BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

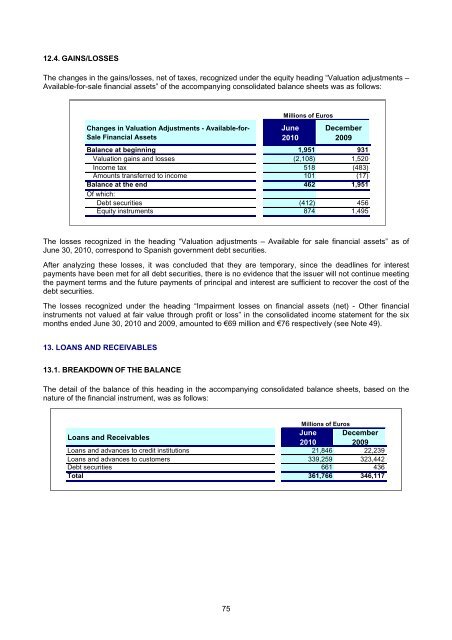

12.4. GAINS/LOSSES<br />

The changes in the gains/losses, net of taxes, recognized under the equity heading “Valuation adjustments –<br />

Available-for-sale financial assets” of the accompanying consolidated balance sheets was as follows:<br />

Changes in Valuation Adjustments - Available-for-<br />

Sale Financial Assets<br />

Millions of Euros<br />

June<br />

2010<br />

December<br />

2009<br />

Balance at beginning 1,951 931<br />

Valuation gains and losses (2,108) 1,520<br />

Income tax 518 (483)<br />

Amounts transferred to income 101 (17)<br />

Balance at the end 462 1,951<br />

Of which:<br />

Debt securities (412) 456<br />

Equity instruments 874 1,495<br />

The losses recognized in the heading “Valuation adjustments – Available for sale financial assets” as of<br />

June 30, 2010, correspond to Spanish government debt securities.<br />

After analyzing these losses, it was concluded that they are temporary, since the deadlines for interest<br />

payments have been met for all debt securities, there is no evidence that the issuer will not continue meeting<br />

the payment terms and the future payments of principal and interest are sufficient to recover the cost of the<br />

debt securities.<br />

The losses recognized under the heading “Impairment losses on financial assets (net) - Other financial<br />

instruments not valued at fair value through profit or loss” in the consolidated income statement for the six<br />

months ended June 30, 2010 and 2009, amounted to €69 million and €76 respectively (see Note 49).<br />

13. LOANS <strong>AND</strong> RECEIVABLES<br />

13.1. BREAKDOWN OF THE BALANCE<br />

The detail of the balance of this heading in the accompanying consolidated balance sheets, based on the<br />

nature of the financial instrument, was as follows:<br />

Millions of Euros<br />

Loans and Receivables<br />

June December<br />

2010 2009<br />

Loans and advances to credit institutions 21,846 22,239<br />

Loans and advances to customers 339,259 323,442<br />

Debt securities 661 436<br />

Total 361,766 346,117<br />

75