OFFERING MEMORANDUM Global Offering of up to ... - Nordex

OFFERING MEMORANDUM Global Offering of up to ... - Nordex

OFFERING MEMORANDUM Global Offering of up to ... - Nordex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

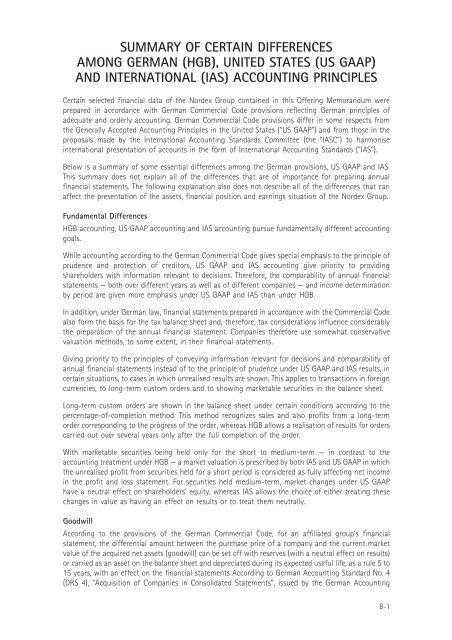

SUMMARY OF CERTAIN DIFFERENCES<br />

AMONG GERMAN (HGB), UNITED STATES (US GAAP)<br />

AND INTERNATIONAL (IAS) ACCOUNTING PRINCIPLES<br />

Certain selected financial data <strong>of</strong> the <strong>Nordex</strong> Gro<strong>up</strong> contained in this <strong>Offering</strong> Memorandum were<br />

prepared in accordance with German Commercial Code provisions reflecting German principles <strong>of</strong><br />

adequate and orderly accounting. German Commercial Code provisions differ in some respects from<br />

the Generally Accepted Accounting Principles in the United States (‘‘US GAAP’’) and from those in the<br />

proposals made by the International Accounting Standards Committee (the ‘‘IASC’’) <strong>to</strong> harmonise<br />

international presentation <strong>of</strong> accounts in the form <strong>of</strong> International Accounting Standards (‘‘IAS’’).<br />

Below is a summary <strong>of</strong> some essential differences among the German provisions, US GAAP and IAS.<br />

This summary does not explain all <strong>of</strong> the differences that are <strong>of</strong> importance for preparing annual<br />

financial statements. The following explanation also does not describe all <strong>of</strong> the differences that can<br />

affect the presentation <strong>of</strong> the assets, financial position and earnings situation <strong>of</strong> the <strong>Nordex</strong> Gro<strong>up</strong>.<br />

Fundamental Differences<br />

HGB accounting, US GAAP accounting and IAS accounting pursue fundamentally different accounting<br />

goals.<br />

While accounting according <strong>to</strong> the German Commercial Code gives special emphasis <strong>to</strong> the principle <strong>of</strong><br />

prudence and protection <strong>of</strong> credi<strong>to</strong>rs, US GAAP and IAS accounting give priority <strong>to</strong> providing<br />

shareholders with information relevant <strong>to</strong> decisions. Therefore, the comparability <strong>of</strong> annual financial<br />

statements — both over different years as well as <strong>of</strong> different companies — and income determination<br />

by period are given more emphasis under US GAAP and IAS than under HGB.<br />

In addition, under German law, financial statements prepared in accordance with the Commercial Code<br />

also form the basis for the tax balance sheet and, therefore, tax considerations influence considerably<br />

the preparation <strong>of</strong> the annual financial statement. Companies therefore use somewhat conservative<br />

valuation methods, <strong>to</strong> some extent, in their financial statements.<br />

Giving priority <strong>to</strong> the principles <strong>of</strong> conveying information relevant for decisions and comparability <strong>of</strong><br />

annual financial statements instead <strong>of</strong> <strong>to</strong> the principle <strong>of</strong> prudence under US GAAP and IAS results, in<br />

certain situations, <strong>to</strong> cases in which unrealised results are shown. This applies <strong>to</strong> transactions in foreign<br />

currencies, <strong>to</strong> long-term cus<strong>to</strong>m orders and <strong>to</strong> showing marketable securities in the balance sheet.<br />

Long-term cus<strong>to</strong>m orders are shown in the balance sheet under certain conditions according <strong>to</strong> the<br />

percentage-<strong>of</strong>-completion method. This method recognizes sales and also pr<strong>of</strong>its from a long-term<br />

order corresponding <strong>to</strong> the progress <strong>of</strong> the order, whereas HGB allows a realisation <strong>of</strong> results for orders<br />

carried out over several years only after the full completion <strong>of</strong> the order.<br />

With marketable securities being held only for the short <strong>to</strong> medium-term — in contrast <strong>to</strong> the<br />

accounting treatment under HGB — a market valuation is prescribed by both IAS and US GAAP in which<br />

the unrealised pr<strong>of</strong>it from securities held for a short period is considered as fully affecting net income<br />

in the pr<strong>of</strong>it and loss statement. For securities held medium-term, market changes under US GAAP<br />

have a neutral effect on shareholders’ equity, whereas IAS allows the choice <strong>of</strong> either treating these<br />

changes in value as having an effect on results or <strong>to</strong> treat them neutrally.<br />

Goodwill<br />

According <strong>to</strong> the provisions <strong>of</strong> the German Commercial Code, for an affiliated gro<strong>up</strong>’s financial<br />

statement, the differential amount between the purchase price <strong>of</strong> a company and the current market<br />

value <strong>of</strong> the acquired net assets (goodwill) can be set <strong>of</strong>f with reserves (with a neutral effect on results)<br />

or carried as an asset on the balance sheet and depreciated during its expected useful life, as a rule 5 <strong>to</strong><br />

15 years, with an effect on the financial statements According <strong>to</strong> German Accounting Standard No. 4<br />

(DRS 4), ‘‘Acquisition <strong>of</strong> Companies in Consolidated Statements’’, issued by the German Accounting<br />

B-1