OFFERING MEMORANDUM Global Offering of up to ... - Nordex

OFFERING MEMORANDUM Global Offering of up to ... - Nordex

OFFERING MEMORANDUM Global Offering of up to ... - Nordex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

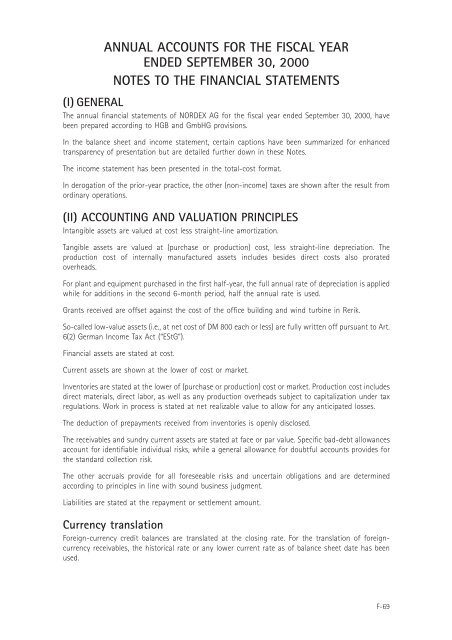

ANNUAL ACCOUNTS FOR THE FISCAL YEAR<br />

ENDED SEPTEMBER 30, 2000<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

(I) GENERAL<br />

The annual financial statements <strong>of</strong> NORDEX AG for the fiscal year ended September 30, 2000, have<br />

been prepared according <strong>to</strong> HGB and GmbHG provisions.<br />

In the balance sheet and income statement, certain captions have been summarized for enhanced<br />

transparency <strong>of</strong> presentation but are detailed further down in these Notes.<br />

The income statement has been presented in the <strong>to</strong>tal-cost format.<br />

In derogation <strong>of</strong> the prior-year practice, the other (non-income) taxes are shown after the result from<br />

ordinary operations.<br />

(II) ACCOUNTING AND VALUATION PRINCIPLES<br />

Intangible assets are valued at cost less straight-line amortization.<br />

Tangible assets are valued at (purchase or production) cost, less straight-line depreciation. The<br />

production cost <strong>of</strong> internally manufactured assets includes besides direct costs also prorated<br />

overheads.<br />

For plant and equipment purchased in the first half-year, the full annual rate <strong>of</strong> depreciation is applied<br />

while for additions in the second 6-month period, half the annual rate is used.<br />

Grants received are <strong>of</strong>fset against the cost <strong>of</strong> the <strong>of</strong>fice building and wind turbine in Rerik.<br />

So-called low-value assets (i.e., at net cost <strong>of</strong> DM 800 each or less) are fully written <strong>of</strong>f pursuant <strong>to</strong> Art.<br />

6(2) German Income Tax Act (‘‘EStG’’).<br />

Financial assets are stated at cost.<br />

Current assets are shown at the lower <strong>of</strong> cost or market.<br />

Inven<strong>to</strong>ries are stated at the lower <strong>of</strong> (purchase or production) cost or market. Production cost includes<br />

direct materials, direct labor, as well as any production overheads subject <strong>to</strong> capitalization under tax<br />

regulations. Work in process is stated at net realizable value <strong>to</strong> allow for any anticipated losses.<br />

The deduction <strong>of</strong> prepayments received from inven<strong>to</strong>ries is openly disclosed.<br />

The receivables and sundry current assets are stated at face or par value. Specific bad-debt allowances<br />

account for identifiable individual risks, while a general allowance for doubtful accounts provides for<br />

the standard collection risk.<br />

The other accruals provide for all foreseeable risks and uncertain obligations and are determined<br />

according <strong>to</strong> principles in line with sound business judgment.<br />

Liabilities are stated at the repayment or settlement amount.<br />

Currency translation<br />

Foreign-currency credit balances are translated at the closing rate. For the translation <strong>of</strong> foreigncurrency<br />

receivables, the his<strong>to</strong>rical rate or any lower current rate as <strong>of</strong> balance sheet date has been<br />

used.<br />

F-69