Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Building Capabilities<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

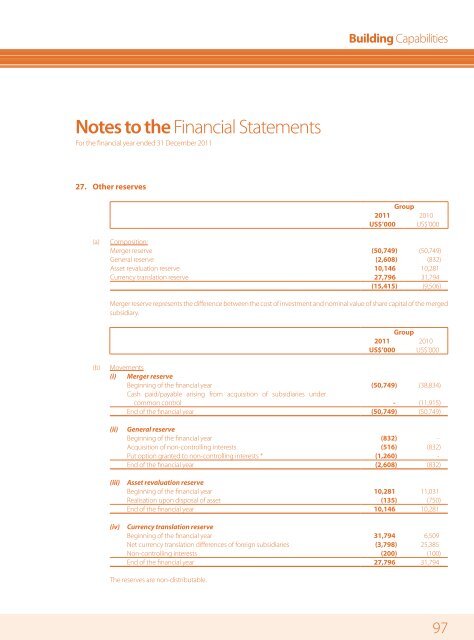

27. Other reserves<br />

<strong>Group</strong><br />

2011 2010<br />

US$’000 US$’000<br />

(a)<br />

Composition:<br />

Merger reserve (50,749) (50,749)<br />

General reserve (2,608) (832)<br />

Asset revaluation reserve 10,146 10,281<br />

Currency translation reserve 27,796 31,794<br />

(15,415) (9,506)<br />

Merger reserve represents the difference between the cost of investment and nominal value of share capital of the merged<br />

subsidiary.<br />

<strong>Group</strong><br />

2011 2010<br />

US$’000 US$’000<br />

(b)<br />

Movements<br />

(i) Merger reserve<br />

Beginning of the financial year (50,749) (38,834)<br />

Cash paid/payable arising from acquisition of subsidiaries under<br />

common control - (11,915)<br />

End of the financial year (50,749) (50,749)<br />

(ii)<br />

(iii)<br />

(iv)<br />

General reserve<br />

Beginning of the financial year (832) -<br />

Acquisition of non-controlling interests (516) (832)<br />

Put option granted to non-controlling interests * (1,260) -<br />

End of the financial year (2,608) (832)<br />

Asset revaluation reserve<br />

Beginning of the financial year 10,281 11,031<br />

Realisation upon disposal of asset (135) (750)<br />

End of the financial year 10,146 10,281<br />

Currency translation reserve<br />

Beginning of the financial year 31,794 6,509<br />

Net currency translation differences of foreign subsidiaries (3,798) 25,385<br />

Non-controlling interests (200) (100)<br />

End of the financial year 27,796 31,794<br />

The reserves are non-distributable.<br />

97