DECLARATION - Administration des contributions directes

DECLARATION - Administration des contributions directes DECLARATION - Administration des contributions directes

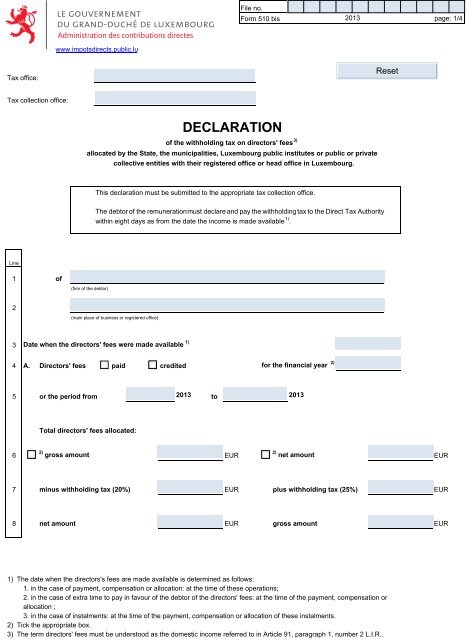

File no. Form 510 bis 2013 page: 1/4 Administration des contributions directes www.impotsdirects.public.lu Tax office: Tax collection office: DECLARATION of the withholding tax on directors' fees 3) allocated by the State, the municipalities, Luxembourg public institutes or public or private collective entities with their registered office or head office in Luxembourg. This declaration must be submitted to the appropriate tax collection office. The debtor of the remunerationmust declare and pay the withholding tax to the Direct Tax Authority within eight days as from the date the income is made available 1) . Line 1 of (firm of the debtor) 2 (main place of business or registered office) 3 Date when the directors' fees were made available 1) 4 A. Directors' fees paid credited for the financial year 2) 5 or the period from 2013 to 2013 Total directors' fees allocated: 6 2) gross amount EUR 2) net amount EUR 7 minus withholding tax (20%) EUR plus withholding tax (25%) EUR 8 net amount EUR gross amount EUR 1) The date when the directors's fees are made available is determined as follows: 1. in the case of payment, compensation or allocation: at the time of these operations; 2. in the case of extra time to pay in favour of the debtor of the directors' fees: at the time of the payment, compensation or allocation ; 3. in the case of instalments: at the time of the payment, compensation or allocation of these instalments. 2) Tick the appropriate box. 3) The term directors' fees must be understood as the domestic income referred to in Article 91, paragraph 1, number 2 L.I.R..

- Page 2 and 3: File no. Form 510 bis 2013 page: 2/

- Page 4: File no. Form 510 bis 2013 page: 4/

File no.<br />

Form 510 bis 2013<br />

page: 1/4<br />

<strong>Administration</strong> <strong>des</strong> <strong>contributions</strong> <strong>directes</strong><br />

www.impotsdirects.public.lu<br />

Tax office:<br />

Tax collection office:<br />

<strong>DECLARATION</strong><br />

of the withholding tax on directors' fees 3)<br />

allocated by the State, the municipalities, Luxembourg public institutes or public or private<br />

collective entities with their registered office or head office in Luxembourg.<br />

This declaration must be submitted to the appropriate tax collection office.<br />

The debtor of the remunerationmust declare and pay the withholding tax to the Direct Tax Authority<br />

within eight days as from the date the income is made available 1) .<br />

Line<br />

1 of<br />

(firm of the debtor)<br />

2<br />

(main place of business or registered office)<br />

3 Date when the directors' fees were made available 1)<br />

4 A. Directors' fees paid credited for the financial year 2)<br />

5 or the period from 2013 to<br />

2013<br />

Total directors' fees allocated:<br />

6<br />

2) gross amount EUR<br />

2) net amount EUR<br />

7 minus withholding tax (20%) EUR plus withholding tax (25%) EUR<br />

8 net amount EUR gross amount EUR<br />

1) The date when the directors's fees are made available is determined as follows:<br />

1. in the case of payment, compensation or allocation: at the time of these operations;<br />

2. in the case of extra time to pay in favour of the debtor of the directors' fees: at the time of the payment, compensation or<br />

allocation ;<br />

3. in the case of instalments: at the time of the payment, compensation or allocation of these instalments.<br />

2) Tick the appropriate box.<br />

3) The term directors' fees must be understood as the domestic income referred to in Article 91, paragraph 1, number 2 L.I.R..

File no.<br />

Form 510 bis 2013<br />

page: 2/4<br />

B. Breakdown of the directors' fees allocated<br />

current<br />

number<br />

beneficiaries of the directors' fees<br />

amount of the<br />

directors' fees 2)<br />

gross<br />

net<br />

amount of the withholding<br />

tax<br />

EUR<br />

%<br />

EUR<br />

1<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

2<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

3<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

4<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

5<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

6<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

7<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

8<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

to be carried forward

File no.<br />

Form 510 bis 2013<br />

page: 3/4<br />

current<br />

number<br />

beneficiaries of the shares<br />

amount of the<br />

directors' fees 2)<br />

gross<br />

net<br />

amount of the withholding<br />

tax<br />

EUR<br />

%<br />

EUR<br />

9<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

10<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

11<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

12<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

13<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

14<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

15<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

16<br />

file no.<br />

domicile<br />

name and forenames<br />

street and no.<br />

total:

File no.<br />

Form 510 bis 2013<br />

page: 4/4<br />

Line<br />

9 C. Declaration and payment of the withholding tax<br />

10<br />

debtor file no.<br />

TAX OFFICE<br />

*<br />

11 TAX COLLECTION OFFICE<br />

12 Total withholding tax (see page 1 line 7)<br />

EUR<br />

13 Date when the directors' fees were made available 1)<br />

day<br />

month<br />

year<br />

14 The withholding tax amount was paid on<br />

15<br />

I certify that this declaration is accurate and complete.<br />

16 , on<br />

17<br />

signature<br />

18<br />

name of signatory<br />

D. For the use of the Direct Tax Authority<br />

Tax office:<br />

verified:<br />

entered / posted:<br />

exchange of information made on:<br />

(date)<br />

(date)<br />

(date)<br />

(initial)<br />

(initial)<br />

(initial)<br />

* tax office co<strong>des</strong>:<br />

Sociétés 1 = S1 Sociétés 4 = S4 Sociétés 6 = S6 other: to be <strong>des</strong>ignated in<br />

Sociétés 2 = S2 Sociétés 5 = S5 Sociétés Diekirch = SN extenso<br />

Sociétés Esch = S.E.<br />

comments: 1) see page 1