Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MEWAH INTERNATIONAL INC.<br />

ANNUAL REPORT 2011<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

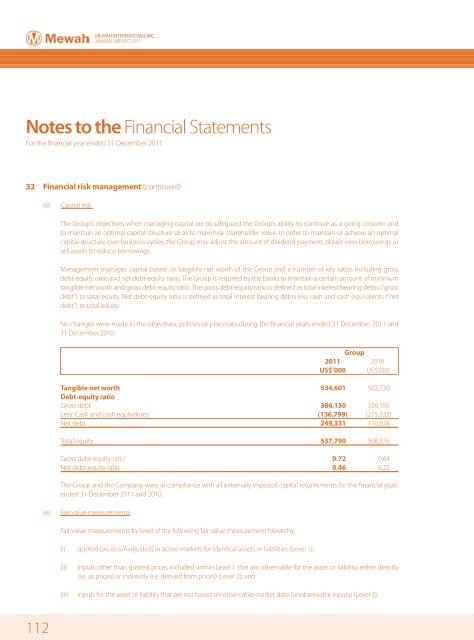

32. <strong>Financial</strong> risk management (continued)<br />

(d)<br />

Capital risk<br />

The <strong>Group</strong>’s objectives when managing capital are to safeguard the <strong>Group</strong>’s ability to continue as a going concern and<br />

to maintain an optimal capital structure so as to maximise shareholder value. In order to maintain or achieve an optimal<br />

capital structure over business cycles, the <strong>Group</strong> may adjust the amount of dividend payment, obtain new borrowings or<br />

sell assets to reduce borrowings.<br />

Management manages capital based on tangible net worth of the <strong>Group</strong> and a number of key ratios including gross<br />

debt-equity ratio and net debt-equity ratio. The <strong>Group</strong> is required by the banks to maintain a certain amount of minimum<br />

tangible net worth and gross debt-equity ratio. The gross debt-equity ratio is defined as total interest bearing debts (“gross<br />

debt”) to total equity. Net debt-equity ratio is defined as total interest bearing debts less cash and cash equivalents (“net<br />

debt”) to total equity.<br />

No changes were made in the objectives, policies or processes during the financial years ended 31 December 2011 and<br />

31 December 2010.<br />

<strong>Group</strong><br />

2011 2010<br />

US$’000 US$’000<br />

Tangible net worth 534,601 502,730<br />

Debt-equity ratio<br />

Gross debt 386,130 326,156<br />

Less: Cash and cash equivalents (136,799) (215,322)<br />

Net debt 249,331 110,834<br />

Total equity 537,790 508,576<br />

Gross debt-equity ratio 0.72 0.64<br />

Net debt-equity ratio 0.46 0.22<br />

The <strong>Group</strong> and the Company were in compliance with all externally imposed capital requirements for the financial years<br />

ended 31 December 2011 and 2010.<br />

(e)<br />

Fair value measurements<br />

Fair value measurements by level of the following fair value measurement hierarchy:<br />

(i) quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1);<br />

(ii)<br />

inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly<br />

(i.e. as prices) or indirectly (i.e. derived from prices) (Level 2); and<br />

(iii) inputs for the asset or liability that are not based on observable market data (unobservable inputs) (Level 3).<br />

112