BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

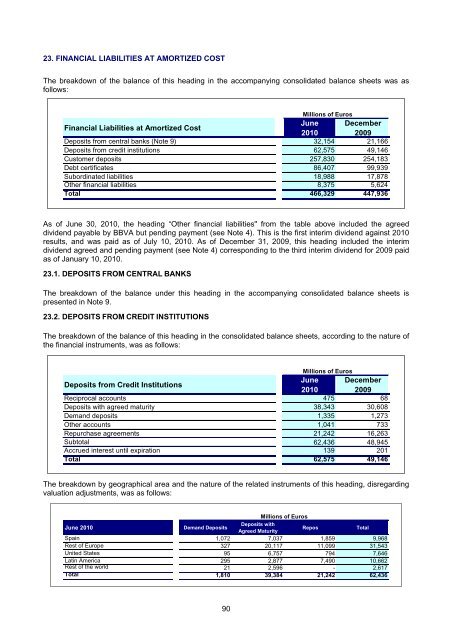

23. FINANCIAL LIABILITIES AT AMORTIZED COST<br />

The breakdown of the balance of this heading in the accompanying consolidated balance sheets was as<br />

follows:<br />

Millions of Euros<br />

Financial Liabilities at Amortized Cost<br />

June December<br />

2010 2009<br />

Deposits from central banks (Note 9) 32,154 21,166<br />

Deposits from credit institutions 62,575 49,146<br />

Customer deposits 257,830 254,183<br />

Debt certificates 86,407 99,939<br />

Subordinated liabilities 18,988 17,878<br />

Other financial liabilities 8,375 5,624<br />

Total 466,329 447,936<br />

As of June 30, 2010, the heading “Other financial liabilities" from the table above included the agreed<br />

dividend payable by <strong>BBVA</strong> but pending payment (see Note 4). This is the first interim dividend against 2010<br />

results, and was paid as of July 10, 2010. As of December 31, 2009, this heading included the interim<br />

dividend agreed and pending payment (see Note 4) corresponding to the third interim dividend for 2009 paid<br />

as of January 10, 2010.<br />

23.1. DEPOSITS FROM CENTRAL BANKS<br />

The breakdown of the balance under this heading in the accompanying consolidated balance sheets is<br />

presented in Note 9.<br />

23.2. DEPOSITS FROM CREDIT INSTITUTIONS<br />

The breakdown of the balance of this heading in the consolidated balance sheets, according to the nature of<br />

the financial instruments, was as follows:<br />

Millions of Euros<br />

Deposits from Credit Institutions<br />

June December<br />

2010 2009<br />

Reciprocal accounts 475 68<br />

Deposits with agreed maturity 38,343 30,608<br />

Demand deposits 1,335 1,273<br />

Other accounts 1,041 733<br />

Repurchase agreements 21,242 16,263<br />

Subtotal 62,436 48,945<br />

Accrued interest until expiration 139 201<br />

Total 62,575 49,146<br />

The breakdown by geographical area and the nature of the related instruments of this heading, disregarding<br />

valuation adjustments, was as follows:<br />

Millions of Euros<br />

June 2010<br />

Demand Deposits<br />

Deposits with<br />

Agreed Maturity<br />

Repos<br />

Total<br />

Spain 1,072 7,037 1,859 9,968<br />

Rest of Europe 327 20,117 11,099 31,543<br />

United States 95 6,757 794 7,646<br />

Latin America 295 2,877 7,490 10,662<br />

Rest of the world 21 2,596 - 2,617<br />

Total 1,810 39,384 21,242 62,436<br />

90