Financial Statements - Mewah Group

Financial Statements - Mewah Group

Financial Statements - Mewah Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Building Capabilities<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong><br />

For the financial year ended 31 December 2011<br />

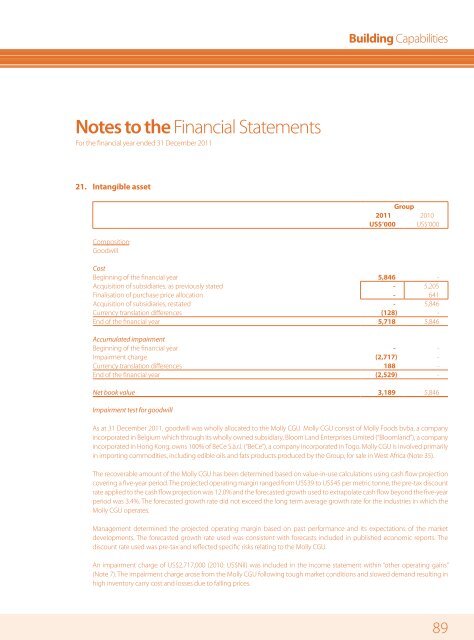

21. Intangible asset<br />

<strong>Group</strong><br />

2011 2010<br />

US$’000 US$’000<br />

Composition:<br />

Goodwill<br />

Cost<br />

Beginning of the financial year 5,846 -<br />

Acquisition of subsidiaries, as previously stated - 5,205<br />

Finalisation of purchase price allocation - 641<br />

Acquisition of subsidiaries, restated - 5,846<br />

Currency translation differences (128) -<br />

End of the financial year 5,718 5,846<br />

Accumulated impairment<br />

Beginning of the financial year - -<br />

Impairment charge (2,717) -<br />

Currency translation differences 188 -<br />

End of the financial year (2,529) -<br />

Net book value 3,189 5,846<br />

Impairment test for goodwill<br />

As at 31 December 2011, goodwill was wholly allocated to the Molly CGU. Molly CGU consist of Molly Foods bvba, a company<br />

incorporated in Belgium which through its wholly owned subsidiary, Bloom Land Enterprises Limited (“Bloomland”), a company<br />

incorporated in Hong Kong, owns 100% of BeCe S.à.r.l. (“BeCe”), a company incorporated in Togo. Molly CGU is involved primarily<br />

in importing commodities, including edible oils and fats products produced by the <strong>Group</strong>, for sale in West Africa (Note 35).<br />

The recoverable amount of the Molly CGU has been determined based on value-in-use calculations using cash flow projection<br />

covering a five-year period. The projected operating margin ranged from US$39 to US$45 per metric tonne, the pre-tax discount<br />

rate applied to the cash flow projection was 12.0% and the forecasted growth used to extrapolate cash flow beyond the five-year<br />

period was 3.4%. The forecasted growth rate did not exceed the long term average growth rate for the industries in which the<br />

Molly CGU operates.<br />

Management determined the projected operating margin based on past performance and its expectations of the market<br />

developments. The forecasted growth rate used was consistent with forecasts included in published economic reports. The<br />

discount rate used was pre-tax and reflected specific risks relating to the Molly CGU.<br />

An impairment charge of US$2,717,000 (2010: US$Nil) was included in the income statement within “other operating gains”<br />

(Note 7). The impairment charge arose from the Molly CGU following tough market conditions and slowed demand resulting in<br />

high inventory carry cost and losses due to falling prices.<br />

89