Consolidated Financial Statements and Consolidated Management ...

Consolidated Financial Statements and Consolidated Management ...

Consolidated Financial Statements and Consolidated Management ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In accordance with Article 12.5 of the Revised Text of the Company Tax Act, the Spanish tax group is offsetting the tax loss carry-forwards of the financial<br />

goodwill arising from the acquisition of the Astron Group in 2002 (80%) <strong>and</strong> 2005 (20%) from the tax base. The amortisation for tax purposes in this financial<br />

year totalled 1.8 million euros (8.9 million euros in 2010). The change in the amount amortised for tax purposes with respect to 2010 is due to a change in<br />

tax legislation. The percentage by which goodwill can be amortised for tax purposes has fallen from 5% to 1%.<br />

Since the above mentioned goodwill was subject to partial impairment in prior years <strong>and</strong> the corresponding prepaid tax had not been booked, the<br />

foregoing amortisation for tax purposes has not led to any movements in temporary differences.<br />

The fiscal cost of Astron Group’s goodwill at 31 December 2011 exceeded the accounting cost by 3.24 million euros. Therefore no deferred tax liability<br />

whatsoever has been booked this year.<br />

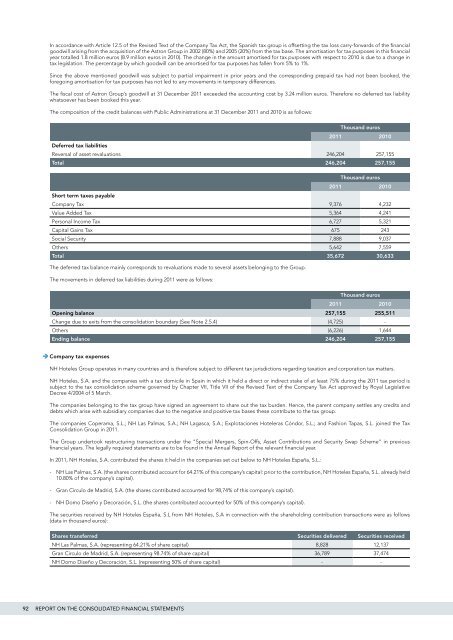

The composition of the credit balances with Public Administrations at 31 December 2011 <strong>and</strong> 2010 is as follows:<br />

Thous<strong>and</strong> euros<br />

2011 2010<br />

Deferred tax liabilities<br />

Reversal of asset revaluations 246,204 257,155<br />

Total 246,204 257,155<br />

Thous<strong>and</strong> euros<br />

2011 2010<br />

Short term taxes payable<br />

Company Tax 9,376 4,232<br />

Value Added Tax 5,364 4,241<br />

Personal Income Tax 6,727 5,321<br />

Capital Gains Tax 675 243<br />

Social Security 7,888 9,037<br />

Others 5,642 7,559<br />

Total 35,672 30,633<br />

The deferred tax balance mainly corresponds to revaluations made to several assets belonging to the Group.<br />

The movements in deferred tax liabilities during 2011 were as follows:<br />

Thous<strong>and</strong> euros<br />

2011 2010<br />

Opening balance 257,155 255,511<br />

Change due to exits from the consolidation boundary (See Note 2.5.4) (4,725) -<br />

Others (6,226) 1,644<br />

Ending balance 246,204 257,155<br />

Company tax expenses<br />

NH Hoteles Group operates in many countries <strong>and</strong> is therefore subject to different tax jurisdictions regarding taxation <strong>and</strong> corporation tax matters.<br />

NH Hoteles, S.A. <strong>and</strong> the companies with a tax domicile in Spain in which it held a direct or indirect stake of at least 75% during the 2011 tax period is<br />

subject to the tax consolidation scheme governed by Chapter VII, Title VII of the Revised Text of the Company Tax Act approved by Royal Legislative<br />

Decree 4/2004 of 5 March.<br />

The companies belonging to the tax group have signed an agreement to share out the tax burden. Hence, the parent company settles any credits <strong>and</strong><br />

debts which arise with subsidiary companies due to the negative <strong>and</strong> positive tax bases these contribute to the tax group.<br />

The companies Coperama, S.L.; NH Las Palmas, S.A.; NH Lagasca, S.A.; Explotaciones Hoteleras Cóndor, S.L.; <strong>and</strong> Fashion Tapas, S.L. joined the Tax<br />

Consolidation Group in 2011.<br />

The Group undertook restructuring transactions under the “Special Mergers, Spin-Offs, Asset Contributions <strong>and</strong> Security Swap Scheme” in previous<br />

financial years. The legally required statements are to be found in the Annual Report of the relevant financial year.<br />

In 2011, NH Hoteles, S.A. contributed the shares it held in the companies set out below to NH Hoteles España, S.L.:<br />

- NH Las Palmas, S.A. (the shares contributed account for 64.21% of this company’s capital: prior to the contribution, NH Hoteles España, S.L. already held<br />

10.80% of the company’s capital).<br />

- Gran Círculo de Madrid, S.A. (the shares contributed accounted for 98,74% of this company’s capital).<br />

- NH Domo Diseño y Decoración, S.L. (the shares contributed accounted for 50% of this company’s capital).<br />

The securities received by NH Hoteles España, S.L from NH Hoteles, S.A in connection with the shareholding contribution transactions were as follows<br />

(data in thous<strong>and</strong> euros):<br />

Shares transferred Securities delivered Securities received<br />

NH Las Palmas, S.A. (representing 64.21% of share capital) 8,828 12,137<br />

Gran Circulo de Madrid, S.A. (representing 98.74% of share capital) 36,789 37,474<br />

NH Domo Diseño y Decoración, S.L. (representing 50% of share capital) - -<br />

92<br />

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS