Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2011</strong><br />

65<br />

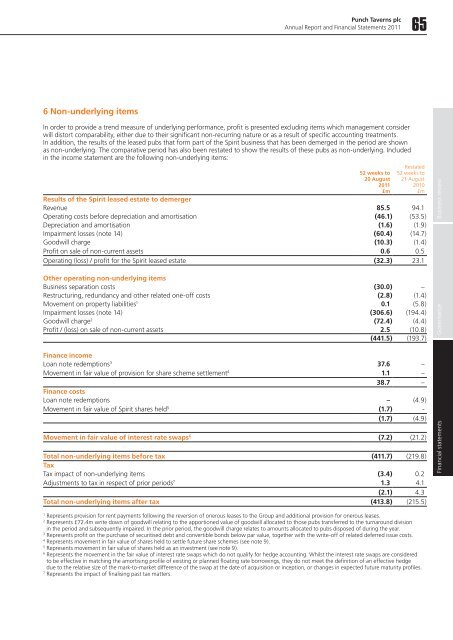

6 Non-underlying items<br />

In order to provide a trend measure of underlying performance, profit is presented excluding items which management consider<br />

will distort comparability, either due to their significant non-recurring nature or as a result of specific accounting treatments.<br />

In addition, the results of the leased pubs that form part of the Spirit business that has been demerged in the period are shown<br />

as non-underlying. The comparative period has also been restated to show the results of these pubs as non-underlying. Included<br />

in the income statement are the following non-underlying items:<br />

52 weeks to<br />

20 August<br />

<strong>2011</strong><br />

£m<br />

Restated<br />

52 weeks to<br />

21 August<br />

2010<br />

£m<br />

Results of the Spirit leased estate to demerger<br />

Revenue 85.5 94.1<br />

Operating costs before depreciation and amortisation (46.1) (53.5)<br />

Depreciation and amortisation (1.6) (1.9)<br />

Impairment losses (note 14) (60.4) (14.7)<br />

Goodwill charge (10.3) (1.4)<br />

Profit on sale of non-current assets 0.6 0.5<br />

Operating (loss) / profit for the Spirit leased estate (32.3) 23.1<br />

Other operating non-underlying items<br />

Business separation costs (30.0) –<br />

Restructuring, redundancy and other related one-off costs (2.8) (1.4)<br />

Movement on property liabilities 1 0.1 (5.8)<br />

Impairment losses (note 14) (306.6) (194.4)<br />

Goodwill charge 2 (72.4) (4.4)<br />

Profit / (loss) on sale of non-current assets 2.5 (10.8)<br />

(441.5) (193.7)<br />

Finance income<br />

Loan note redemptions 3 37.6 –<br />

Movement in fair value of provision for share scheme settlement 4 1.1 –<br />

38.7 –<br />

Finance costs<br />

Loan note redemptions – (4.9)<br />

Movement in fair value of Spirit shares held 5 (1.7) -<br />

(1.7) (4.9)<br />

Movement in fair value of interest rate swaps 6 (7.2) (21.2)<br />

Total non-underlying items before tax (411.7) (219.8)<br />

Tax<br />

Tax impact of non-underlying items (3.4) 0.2<br />

Adjustments to tax in respect of prior periods 7 1.3 4.1<br />

(2.1) 4.3<br />

Total non-underlying items after tax (413.8) (215.5)<br />

Governance Business review<br />

Financial statements<br />

1<br />

Represents provision for rent payments following the reversion of onerous leases to the Group and additional provision for onerous leases.<br />

2<br />

Represents £72.4m write down of goodwill relating to the apportioned value of goodwill allocated to those pubs transferred to the turnaround division<br />

in the period and subsequently impaired. In the prior period, the goodwill charge relates to amounts allocated to pubs disposed of during the year.<br />

3<br />

Represents profit on the purchase of securitised debt and convertible bonds below par value, together with the write-off of related deferred issue costs.<br />

4<br />

Represents movement in fair value of shares held to settle future share schemes (see note 9).<br />

5<br />

Represents movement in fair value of shares held as an investment (see note 9).<br />

6<br />

Represents the movement in the fair value of interest rate swaps which do not qualify for hedge accounting. Whilst the interest rate swaps are considered<br />

to be effective in matching the amortising profile of existing or planned floating rate borrowings, they do not meet the definition of an effective hedge<br />

due to the relative size of the mark-to-market difference of the swap at the date of acquisition or inception, or changes in expected future maturity profiles.<br />

7<br />

Represents the impact of finalising past tax matters.