Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

68<br />

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2011</strong><br />

Notes to the financial statements continued<br />

for the 52 weeks ended 21 August <strong>2011</strong><br />

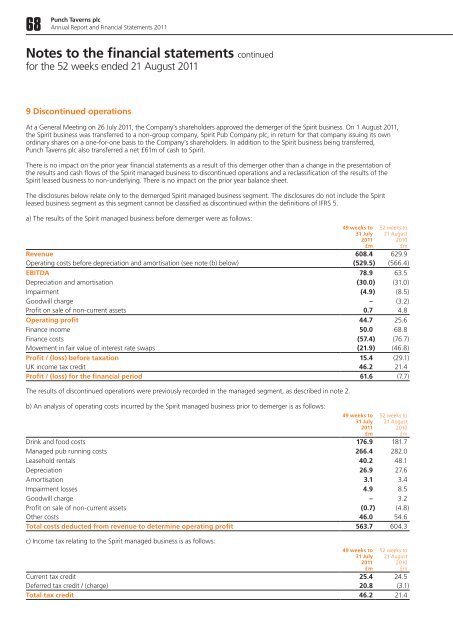

9 Discontinued operations<br />

At a General Meeting on 26 July <strong>2011</strong>, the Company’s shareholders approved the demerger of the Spirit business. On 1 August <strong>2011</strong>,<br />

the Spirit business was transferred to a non-group company, Spirit Pub Company <strong>plc</strong>, in return for that company issuing its own<br />

ordinary shares on a one-for-one basis to the Company’s shareholders. In addition to the Spirit business being transferred,<br />

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong> also transferred a net £61m of cash to Spirit.<br />

There is no impact on the prior year financial statements as a result of this demerger other than a change in the presentation of<br />

the results and cash flows of the Spirit managed business to discontinued operations and a reclassification of the results of the<br />

Spirit leased business to non-underlying. There is no impact on the prior year balance sheet.<br />

The disclosures below relate only to the demerged Spirit managed business segment. The disclosures do not include the Spirit<br />

leased business segment as this segment cannot be classified as discontinued within the definitions of IFRS 5.<br />

a) The results of the Spirit managed business before demerger were as follows:<br />

49 weeks to<br />

31 July<br />

<strong>2011</strong><br />

£m<br />

52 weeks to<br />

21 August<br />

2010<br />

£m<br />

Revenue 608.4 629.9<br />

Operating costs before depreciation and amortisation (see note (b) below) (529.5) (566.4)<br />

EBITDA 78.9 63.5<br />

Depreciation and amortisation (30.0) (31.0)<br />

Impairment (4.9) (8.5)<br />

Goodwill charge – (3.2)<br />

Profit on sale of non-current assets 0.7 4.8<br />

Operating profit 44.7 25.6<br />

Finance income 50.0 68.8<br />

Finance costs (57.4) (76.7)<br />

Movement in fair value of interest rate swaps (21.9) (46.8)<br />

Profit / (loss) before taxation 15.4 (29.1)<br />

UK income tax credit 46.2 21.4<br />

Profit / (loss) for the financial period 61.6 (7.7)<br />

The results of discontinued operations were previously recorded in the managed segment, as described in note 2.<br />

b) An analysis of operating costs incurred by the Spirit managed business prior to demerger is as follows:<br />

49 weeks to<br />

31 July<br />

<strong>2011</strong><br />

£m<br />

52 weeks to<br />

21 August<br />

2010<br />

£m<br />

Drink and food costs 176.9 181.7<br />

Managed pub running costs 266.4 282.0<br />

Leasehold rentals 40.2 48.1<br />

Depreciation 26.9 27.6<br />

Amortisation 3.1 3.4<br />

Impairment losses 4.9 8.5<br />

Goodwill charge – 3.2<br />

Profit on sale of non-current assets (0.7) (4.8)<br />

Other costs 46.0 54.6<br />

Total costs deducted from revenue to determine operating profit 563.7 604.3<br />

c) Income tax relating to the Spirit managed business is as follows:<br />

49 weeks to<br />

31 July<br />

<strong>2011</strong><br />

£m<br />

52 weeks to<br />

21 August<br />

2010<br />

£m<br />

Current tax credit 25.4 24.5<br />

Deferred tax credit / (charge) 20.8 (3.1)<br />

Total tax credit 46.2 21.4