Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Building Capabilities<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

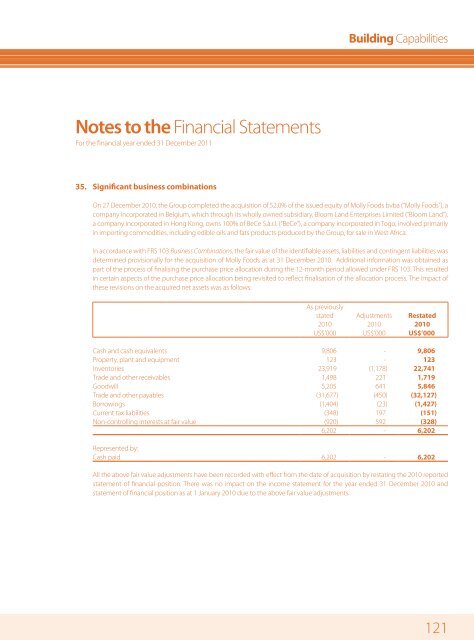

35. Significant business combinations<br />

On 27 December 2010, the <strong>Group</strong> completed the acquisition of 52.0% of the issued equity of Molly Foods bvba (“Molly Foods”), a<br />

company incorporated in Belgium, which through its wholly owned subsidiary, Bloom Land Enterprises Limited (“Bloom Land”),<br />

a company incorporated in Hong Kong, owns 100% of BeCe S.à.r.l. (“BeCe”), a company incorporated in Togo, involved primarily<br />

in importing commodities, including edible oils and fats products produced by the <strong>Group</strong>, for sale in West Africa.<br />

In accordance with FRS 103 Business Combinations, the fair value of the identifiable assets, liabilities and contingent liabilities was<br />

determined provisionally for the acquisition of Molly Foods as at 31 December 2010. Additional information was obtained as<br />

part of the process of finalising the purchase price allocation during the 12-month period allowed under FRS 103. This resulted<br />

in certain aspects of the purchase price allocation being revisited to reflect finalisation of the allocation process. The impact of<br />

these revisions on the acquired net assets was as follows:<br />

As previously<br />

stated<br />

2010<br />

Adjustments<br />

2010<br />

Restated<br />

2010<br />

US$’000 US$’000 US$’000<br />

Cash and cash equivalents 9,806 - 9,806<br />

Property, plant and equipment 123 - 123<br />

Inventories 23,919 (1,178) 22,741<br />

Trade and other receivables 1,498 221 1,719<br />

Goodwill 5,205 641 5,846<br />

Trade and other payables (31,677) (450) (32,127)<br />

Borrowings (1,404) (23) (1,427)<br />

Current tax liabilities (348) 197 (151)<br />

Non-controlling interests at fair value (920) 592 (328)<br />

6,202 - 6,202<br />

Represented by:<br />

Cash paid 6,202 - 6,202<br />

All the above fair value adjustments have been recorded with effect from the date of acquisition by restating the 2010 reported<br />

statement of financial position. There was no impact on the income statement for the year ended 31 December 2010 and<br />

statement of financial position as at 1 January 2010 due to the above fair value adjustments.<br />

121