Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

92<br />

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2011</strong><br />

Notes to the financial statements continued<br />

for the 52 weeks ended 21 August <strong>2011</strong><br />

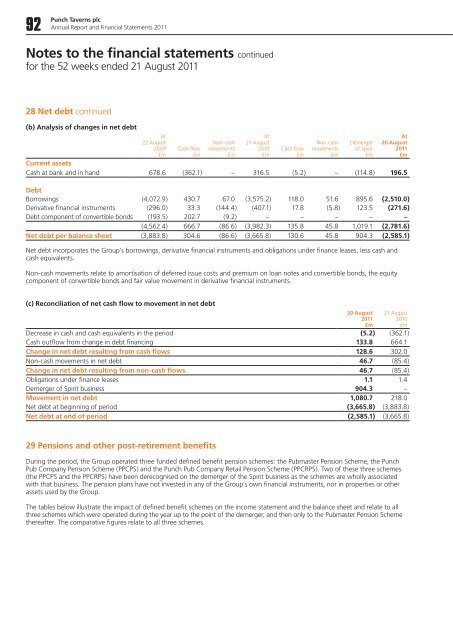

28 Net debt continued<br />

(b) Analysis of changes in net debt<br />

At<br />

22 August<br />

2009<br />

£m<br />

Cash flow<br />

£m<br />

Non-cash<br />

movements<br />

£m<br />

At<br />

21 August<br />

2010<br />

£m<br />

Cash flow<br />

£m<br />

Non-cash<br />

movements<br />

£m<br />

Demerger<br />

of Spirit<br />

£m<br />

At<br />

20 August<br />

<strong>2011</strong><br />

£m<br />

Current assets<br />

Cash at bank and in hand 678.6 (362.1) – 316.5 (5.2) – (114.8) 196.5<br />

Debt<br />

Borrowings (4,072.9) 430.7 67.0 (3,575.2) 118.0 51.6 895.6 (2,510.0)<br />

Derivative financial instruments (296.0) 33.3 (144.4) (407.1) 17.8 (5.8) 123.5 (271.6)<br />

Debt component of convertible bonds (193.5) 202.7 (9.2) – – – – –<br />

(4,562.4) 666.7 (86.6) (3,982.3) 135.8 45.8 1,019.1 (2,781.6)<br />

Net debt per balance sheet (3,883.8) 304.6 (86.6) (3,665.8) 130.6 45.8 904.3 (2,585.1)<br />

Net debt incorporates the Group’s borrowings, derivative financial instruments and obligations under finance leases, less cash and<br />

cash equivalents.<br />

Non-cash movements relate to amortisation of deferred issue costs and premium on loan notes and convertible bonds, the equity<br />

component of convertible bonds and fair value movement in derivative financial instruments.<br />

(c) Reconciliation of net cash flow to movement in net debt<br />

20 August<br />

<strong>2011</strong><br />

£m<br />

21 August<br />

2010<br />

£m<br />

Decrease in cash and cash equivalents in the period (5.2) (362.1)<br />

Cash outflow from change in debt financing 133.8 664.1<br />

Change in net debt resulting from cash flows 128.6 302.0<br />

Non-cash movements in net debt 46.7 (85.4)<br />

Change in net debt resulting from non-cash flows 46.7 (85.4)<br />

Obligations under finance leases 1.1 1.4<br />

Demerger of Spirit business 904.3 –<br />

Movement in net debt 1,080.7 218.0<br />

Net debt at beginning of period (3,665.8) (3,883.8)<br />

Net debt at end of period (2,585.1) (3,665.8)<br />

29 Pensions and other post-retirement benefits<br />

During the period, the Group operated three funded defined benefit pension schemes: the Pubmaster Pension Scheme, the <strong>Punch</strong><br />

Pub Company Pension Scheme (PPCPS) and the <strong>Punch</strong> Pub Company Retail Pension Scheme (PPCRPS). Two of these three schemes<br />

(the PPCPS and the PPCRPS) have been derecognised on the demerger of the Spirit business as the schemes are wholly associated<br />

with that business. The pension plans have not invested in any of the Group’s own financial instruments, nor in properties or other<br />

assets used by the Group.<br />

The tables below illustrate the impact of defined benefit schemes on the income statement and the balance sheet and relate to all<br />

three schemes which were operated during the year up to the point of the demerger, and then only to the Pubmaster Pension Scheme<br />

thereafter. The comparative figures relate to all three schemes.