Consolidated Financial Statements and Consolidated Management ...

Consolidated Financial Statements and Consolidated Management ...

Consolidated Financial Statements and Consolidated Management ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.5.2. Associate companies (See Annex II)<br />

Associated companies are considered as any companies in which the Parent Company holds the capacity to exercise significant influence, though it<br />

does not exercise either control or joint control. In general terms, it is assumed that significant influence exists when the percentage stake (direct or<br />

indirect) held by the Group exceeds 20% of the voting rights, as long as it does not exceed 50%.<br />

Capredo Investments GmbH is a vehicle lacking any inherent activity used for making final investments in a series of companies domiciled in the<br />

Dominican Republic in which the Group holds an effective stake of 25%. Hence, this vehicle has been considered an associated company.<br />

Associated companies are valued in the consolidated financial statements by the equity method; in other words, through the fraction of their net equity<br />

value the Group’s stake in their capital represents once any dividends received <strong>and</strong> other equity write-offs have been considered.<br />

2.5.3. Joint ventures (See Annex III)<br />

Joint ventures are considered to be any ventures in which the management of the investee companies is jointly held by the Parent Company <strong>and</strong> third<br />

parties not related to the Group, without any of them holding a greater degree of control than the others. The financial statements of joint ventures are<br />

consolidated by the proportional consolidation method, so that aggregation of balances <strong>and</strong> subsequent eliminations are carried out in proportion to<br />

the stake held by Group in relation to the capital of said entities.<br />

If necessary, any adjustments required are made to the financial statements of said companies to st<strong>and</strong>ardise their accounting policies with those used<br />

by the Group.<br />

2.5.4. Foreign currency conversion<br />

The following criteria have been different applied for converting into euros the different items of the consolidated balance sheet <strong>and</strong> the consolidated<br />

comprehensive profit <strong>and</strong> loss statement of foreign companies included within the scope of consolidation:<br />

• Assets <strong>and</strong> liabilities have been converted by applying the effective exchange rate prevailing at year-end.<br />

• Equity has been converted by applying the historical exchange rate. The historical exchange rate existing at 31 December 2003 of any companies<br />

included within the scope of consolidation prior to the transitional date has been considered as the historical exchange rate.<br />

• The consolidated comprehensive profit <strong>and</strong> loss statement has been converted by applying the average exchange rate of the financial year.<br />

Any difference resulting from the application these criteria have been included in the “Translation differences” item under the “Equity” heading.<br />

Any adjustments arising from the application of IFRS at the time of acquisition of a foreign company with regard to market value <strong>and</strong> goodwill are<br />

considered as assets <strong>and</strong> liabilities of such company <strong>and</strong> are therefore converted using the exchange rate prevailing at year-end.<br />

2.5.5. Changes in the consolidation boundary<br />

The most significant changes in the scope of consolidation during 2011 <strong>and</strong> 2010 that affect the comparison between financial years were the following:<br />

a.1. Changes in the scope of consolidation in 2011<br />

a.1.1. Incorporations<br />

On 30 April 2011, the General Shareholders’ Meeting of Donnafugata Resort S.r.l. resolved to reduce capital by 6,784,000 euros <strong>and</strong> charge it to prior<br />

years’ losses, <strong>and</strong> to subsequently increase capital by approximately 6,294,000 euros. Both transactions were recorded in public instruments on 3 May<br />

2011. Given that the remaining members did not participate in this increase of capital, the Parent Company subscribed all of it, thereby increasing its<br />

percentage interest from 58.82% to 78.00%.<br />

a.1.2. Exits<br />

The company Jolly Hotels France, S.A., the owner of a hotel in Paris, was sold in 2011 for 89 million euros. The capital gain booked for this transaction<br />

amounted to 19.94 million euros.<br />

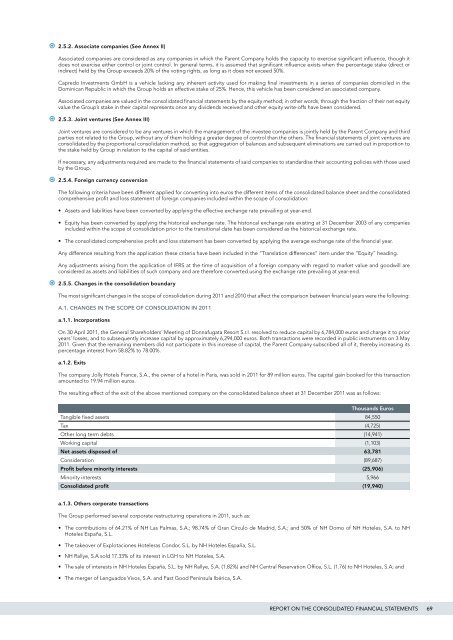

The resulting effect of the exit of the above mentioned company on the consolidated balance sheet at 31 December 2011 was as follows:<br />

Thous<strong>and</strong>s Euros<br />

Tangible fixed assets 84,550<br />

Tax (4,725)<br />

Other long term debts (14,941)<br />

Working capital (1,103)<br />

Net assets disposed of 63,781<br />

Consideration (89,687)<br />

Profit before minority interests (25,906)<br />

Minority interests 5,966<br />

<strong>Consolidated</strong> profit (19,940)<br />

a.1.3. Others corporate transactions<br />

The Group performed several corporate restructuring operations in 2011, such as:<br />

• The contributions of 64.21% of NH Las Palmas, S.A.; 98.74% of Gran Círculo de Madrid, S.A.; <strong>and</strong> 50% of NH Domo of NH Hoteles, S.A. to NH<br />

Hoteles España, S.L.<br />

• The takeover of Explotaciones Hoteleras Condor, S.L. by NH Hoteles España, S.L.<br />

• NH Rallye, S.A sold 17.33% of its interest in LGH to NH Hoteles, S.A.<br />

• The sale of interests in NH Hoteles España, S.L. by NH Rallye, S.A. (1.82%) <strong>and</strong> NH Central Reservation Office, S.L. (1.76) to NH Hoteles, S.A; <strong>and</strong><br />

• The merger of Lenguados Vivos, S.A. <strong>and</strong> Fast Good Peninsula Ibérica, S.A.<br />

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS 69