Consolidated Financial Statements and Consolidated Management ...

Consolidated Financial Statements and Consolidated Management ... Consolidated Financial Statements and Consolidated Management ...

CONSOLIDATED BALANCE SHEETS NH HOTELES, S.A. AND SUBSIDIARIES Consolidated Financial Statements for 2011 drawn up in accordance with the International Financial Reporting Standards adopted by the European Union. *Translation of consolidated financial statements originally issued in Spanish and prepared in accordance with IFRS’s as adopted by the European Union. In the event of a discrepancy, the Spanish-language version prevails. CONSOLIDATED BALANCE SHEETS AT 31 DECEMBER 2011 AND 31 DECEMBER 2010 (Thousands Euros) Note 31.12.11 31.12.10 NON-CURRENT ASSETS: Tangible fixed assets 8 2,108,812 2,199,307 Goodwill 6 119,968 120,408 Intangible assets 7 107,575 115,925 Real estate investments 9 6,775 7,864 Investments valued through the equity method 10 73,727 69,992 Non-current financial investments 108,690 177,051 Loans and accounts receivable not available for trading 11.1 96,184 155,607 Other non-current financial investments 11.2 12,506 21,444 Deferred tax assets 21 134,936 119,574 Other non-current assets 1,328 1,580 Total non-current assets 2,661,811 2,811,701 Note 31.12.11 31.12.10 CURRENT ASSETS: Inventories 12 116,228 118,973 Trade accounts receivable 13 121,191 127,394 Non-trade accounts receivable 73,032 75,779 Public Administration accounts receivable 21 43,963 47,408 Other non-trade receivables 29,069 28,371 Current financial investments - 94 Cash and cash equivalents 14 91,143 173,117 Other current assets 11,365 13,839 Total current assets 412,959 509,196 TOTAL ASSETS 3,074,770 3,320,897 60 CONSOLIDATED BALANCE SHEETS

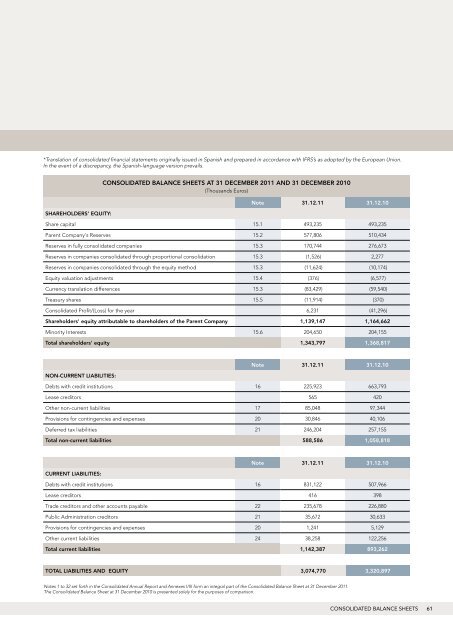

*Translation of consolidated financial statements originally issued in Spanish and prepared in accordance with IFRS’s as adopted by the European Union. In the event of a discrepancy, the Spanish-language version prevails. CONSOLIDATED BALANCE SHEETS AT 31 DECEMBER 2011 AND 31 DECEMBER 2010 (Thousands Euros) Note 31.12.11 31.12.10 SHAREHOLDERS’ EQUITY: Share capital 15.1 493,235 493,235 Parent Company's Reserves 15.2 577,806 510,434 Reserves in fully consolidated companies 15.3 170,744 276,673 Reserves in companies consolidated through proportional consolidation 15.3 (1,526) 2,277 Reserves in companies consolidated through the equity method 15.3 (11,624) (10,174) Equity valuation adjustments 15.4 (376) (6,577) Currency translation differences 15.3 (83,429) (59,540) Treasury shares 15.5 (11,914) (370) Consolidated Profit/(Loss) for the year 6,231 (41,296) Shareholders' equity attributable to shareholders of the Parent Company 1,139,147 1,164,662 Minority Interests 15.6 204,650 204,155 Total shareholders' equity 1,343,797 1,368,817 Note 31.12.11 31.12.10 NON-CURRENT LIABILITIES: Debts with credit institutions 16 225,923 663,793 Lease creditors 565 420 Other non-current liabilities 17 85,048 97,344 Provisions for contingencies and expenses 20 30,846 40,106 Deferred tax liabilities 21 246,204 257,155 Total non-current liabilities 588,586 1,058,818 Note 31.12.11 31.12.10 CURRENT LIABILITIES: Debts with credit institutions 16 831,122 507,966 Lease creditors 416 398 Trade creditors and other accounts payable 22 235,678 226,880 Public Administration creditors 21 35,672 30,633 Provisions for contingencies and expenses 20 1,241 5,129 Other current liabilities 24 38,258 122,256 Total current liabilities 1,142,387 893,262 TOTAL LIABILITIES AND EQUITY 3,074,770 3,320,897 Notes 1 to 32 set forth in the Consolidated Annual Report and Annexes I/III form an integral part of the Consolidated Balance Sheet at 31 December 2011. The Consolidated Balance Sheet at 31 December 2010 is presented solely for the purposes of comparison. CONSOLIDATED BALANCE SHEETS 61

- Page 9 and 10: End customers, who are even more de

- Page 11 and 12: Revenue from Real Estate Activity,

- Page 13 and 14: The level of consolidated net finan

- Page 15 and 16: SUBSEQUENT DISCLOSURES The process

- Page 17 and 18: A.3. Complete the following tables

- Page 19 and 20: B. STRUCTURE OF THE COMPANY’S COR

- Page 21 and 22: B.1.7. Identify, as applicable, the

- Page 23 and 24: Process for determining the remuner

- Page 25 and 26: For the purposes of this definition

- Page 27 and 28: State and explain, as applicable, w

- Page 29 and 30: Does the Appointments Committee not

- Page 31 and 32: Explain the rules Article 14.2.e) o

- Page 33 and 34: Committee name AUDIT COMMITTEE Shor

- Page 35 and 36: C. RELATED-PARTY TRANSACTIONS C.1.

