Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

34 CROSS-SEGMENT OFFERING – UTILIZING THE LINK OF BUSINESS AND PERSONAL NEEDS Furthermore, expectations vary among countries and it is important to understand all the local specialties of clients. Deviations can result from different country cultures or grey economy aspects in CEE compared to Western Europe. Thus it may be risky for some CEE clients to make their wealth visible for tax authorities with one-stop shopping. COVERAGE MODEL ALTERNATIVES There are four major models that can be used when serving two identities of a client. Our interviews showed that the majority of the CEE banks use the separated-businessand-private-banking model. This traditional approach does not allow the full utilization of client potential and guarantees no more than limited information sharing, even in case of a sophisticated cross-motivation system. The super-banker model is mainly applied in Western Europe where economies are much more transparent and the grey zone is insignificant. There banks can afford the most expensive relationship managers that are able to serve both private and business needs of micro clients. This model requires high quality staff and a huge amount of trainings. Thus it is not yet recommended for implementation in Central and Eastern Europe. Here banks should rather strive for the lead-banker model, which is one centralization step before the super-banker one. With lower expenditure, it nevertheless offers fast information flow and opportunity utilization as well as a "virtual" one-stop shopping experience for clients. For initiators, there are two types of cross-capturing in terms of private and micro business needs: either they motivate professionals to use the banking services for private purposes as well or they target private clients (mainly affluents in CEE) considering their micro business interest.

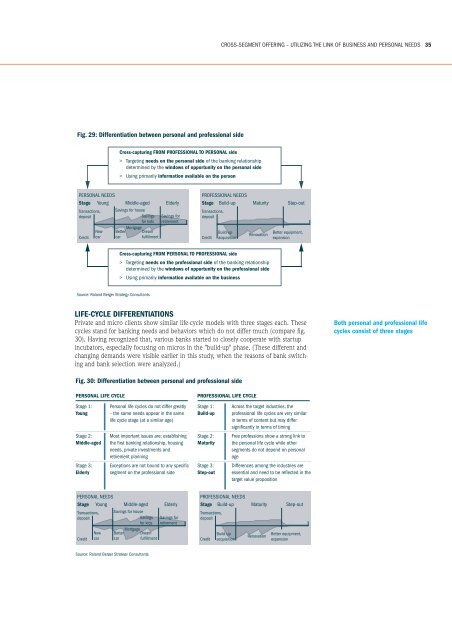

CROSS-SEGMENT OFFERING – UTILIZING THE LINK OF BUSINESS AND PERSONAL NEEDS 35 LIFE-CYCLE DIFFERENTIATIONS Private and micro clients show similar life-cycle models with three stages each. These cycles stand for banking needs and behaviors which do not differ much (compare fig. 30). Having recognized that, various banks started to closely cooperate with startup incubators, especially focusing on micros in the "build-up" phase. (These different and changing demands were visible earlier in this study, when the reasons of bank switching and bank selection were analyzed.) Both personal and professional life cycles consist of three stages

- Page 1: RETAIL BANKING IN CEE EXPLOITING OP

- Page 5: PREFACE 3 PREFACE EFMA AND ROLAND B

- Page 8 and 9: 6 SUMMARY OF KEY FINDINGS SUMMARY O

- Page 11 and 12: 9 PART I IMPORTANCE OF MICRO BUSINE

- Page 13 and 14: IMPORTANCE OF MICRO BUSINESS - HIGH

- Page 15: IMPORTANCE OF MICRO BUSINESS - HIGH

- Page 18 and 19: 16 MICRO STRATEGIES - ELABORATING S

- Page 20 and 21: 18 MICRO STRATEGIES - ELABORATING S

- Page 22 and 23: 20 MICRO STRATEGIES - ELABORATING S

- Page 24 and 25: 22 MICRO STRATEGIES - ELABORATING S

- Page 26 and 27: 24 MICRO STRATEGIES - ELABORATING S

- Page 29 and 30: 27 PART III RISK MANAGEMENT - MANAG

- Page 31: RISK MANAGEMENT - MANAGING RISK COS

- Page 34 and 35: 32 CROSS-SEGMENT OFFERING - UTILIZI

- Page 38 and 39: 36 CROSS-SEGMENT OFFERING - UTILIZI

- Page 41 and 42: 39 PART V SUMMARY - RECOMMENDATIONS

- Page 43 and 44: SUMMARY - RECOMMENDATIONS FOR "MICR

- Page 45: METHODOLOGY AND SCOPE OF THE STUDY

- Page 49: 47 Many thanks to the following per

CROSS-SEGMENT OFFERING – UTILIZING THE LINK OF BUSINESS AND PERSONAL NEEDS 35<br />

LIFE-CYCLE DIFFERENTIATIONS<br />

Private and micro clients show similar life-cycle models with three stages each. These<br />

cycles stand for bank<strong>in</strong>g needs and behaviors which do not differ much (compare fig.<br />

30). Hav<strong>in</strong>g recognized that, various banks started to closely cooperate with startup<br />

<strong>in</strong>cubators, especially focus<strong>in</strong>g on micros <strong>in</strong> <strong>the</strong> "build-up" phase. (These different and<br />

chang<strong>in</strong>g demands were visible earlier <strong>in</strong> this study, when <strong>the</strong> reasons <strong>of</strong> bank switch<strong>in</strong>g<br />

and bank selection were analyzed.)<br />

Both personal and pr<strong>of</strong>essional life<br />

cycles consist <strong>of</strong> three stages