Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger Retail Banking in CEE: Exploiting the Potential of ... - Roland Berger

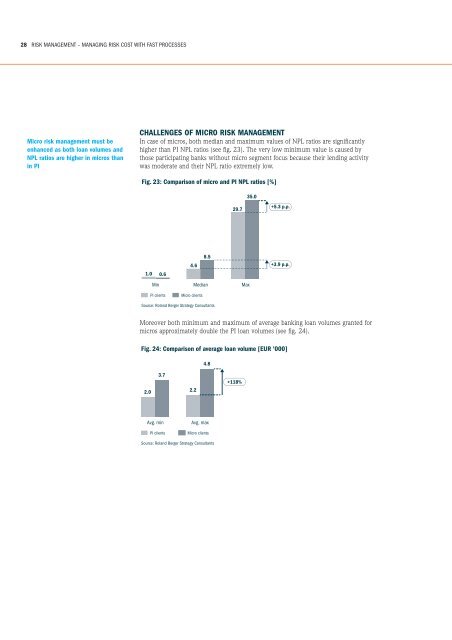

28 RISK MANAGEMENT – MANAGING RISK COST WITH FAST PROCESSES Micro risk management must be enhanced as both loan volumes and NPL ratios are higher in micros than in PI CHALLENGES OF MICRO RISK MANAGEMENT In case of micros, both median and maximum values of NPL ratios are significantly higher than PI NPL ratios (see fig. 23). The very low minimum value is caused by those participating banks without micro segment focus because their lending activity was moderate and their NPL ratio extremely low. Moreover both minimum and maximum of average banking loan volumes granted for micros approximately double the PI loan volumes (see fig. 24).

RISK MANAGEMENT – MANAGING RISK COST WITH FAST PROCESSES 29 SOLUTION DEPENDING ON THE APPLIED SEGMENTATION The recommendations to avoid an unexpected growth of NPL rates can be grouped into two major topics: A. Segment-specific risk assessment and scoring Generally banks assume: one client group with a high NPL is not a problem if it was priced accordingly. To be able to price accordingly, however, banks need to forecast the risks as exactly as possible before a loan becomes an NPL. Thus elaborating a proper risk assessment (scoring) tool for micro sub-segments has a huge added value but was not found in many participating banks. Setting up such a tool requires the following steps: Homogeneous risk groups of micro sub-segments allow an efficient scoring model and a fast lending process 1. Having defined suitable target sub-segments, create a proper scoring database for micros 2. Analyze the existing loan portfolio of the targeted sub-segments with their loan volumes (min, median, max) and NPL ratio 3. Incorporate the identified risk cost into the normal pricing of lending products for the targeted sub-segments B. Fast and transparent processes to assess loan requests Loan request assessments usually take time because the evaluation processes and criteria are not properly defined. That means, standardization is not possible and each request is evaluated on a case-by-case basis. The root cause is the non-proper scoring system, thus each process weakness is in reality a workaround to compensate for the weaknesses of the scoring model. Establishing a sub-segment based micro scoring model allows a fast and automatic evaluation of loan requests in a standardized form. This satisfies the clients in terms of processing speed and helps the bank avoid non-planned NPL growth.

- Page 1: RETAIL BANKING IN CEE EXPLOITING OP

- Page 5: PREFACE 3 PREFACE EFMA AND ROLAND B

- Page 8 and 9: 6 SUMMARY OF KEY FINDINGS SUMMARY O

- Page 11 and 12: 9 PART I IMPORTANCE OF MICRO BUSINE

- Page 13 and 14: IMPORTANCE OF MICRO BUSINESS - HIGH

- Page 15: IMPORTANCE OF MICRO BUSINESS - HIGH

- Page 18 and 19: 16 MICRO STRATEGIES - ELABORATING S

- Page 20 and 21: 18 MICRO STRATEGIES - ELABORATING S

- Page 22 and 23: 20 MICRO STRATEGIES - ELABORATING S

- Page 24 and 25: 22 MICRO STRATEGIES - ELABORATING S

- Page 26 and 27: 24 MICRO STRATEGIES - ELABORATING S

- Page 29: 27 PART III RISK MANAGEMENT - MANAG

- Page 34 and 35: 32 CROSS-SEGMENT OFFERING - UTILIZI

- Page 36 and 37: 34 CROSS-SEGMENT OFFERING - UTILIZI

- Page 38 and 39: 36 CROSS-SEGMENT OFFERING - UTILIZI

- Page 41 and 42: 39 PART V SUMMARY - RECOMMENDATIONS

- Page 43 and 44: SUMMARY - RECOMMENDATIONS FOR "MICR

- Page 45: METHODOLOGY AND SCOPE OF THE STUDY

- Page 49: 47 Many thanks to the following per

28<br />

RISK MANAGEMENT – MANAGING RISK COST WITH FAST PROCESSES<br />

Micro risk management must be<br />

enhanced as both loan volumes and<br />

NPL ratios are higher <strong>in</strong> micros than<br />

<strong>in</strong> PI<br />

CHALLENGES OF MICRO RISK MANAGEMENT<br />

In case <strong>of</strong> micros, both median and maximum values <strong>of</strong> NPL ratios are significantly<br />

higher than PI NPL ratios (see fig. 23). The very low m<strong>in</strong>imum value is caused by<br />

those participat<strong>in</strong>g banks without micro segment focus because <strong>the</strong>ir lend<strong>in</strong>g activity<br />

was moderate and <strong>the</strong>ir NPL ratio extremely low.<br />

Moreover both m<strong>in</strong>imum and maximum <strong>of</strong> average bank<strong>in</strong>g loan volumes granted for<br />

micros approximately double <strong>the</strong> PI loan volumes (see fig. 24).