- Page 37 and 38: D. RISK CONTROL SYSTEMS D.1. Genera

- Page 39 and 40: The Audit Department therefore cont

- Page 41 and 42: In any event, the website shall con

- Page 43 and 44: E.10. State and explain the policie

- Page 45 and 46: ) The following decisions: i) The a

- Page 47 and 48: 23. All directors must be able to e

- Page 49 and 50: 41. The Annual Report shall include

- Page 51 and 52: 53. The Board of Directors shall se

- Page 53 and 54: Mr Roberto Cibeira Moreiras - Annua

- Page 55 and 56: APENDIX TO THE 2011 ANNUAL CORPORAT

- Page 57 and 58: - to keep records of transactions r

- Page 59: - Supervision of internal control a

- Page 63 and 64: CONSOLIDATED STATEMENTS OF CHANGES

- Page 65 and 66: REPORT ON THE CONSOLIDATED FINANCIA

- Page 67 and 68: 2.1.2. Standards and interpretation

- Page 69 and 70: 2.5.2. Associate companies (See Ann

- Page 71 and 72: 4. VALUATION STANDARDS The main pri

- Page 73 and 74: - Outstanding loans and accounts re

- Page 75 and 76: Deferred tax liabilities for all ta

- Page 77 and 78: A breakdown of the cash generating

- Page 79 and 80: • The most significant addition i

- Page 81 and 82: NH Hoteles Group’s policy on inte

- Page 83 and 84: The analysis of the aging of financ

- Page 85 and 86: 15.5. Treasury shares At year-end,

- Page 87 and 88: Additionally, two loans for a joint

- Page 89 and 90: The details of the sensitivity anal

- Page 91 and 92: Onerous agreements The NH Hoteles G

- Page 93 and 94: Additionally, NH Hoteles España, S

- Page 95 and 96: Negative tax bases At 31 December 2

- Page 97 and 98: - Article 9 of the Articles of Asso

- Page 99 and 100: 26.3. Personnel expenses The compos

- Page 101 and 102: 26.6. Financial expenses and change

- Page 103 and 104: Secondary segments - Geographic The

- Page 105 and 106: Holder Investee Company Activity Nu

- Page 107 and 108: 31. INFORMATION ON ENVIRONMENTAL PO

- Page 109 and 110: ANNEX I: SUBSIDIARIES The data on t

*Translation of consolidated financial statements originally issued in Spanish <strong>and</strong> prepared in accordance with IFRS’s as adopted by the European Union.<br />

In the event of a discrepancy, the Spanish-language version prevails.<br />

CONSOLIDATED BALANCE SHEETS AT 31 DECEMBER 2011 AND 31 DECEMBER 2010<br />

(Thous<strong>and</strong>s Euros)<br />

Note 31.12.11 31.12.10<br />

SHAREHOLDERS’ EQUITY:<br />

Share capital 15.1 493,235 493,235<br />

Parent Company's Reserves 15.2 577,806 510,434<br />

Reserves in fully consolidated companies 15.3 170,744 276,673<br />

Reserves in companies consolidated through proportional consolidation 15.3 (1,526) 2,277<br />

Reserves in companies consolidated through the equity method 15.3 (11,624) (10,174)<br />

Equity valuation adjustments 15.4 (376) (6,577)<br />

Currency translation differences 15.3 (83,429) (59,540)<br />

Treasury shares 15.5 (11,914) (370)<br />

<strong>Consolidated</strong> Profit/(Loss) for the year 6,231 (41,296)<br />

Shareholders' equity attributable to shareholders of the Parent Company 1,139,147 1,164,662<br />

Minority Interests 15.6 204,650 204,155<br />

Total shareholders' equity 1,343,797 1,368,817<br />

Note 31.12.11 31.12.10<br />

NON-CURRENT LIABILITIES:<br />

Debts with credit institutions 16 225,923 663,793<br />

Lease creditors 565 420<br />

Other non-current liabilities 17 85,048 97,344<br />

Provisions for contingencies <strong>and</strong> expenses 20 30,846 40,106<br />

Deferred tax liabilities 21 246,204 257,155<br />

Total non-current liabilities 588,586 1,058,818<br />

Note 31.12.11 31.12.10<br />

CURRENT LIABILITIES:<br />

Debts with credit institutions 16 831,122 507,966<br />

Lease creditors 416 398<br />

Trade creditors <strong>and</strong> other accounts payable 22 235,678 226,880<br />

Public Administration creditors 21 35,672 30,633<br />

Provisions for contingencies <strong>and</strong> expenses 20 1,241 5,129<br />

Other current liabilities 24 38,258 122,256<br />

Total current liabilities 1,142,387 893,262<br />

TOTAL LIABILITIES AND EQUITY 3,074,770 3,320,897<br />

Notes 1 to 32 set forth in the <strong>Consolidated</strong> Annual Report <strong>and</strong> Annexes I/III form an integral part of the <strong>Consolidated</strong> Balance Sheet at 31 December 2011.<br />

The <strong>Consolidated</strong> Balance Sheet at 31 December 2010 is presented solely for the purposes of comparison.<br />

CONSOLIDATED BALANCE SHEETS 61