Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2011</strong><br />

17<br />

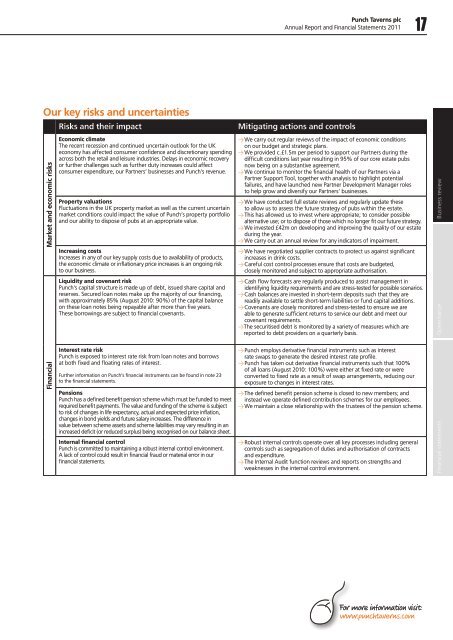

Our key risks and uncertainties<br />

Market and economic risks<br />

Financial<br />

Risks and their impact<br />

Economic climate<br />

The recent recession and continued uncertain outlook for the UK<br />

economy has affected consumer confidence and discretionary spending<br />

across both the retail and leisure industries. Delays in economic recovery<br />

or further challenges such as further duty increases could affect<br />

consumer expenditure, our Partners’ businesses and <strong>Punch</strong>’s revenue.<br />

Property valuations<br />

Fluctuations in the UK property market as well as the current uncertain<br />

market conditions could impact the value of <strong>Punch</strong>’s property portfolio<br />

and our ability to dispose of pubs at an appropriate value.<br />

Increasing costs<br />

Increases in any of our key supply costs due to availability of products,<br />

the economic climate or inflationary price increases is an ongoing risk<br />

to our business.<br />

Liquidity and covenant risk<br />

<strong>Punch</strong>’s capital structure is made up of debt, issued share capital and<br />

reserves. Secured loan notes make up the majority of our financing,<br />

with approximately 85% (August 2010: 90%) of the capital balance<br />

on these loan notes being repayable after more than five years.<br />

These borrowings are subject to financial covenants.<br />

Interest rate risk<br />

<strong>Punch</strong> is exposed to interest rate risk from loan notes and borrows<br />

at both fixed and floating rates of interest.<br />

Further information on <strong>Punch</strong>’s financial instruments can be found in note 23<br />

to the financial statements.<br />

Pensions<br />

<strong>Punch</strong> has a defined benefit pension scheme which must be funded to meet<br />

required benefit payments. The value and funding of the scheme is subject<br />

to risk of changes in life expectancy, actual and expected price inflation,<br />

changes in bond yields and future salary increases. The difference in<br />

value between scheme assets and scheme liabilities may vary resulting in an<br />

increased deficit (or reduced surplus) being recognised on our balance sheet.<br />

Internal financial control<br />

<strong>Punch</strong> is committed to maintaining a robust internal control environment.<br />

A lack of control could result in financial fraud or material error in our<br />

financial statements.<br />

Mitigating actions and controls<br />

> We carry out regular reviews of the impact of economic conditions<br />

on our budget and strategic plans.<br />

> We provided c.£1.5m per period to support our Partners during the<br />

difficult conditions last year resulting in 95% of our core estate pubs<br />

now being on a substantive agreement.<br />

> We continue to monitor the financial health of our Partners via a<br />

Partner Support Tool, together with analysis to highlight potential<br />

failures, and have launched new Partner Development Manager roles<br />

to help grow and diversify our Partners’ businesses.<br />

> We have conducted full estate reviews and regularly update these<br />

to allow us to assess the future strategy of pubs within the estate.<br />

> This has allowed us to invest where appropriate; to consider possible<br />

alternative use; or to dispose of those which no longer fit our future strategy.<br />

> We invested £42m on developing and improving the quality of our estate<br />

during the year.<br />

> We carry out an annual review for any indicators of impairment.<br />

> We have negotiated supplier contracts to protect us against significant<br />

increases in drink costs.<br />

> Careful cost control processes ensure that costs are budgeted,<br />

closely monitored and subject to appropriate authorisation.<br />

> Cash flow forecasts are regularly produced to assist management in<br />

identifying liquidity requirements and are stress-tested for possible scenarios.<br />

> Cash balances are invested in short-term deposits such that they are<br />

readily available to settle short-term liabilities or fund capital additions.<br />

> Covenants are closely monitored and stress-tested to ensure we are<br />

able to generate sufficient returns to service our debt and meet our<br />

covenant requirements.<br />

>The securitised debt is monitored by a variety of measures which are<br />

reported to debt providers on a quarterly basis.<br />

> <strong>Punch</strong> employs derivative financial instruments such as interest<br />

rate swaps to generate the desired interest rate profile.<br />

> <strong>Punch</strong> has taken out derivative financial instruments such that 100%<br />

of all loans (August 2010: 100%) were either at fixed rate or were<br />

converted to fixed rate as a result of swap arrangements, reducing our<br />

exposure to changes in interest rates.<br />

> The defined benefit pension scheme is closed to new members; and<br />

instead we operate defined contribution schemes for our employees.<br />

> We maintain a close relationship with the trustees of the pension scheme.<br />

> Robust internal controls operate over all key processes including general<br />

controls such as segregation of duties and authorisation of contracts<br />

and expenditure.<br />

> The Internal Audit function reviews and reports on strengths and<br />

weaknesses in the internal control environment.<br />

Business review<br />

Financial statements Governance<br />

For more information visit:<br />

www.punchtaverns.com