42 (4.30) Earnings (Loss) per share for 1Q2012 and 1Q2011 have been computed based on the weighted average share capital of 486,275,836and 488,217,836 shares respectively. Page 13 of 16

- Page 1 and 2: First Quarter ended 31 March 2012 F

- Page 3 and 4: 1(b)(i) A balance sheet (for the is

- Page 5 and 6: 1(b)(ii) Aggregate amount of group'

- Page 7 and 8: v) an amount of $2,000,000 extended

- Page 9 and 10: 3 months ended 3 months ended 31.03

- Page 11: Share capital Treasury shares Warra

- Page 15 and 16: Results for 1Q2012 Revenue Turnover

1(d)(ii) Details of any changes in the company's share capital arising from rights issue, bonus issue, share<br />

buy-backs, exercise of share options or warrants, conversion of other issues of equity securities, issue of<br />

shares for cash or as consideration for acquisition or for any other purpose since the end of the previous<br />

period reported on. State also the number of shares that may be issued on conversion of all the outstanding<br />

convertibles as at the end of the current financial period reported on and as at the end of the corresponding<br />

period of the immediately preceding financial year.<br />

Share Capital<br />

Ordinary shares issued and fully paid<br />

2012<br />

’000<br />

2011<br />

’000<br />

Number of ordinary shares<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Balance as at 1 January and 31 March 510,077 510,077 121,447 121,447<br />

2012<br />

’000<br />

Number of<br />

Share Options<br />

2011<br />

’000<br />

2012<br />

’000<br />

Number of<br />

2012 Warrants<br />

Balance as at 1 January 7,506 10,432 80,949 80,949<br />

Forfeited - (855) - -<br />

Balance as at 31 March 7,506 9,577 80,949 80,949<br />

2011<br />

’000<br />

As at 31 March 2012, there were 7,506,445 (FY2011: 7,506,445) unissued ordinary shares under exercisable<br />

options granted and unexercised under <strong>Aztech</strong> <strong>Group</strong> Employee Share Option Scheme 2000.<br />

As at 31 March 2012, there were 80,949,223 (FY2011: 80,949,223) outstanding convertible warrants with exercise<br />

price at $0.20 for each ordinary share.<br />

Treasury Shares<br />

Ordinary shares issued and fully paid<br />

2012<br />

’000<br />

2011<br />

’000<br />

Number of treasury shares<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Balance as at 1 January and 31 March 23,801 21,859 5,875 5,636<br />

The Companies Act was amended to allow companies to hold Treasury Shares after 30 January 2006. Pursuant to a<br />

share purchase mandate (“Share Purchase Mandate”) approved by shareholders on 12 April 2006 and renewed on<br />

10 April 2007, the Company purchased a total of 23,801,000 shares through market purchase on the Singapore<br />

Exchange Securities Trading Limited during the period. The total amount paid to acquire shares pursuant to the<br />

Share Purchase Mandate was $5,875,000 and has been deducted from shareholders’ equity. The repurchased shares<br />

are held as “Treasury Shares”.<br />

1 (d)(iii) Total number of issued shares excluding treasury shares<br />

31.03.12<br />

’000<br />

31.12.11<br />

’000<br />

Number of ordinary shares 510,077 510,077<br />

Treasury shares (23,801) (23,801)<br />

Number of issued shares excluding treasury shares 486,276 486,276<br />

Page 12 of 16