BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND ... - BBVA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

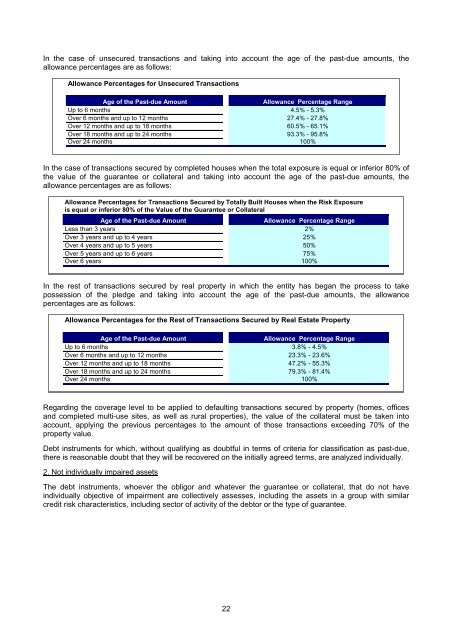

In the case of unsecured transactions and taking into account the age of the past-due amounts, the<br />

allowance percentages are as follows:<br />

Allowance Percentages for Unsecured Transactions<br />

Age of the Past-due Amount<br />

Allowance Percentage Range<br />

Up to 6 months 4.5% - 5.3%<br />

Over 6 months and up to 12 months 27.4% - 27.8%<br />

Over 12 months and up to 18 months 60.5% - 65.1%<br />

Over 18 months and up to 24 months 93.3% - 95.8%<br />

Over 24 months 100%<br />

In the case of transactions secured by completed houses when the total exposure is equal or inferior 80% of<br />

the value of the guarantee or collateral and taking into account the age of the past-due amounts, the<br />

allowance percentages are as follows:<br />

Allowance Percentages for Transactions Secured by Totally Built Houses when the Risk Exposure<br />

is equal or inferior 80% of the Value of the Guarantee or Collateral<br />

Age of the Past-due Amount<br />

Allowance Percentage Range<br />

Less than 3 years 2%<br />

Over 3 years and up to 4 years 25%<br />

Over 4 years and up to 5 years 50%<br />

Over 5 years and up to 6 years 75%<br />

Over 6 years 100%<br />

In the rest of transactions secured by real property in which the entity has began the process to take<br />

possession of the pledge and taking into account the age of the past-due amounts, the allowance<br />

percentages are as follows:<br />

Allowance Percentages for the Rest of Transactions Secured by Real Estate Property<br />

Age of the Past-due Amount<br />

Allowance Percentage Range<br />

Up to 6 months 3.8% - 4.5%<br />

Over 6 months and up to 12 months 23.3% - 23.6%<br />

Over 12 months and up to 18 months 47.2% - 55.3%<br />

Over 18 months and up to 24 months 79.3% - 81.4%<br />

Over 24 months 100%<br />

Regarding the coverage level to be applied to defaulting transactions secured by property (homes, offices<br />

and completed multi-use sites, as well as rural properties), the value of the collateral must be taken into<br />

account, applying the previous percentages to the amount of those transactions exceeding 70% of the<br />

property value.<br />

Debt instruments for which, without qualifying as doubtful in terms of criteria for classification as past-due,<br />

there is reasonable doubt that they will be recovered on the initially agreed terms, are analyzed individually.<br />

2. Not individually impaired assets<br />

The debt instruments, whoever the obligor and whatever the guarantee or collateral, that do not have<br />

individually objective of impairment are collectively assesses, including the assets in a group with similar<br />

credit risk characteristics, including sector of activity of the debtor or the type of guarantee.<br />

22