Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Punch Taverns plc 2011 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Punch</strong> <strong>Taverns</strong> <strong>plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2011</strong><br />

103<br />

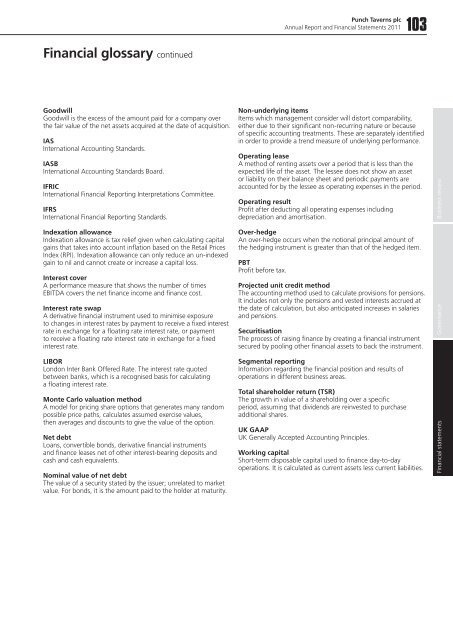

Financial glossary continued<br />

Goodwill<br />

Goodwill is the excess of the amount paid for a company over<br />

the fair value of the net assets acquired at the date of acquisition.<br />

IAS<br />

International Accounting Standards.<br />

IASB<br />

International Accounting Standards Board.<br />

IFRIC<br />

International Financial <strong>Report</strong>ing Interpretations Committee.<br />

IFRS<br />

International Financial <strong>Report</strong>ing Standards.<br />

Indexation allowance<br />

Indexation allowance is tax relief given when calculating capital<br />

gains that takes into account inflation based on the Retail Prices<br />

Index (RPI). Indexation allowance can only reduce an un-indexed<br />

gain to nil and cannot create or increase a capital loss.<br />

Interest cover<br />

A performance measure that shows the number of times<br />

EBITDA covers the net finance income and finance cost.<br />

Interest rate swap<br />

A derivative financial instrument used to minimise exposure<br />

to changes in interest rates by payment to receive a fixed interest<br />

rate in exchange for a floating rate interest rate, or payment<br />

to receive a floating rate interest rate in exchange for a fixed<br />

interest rate.<br />

LIBOR<br />

London Inter Bank Offered Rate. The interest rate quoted<br />

between banks, which is a recognised basis for calculating<br />

a floating interest rate.<br />

Monte Carlo valuation method<br />

A model for pricing share options that generates many random<br />

possible price paths, calculates assumed exercise values,<br />

then averages and discounts to give the value of the option.<br />

Net debt<br />

Loans, convertible bonds, derivative financial instruments<br />

and finance leases net of other interest-bearing deposits and<br />

cash and cash equivalents.<br />

Nominal value of net debt<br />

The value of a security stated by the issuer; unrelated to market<br />

value. For bonds, it is the amount paid to the holder at maturity.<br />

Non-underlying items<br />

Items which management consider will distort comparability,<br />

either due to their significant non-recurring nature or because<br />

of specific accounting treatments. These are separately identified<br />

in order to provide a trend measure of underlying performance.<br />

Operating lease<br />

A method of renting assets over a period that is less than the<br />

expected life of the asset. The lessee does not show an asset<br />

or liability on their balance sheet and periodic payments are<br />

accounted for by the lessee as operating expenses in the period.<br />

Operating result<br />

Profit after deducting all operating expenses including<br />

depreciation and amortisation.<br />

Over-hedge<br />

An over-hedge occurs when the notional principal amount of<br />

the hedging instrument is greater than that of the hedged item.<br />

PBT<br />

Profit before tax.<br />

Projected unit credit method<br />

The accounting method used to calculate provisions for pensions.<br />

It includes not only the pensions and vested interests accrued at<br />

the date of calculation, but also anticipated increases in salaries<br />

and pensions.<br />

Securitisation<br />

The process of raising finance by creating a financial instrument<br />

secured by pooling other financial assets to back the instrument.<br />

Segmental reporting<br />

Information regarding the financial position and results of<br />

operations in different business areas.<br />

Total shareholder return (TSR)<br />

The growth in value of a shareholding over a specific<br />

period, assuming that dividends are reinvested to purchase<br />

additional shares.<br />

UK GAAP<br />

UK Generally Accepted Accounting Principles.<br />

Working capital<br />

Short-term disposable capital used to finance day-to-day<br />

operations. It is calculated as current assets less current liabilities.<br />

Governance Business review<br />

Financial statements