BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

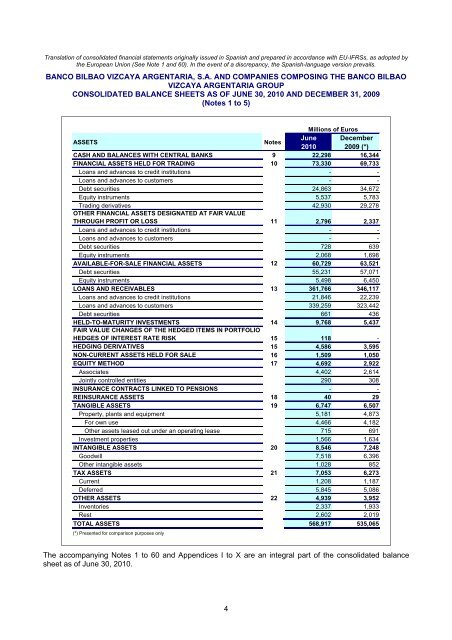

Translation of consolidated financial statements originally issued in Spanish and prepared in accordance with EU-IFRSs, as adopted by<br />

the European Union (See Note 1 and 60). In the event of a discrepancy, the Spanish-language version prevails.<br />

<strong>BANCO</strong> <strong>BILBAO</strong> <strong>VIZCAYA</strong> <strong>ARGENTARIA</strong>, S.A. <strong>AND</strong> COMPANIES COMPOSING THE <strong>BANCO</strong> <strong>BILBAO</strong><br />

<strong>VIZCAYA</strong> <strong>ARGENTARIA</strong> GROUP<br />

CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2010 <strong>AND</strong> DECEMBER 31, 2009<br />

(Notes 1 to 5)<br />

Millions of Euros<br />

ASSETS<br />

Notes<br />

June December<br />

2010 2009 (*)<br />

CASH <strong>AND</strong> BALANCES WITH CENTRAL BANKS 9 22,298 16,344<br />

FINANCIAL ASSETS HELD FOR TRADING 10 73,330 69,733<br />

Loans and advances to credit institutions - -<br />

Loans and advances to customers - -<br />

Debt securities 24,863 34,672<br />

Equity instruments 5,537 5,783<br />

Trading derivatives 42,930 29,278<br />

OTHER FINANCIAL ASSETS DESIGNATED AT FAIR VALUE<br />

THROUGH PROFIT OR LOSS 11 2,796 2,337<br />

Loans and advances to credit institutions - -<br />

Loans and advances to customers - -<br />

Debt securities 728 639<br />

Equity instruments 2,068 1,698<br />

AVAILABLE-FOR-SALE FINANCIAL ASSETS 12 60,729 63,521<br />

Debt securities 55,231 57,071<br />

Equity instruments 5,498 6,450<br />

LOANS <strong>AND</strong> RECEIVABLES 13 361,766 346,117<br />

Loans and advances to credit institutions 21,846 22,239<br />

Loans and advances to customers 339,259 323,442<br />

Debt securities 661 436<br />

HELD-TO-MATURITY INVESTMENTS 14 9,768 5,437<br />

FAIR VALUE CHANGES OF THE HEDGED ITEMS IN PORTFOLIO<br />

HEDGES OF INTEREST RATE RISK 15 118 -<br />

HEDGING DERIVATIVES 15 4,586 3,595<br />

NON-CURRENT ASSETS HELD FOR SALE 16 1,509 1,050<br />

EQUITY METHOD 17 4,692 2,922<br />

Associates 4,402 2,614<br />

Jointly controlled entities 290 308<br />

INSURANCE CONTRACTS LINKED TO PENSIONS - -<br />

REINSURANCE ASSETS 18 40 29<br />

TANGIBLE ASSETS 19 6,747 6,507<br />

Property, plants and equipment 5,181 4,873<br />

For own use 4,466 4,182<br />

Other assets leased out under an operating lease 715 691<br />

Investment properties 1,566 1,634<br />

INTANGIBLE ASSETS 20 8,546 7,248<br />

Goodwill 7,518 6,396<br />

Other intangible assets 1,028 852<br />

TAX ASSETS 21 7,053 6,273<br />

Current 1,208 1,187<br />

Deferred 5,845 5,086<br />

OTHER ASSETS 22 4,939 3,952<br />

Inventories 2,337 1,933<br />

Rest 2,602 2,019<br />

TOTAL ASSETS 568,917 535,065<br />

(*) Presented for comparison purposes only<br />

The accompanying Notes 1 to 60 and Appendices I to X are an integral part of the consolidated balance<br />

sheet as of June 30, 2010.<br />

4