BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

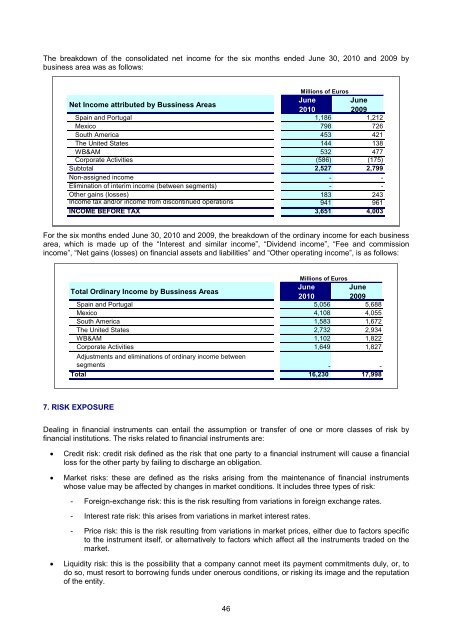

The breakdown of the consolidated net income for the six months ended June 30, 2010 and 2009 by<br />

business area was as follows:<br />

Millions of Euros<br />

Net Income attributed by Bussiness Areas<br />

June June<br />

2010 2009<br />

Spain and Portugal 1,186 1,212<br />

Mexico 798 726<br />

South America 453 421<br />

The United States 144 138<br />

WB&AM 532 477<br />

Corporate Activities (586) (175)<br />

Subtotal 2,527 2,799<br />

Non-assigned income - -<br />

Elimination of interim income (between segments) - -<br />

Other gains (losses) 183 243<br />

Income tax and/or income from discontinued operations 941 961<br />

INCOME BEFORE TAX 3,651 4,003<br />

For the six months ended June 30, 2010 and 2009, the breakdown of the ordinary income for each business<br />

area, which is made up of the “Interest and similar income”, “Dividend income”, “Fee and commission<br />

income”, “Net gains (losses) on financial assets and liabilities” and “Other operating income”, is as follows:<br />

Millions of Euros<br />

Total Ordinary Income by Bussiness Areas<br />

June June<br />

2010 2009<br />

Spain and Portugal 5,056 5,688<br />

Mexico 4,108 4,055<br />

South America 1,583 1,672<br />

The United States 2,732 2,934<br />

WB&AM 1,102 1,822<br />

Corporate Activities 1,649 1,827<br />

Adjustments and eliminations of ordinary income between<br />

segments - -<br />

Total 16,230 17,998<br />

7. RISK EXPOSURE<br />

Dealing in financial instruments can entail the assumption or transfer of one or more classes of risk by<br />

financial institutions. The risks related to financial instruments are:<br />

• Credit risk: credit risk defined as the risk that one party to a financial instrument will cause a financial<br />

loss for the other party by failing to discharge an obligation.<br />

• Market risks: these are defined as the risks arising from the maintenance of financial instruments<br />

whose value may be affected by changes in market conditions. It includes three types of risk:<br />

- Foreign-exchange risk: this is the risk resulting from variations in foreign exchange rates.<br />

- Interest rate risk: this arises from variations in market interest rates.<br />

- Price risk: this is the risk resulting from variations in market prices, either due to factors specific<br />

to the instrument itself, or alternatively to factors which affect all the instruments traded on the<br />

market.<br />

• Liquidity risk: this is the possibility that a company cannot meet its payment commitments duly, or, to<br />

do so, must resort to borrowing funds under onerous conditions, or risking its image and the reputation<br />

of the entity.<br />

46